PLTR vs. CRM: Which Software Stock Is the Better Buy?

In this piece, I evaluated two software stocks, Palantir Technologies (NYSE:PLTR) and Salesforce (NYSE:CRM), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a neutral view of Palantir Technologies and a bullish view of Salesforce.

While both companies develop software, Palantir Technologies specializes in big-data analytics, while Salesforce focuses on customer relationship management (CRM). Shares of Palantir Technologies are up 25% year-to-date and have soared 48% over the last year. Meanwhile, Salesforce stock is down 14% year-to-date, although it has gained 6.5% over the past year.

With such a dramatic difference in their share price performances, the significant gap in their valuations is no surprise. Below, we’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry.

For comparison, the software industry is trading at a P/E of 50.7x versus its three-year average of 61.5x.

Palantir Technologies (NYSE:PLTR)

At a GAAP P/E of 165.4x, Palantir Technologies is trading at a significant premium to its industry and to Salesforce. While there is much to like about the company and its exposure to artificial intelligence, its valuation has simply gotten too high. Thus, a neutral view seems appropriate, pending a more attractive entry price.

Importantly, 2023 was Palantir’s first GAAP-profitable year, meaning it was profitable based on generally accepted accounting principles and thus needed no adjustments to make it look profitable. The company has benefited greatly from its association with artificial intelligence, given that any company with a distant interest in AI has seen its stock explode over the last year or two.

While Palantir likely has a long life ahead, its valuation has just gotten too far ahead of itself. As a result, it only takes a single questionable metric within its financial results to spark a sell-off — making stocks like Palantir extremely risky because it’s virtually impossible to predict what small detail might trigger a sell-off. However, even after the post-earnings drop, Palantir stock is still up 25% year-to-date.

For the most recent quarter, Palantir posted adjusted earnings of eight cents per share, in line with the consensus, on $634.3 million in revenue, significantly ahead of expectations of $615.4 million. The company even boosted its guidance for full-year revenue to between $2.677 billion and $2.689 billion.

Palantir also raised its guidance for U.S. Commercial revenue to more than $661 million, suggesting a growth rate of at least 45%. This second piece is critical because investors may have focused on decelerating growth in the company’s U.S. commercial segment, which houses its AI platform.

For context, Palantir reported a year-over-year growth rate of 40% for the Commercial division in the first quarter, resulting in revenue of $150 million. However, that’s a sizable drop from the 70% growth rate recorded in the fourth quarter.

Additionally, total contract value may be the more important financial metric for Palantir. In this area, the company posted a 131% year-over-year increase, which outperformed the fourth quarter’s 107% gain. Thus, while things are looking up for Palantir over the long term, I’d prefer to see a more attractive entry price before diving into the stock.

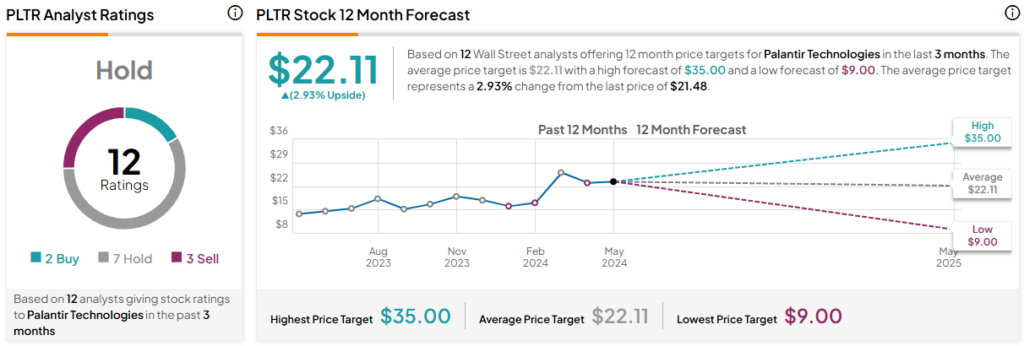

What Is the Price Target for PLTR Stock?

Palantir Technologies has a Hold consensus rating based on two Buys, seven Holds, and three Sell ratings assigned over the last three months. At $22.11, the average Palantir Technologies stock price target implies upside potential of 2.9%.

Salesforce (NYSE:CRM)

At a GAAP P/E of about 41x following the latest earnings release and plunge in its stock price, Salesforce is far more reasonably valued than Palantir Technologies. It appears that the post-earnings sell-off may be overdone, given that this is an excellent company with staying power. Thus, a bullish view seems appropriate.

Salesforce stock sold off in after-hours trading on Wednesday following the company’s first revenue miss since 2006, plummeting from around $270 to below $230 a share. The company posted $2.44 per share in adjusted earnings on $9.13 billion in revenue versus expectations of $2.37 per share on $9.15 billion in revenue.

Unfortunately, Salesforce also disappointed widely with its guidance for the current quarter, calling for adjusted earnings of $2.34 to $2.36 per share on $9.2 billion to $9.25 billion in revenue. Analysts had been expecting adjusted earnings of $2.38 per share on $9.37 billion in revenue for the current quarter.

However, there were some bright areas in Salesforce’s earnings release that investors appear to have overlooked in their knee-jerk reaction to dump the shares. The company became much more profitable in the latest quarter as its GAAP net income surged to $1.53 billion or $1.56 per share from $199 million or 20 cents per share in the year-ago quarter.

Salesforce also boosted its full-year earnings guidance, calling for adjusted earnings between $9.86 and $9.94 per share, up from the previous range of $9.68 to $9.76 per share three months ago. Analysts had been expecting $9.76 per share in adjusted earnings on $38.08 billion in revenue for the full year.

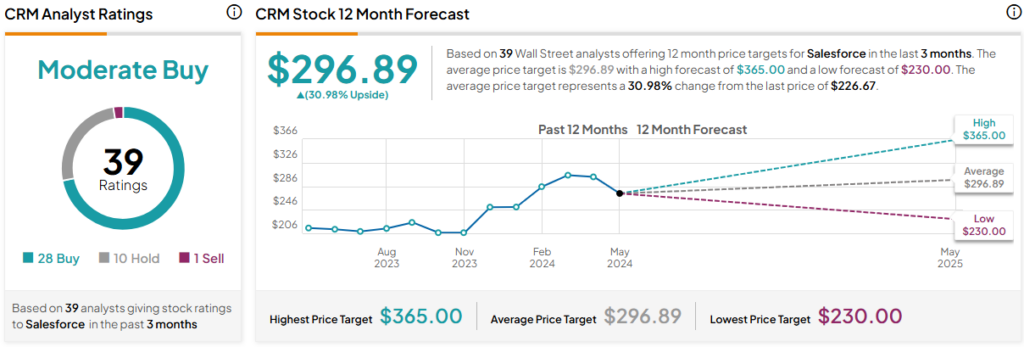

What Is the Price Target for CRM Stock?

Salesforce has a Moderate Buy consensus rating based on 21 Buys, eight Holds, and zero Sell ratings assigned over the last three months. At $296.89, the average Salesforce stock price target implies upside potential of 31%.

Conclusion: Neutral on PLTR, Bullish on CRM

Once the market fully digests Salesforce’s complete earnings report, I would expect its stock to recover, at least somewhat. However, even if it doesn’t bounce back immediately, the company’s long-term share-price gains over the last five and 10 years demonstrate that it has staying power, so CRM’s recent sell-off has presented a compelling buy-the-dip opportunity.

On the other hand, Palantir Technologies is simply overvalued, although at a better entry price, I could be persuaded to pick up a few shares.