Salesforce Q1: cRPO Deceleration Continues; Rating Downgrade (NYSE:CRM)

wdstock

I presented my ‘Hold’ thesis on Salesforce (NYSE:CRM) in my initiation report published in December 2023, pointing out their multi-cloud strategy and large deals growth. The company published their Q1 FY25 report on May 29th after the market close, lowering the guidance of subscription & support revenue and GAAP operating margin for the full year. Salesforce’s current remaining performance obligation (cPRO) growth continues to decelerate caused by cautious enterprise spending. I think the current stock price is overvalued and I am downgrading to ‘Sell’ rating with a fair value of $210 per share.

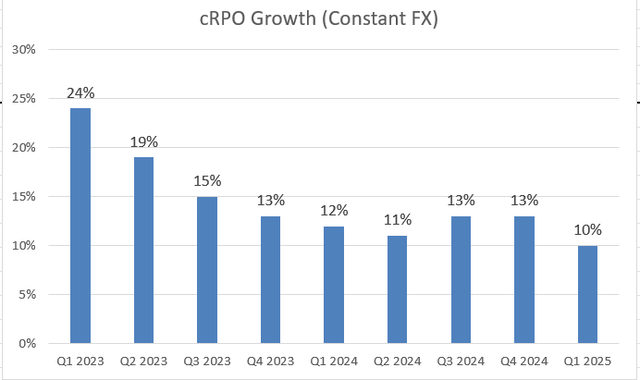

Weak cRPO Growth Amid Cautious Enterprise Spending

The biggest takeaway from the quarter is Salesforce’s deceleration of cRPO growth, as depicted in the chart below. The company anticipates 9% constant growth in cRPO in Q2 FY25.

During the earning call, the management pointed out enterprise customers continued to be cautious about IT spending amid the current macro environment. Enterprise customers are seeking short-duration projects, which has affected Salesforce’s service cRPO growth. I believe the weak enterprise software spending could persist in the near future for the following reasons:

- Enterprise customers allocate more IT budget towards AI computing, while adopting a cautious approach to consulting services and other discretionary spending. According to a study by SiliconANGLE, 40% of organizations acknowledge that generative AI funding is diverting resources from other tech budgets. The rising AI technology has forced enterprise CIOs to rethink their IT budget allocations. Some of Salesforce’s services are quite discretionary, which could potentially be affected by the IT budget reallocation.

- During Workday’s (WDAY) recent earnings call, Workday expressed that large enterprises were quite cautious about IT platform spending, and the company experienced increased deal scrutiny. As such, I think Salesforce’s weakness is not unique to the company, but indicative of industry-wide softness.

Financial Recap and FY25 Outlook

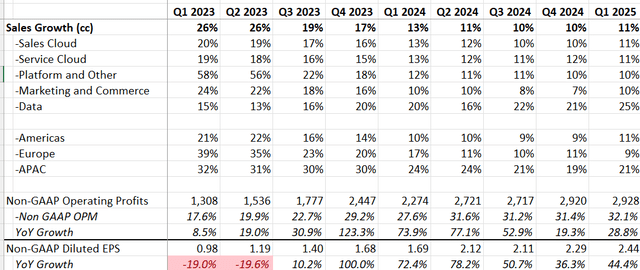

In Q1 FY25, Salesforce delivered 11% constant currency revenue growth and 28.8% adjusted operating profit growth, reflecting strong margin expansion, as shown in the table below.

The strong margin expansion is primarily driven by disciplined expense management that the company put in place several quarters ago, as discussed in my initiation report. Salesforce laid off roughly 8,000 employees in 2023, which helped their margin expansion this year.

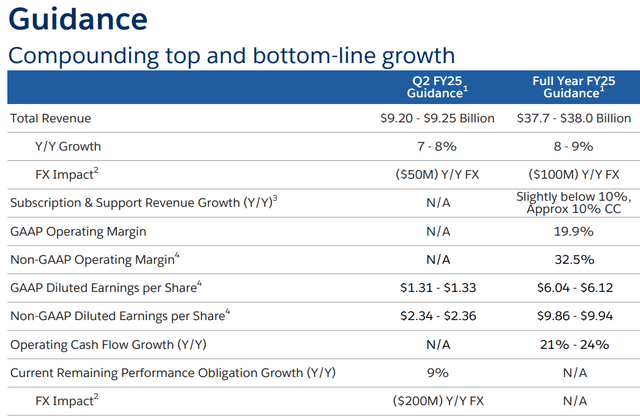

Salesforce guides 8-9% revenue growth with 550bps reported margin expansion for FY25. I appreciate the company’s efforts to control expenses and drive growth of profits and cash flow.

Salesforce Investor Presentation

For FY25’s growth, I consider the followings:

- Considering the deceleration of cRPO growth, I anticipate the company’s revenue growth will begin to decelerate in the coming quarters, especially in the second of FY25. As discussed earlier, enterprise customers are more likely to maintain a cautious stance on IT spending in the near-term.

- As pointed out in my previous report, Salesforce is focusing on multi-cloud large-sized deals, leveraging their multiple platforms including CRM, MuleSoft, Tableau and Slack. I continue to anticipate low-teen growth from these multi-cloud businesses.

- Salesforce is integrating their Einstein AI into their platforms such as Slack. Considering Salesforce’s massive customer base, the company could generate additional revenue from Einstein AI product.

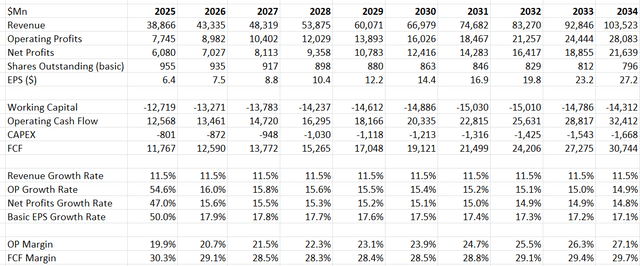

Considering all these factors, I forecast Salesforce will grow their revenue by 9% organically in the future years, a deceleration from double-digit in the past.

Valuation Update

Salesforce spent $7.6 billion in shares repurchase in FY24 and returned another $2.5 billion in the form of shares buyback and dividends in Q1 FY25. I calculate that the total number of shares outstanding will decline by 2% annually at the current stock price.

Salesforce has done a great job to control their operating expenses over the past few quarters. I forecast the company will continue its efforts to improve gross profits and control sales/marketing expenses. I forecast the company will generate 30bps gross profit leverage from COGS and 50bps leverage from sales and marketing expenses.

In addition, I forecast Salesforce will allocate 10% of revenue towards M&A, contributing 2.5% growth to the topline.

The quick summary of the DCF model can be found below:

Salesforce DCF – Author’s Calculations

The WACC is calculated to be 14.4% with the following assumptions:

-Risk free rate: 4.25% (US 10Y Treasury Yield)

-Beta 1.67 (SA)

-equity risk premium 7%; cost of debt 7%;

-debt balance $10 billion; equity $59 billion

-tax rate: 23.5%

Discounting all the future free cash flow and adjusting the net cash balance, the fair value is calculated to be $210 per share, as per my estimate.

Key Risks

As reported by the media in April 2024, Salesforce was in advance talks to acquire Informatica (INFA). While the news was merely market speculation, Salesforce has a history of making large-size acquisitions, and Marc Benioff has a huge ambition to consolidate the software platforms. In most cases, large acquisitions tend to hurt the stock price in the near-term, potentially diluting shareholders value. Therefore, Salesforce’s shareholders should be well prepared for any large deal announcement in the future.

Additionally, Salesforce’s stock-based compensation (SBC) continues to be at a relatively high level, and the management anticipate SBC will be around 8% of total revenue in FY25. Salesforce needs to lower its SBC level if they want to continue to expand their reported operating margin going forward.

Since this report is a ‘Sell’ thesis, I am thinking about the potential upside of the stock price. Salesforce is a well-respected platform company across data, CRM and cloud. The current deceleration is not driven by the company’s internal issues as discussed earlier, but by the softness of enterprise IT spendings. Over the long term, I continue to believe enterprises will invest in IT platforms, seeking a balanced budget allocations towards AI and other IT solutions.

In addition, Salesforce has been investing heavily in their AI solutions, such as Einstein AI. I acknowledge that Salesforce has tremendous amount of data from enterprise customers, which could be quite valuable for their AI solutions. At this moment, Salesforce doesn’t disclose the revenue contribution from Einstein AI. In the future, when the AI business grows to a certain scale, the company might separate the reporting of AI, which could potentially be favored by the market.

Conclusion

I anticipate continuing weakness in platform spending among large-enterprise customers in the near term. As Salesforce’s stock price is overvalued based on my calculation, I am downgrading to ‘Sell’ rating with a fair value of $210 per share.