AI in Fintech Market Sees Unprecedented Growth as Financial

AI in Fintech Market Scope and Overview

The convergence of artificial intelligence (AI) and financial technology (Fintech) has revolutionized the landscape of financial services, empowering institutions with advanced analytics, automation, and personalized customer experiences. From virtual assistants and predictive analytics to risk management and fraud detection, AI-driven solutions are reshaping how financial institutions operate, innovate, and engage with customers. This report delves into the burgeoning AI in Fintech Market, offering insights into competitive dynamics, market segmentation, regional outlook, key growth drivers, strengths, recession impacts, and concluding reflections.

The AI in Fintech Market is disrupting the financial services industry by leveraging artificial intelligence and machine learning to automate processes, enhance decision-making, and improve customer experiences. AI-powered solutions in fintech encompass a wide range of applications, including fraud detection, credit scoring, robo-advisors, and chatbots. Financial institutions are increasingly adopting AI to drive operational efficiency, reduce risk, and personalize services for customers. As the volume of data grows and regulatory requirements evolve, the demand for AI in fintech is expected to soar, reshaping the industry landscape and unlocking new opportunities for innovation and growth.

Get a Report Sample of AI in Fintech Market @ https://www.snsinsider.com/sample-request/1259

Competitive Analysis

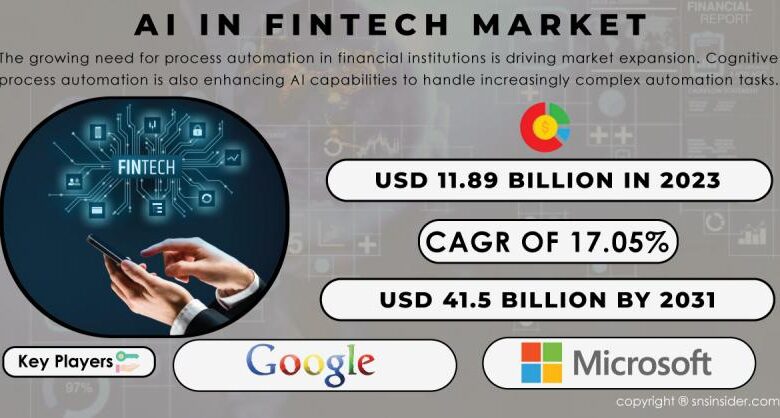

In the fiercely competitive arena of AI in Fintech, several major players vie for market dominance, leveraging their technological prowess, strategic partnerships, and innovation capabilities. Microsoft, Google, Salesforce, IBM, Intel, Amazon Web Services (AWS), Inbenta Technologies, IPsoft, Nuance Communications, ComplyAdvantage, alongside numerous other emerging players, constitute the key contenders in this dynamic market. Each player brings its unique blend of AI algorithms, cloud infrastructure, and domain expertise, driving innovation and propelling the industry forward.

Market Segmentation

By Component:

➤ Solutions: AI-driven solutions encompass a diverse array of offerings, including software tools, platforms, and services tailored to address specific challenges and opportunities within the Fintech landscape. These solutions leverage AI algorithms and machine learning techniques to automate processes, enhance decision-making, and deliver actionable insights, driving efficiency and competitiveness.

✧ Software Tools: Software tools encompass AI-powered applications and algorithms designed to streamline financial operations, automate routine tasks, and optimize resource utilization. From predictive analytics and credit scoring to algorithmic trading and portfolio management, software tools empower financial institutions with actionable insights and real-time decision support.

✧ Platforms: AI platforms provide a robust foundation for developing, deploying, and managing AI-driven applications and services within the Fintech ecosystem. These platforms offer scalable infrastructure, pre-built models, and developer tools to accelerate innovation and facilitate collaboration, enabling organizations to harness the full potential of AI in driving business growth and differentiation.

➤ Services: AI services encompass a range of offerings, including managed services and professional services, aimed at supporting organizations in their AI adoption journey, from strategy formulation and implementation to ongoing support and optimization. Managed services offer end-to-end AI solutions, including infrastructure management, model training, and monitoring, while professional services provide consulting, training, and customization to meet specific business needs.

By Deployment Mode:

➤ Cloud: Cloud-based deployment models offer scalability, flexibility, and cost-effectiveness, enabling financial institutions to leverage AI capabilities without the need for upfront investment in hardware infrastructure or software licenses. Cloud-based AI solutions facilitate rapid deployment, seamless integration, and on-demand scalability, empowering organizations to innovate and adapt to evolving market dynamics with agility and efficiency.

➤ On-premises: On-premises deployment models cater to organizations with stringent security and compliance requirements or legacy infrastructure limitations that necessitate localized data processing and control. On-premises AI solutions offer enhanced data privacy, control, and customization options, enabling organizations to leverage AI capabilities while retaining full ownership and governance over their data and resources.

By Application:

➤ Virtual Assistant (Chatbots): Virtual assistants, powered by AI and natural language processing (NLP) technologies, serve as the frontline interface for customer interactions, providing personalized assistance, account inquiries, and transactional support round-the-clock. AI-driven chatbots streamline customer service operations, improve response times, and enhance user experiences, driving customer satisfaction and loyalty in an increasingly digital-first world.

➤ Business Analytics and Reporting: AI-driven business analytics and reporting solutions enable financial institutions to extract actionable insights from vast volumes of structured and unstructured data, empowering stakeholders with data-driven decision-making capabilities. From trend analysis and predictive modeling to risk assessment and performance monitoring, AI-powered analytics enhance operational efficiency, mitigate risks, and uncover new business opportunities, driving value creation and competitive advantage.

➤ Customer Behavioral Analytics: Customer behavioral analytics leverage AI algorithms and machine learning techniques to analyze customer interactions, preferences, and patterns, enabling financial institutions to personalize offerings, optimize marketing strategies, and detect anomalous behavior indicative of fraud or risk. By gaining deeper insights into customer behavior, financial institutions can tailor products and services to meet evolving needs, enhance customer engagement, and foster long-term relationships, driving customer lifetime value and profitability.

➤ Others (includes market research, advertising, and marketing campaign): Beyond customer-facing applications, AI in Fintech extends to market research, advertising, and marketing campaigns, leveraging predictive analytics, sentiment analysis, and recommendation engines to optimize marketing spend, target audience segmentation, and campaign effectiveness. AI-driven insights enable financial institutions to identify market trends, anticipate customer needs, and deliver targeted messaging, enhancing brand visibility, customer acquisition, and retention in an increasingly competitive landscape.

Regional Outlook

The adoption of AI in Fintech varies across regions, influenced by factors such as technological infrastructure, regulatory environment, and market maturity. North America leads the global AI in Fintech market, driven by a thriving Fintech ecosystem, robust regulatory frameworks, and investments in AI research and development. Europe follows suit, propelled by initiatives to foster innovation, digitalization, and financial inclusion, while Asia-Pacific emerges as a burgeoning market, fueled by rapid urbanization, rising disposable incomes, and increasing demand for digital financial services.

Key Growth Drivers of the Market

The exponential growth of the AI in Fintech market can be attributed to a confluence of factors, including:

➤ The proliferation of digital transactions, social media interactions, and IoT devices generates vast volumes of data, creating opportunities for AI-driven analytics to extract actionable insights, detect patterns, and derive predictive models, enhancing decision-making and risk management in financial services.

➤ Stringent regulatory requirements, such as Know Your Customer (KYC), Anti-Money Laundering (AML), and General Data Protection Regulation (GDPR), drive demand for AI-driven solutions that automate compliance processes, monitor transactions, and detect fraudulent activities, enabling financial institutions to adhere to regulatory standards and mitigate compliance risks.

➤ With consumers increasingly demanding personalized and frictionless experiences, AI-powered chatbots, recommendation engines, and virtual assistants enable financial institutions to deliver tailored offerings, anticipate customer needs, and provide proactive support, fostering customer satisfaction, loyalty, and advocacy.

➤ AI-driven automation and optimization algorithms streamline back-office operations, automate routine tasks, and enhance operational efficiency, enabling financial institutions to reduce costs, improve scalability, and focus resources on strategic initiatives and value-added activities, driving productivity and profitability.

➤ Ongoing advancements in AI, machine learning, natural language processing, and blockchain technologies unlock new opportunities for innovation and disruption within the Fintech ecosystem, enabling financial institutions to develop cutting-edge solutions for payments, lending, wealth management, and insurance, driving market growth and differentiation.

Strengths of the Market

The AI in Fintech market boasts several inherent strengths, including:

➤ AI-driven innovations disrupt traditional business models, enabling financial institutions to create new revenue streams, enter new markets, and unlock value from data, driving competitiveness and differentiation in an increasingly digital-first world.

➤ AI-powered personalization and predictive analytics enable financial institutions to better understand customer needs, preferences, and behaviors, delivering tailored offerings and experiences that foster customer satisfaction, loyalty, and lifetime value. By leveraging AI-driven insights, financial institutions can anticipate customer needs, proactively address pain points, and build meaningful relationships, driving customer retention and advocacy in a hyper-competitive landscape.

➤ AI-driven risk management and compliance solutions enable financial institutions to mitigate regulatory risks, detect fraudulent activities, and safeguard against cyber threats in real-time. By leveraging advanced analytics and machine learning algorithms, organizations can enhance fraud detection capabilities, strengthen security protocols, and ensure regulatory compliance, protecting both their assets and reputation.

➤ AI-driven automation streamlines operational processes, reduces manual errors, and enhances productivity across various functions, from underwriting and loan processing to claims management and reconciliation. By automating routine tasks and optimizing resource allocation, financial institutions can achieve cost savings, scalability, and agility, driving operational excellence and profitability.

➤ Cloud-based AI solutions offer scalability, flexibility, and cost-effectiveness, enabling financial institutions to adapt to changing market conditions, scale operations, and deploy new capabilities with speed and agility. By leveraging cloud infrastructure and AI platforms, organizations can accelerate innovation, reduce time-to-market, and stay ahead of competitors in a rapidly evolving landscape.

Impact of the Recession

The COVID-19 pandemic and ensuing economic downturn have accelerated the adoption of AI in Fintech, as financial institutions seek innovative solutions to navigate unprecedented challenges and capitalize on emerging opportunities. While the recession has exerted pressure on profitability, tightened regulatory scrutiny, and heightened cybersecurity risks, it has also underscored the importance of digital transformation, resilience, and agility in driving business continuity and growth. As organizations prioritize cost efficiency, risk management, and customer-centricity, AI-driven solutions emerge as essential enablers of recovery, differentiation, and future success in the post-pandemic era.

Get a Discount @ https://www.snsinsider.com/discount/1259

Key Objectives of the Market Research Report

A comprehensive market research report on AI in Fintech aims to achieve the following objectives:

➤ Conducting a thorough analysis of market dynamics, trends, and growth drivers to provide accurate projections and insights into the size, share, and trajectory of the AI in Fintech market, including revenue forecasts, segment-wise analysis, and regional outlook.

➤ Assessing the competitive landscape and profiling major players, including market share analysis, SWOT analysis, and strategic initiatives, to provide stakeholders with actionable intelligence for informed decision-making, partnership identification, and competitive positioning.

➤ Segmenting the market based on key parameters such as component, deployment mode, application, and region to identify target segments, understand their unique needs and preferences, and tailor marketing strategies, product offerings, and distribution channels accordingly.

➤ Tracking technological advancements, emerging trends, and disruptive innovations in AI, machine learning, natural language processing, and blockchain within the Fintech ecosystem to anticipate market evolution, identify growth opportunities, and stay ahead of the competition in a rapidly evolving landscape.

➤ Analyzing regulatory frameworks, compliance requirements, and risk management practices governing AI in Fintech to help financial institutions navigate legal complexities, mitigate compliance risks, and ensure ethical and responsible AI deployment, fostering trust, transparency, and accountability in the industry.

Conclusion

In conclusion, the AI in Fintech market represents a dynamic and transformative force within the financial services industry, driving innovation, efficiency, and customer-centricity. As financial institutions embrace digital transformation, AI emerges as a critical enabler of growth, differentiation, and resilience, empowering organizations to navigate unprecedented challenges, capitalize on emerging opportunities, and deliver value-added services to customers. With its inherent strengths, including innovation, customer-centricity, and operational efficiency, coupled with ongoing advancements and market resilience, AI in Fintech is poised to reshape the future of finance, driving sustainable growth, inclusion, and prosperity in the digital economy.

View Complete Report Details @ https://www.snsinsider.com/reports/ai-in-fintech-market-1259

Table of Contents- Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

4. Impact Analysis

4.1. Impact of Ukraine- Russia war

4.2. Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter’s 5 Forces Model

7. PEST Analysis

8. AI in Fintech market Segmentation, by Service Type by Component

9. AI in Fintech market By Deployment Mode

10. AI in Fintech Market by Application

11. Regional Analysis

11.1. Introduction

11.2. North America

11.3. Europe

11.4. Asia-Pacific

11.5. The Middle East & Africa

11.6. Latin America

12. Company Profile

13. Competitive Landscape

14. USE Cases and Best Practices

15. Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com

Office No. 305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we’re proud to be recognized as one of the world’s top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

This release was published on openPR.