The Cheapest Car Insurance Of June 2024 – Forbes Advisor

Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

USAA, Nationwide, Travelers, Erie, Geico and Progressive are the cheapest car insurance companies nationwide, according to our analysis.

Car insurance rates are expected to rise even further this spring. We analyzed rates for a variety of driver ages and profiles to see which companies have the lowest prices.

Here is the cheapest car insurance of June 2024, according to our analysis:

In some instances USAA was the cheapest but the next cheapest company is listed because USAA auto insurance is only available to veterans, military members and their families.

How We Chose the Cheapest Car Insurance

We analyzed auto insurance rates, complaints and collision repair scores to determine the cheapest car insurance companies. Our editors are committed to bringing you unbiased ratings and information. Our editorial content is not influenced by advertisers. You can read more about our editorial guidelines and the methodology for the ratings below.

- 191,500 car insurance rates analyzed

- 338 data points crunched

- 102 years of insurance experience on the editorial team

Cheapest Car Insurance Rates

How much you pay for car insurance will depend on a number of factors, including your age, claims history and driving record. The company that offers the cheapest car insurance for you can vary depending on the class of driver you fall into.

The Cheapest Car Insurance for Good Drivers: Nationwide

Nationwide is the cheapest company for good drivers that is available to the general public. USAA auto insurance is a bit cheaper but only available to those with a military connection.

We found that the national average for good drivers is $2,026 a year. The cheapest companies come in hundreds of dollars below that.

*Average rates are based on good drivers with a clean driving record, meaning no at-fault accidents or traffic violations.

*USAA is available only to the military, veterans and their families.

The Cheapest Car Insurance After a Speeding Ticket: Nationwide

Our analysis found that Nationwide offers the cheapest car insurance after a speeding ticket, followed by Erie, Travelers and Geico. USAA is a top choice for people who qualify.

Our analysis found that having a speeding ticket on your driving record means an average insurance increase of 26%.

*USAA is available only to the military, veterans and their families.

The Cheapest Car Insurance After an Accident Causing Injury: Erie

Erie and Travelers have the cheapest rates if you have caused an accident that injured someone else. Erie is a regional insurer that serves 12 states in the East and Midwest. USAA offers excellent rates to military members and veterans.

Nationally, the average increase after an accident is 49% compared to a driver with a clean record.

*USAA auto insurance is available only to the military, veterans and their families.

The Cheapest Car Insurance After a DUI: Progressive

Progressive has the cheapest rates in our analysis for drivers with a DUI, with USAA a good option for military members and veterans who qualify. A DUI conviction leads to an average increase of 71%.

Car insurance companies usually request motor vehicle records before your policy renewal time to check for tickets and convictions such as DUIs.

*USAA is available only to the military, veterans and their families.

The Cheapest Car Insurance for People With Bad Credit: Nationwide

Nationwide and Geico have relatively cheap car insurance for drivers with bad credit, among the companies we analyzed. USAA is a good bet for military members and veterans.

Poor credit can cause higher auto insurance rates than having a DUI or at-fault accident on your record. Average auto insurance costs go up 94% for drivers with poor credit compared to those with good credit.

*USAA auto insurance is available only to the military, veterans and their families.

The Cheapest Car Insurance for Seniors: Nationwide

Nationwide has the best rates for senior drivers ages 65 and 80, according to our analysis. The best car insurance for seniors will vary based on where you live and your personal details, such as your driving record.

We found that senior drivers see an average increase of 6% from age 60 to 70. By age 80, your rates may have increased 23% above the rate you were paying at age 70 and 31% more than your car insurance cost at age 60.

*USAA is only available to military members, veterans and their families.

The Cheapest Car Insurance for Young Drivers: Erie

Erie, Travelers, Geico and Nationwide are the cheapest car insurance companies for young drivers buying their own policies. USAA is also usually a top choice if you qualify.

It’s typically cheaper for a young new driver to remain on a parent’s policy if they’re still living at home, whether they’re an 18-year-old or 25-year-old.

*USAA is only available to military members, veterans and their families.

The Cheapest Car Insurance After Adding a Teen Driver: Nationwide

We found that Nationwide has the lowest rates after a teen driver is added to a parent’s policy. Other cheap companies include Erie, Progressive and Geico. USAA also has low rates for adding a teen if you’re eligible.

It can be hard to find cheap car insurance for teens because young new drivers pose a considerable risk to insurers. We found that adding a teenage driver to a parent’s policy costs $4,362 a year on average.

Adding a teen driver typically doubles the parent’s auto insurance bill. But it’s usually less expensive to add a teenager to a parent’s auto policy than to have the teen driver buy their own.

*USAA is only available to military members, veterans and their families.

States With the Cheapest Car Insurance

Vermont is the cheapest state for auto insurance for good drivers. Idaho, Maine, Hawaii and New Hampshire round out the top five. Car insurance rates vary by state due to the different risks and claims made.

Rates are based on a 40-year-old female driver with a good driving record. Averages are based on coverage with $100,000 for injuries to one person, $300,000 for injuries per accident and $100,000 for property damage (known as 100/300/100), uninsured motorist coverage, and collision and comprehensive insurance with a $500 deductible.

Source: Quadrant Information Services.

Cheapest Car Insurance by Age

Erie has the lowest-cost insurance for drivers age 16, 18 and 20, based on our analysis of auto insurance rates by age. Nationwide is the cheapest option for drivers of many other ages.

In some cases, USAA is the cheapest company but membership is limited to military personnel, veterans and their families.

The Cheapest Car Insurance Companies of 2024

*USAA auto insurance is available only to the military, veterans and their families.

The Cheapest Car Insurance Companies in More Detail

Our analysis for June 2024 finds that the cheapest auto insurance companies are:

USAA

Editors’ Take

We recommend military members, veterans and their families take a look at USAA for cheap car insurance for many driver profiles, including good drivers and those with spotty driving records. Its excellent rates earned USAA 5 stars in our analysis.

Expert’s Take

Kate Terry, Advisory Board Member

USAA’s Average Car Insurance Costs

Discounts Available

USAA offers a wide variety of discounts.

Nationwide

Editors’ Take

We like Nationwide because it has some of the cheapest rates for most driver types, from those with a pristine driving record to those with a ticket or accident and for a variety of ages. In some instances, USAA has better rates, but you must have a military connection to be eligible. Nationwide earned 4.9 stars in our analysis.

Expert’s Take

Marty Ellingsworth, Advisory Board Member

Nationwide’s Average Car Insurance Costs

Discounts Available

Nationwide has a decent variety of possible discounts.

Travelers

Editors’ Take

We like Travelers for its competitive rates for many types of drivers. It’s consistently one of the top three to five cheapest companies. Travelers also has a very low level of complaints made against it to state insurance departments, which helped it earn 4.8 stars.

Expert’s Take

Kate Terry, Advisory Board Member

Travelers’ Average Car Insurance Costs

Discounts Available

Travelers Insurance offers a wide array of car insurance discounts for its customers.

Erie

Editors’ Take

Erie offers the best rates (after USAA) for some driver profiles, which helped it earn 4.6 stars in our evaluation. Erie also stands out for its excellent grade (A-) from repair professionals for its collision claims process.

Expert’s Take

Kate Terry, Advisory Board Member

Erie’s Average Car Insurance Costs

Discounts Available

Erie offers a variety of ways to save money on car insurance.

Geico

Editors’ Take

Geico earned 4.2 stars in our evaluation thanks to its low costs for many driver types. We also like that Geico has a low level of complaints, making it worth a look if you’re the hunt for low rates.

Expert’s Take

Kate Terry, Advisory Board Member

Geico’s Average Car Insurance Costs

Discounts Available

Geico offers a wide range of discounts.

Progressive

Editors’ Take

Progressive earned 4 stars in our analysis because it has the cheapest rates for drivers with a DUI and competitive rates for a broad range of other driver profiles. Progressive also has a low level of complaints against it with state insurance departments.

Expert’s Take

Kate Terry, Advisory Board Member

Progressive’s Average Car Insurance Costs

Discounts Available

Progressive offers its customers a good variety of discounts.

Expert Roundup: How to Find Cheap Car Insurance

Here are our top tips for lowering your insurance bill.

Tips on How to Find Cheap Car Insurance

The Risks of Buying Cheap Car Insurance

Buying a cheap car insurance policy with bare-bones limits and minimal coverage may sound like a pathway to low costs, but it could end up costing you much more in the long run. Risks of purchasing such a policy include:

- Low liability limits. You must buy at least state minimum limits for liability, but that may not be enough to cover all the damage you cause others in an auto accident. If the accident bills of others exceed your liability limits, you’re left personally responsible, which could lead to a financial crisis.

- Coverage gaps. The cheapest auto policy will only include state minimum coverage, so you won’t have collision or comprehensive coverage that comes with full coverage car insurance. Comprehensive and collision coverage pay out if your car is damaged from an accident or other certain problems, flood waters, hail, striking an animal or vandalism.

Methodology

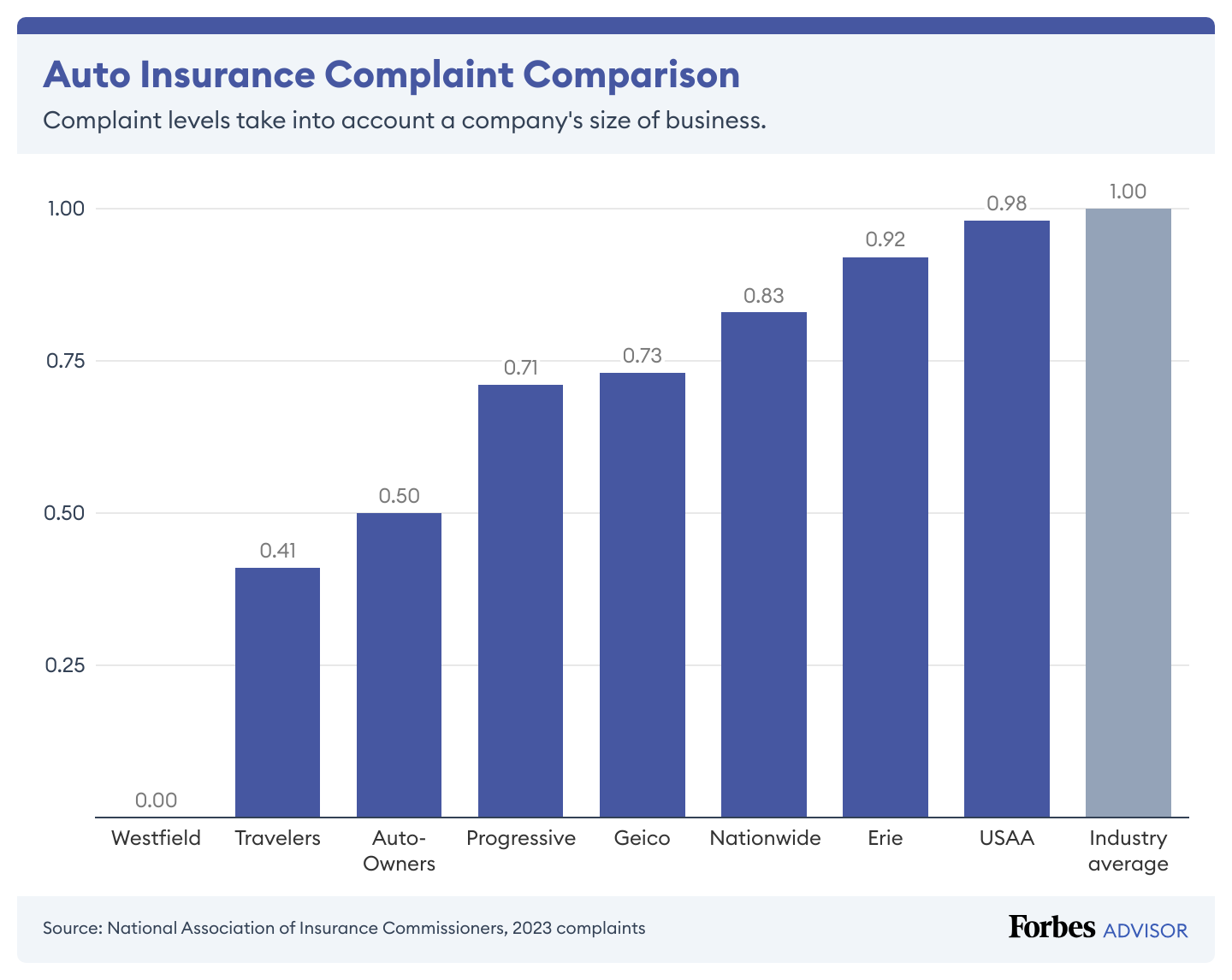

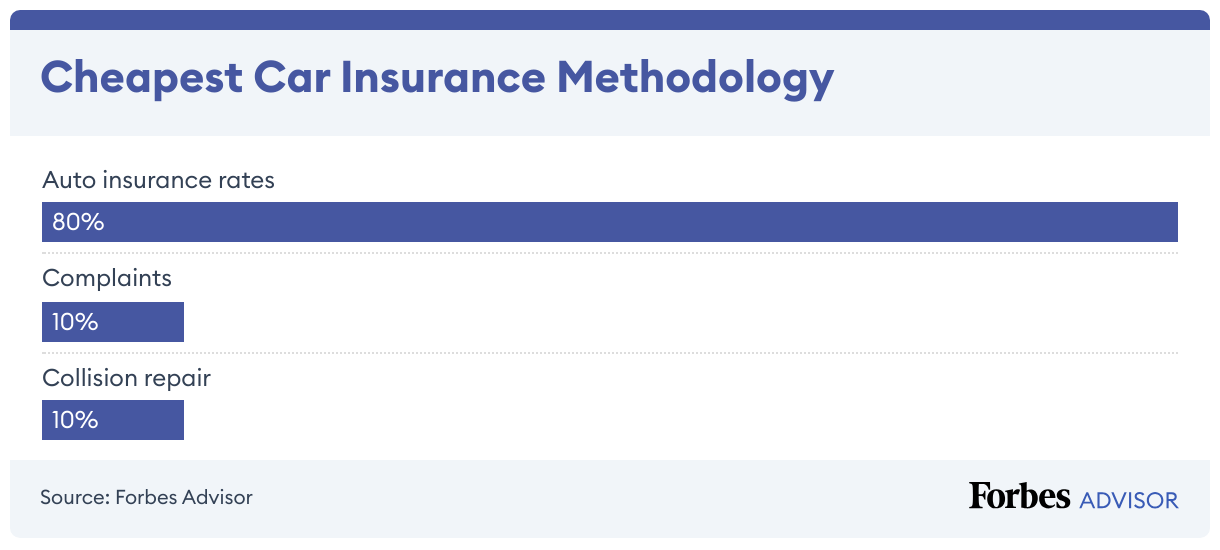

To identify the cheapest car insurance companies we evaluated each insurer based on its average rates for a variety of drivers, complaints against the company and collision repair grades from auto body professionals.

Auto insurance rates (80% of score): We used data from Quadrant Information Services to find average rates from each company for good drivers, drivers who have caused an accident, drivers with a speeding ticket, drivers with a DUI, drivers with poor credit, drivers caught without insurance, adding a teen driver, senior drivers and young drivers.

Unless otherwise noted, rates are based on a 40-year-old female driver insuring a new Toyota RAV4 and coverage of:

- $100,000 for injuries to one person, $300,000 for injuries per accident and $100,000 of property damage (known as 100/300/100).

- Uninsured motorist coverage of 100/300.

- Collision and comprehensive insurance with a $500 deductible.

State minimum coverage rates reflect the minimum amount of auto insurance required in each state.

Complaints (10% of score): We used auto insurance complaint data from the National Association of Insurance Commissioners. Each state’s department of insurance is in charge of logging and monitoring complaints against companies operating in their states. Most auto insurance complaints center on claims, including unsatisfactory settlements, delays and denials.

The industry complaint average is 1.00, so companies with a ratio below 1.00 have lower levels of complaints.

Collision repair (10% of score): We incorporated insurance company grades from collision repair professionals. We used data provided by CRASH Network, a weekly newsletter covering the collision repair and auto insurance market segments. CRASH Network’s Insurer Report Card used grades from more than 1,100 collision repair professionals to gauge auto insurers on the quality of their collision claims service.

Auto Insurance Collision Repair Grades

Source: Courtesy of CRASH Network

Read more: How Forbes Advisor rates car insurance companies

Other Car Insurance Companies We Rated

Compare Car Insurance Quotes

Get Auto Quotes As Low As $63/month, Compare Rates For Free, and Pay Less For Car Insurance

Cheap Car Insurance Frequently Asked Questions

Who has the cheapest car insurance?

Nationwide, Travelers and Geico have the cheapest car insurance in our analysis of rates for good drivers. USAA also has very good rates but sells auto insurance only to military members, veterans and their families.

Our findings are a jumping off point, as car insurance costs vary greatly based on personal factors like your location, vehicle and driving record. You’ll want to compare quotes with multiple insurers to find the cheapest car insurance for your particular situation.

What is the cheapest type of car insurance?

The cheapest type of car insurance is a state-minimum policy, sometimes referred to as liability-only auto insurance. It provides the minimum car insurance required by your state to drive legally. A state-minimum car insurance policy costs an average of $638 per year, based on our analysis. That’s nearly $1,400 cheaper than the average annual cost of a full coverage policy ($2,026).

A state-minimum policy is cheap because it generally has low limits of liability car insurance, which pays for injuries and property damage you cause others in an auto accident. Once accident costs pass your liability limit, though, you’ll be personally responsible for any remaining expenses. For better financial protection, it’s wise to raise your liability limits if possible in case you cause an expensive car accident.

Should I drop collision and comprehensive coverage to get cheap car insurance?

If you drop collision and comprehensive coverage you’ll get cheaper insurance—but you’ll lose the ability to make a claim with your insurer if your car is stolen, totaled or severely damaged in an accident you cause.

The value of your vehicle can help determine if removing comprehensive and collision is a good idea or not. If your car’s value is low and would result in a small claim check if totaled, consider dropping the coverage if you own the car outright. A vehicle with a lease or loan must have comprehensive and collision coverage no matter the value because the lessor or lender mandates it.

How do I get cheap car insurance for a teenager?

Comparison shopping with multiple insurers is the best way to find cheap car insurance for teen drivers. Auto insurance for teenagers is quite pricey—parents can expect their policy costs to double—because of the inexperience and immaturity that these novice drivers.

It costs an average of $2,359 more per year for parents to add a 16-year-old to their car insurance policies, according to our analysis. Adding a teen to a parent’s policy is typically the best way to get a teen insured. It costs an average of $8,572 per year for a 16-year-old to purchase an auto insurance policy on their own.

How can I find the cheapest car insurance quotes?

You can find the cheapest car insurance quotes by comparing rates from multiple insurance companies. Insurers all have different formulas for calculating rates, so you’ll often find a wide range of prices for the exact same coverage.

If you’re a safe driver, a usage-based insurance (UBI) program may be worth trying out to see if you get good rates. With some companies, you can get a sign-on discount plus a bigger discount at renewal time—if your driving scores well. Before signing up for a UBI program, check to see if your rates could possibly go up if your driving score isn’t great.

Do teachers get cheaper car insurance?

Teachers may be able to score cheaper car insurance rates from insurers that offer affiliate group discounts for educators or certain occupations, such as teachers or school administrators. For instance, if you’re part of a national educational association—such as the Association of American Educators—ask your insurance company if you can get a price break on car insurance for teachers.

Companies that offer discounts for teachers include Country Financial, Geico, and Liberty Mutual. While a discount for teachers is nice, the final price you pay is most important. Be sure to shop around with multiple auto insurance companies to find out which ones have the best rates for you.