Salesforce (CRM) Q1 Earnings Top, Stock Falls on Weak Sales View – May 30, 2024

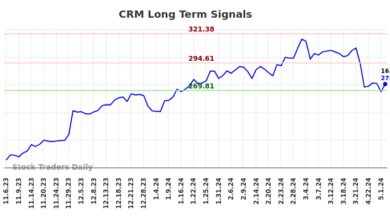

Salesforce (CRM – Free Report) shares were trading nearly 16% lower in Thursday’s pre-market trading session as the company reported mixed first-quarter fiscal 2025 results, wherein non-GAAP earnings surpassed the Zacks Consensus Estimate, but revenues fell short of the same.

The customer relationship management software maker also provided weak sales and earnings guidance for the second quarter, turning investors increasingly cautious about its near-term prospects. A dim second-quarter outlook signals a slowdown in cloud and tech spending amid still-high interest rates and protracted inflationary conditions.

Before delving deeper into guidance, let’s discuss first-quarter results.

The enterprise cloud computing solution provider’s first-quarter non-GAAP earnings increased 44% to $2.44 per share from $1.69 in the year-ago quarter. The figure also surpassed the Zacks Consensus Estimate of $2.38. The robust year-over-year growth was mainly driven by higher sales and the benefits of ongoing cost-restructuring initiatives, which include the trimming of the workforce and a reduction in office spaces.

Salesforce’s quarterly revenues of $9.13 billion climbed 11% year over year. The top line also improved 11% at constant currency. However, quarterly revenues marginally fell short of the Zacks Consensus Estimate of $9.14 billion.

CRM has been benefiting from resilient demand for its cloud and business software offerings in an uncertain macroeconomic environment. The first-quarter top-line performance also reflected the benefits of its go-to-market strategy and sustained focus on customer success.

Additionally, the company’s initiative to integrate artificial intelligence into its offerings, like Slack and the launch of a generative AI-enabled Einstein GPT product, also boosted demand for its solutions during the reported quarter.

Quarterly Details

Coming to CRM’s business segments, revenues from Subscription and Support (94% of total revenues) increased 12.3% year over year to $8.59 billion. However, Professional Services and Other (6% of total sales) revenues decreased 9.4% to $548 million. Our estimates for the Subscription and Support, and Professional Services and Other segments’ revenues were pegged at $8.52 billion and $609.4 million, respectively.

Under the Subscription and Support segment, Sales Cloud revenues grew 10.4% year over year to $2 billion. Revenues from Service Cloud also improved 11.1% to $2.18 billion.

Marketing & Commerce Cloud revenues increased 9.6% to $1.28 billion. Platform & Other revenues were up 9.6% to $1.72 billion. The company has renamed the Data sub-segment to the Integration and Analytics division. Revenues from the Integration and Analytics division increased 24.2% year over year to $1.41 billion.

Our estimates for Sales, Service, Market & Commerce, Platform & Other, and Integration & Analytics services revenues were pegged at $2 billion, $2.18 billion, $1.27 billion, $1.73 billion and $1.34 billion, respectively.

Geographically, revenues from America (66% of total revenues) grew 10.6% year over year to $6.06 billion. Sales in the EMEA (23%) increased 9.9% to $2.15 billion, while the Asia Pacific (11%) region’s revenues soared 13.8% to $926 million.

Salesforce’s non-GAAP gross profit came in at $7.33 billion, up 13.2% year over year. Moreover, the gross margin improved 170 basis points (bps) to 80.2%.

It recorded a non-GAAP operating income of $2.93 billion, up 28.8% from the year-ago quarter’s $2.27 billion. Moreover, the non-GAAP operating margin expanded 450 bps to 32.1%, primarily due to an improvement in the gross margin and benefits from cost restructuring initiatives, including the trimming of the workforce and a reduction in office spaces.

Balance Sheet & Other Details

Salesforce exited the fiscal first quarter with cash, cash equivalents and marketable securities of $17.7 billion, up from $14.2 billion at the end of the previous quarter. CRM generated operating cash flow of $6.25 billion and free cash flow of $6.08 billion in the first quarter.

As of Apr 30, 2024, the current remaining performance obligation reflecting revenues under contract for the next 12 months was $26.4 billion, up 10% on a year-over-year basis. The company bought back shares worth $2.13 billion and paid $388 million in dividends during the first quarter.

Guidance Update

Salesforce provided guidance for the second quarter of fiscal 2025. For the fiscal second quarter, it projects total sales between $9.20 billion and $9.25 billion (midpoint $9.225 billion), which indicates 7-8% growth from the year-ago levels. However, revenue guidance falls short of the Zacks Consensus Estimate of $9.32 billion.

The company expects a $50 million impact on second-quarter revenues from foreign currency exchange rates. Furthermore, CRM anticipates non-GAAP earnings per share in the band of $2.34-$2.36 for the current quarter. The consensus mark for second-quarter earnings is currently pegged at $2.40.

For fiscal 2025, Salesforce still expects revenues in the range of $37.7-$38 billion. The consensus mark for fiscal 2025 revenues is pegged at $37.93 billion.

It continues to anticipate foreign currency exchange rates to negatively impact its fiscal 2025 revenues by $100 million. However, it slightly lowered projections for Subscription and Support revenues. CRM now anticipates Subscription and Support revenues to increase slightly below 10% on a year-over-year basis and approximately 10% on a constant currency basis. Earlier, the division’s sales were expected to grow 10% on a reported basis and slightly above 10% at constant currency.

Salesforce raised the fiscal 2025 non-GAAP earnings guidance range to $9.86-$9.94 per share from $9.68-$9.76 per share projected previously. The consensus mark for the bottom line currently stands at $9.71. The non-GAAP operating margin is still projected to be approximately 32.5%. It continues to anticipate operating cash flow to increase 21-24% from the prior-year levels.

Zacks Rank & Stocks to Consider

Salesforce currently carries a Zacks Rank #3 (Hold). Shares of CRM have risen 3.2% year to date (YTD).

Some better-ranked stocks in the broader technology sector are Tyler Technologies (TYL – Free Report) , Datadog (DDOG – Free Report) and Palo Alto Networks (PANW – Free Report) . Tyler Technologies and Datadog each sport a Zacks Rank #1 (Strong Buy), while Palo Alto has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tyler Technologies’ 2024 earnings has been revised 18 cents upward to $9.15 per share in the past 60 days, which suggests year-over-year growth of 17.3%. The long-term estimated earnings growth rate for the stock stands at 15%. The TYL stock has soared 13.7% YTD.

The Zacks Consensus Estimate for Datadog’s 2024 earnings has been revised upward by 12 cents to $1.54 per share in the past 30 days, which calls for an increase of 16.7% on a year-over-year basis. The long-term expected earnings growth rate for the stock is pegged at 9.6%. DDOG shares have risen 0.2% YTD.

The consensus mark for Palo Alto’s fiscal 2024 earnings has remained unchanged at $5.50 per share over the past 60 days, which indicates a 23.9% increase from that reported in fiscal 2023. It has a long-term earnings growth expectation of 22.1%. The PANW stock has risen 4% in the YTD period.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.