Product-Market Fit: What It Is and How to Measure It

Product-market fit is what every new startup strives for. It describes the undeniable market demand for the product or service a company offers, demonstrated by people buying it, using it and telling their friends about it.

What Is Product-Market Fit?

Product-market fit is a term used by startup founders to describe the strong alignment between their product’s value proposition and the underserved needs of target customers. There are different ways to try to measure product-market fit, but you know you achieved it when customers are enthusiastically buying, using and sharing your product.

Investor and Netscape co-founder Marc Andreessen popularized the term product-market fit in a 2007 blog post, where he wrote that it “means being in a good market with a product that can satisfy that market.”

“And you can always feel product/market fit when it’s happening,” Andreessen continued. “The customers are buying the product just as fast as you can make it — or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can.”

There are a variety of ways to determine if a product has product-market fit, but understanding why a product even is a good fit for a market is the first step.

Why Is Product-Market Fit Important?

Venture capitalists often want evidence of product-market fit before investment. Even Andreessen categorizes startups in two ways: before product-market fit and after product-market fit. Why is this?

VCs, department heads and others in positions of leadership want a product to be a good fit for a market for a simple reason: so the company can grow. Finding product-market fit — which means you have developed a product that addresses a valid consumer problem — creates opportunities for company growth as well as upselling a product to existing customers.

Product-market fit proves that a product has a sustainable and rich market to tap into. And let’s be honest, isn’t that what every startup is looking for?

How to Achieve a Product-Market Fit

Finding product-market fit may look different depending on the product, industry and business. That said, Dan Olsen, author of The Lean Product Playbook, recommends six steps:

Determine the Target Customer

Finding the right consumer for a product means asking who might buy the product and if they do, will it meet a consumer need? Olsen recommends conducting market research and creating consumer personas. Creating a persona is essentially developing a profile of an ideal audience or consumer of a product. This can help you visualize and develop what products would be useful to a certain type of consumer.

Identify Underserved Customer Needs

Selling a product to a market that is already oversaturated and serving consumers is definitely not a good idea. But you can ask what these consumers might be unhappy with and what your product might be able to change.

Define the Product’s Value Proposition

Defining a product’s value is essentially understanding how it can be better than those offered by competitors. Factors in this category to think about include quality, price as well as additional services and marketing.

Specify a Minimum Viable Product Feature Set (MVP)

Every product needs to have a baseline of features before it’s released. These features should be simple but essential to functionality and performance.

Create an MVP Prototype

The good thing about MVPs is that they don’t need to be a version of the final products. MVPs are meant to help gain consumer feedback that can be applied to the next iteration of a product.

Test the MVP With Customers

Getting feedback from consumers is a crucial step to achieving a product-market fit. Letting consumers test a product can help developers understand what’s working and what isn’t.

How to Measure Product-Market Fit

There are several methods and approaches to use when trying to measure product-market fit.

When Sean Ellis, author of Hacking Growth, began work at a software company called Xobni, he developed a series of customer satisfaction questions intended to serve two purposes. First, they could be used to assess how much loyalty Xobni’s customers — who tended to be managers — had to the product. The survey could also serve as a sniff test for the growth potential of future prospective employers, should his role at Xobni go away.

The key was in the phrasing: He deliberately left out the word “satisfaction,” because, as he told Built In, “a good manager is never satisfied.” Instead, he asked “How would you feel if you could no longer use [this product]?”

Four answer choices: (a) very disappointed, (b) somewhat disappointed, (c) not disappointed (it isn’t really that useful), and (d) not applicable (I no longer use [product]) became the basis for a quantitative framework to assess product-market fit.

“I just honed in on that benchmark over time.” Ellis said. “Five of the first seven businesses I worked at reached billion-dollar valuations. So, I knew what success looked like. And what I started to see was, really, every business I worked on that did well was around 40 percent or higher.”

That was the magic number — the percentage of users who took the survey, and said that they would be very disappointed without the product; it’s a benchmark Ellis said has been used by thousands of startups to determine their market viability.

Of course, his method is just one of many for calculating product-market fit, and, as he acknowledges, not necessarily the most useful after the first few months of the product journey.

The point is, assessing market viability is complicated. We asked a simple question: Which method is best? And we got a simple answer: it depends. What it depends on, however — the size, stage, cash reserves and growth ambitions of the business — is enlightening.

Maegan Lujan, director of solutions and services at Toshiba America Business Solutions, Inc., conducted a LinkedIn poll that generated responses from technical experts across 14 different companies. Here’s what they had to say when asked which tool is most valuable for determining product-market fit:

- The retention curve: 43 percent

- Net promoter score: 36 percent

- LTV/CAC ratio: 21 percent

The Sean Ellis Survey Method

Ellis said the reason his survey is effective is because it identifies a company’s core customers, so firms can build accurate user personas and marketing campaigns around them. As reported by Rahul Vohra, the founder and CEO of Superhuman in First Round, “when Hiten Shah posed one of Ellis’ questions to 731 Slack users in a 2015 open research project, 51 percent of these users responded that they would be very disappointed without Slack.”

Evidence the software tool had product-market fit was borne out in Slack’s later success.

But even for companies that don’t initially meet the 40 percent threshold, the results of the survey are instructive. When Ellis was working for San Francisco-based Lookout, only seven percent of survey respondents said they would be very disappointed if they could no longer use the product.

In light of the survey, Ellis said, the mobile security company quickly shifted its business model. It had initially placed equal value on five or six different sets of mobile apps and security software products, but it was the antivirus software that drew the most enthusiasm.

“By shining a spotlight on that, we were able to set the right expectations for what the product was able to truly deliver,” Ellis said. “By the time I left that company, they were at 60 percent. And within three years, they came out with a billion-dollar-plus valuation.”

There are rules to administering the survey, he cautions. It’s important to filter out users who register, but never use your product. Ideally, the survey should be administered to 40 users who have interacted with the product at least twice in two weeks (though this depends on the product cycle; loyal Airbnb users, for instance, don’t use the service every two weeks).

Whenever new customers arrive on the market, or a company expands internationally, Ellis said, it’s a good time to refresh the data, with surveys distributed about once a month until you reach product-market fit. Once you’re above the 40 percent mark, surveys can be sent once every six months.

Being conscientious about repeating the survey is important, though, as product market-fit is perishable. Marco Perry, founder of the Brooklyn-based product design consultancy PENSA, points to the widespread availability of voice recording features native to the Evernote app as a cautionary tale of how differentiating product features can be swallowed by copycats.

One of the advantages of Ellis’s survey is its speed of delivery; it can be easily administered through Typeform or similar tools. Another strength, according to Ellis, is its depth: “The benefit of surveys versus retention cohorts is that you can use them to understand everything about the users. ‘Who are they? What were they using before? Why did they decide to try the product?’” Ellis said.

Cohort Retention Rate

The gold standard at later stages of development, said Danielle Cohen-Shohet, CEO of GlossGenius, an office management and payment technology provider for beauty and wellness businesses, is the cohort retention curve. The graph measures the percentage of users who continue to pay for a product eight weeks after onboarding.

Resembling a hockey stick, the downward-sloping curve should flatline above zero — ideally, at or above six to 20 percent of users, according to Mixpanel’s 2019 Product Benchmarks Report — otherwise you’re paying more to acquire your users than they’re paying you to keep them.

Cohort retention rate has been widely touted by industry insiders as an indicator of product-market fit. Yet, the formula requires data most startups don’t have access to in their first months, Ellis said. If you do have the data, however, like GlossGenius does, the cohort retention curve can be telling.

“We think of product-market fit as this: When the product is really good and we can attract paying customers organically, primarily through word of mouth and referrals, and shift the focus from improving the product to growing distribution channels,” Cohen-Shohet said. “When we look at what builds scalable acquisition channels, it’s having a strong cohort retention rate.”

The rate measures the proportion of active users who continue to use a product after a set period of time: typically 14 days. If the curve tapers to a straight line above the X axis, it signals a product-market fit.

At GlossGenius, the metric is based on a group of people who download the app during the same 30-day interval, Cohen-Shohet said. Because their experiences with onboarding, product interaction and customer service are roughly equivalent, they are evaluated as a group. New cohorts are introduced each month, and insights from the customer experience team, as well as analytics software such as Mixpanel’s, help improve retention over time.

Cohen-Shohet said the retention curve tends to be less biased than survey methods. “You don’t have response bias, right?” she said. “You’re getting information from all users, not just ones that have enough time and intent to fill out a survey. You’re getting full life-cycle data, not data from a specific survey at a specific point in time,” she said.

How high above the X axis the retention curve needs to flatline to indicate product-market fit is murkier. According to a report from Mixpanel, “most apps and software have a six to 20 percent eight-week retention rate. For products in the media or finance industry, an eight-week retention rate over 25 percent is considered elite. For SaaS and e-commerce industries, over 35 percent retention is considered elite.”

Based on analysis of Quettra’s usage statistics from over 125 million Android mobile phones, Andrew Chen, a general partner at Andreessen Horowitz and former head of rider growth at Uber, reports on his blog that the top 10 apps had a 60-day retention rate of 55 percent, the next 50 had a 60-day retention rate of 40 percent and the next 100 had a 60-day retention rate of 21 percent.

But here’s where the analysis gets interesting: the next 5,000 apps had a 60-day retention rate of 11 percent, and the average of all apps assessed at 60 days was just seven percent.

Yet, even at that level, “you probably have some sign of product-market fit,” Ellis said. “It’s similar to the seven percent we found at Lookout [using the Sean Ellis survey]. You just want to study that [cohort] and understand who they are.”

Analytics software can go a long way to do that, according to Perry, by assessing where in the mobile experience problems are arising.

“If somebody is onboarding on your app for the first time, and they drop out early in the process, you have to find out why,” he said. “‘Are they getting confused? Do they not find value in the time they’re spending? Are you asking for a credit card when they expected a free product? Analytics is very good at optimizing those tactical issues. And, ultimately, some apps win or lose by those things. Like, how fast is it to use Instagram versus its competitors?”

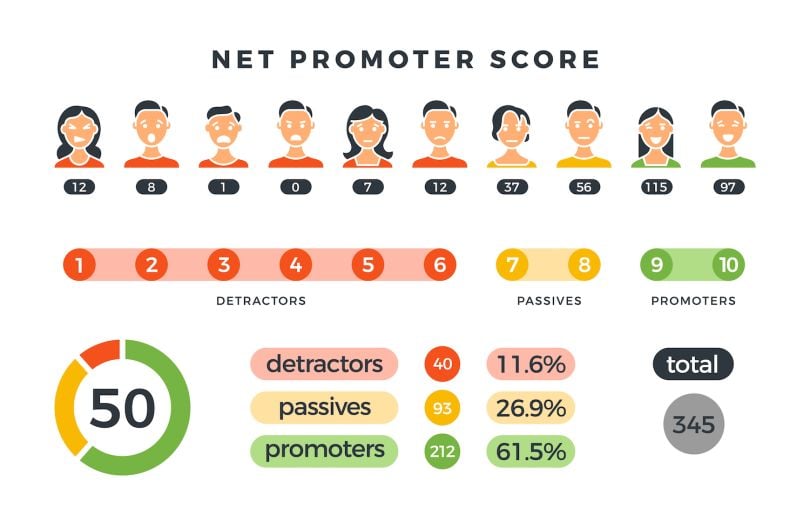

Net Promoter Score

If the cohort retention rate measures users’ willingness to stick with your product, the net promoter score is an indication of how likely they are to recommend it to others.

The score can be tallied with a single question: “How likely is it that you would recommend our product or service to a friend or colleague?”

People who rate the product six or lower are called “detractors,” those who give the product a seven or eight are called “passives” and respondents who select a nine or 10 are “promoters.” These responses are then plugged into the formula below for a score.

NPS = percentage of promoters – percentage of detractors.

The San Diego-based online grocery shopping and delivery company Mercato scores around 70, said Mike Mason, a product manager at the company. But Mercato actually uses the metric to diagnose service gaps, not to assess product-market fit.

“We’ve never really seen a huge increase in the NPS just based on a feature we added,” Mason said. “It can be misleading, too, because you might have exceptional customer service but not a great product, or vice versa. It doesn’t tell the full story.”

Another issue is that people completing the survey might be end users — not the people paying for the service. That’s according to Alex Willen, who spent 10 years as a product manager at early stage enterprise SaaS startups.

While the net promoter score may not tell you whether you have product-market fit, it’s a useful measure of a company’s customer experience and perceived ethos, Ellis said.

Customer Lifetime Value (LTV/CAC Ratio)

The lifetime value to customer acquisition cost ratio — arguably the most revenue-driven framework — is a measure of how much you make from a customer relative to how much you spend to get one.

A report in Klipfolio describes one of the most powerful indicators of product-market fit — the customer lifetime value metric — by this equation.

(LTV) = Gross Margin % X Avg. Monthly Payment / Churn Rate

/

(CAC) = Sales and Marketing Costs / New Customers Won

This might seem like a straightforward metric until you start to unpack marketing acquisition costs and define what it means to be an acquired customer.

Go-to-Market

Some entrepreneurial-minded skeptics, like Willen, view all these methods as lagging indicators of product-market fit: a case of the chicken and the egg.

“By the time you have enough customers to use these methods,” he wrote, “you’ve probably already signed enough deals to indicate that you do have product-market fit.”

So what do you do if, like Willen, you’re trying to launch an online dog treat business on a shoestring budget?

“There’s no better way to know if people want your product than if they’re willing to pay for it — or use it, visit it, or whatever else you’re hoping people will do,” he wrote.

Willen already had the product developed, and it was cheap to produce. For about $2,000, he was able to get packaging designed on 99designs, set up a Shopify site, do a small production run and start advertising on Google and Instagram.

If going to market without knowing you have product-market fit is prohibitively expensive or time-consuming, according to Willen, you should be inventive — find a hack that’s a cheaper way to judge people’s intent to purchase your product. For a consumer app, that might mean running ads for it and seeing if people click on them. Say you’ve got a wild idea for on-demand llama delivery. If you want to know if it will work, put up some Facebook ads and test the water.

“Of course, in that case people might just click out of amusement, so the further you can go to judge actual intent, the better,” Willen said. “If you put up a landing page asking people for their email addresses to find out when llamas will be available in your city, that will give you a better signal of intent.”

In essence, there’s a tradeoff between the upfront time and cost investment you make and how strong of a product-market fit gauge you’ll get in return. If you fully build and launch your product, you’ll have a nearly irrefutable determination — the product sells well or it doesn’t — but at a high cost. If you send a quick survey to people in your network asking if they’d be interested in your product, you’re not going to get a great signal of product-market fit, but your cost will be low.

The key, according to Willen, is to find the right balance of cost versus signal quality. In some cases you might need to launch a scaled-down version of your app, where in others you might do well building a deck that lays out the product and value proposition for people in your target audience.