Main takeaways from Salesforce’s (CRM) Q1 2025 earnings report

Salesforce, Inc. (NYSE: CRM) this week reported better-than-expected earnings for the first three months of fiscal 2025. However, the customer relationship management platform’s stock suffered a selloff post-earnings, reflecting the market’s disappointment over its weak second-quarter guidance. Currently, the tech firm is going through an AI transformation, enabling customers to become more efficient by using the technology.

Selloff

The stock plunged on Wednesday evening, marking the biggest fall in nearly two decades. In the following session, CRM traded at the lowest level in more than six months and 32% below its March peak. In Q1, the company paid its first-ever quarterly dividend of $0.40 per share for a total of 388 million, a move that could attract more income investors to the stock. Salesforce has delivered predictive AI across all its clouds with Einstein, which is an integrated set of AI technologies for its CRM platform.

While market conditions for the broad technology sector have improved significantly after a challenging period, lingering macroeconomic uncertainties continue to worry companies like Salesforce. The current slowdown doesn’t seem to be secular, rather it is more cyclical in nature. While the company’s leadership is bullish on its growing AI capabilities, it is expected that easing interest rates and economic recovery would catalyze future revenue growth.

Earnings Beat

The cloud software vendor has a history of consistently beating analysts’ earnings estimates – In the past one and a half decades, quarterly EPS either beat or matched Street View. In the first quarter of 2025, adjusted net income increased sharply to $2.44 per share from $1.69 per share in the same period last year. Analysts were looking for slower bottom-line growth. On an unadjusted basis, net profit surged to $1.53 billion or $1.56 per share in Q1 from $199 million or $0.20 per share in the corresponding period of 2024.

Anticipating the positive momentum to continue in the current quarter, the company forecasts Q2 earnings per share in the range of $2.34 to $2.36 and full-year EPS between $9.86 and $9.94. However, the second-quarter outlook is below analysts’ consensus forecast. The company ended the first quarter with a healthy free cash flow of $6.1 billion, which is up 43% year-over-year.

“We continue to adopt AI inside Salesforce. Under the leadership of our chief people officer, Nathalie Scardino; and our chief information officer, Juan Perez, we’ve integrated Einstein right into Slack, helping our employees schedule, plan, and summarize meetings and answer employee questions. Einstein has already answered nearly 370,000 employee queries in a single quarter. In our engineering organization, our developers now save more than 20,000 hours of coding each month through the use of our AI tools,” said COO Brian Millham at the Q1 earnings call.

Revenue up 11%

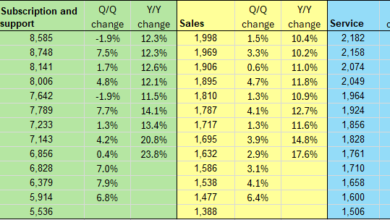

April-quarter revenues advanced 11% year-over-year to $9.13 billion but missed estimates. All key operating segments registered double-digit revenue growth during the three months. The management forecasts an increase in July-quarter revenues to $9.20-$9.25 billion, which falls short of the market’s projection. The full-year revenue guidance is in the $37.7-38 billion range.

Recovering from the post-earnings dip, shares of Salesforce traded higher on Friday afternoon after closing the previous session lower. They have dropped around 25% in the past three months.

![Rick and Michonne Finally Dispose of the CRM in ‘The Ones Who Live’ Finale [Spoilers] Rick and Michonne Finally Dispose of the CRM in ‘The Ones Who Live’ Finale [Spoilers]](https://europeantech.news/wp-content/uploads/2024/04/the-walking-dead-crm-thumb-700xauto-261596-390x220.jpeg)