3 Artificial Intelligence (AI) Stocks Set to Benefit

For the first time in a long while, the United States is serious about increasing domestic semiconductor (“chip”) manufacturing. For years, the U.S. has been hyper-reliant on Taiwan for chip production; however, the threat that China will seek to reunify with the island, potentially by force, makes this a massive economic risk.

Because of this, the U.S. introduced the CHIPS and Science Act, which provides monetary incentives to companies that increase manufacturing capacity domestically.

The Semiconductor Industry Association (SIA) recently released a report predicting that domestic production capacity will triple by 2032. This is a gigantic boon, considering that U.S. capacity only increased by 11% from 2012 to 2022. The SIA reports 83 new endeavors, $447 billion in investments in 25 states, and over 50,000 jobs created since the CHIPS Act was introduced in 2020.

Perhaps the most exciting development is the expected increase in domestic production of advanced logic chips used in artificial intelligence (AI). In 2022, the U.S. held a whopping 0% of the world’s capacity. American advanced logic chip capacity will increase to 28% by 2032, according to SIA projections.

Here are some companies that will benefit from the upcoming explosion in domestic manufacturing.

Intel

According to the SIA, Intel (NASDAQ: INTC) has received the largest grant of any company thus far at $8.5 billion. It also received $11 billion in loans for projects in Oregon, Arizona, New Mexico, and Ohio. The total investment in these projects, which include new fabrication plants, expansions, and modernization, is expected to be $100 billion. These projects should have significant long-term benefits for Intel due to increased capacity and efficiency.

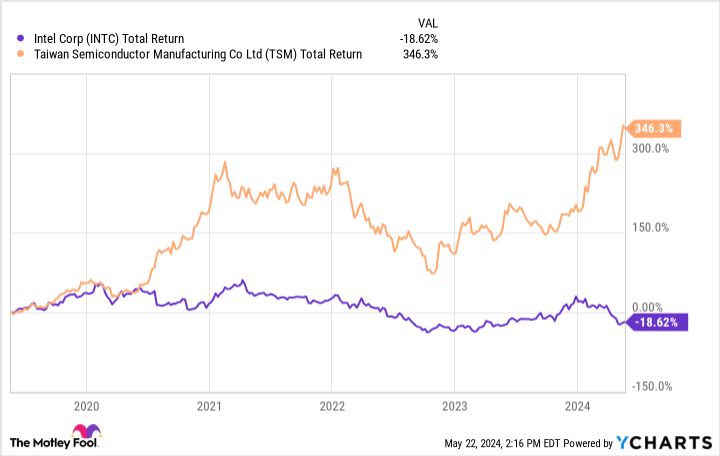

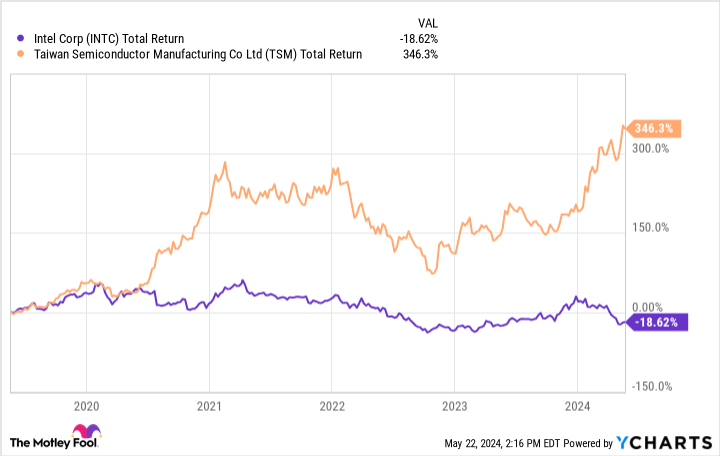

Intel has fallen from its former glory after missing out on the smartphone revolution (the vast majority use Arm Holdings-designed chips instead of Intel’s) and falling behind competitors like Taiwan Semiconductor Manufacturing (NYSE: TSM). The proof is in the pudding, or, in this case, the stock performance:

Investing billions in modernization and increased capacity is critical as Intel plays catch-up in the industry. The question is whether it can do this effectively to catch the AI wave washing over the market. Advanced logic chips are critical to AI, and Intel is the only U.S. company that designs and manufactures them. The grants and loans will provide an important boost and defray some of the costs of expansion.

Intel reported improved financials in the first quarter, with sales up 9% to $12.7 billion and a narrower operating loss. However, the company is not free-cash-flow-positive and is saddled with $48 billion in long-term debt. The stock trades with a forward price-to-earnings (P/E) ratio of 28, which is higher than TSMC’s 25 P/E. Still, Intel has ambitious plans and significant backing from the government as it seeks to increase domestic capacity. The market opportunity is enormous, so it will ultimately come down to Intel’s execution.

Taiwan Semiconductor

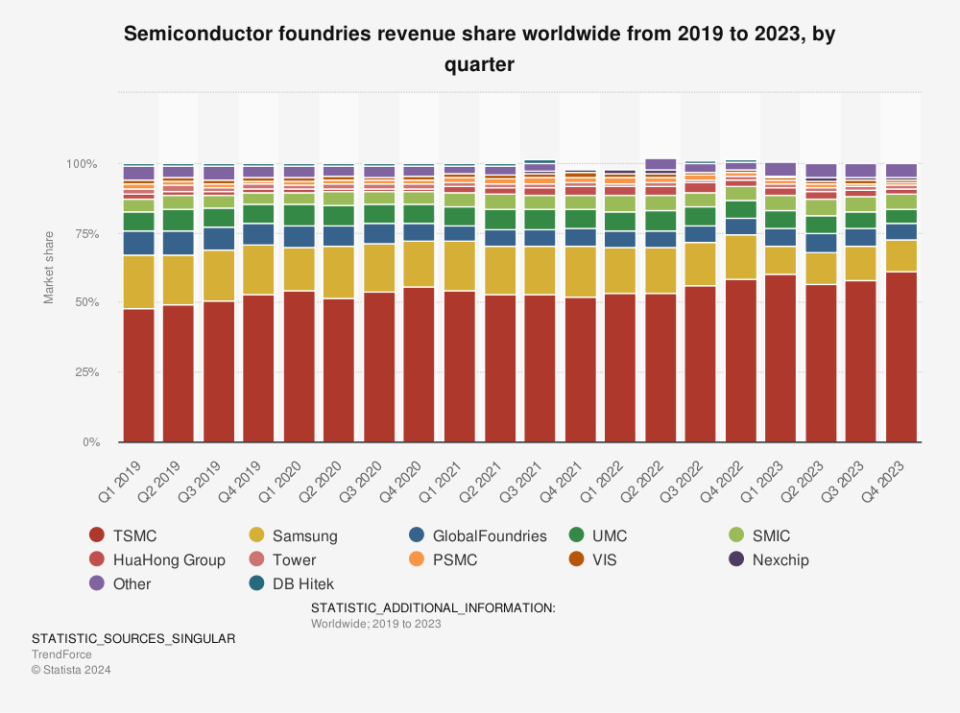

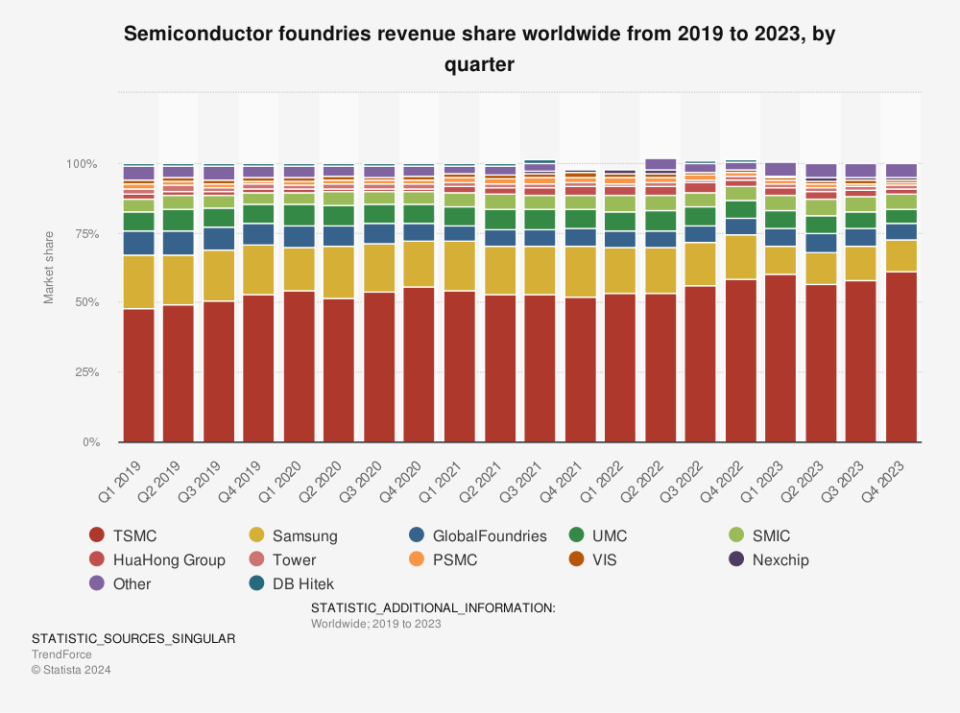

As you can see below, TSMC dominates the global foundry market share with more than 60%, but it isn’t resting on its laurels. The company is building three new fabrication plants in Arizona, a $65 billion project financed partly through the CHIPS Act, with $6.6 billion in grants and $5 billion in loans. This diversification to U.S. manufacturing is critical due to Taiwan’s geopolitical realities with China.

TSMC’s Q1 revenue increased 13% year over year to $19 billion when measured in U.S. dollars. The company has a terrific business model with a 42% operating margin, $14 billion in cash generated from operations, and total assets that outweigh total liabilities by almost three to one.

Taiwan Semi stock trades at a P/E of 30 (25 on a forward basis), compared to its five-year average P/E of 23. The market is pricing in the benefits of expansion and a new wave of spending related to AI. Still, this stock is an excellent long-term semiconductor play, so investors should watch closely to capitalize on any short-term dips.

Vertiv Holdings

Along with the direct beneficiaries of government assistance, there will be many adjacent companies that benefit. AI applications need data centers to process gigantic amounts of information, and data centers need high-performance chips produced by Intel and TSM. As more data centers come online, the companies that make the infrastructure will see tremendous demand.

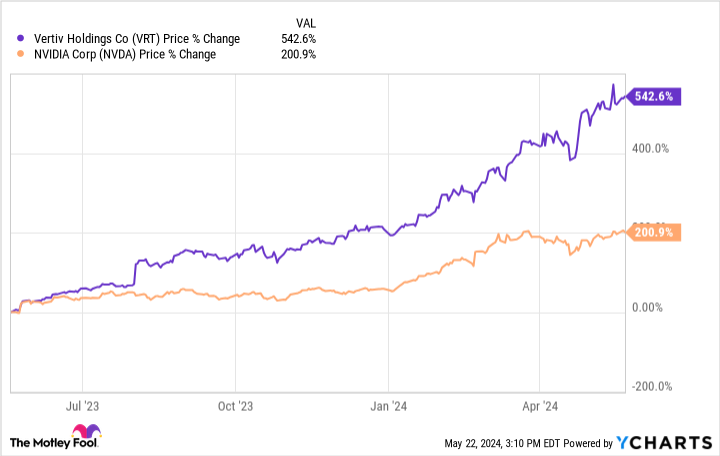

You may not have heard of Vertiv Holdings (NYSE: VRT), but the stock has far outpaced Nvidia over the past year, as shown below.

Vertiv provides data centers with critical power, cooling, racking, cabling, other infrastructure, and monitoring and management software. Its Vertiv 360AI product covers all of these challenges in a comprehensive solution.

The first quarter saw 8% year-over-year revenue growth for Vertiv, reaching $1.6 billion. But this wasn’t the full story. The company reported a 60% increase in orders, pushing its backlog to $6.3 billion. This is a massive number for Vertiv, which earned $6.9 billion in total revenue in 2023 and expects to earn up to $7.7 billion this year.

Vertiv’s market capitalization of $37 billion isn’t outrageous despite the stock’s impressive run, given that the company is expecting operating profits of $1.2 billion this year — $1.35 billion on a non-GAAP (adjusted) basis — and free cash flow over $800 million. The company is also buying back its stock. It used $600 million to take more than 9 million shares off the market in Q1.

Two of Vertiv’s partners are industry giants Nvidia and Intel, so this data center infrastructure provider looks like a long-term AI winner.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $697,878!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Bradley Guichard has positions in Arm Holdings. The Motley Fool has positions in and recommends Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

U.S. Chip Manufacturing Could Triple in Less Than a Decade: 3 Artificial Intelligence (AI) Stocks Set to Benefit was originally published by The Motley Fool