What it’s like to work at Robinhood and who it’s hiring, from CEO Vlad Tenev

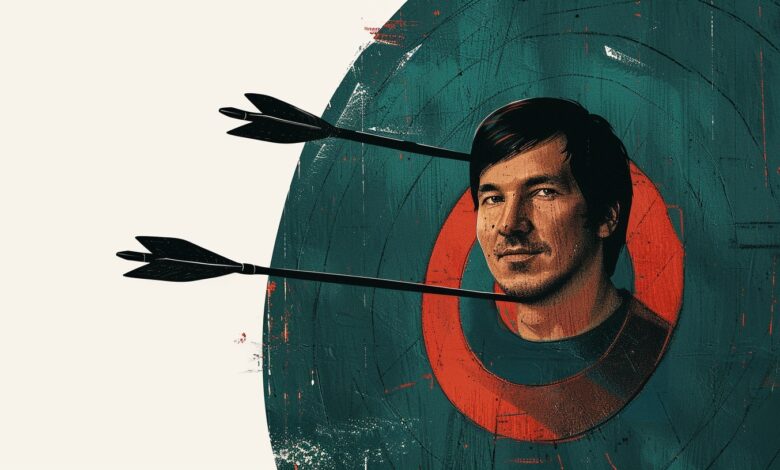

Robinhood is one of the most recognizable names in fintech, but how do you get a job there and what’s it really like? Robinhood’s founder and CEO, Vlad Tenev, recently appeared on a podcast with venture capitalist Logan Bartlett in which he discussed how the company approaches hiring, and how much autonomy Robinhood employees have.

Click here to sign up for our fintech newsletter 🤖

How to get a job at Robinhood

Robinhood loves hiring two kinds of people. Tenev said these are “people who are earlier in their career” with “higher potential,” and “people with high mathematical talent.”

Tenev said Robinhood’s products require “a lot of hardcore engineering work” to perfect, but coding expertise isn’t (always) essential. “In some cases, even if you don’t know how to code in Python, we’ll give you a shot,” provided you’ve proven your competency elsewhere.

Robinhood also has a thing for AI talent. Tenev said the fintech has been hiring AI employees “from when it was called machine learning,” and that “Robinhood will be the leader for AI in financial services.” What’s he using all the AI for? “Taking a lot of the transactional relationship stuff and completely automating it.”

Tenev said Robinhood has a high bar for hiring. He also said there have been some issues with people hired in the past. A few years ago, “a lot of people came to Robinhood because they thought it would look good on their resume.” In 2022, when Robinhood’s situation was more difficult, “a lot of those folks were unhappy.” Tenev says that period was “excruciating,” but that people who aren’t fair weather hires can be better. “Some of the people that joined in those times were actually incredibly good.”

What are the best jobs at Robinhood?

Tenev also shed some insights on Revolut’s general manager (GM) roles. These are leadership roles specific to product fields, but Tenev says they’re much more than just product managers (PMs). GMs “decentralize accountability and responsibility,” taking more of a focus on P&L than traditional PMs. Tenev says general managers “live and breathe the product” and “feel a tonne of pressure” to see them succeed.

There doesn’t appear to be a specific profile for Robinhood’s GMs. Crypto GM Johann Kerbrat had a background in engineering with Uber and AirBnB. Futures GM JB Mackenzie previously worked in electronic trading for MF Global and was most recently a managing director at Toronto Dominion. Rich Sommers, meanwhile, spent the bulk of his career as a laboratory technician.

Robinhood also has core product and marketing teams, and Tenev says that there can often be “conflict and tension between the platform teams and GMs.” One issue is that GMs “want to move fast and be independent,” without always ensuring consistency with Robinhood’s product suite. Tenev says the advantage of this is that these arguments are “conscious conflicts that by-and-large make the company better” once resolved.

Why did Robinhood stop being remote-first?

Robinhood is also different to most fintechs in that it is staunchly anti-remote work. Bartlett said on the podcast that he asked a Robinhood employee if they were in the office every day, and they unironically answered, “no, just Monday to Friday.” Robinhood once upon a time announced itself as a remote-first company, but Tenev said he knew he “made a terrible mistake” the moment he announced it.

A minute number of remote jobs are still available at Robinhood, and Tenev says that he didn’t ask remote workers miles away from Robinhood’s offices to come in if they were already working there. Tenev said that “most people actually clustered around areas we had offices anyway.”

Tenev said the reason for abandoning remote work is that “having some awareness for what people are doing is important,” and the interactions that facilitate this are “very difficult to manufacture in the remote world.” Even if you are the only person on your team working from your office, Tenev says that you should look at things as though “everyone on the company is ‘on your team.'”

What do employees think about working at Revolut?

Like hard-driving fintechs such as Revolut and OakNorth, Robinhood isn’t free from internal criticism. Reviews on jobs forum Blind in 2024 say managers “won’t feel ashamed to drop work on teams chat at 12 am on a weekend and expect you to respond,” and many describe the environment as “chaotic.” One review says most of these employees simply have “low horsepower” and only average “~25 hours of actual work per week.” Tenev himself said people at Revolut need to be “really, really smart and high horsepower.”

More positive reviews gush over the quality of the technical staff, and say the tech stack is “pleasant to work with.” They also praise how “open and transparent” the leadership team is. A frequent compliment to Robinhood is its compensation; it ranks fourth in our list of the highest paying fintechs, and engineers earn an average total compensation of $347.5k, according to Levels.fyi.

In spite of the criticisms, Robinhood’s staff seem to get results. Robinhood’s employees generate an obscene amount of revenue-per-employee, peaking at $871k last year. Think you have what it takes to be one of them?

Have a confidential story, tip, or comment you’d like to share? Contact: +44 7537 182250 (SMS, Whatsapp or voicemail). Telegram: @SarahButcher. Click here to fill in our anonymous form, or email editortips@efinancialcareers.com. Signal also available.

Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. Eventually it will – unless it’s offensive or libelous (in which case it won’t.)