Global fintech funding declined by 16% in Q1 2024, its lowest quarterly slump in 7 years

Global fintech funding suffered a stiff decline in the first quarter of the year, falling by an outstanding 16 per cent in the first three months of 2024. This was disclosed in a State of Fintech report by the tech startup analytics company, CB Insights.

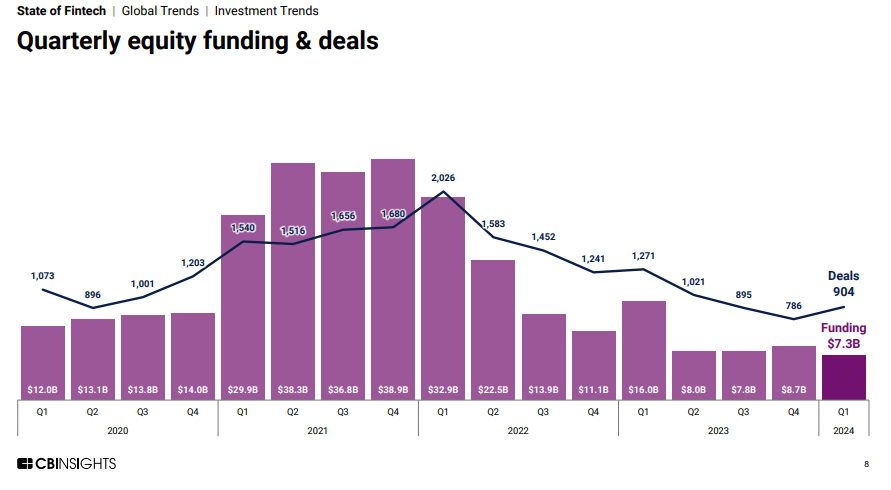

Per the report, financial technology companies around the world were able to attract $7.3 billion in the quarter, representing a 16 per cent drop from $8.7 billion attracted in the third quarter of 2024. The slump represents the largest quarterly decline in fintech funding since 2017.

The report noted that the decline in global fintech funding is in sharp contrast to the gains that have been made in the broader venture market.

However, while the value of the deals might have suffered a stiff quarterly decline, the total number of deals enjoyed a 15 per cent increase, ramping up a total of 904 deals against 724 recorded in the last quarter of 2023. This indicates that investors remain active in the market but are focused on smaller deals.

Apart from the total value of the deals, the average deal size in 2024 so far has also suffered a decline, with an average of $11.1 million year-to-date. This represents an 18 per cent drop from the average of $13.6 million recorded in 2023.

“A dearth of blockbuster deals is driving the decline: In Q1’24, there were just 12 mega-rounds (deals worth $100M+) representing 26% of total funding — the lowest share since Q2’23. Despite declines in deal size, UK-based challenger bank Monzo still raised a $431M Series I round — the largest fintech deal of the quarter,” the report noted.

Startups with the largest global fintech funding

At the top of the global fintech funding pile, United Kingdom’s Monzo led the global fintech funding for the quarter, raising $431 million in a Series I funding round in March. The round which was led by Capital G and supported by Tencent and Google Ventures meant the startup contributed 5.1 per cent to the total fintech funding in the quarter while giving the startup a $5.1 billion valuation.

The USA’s Flexport is next after raising $260 million in convertible notes back in January. The funding provided by Shopify means Flexport contributed 3.6 per cent to total fintech funding in the quarter.

American fintech, Bilt Rewards raised $200 million in a Series C round back in January. The round which was led by General Catalyst put the startup’s valuation at $3.1 billion and a contribution of 2.8 per cent to the global total for the quarter.

Another American fintech, Kore.ai is next, raising $150 million in a Series D round in January led by FTV Capital. The funding means Kore contributed 2.1 per cent to the global quarterly total funding in the fintech sector.

The United Kingdom’s Flagstone raised $139 million in a Private Equity round financed wholly by Estancia Capital Partners in March. With that, Flagstone contributed 1.9 per cent to the total funding into the sector between January and March.

Mews, a financial technology company operating out of the Netherlands contributed 1.5 per cent to global fintech funding in the quarter after raising $110 million in a Series D funding in March. The round, led by Kinnevik and Goldman Sachs Asset Management, put Mews’ valuation at $1.2 billion.

Germany’s Solaris is next up, having raised $104 million in a Series F round in March led by the SBI Group. Solaris contributed 1.4 per cent to the total global quarterly funding.

Nigeria’s Moove, the Netherlands DataSnipper, the United States FundGuard and Watershed, and Hong Kong’s HashKey all raised $100 million in equity funding during the quarter under review.

See also: Nigeria’s Moove makes Top 10 global fintech funding in Q1 2024 with $100 million raise