Nvidia and 4 Other Stocks Can Help You Build the Ultimate Artificial Intelligence (AI) Portfolio

Artificial intelligence (AI) could create trillions of dollars in economic activity, and that spells opportunity for investors.

At the beginning of 2023, semiconductor giant Nvidia (NVDA 0.81%) was a $360 billion company. Its fortunes quickly changed when OpenAI and its artificial intelligence (AI)-powered chatbot, ChatGPT, captivated investors.

ChatGPT’s ability to accurately answer complex questions and generate text and computer code on command sent some of the world’s largest tech giants clamoring to buy Nvidia’s graphics chips (GPUs) for their data centers since they are the best in the industry for developing, training, and deploying AI applications.

As a result, Nvidia’s revenue soared, and the company is now worth an eyewatering $2.6 trillion. That could be a mere taste of what’s to come because Wall Street thinks AI will add somewhere between $7 trillion to $200 trillion to the global economy within the next decade.

Picking winners and losers in the AI race won’t be easy for investors, but the following five stocks offer a solid starting point.

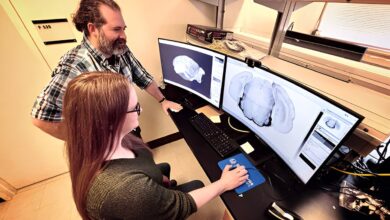

Image source: Getty Images.

1. Nvidia

Nvidia is currently unrivaled in the data center chip market. Its H100 GPU is the go-to choice for data center operators like Amazon and Microsoft (MSFT -0.27%), which are buying them by the tens of thousands and renting the computing power to AI developers. They can earn $5 in rental revenue over a four-year period for every $1 they invest in AI GPUs, according to Nvidia, so their appetite to spend big comes as no surprise.

But Nvidia is gearing up to start shipping its new H200, which is twice as fast as the H100 for inferencing AI models (feeding them live data so they can make predictions). Plus, production has begun on another series of GPUs built on Nvidia’s new Blackwell architecture, which could inference up to 30 times faster than the H100.

Nvidia reported its financial results for the first quarter of fiscal 2025 (ended April 28), and its data center revenue soared by a whopping 427% year over year to a record $22.6 billion. Remarkably, it accelerated from the 217% growth the company generated during fiscal 2024, and with new GPUs on the horizon, its momentum looks certain to roll on for now.

Nvidia’s 10-for-1 stock split will come into effect on June 10, so buying one share will soon cost a fraction of the $1,064 investors would have to fork out today.

2. Alphabet

Alphabet (GOOG -0.35%) (GOOGL -0.28%) is the parent company of Google, YouTube, Waymo, and DeepMind (among other subsidiaries). Google Search has been the window to the internet for more than two decades, so Alphabet has mountains of useful data with which to build AI models, and it’s doing just that.

The company launched a chatbot called Bard last year to compete with the new ChatGPT-powered Microsoft Bing search engine, but it has since been superseded by a more advanced lineup of AI models called Gemini. Alphabet touts Gemini’s multimodal capabilities as among the most advanced in the industry, which means it can interpret and generate text, images, videos, and computer code better than most competing models.

Alphabet stock is up 26% this year, and it’s trading at an all-time high, yet with a price-to-earnings (P/E) ratio of just 26.8, it remains far cheaper than the 31.3 P/E ratio of the Nasdaq-100 technology index. In other words, it’s a great value compared to almost every other AI tech giant.

3. Broadcom

Over the course of decades, Broadcom (AVGO -1.54%) developed innovative products in the semiconductor and computing industry, including the world’s first small infrared transceiver, which allowed wireless data exchange for computers, phones, printers, and more. In 2016, it merged with semiconductor giant Avago Technologies and then acquired semiconductor device supplier CA Technologies, cybersecurity company Symantec, and cloud software giant VMware.

Broadcom now has a multifaceted presence in AI. For example, Symantec partnered with Google’s VertexAI platform to create SymantecAI, a virtual assistant designed to accelerate incident response in its existing cybersecurity software. Then there is VMware, which facilitates virtual machines so multiple users can plug into the same servers to utilize all of their capacity. In the age of AI, where chips are expensive (and in short supply), this helps developers get the most from their data center infrastructure.

Broadcom also offers AI operations software for businesses and data center hardware designed to accelerate AI workloads. The company is poised for strong growth in 2024 and is one of the most diverse AI stocks money can buy.

4. Lemonade

Lemonade (LMND 0.79%) is using AI to transform the insurance industry, from the customer experience to the way premiums are calculated. Its chatbot, Maya, can write quotes for potential customers in under 90 seconds, and its AI bot, Jim, can pay claims for existing policyholders in three minutes without human intervention.

Lemonade’s internal Lifetime Value (LTV) models predict everything from a customer’s likelihood of making a claim, to the performance of its insurance products in specific geographic markets. All of this information is pulled together so Lemonade can try to deliver the most accurate premiums possible, which can translate to savings for policyholders.

Lemonade has attracted over 2 million customers so far — many of them from younger age cohorts — which proves its tech-powered approach to the relatively boring insurance industry is resonating. It’s still a small company with a market capitalization of just $1.2 billion, but it’s growing quickly and its stock offers an attractive risk-reward profile right now.

5. Microsoft

Last but certainly not least is Microsoft. It’s the world’s largest company, and as I touched on earlier, it agreed to invest a chunk of its treasure into OpenAI last year. The deal quickly made Microsoft a leader in the AI software space thanks to the start-up’s latest GPT-4 models, which power a growing number of the tech giant’s products.

Legacy 365 software applications Word, Excel, PowerPoint, and Outlook now feature an AI Copilot, which is capable of rapidly generating text, images, and more to boost the user’s productivity. Even Windows and the Edge internet browser come fitted with an AI assistant that stands ready to answer even the most complex questions.

However, the Azure cloud platform for businesses is the fastest-growing part of Microsoft’s business right now. Its Azure OpenAI Service gives developers access to the most advanced large language models (LLMs), which they can use to create their own applications. As of the recent third quarter of fiscal 2024 (ended March 31), Microsoft said that 65% of the Fortune 500 companies were customers of Azure OpenAI Service, which highlights how quickly AI is traveling through the corporate world.

Microsoft is one of the greatest AI software stocks investors can buy right now.