Salesforce: Earnings Overreaction Creates A Buying Opportunity (NYSE:CRM)

wdstock

Introduction

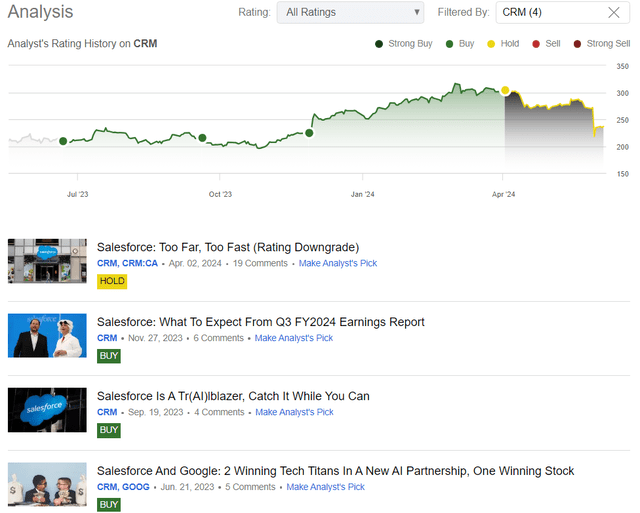

In April 2024, I downgraded Salesforce, Inc. (NYSE:CRM) from “Buy” to “Hold” at ~$300 per share due to significant deterioration in its long-term risk/reward after a rapid run-up in CRM stock:

From a business standpoint, Salesforce remains a high-conviction play for me, despite management’s projection of further moderation in top-line growth to high single digits. We own Salesforce and plan to continue to do so for the foreseeable future.

That said, given the significant deterioration in Salesforce’s 5-year expected CAGR return from 18% to 11%, I am downgrading CRM stock to a “Hold”.

Author’s Coverage on Salesforce (Seeking Alpha)

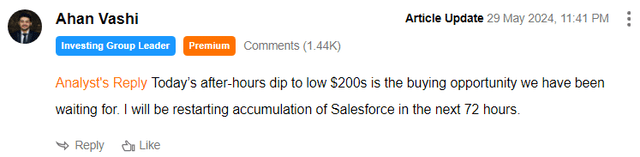

However, after a 20% post-ER plunge last week, I shared the following update:

In today’s note, we will briefly analyze Salesforce’s Q1 FY2025 report and then re-evaluate CRM’s long-term risk/reward to see if it is still a good buying opportunity in light of a ~12% jump over the last five trading sessions!

Salesforce’s Q1 Report And FY-2025 Guidance

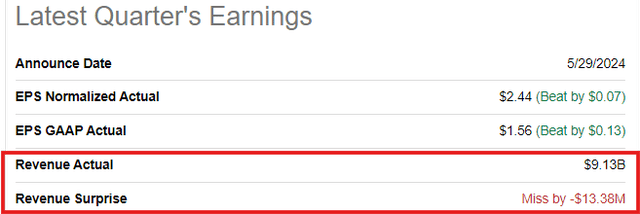

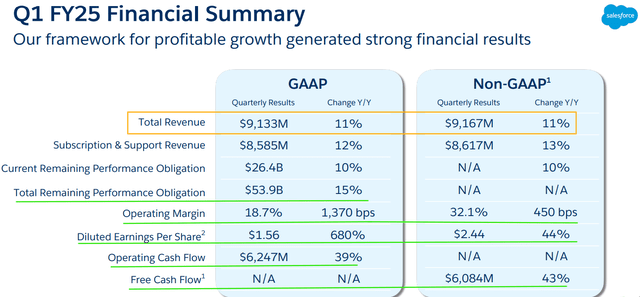

For Q1 FY-2025, Salesforce recorded total revenues of $9.13B (up 11% year-over-year), missing consensus street estimates by $13.4M. While Salesforce’s top-line performance came in at the low end of management’s guidance range for the quarter, Mr. Market punished this result with a -20% drop in the stock! On the earnings call, Salesforce’s leadership pointed to a weaker buying environment in the software industry caused by post-COVID normalization/rationalization; however, given the rapid rise of GenAI, the broad weakness across software could yet prove to be a structural shift rather than a temporary headwind.

Seeking Alpha Salesforce Q1 FY2025 Presentation

On the earnings call, management once again highlighted Salesforce Data Cloud as the fastest-growing product in the company’s history, pitching it as the next big growth driver. As I have said in the past, there’s no AI strategy without a data strategy, and Salesforce is a gold mine of data! Hence, as the No.1 AI CRM, Salesforce is a natural winner in the era of AI:

Einstein AI copilot is now live, and I believe this product will help Salesforce increase its share of wallet among existing enterprise customers in a ~$70B CRM software market that’s expected to grow at ~12% per year until 2030.

In my view, Salesforce’s AI efforts are yet to show up in the numbers, but they are still very likely to bear fruit in upcoming years. While the spectacular drop in CRM stock may lead you to believe that Salesforce’s business is collapsing; however, management’s full-year outlook for revenue is unchanged and the company is generating boatloads of cash, with Q1 FY2025 free cash flow rising +43% y/y to $6.084B powered by operating leverage.

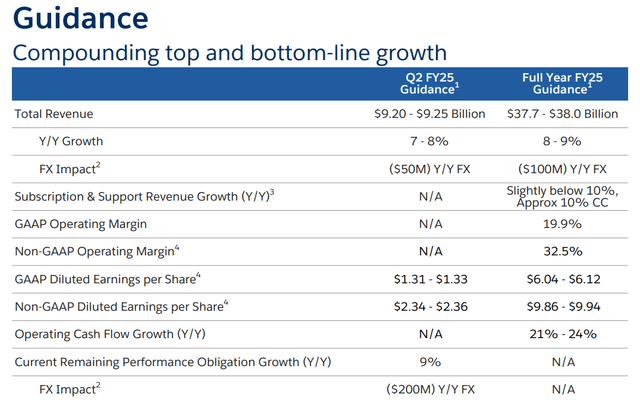

Salesforce Q1 FY2025 Presentation

In Q1, Salesforce continued making progress on the profitability front, with its normalized EPS of $2.44, beating consensus expectations by $0.07 per share. Also, management’s updated FY2025 guidance of $9.86-9.94 per share of normalized earnings was an improvement from previously guided range of $9.68-9.76 per share.

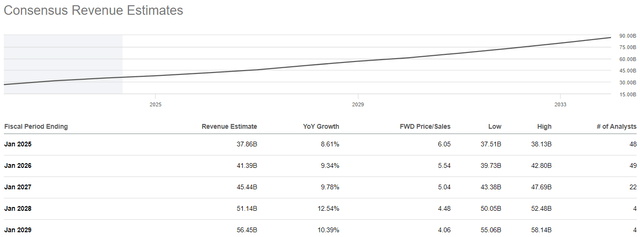

Yes, Salesforce’s Q2 revenue guide fell short of consensus estimates and management calling out “elongated sales cycles” is nerve-racking; however, as I see it, the full-year top-line guide is intact [primarily due to strong adoption of Salesforce Data Cloud and new AI solutions] and bottom-line performance is getting better. Furthermore, a top-line re-acceleration in CY-2025/2026 is still very much on the cards.

Salesforce Revenue Estimates (Seeking Alpha)

Here’s what Salesforce’s leadership had to say about their Q1 results:

“Our profitable growth trajectory continues to drive strong cash flow generation. Q1 operating cash flow was $6.25 billion, up 39% year-over-year. Q1 free cash flow was $6.1 billion, up 43% year-over-year. We are at the beginning of a massive opportunity for our customers to connect with their customers in a whole new way with AI. As the world’s #1 AI CRM, we’re incredibly well positioned to help companies realize the promise of AI over the next decade.”

– Marc Benioff, Chair and CEO, Salesforce

“We delivered another quarter of disciplined profitable growth, with GAAP operating margin of 18.7%, up 1,370 basis points year-over-year, and Non-GAAP operating margin of 32.1%, up 450 basis points year-over year. We’ve also made significant progress on our capital return program, returning more than $14 billion to shareholders since inception, including the payout of our first ever quarterly dividend in Q1.”

– Amy Weaver, President and CFO of Salesforce

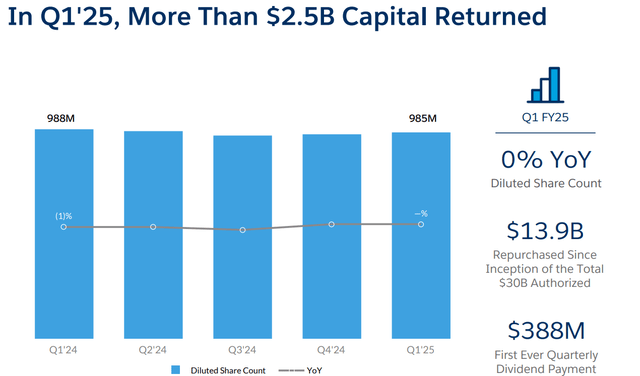

In Q1, Salesforce repurchased roughly $2.2B worth of its stock (completely offsetting y/y shareholder dilution from stock-based compensation) and paid $388M in its first-ever quarterly dividend.

Salesforce Q1 FY2025 Presentation

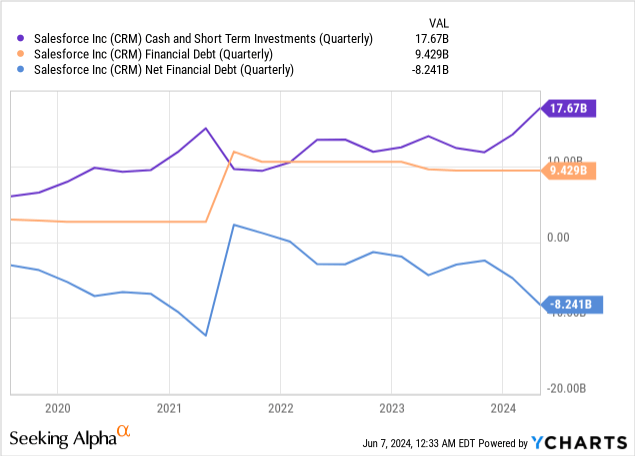

In my previous assessments, I have shared expectation of an even bigger capital return program from Salesforce. And that’s precisely what we are getting from the software giant. Interestingly, despite Salesforce getting more aggressive with its capital return program, Salesforce’s net cash balance expanded to $8.24B as of the end of Q1 FY2025, with the company holding $17.7B in cash and short-term investments against financial debt of $9.4B.

Overall, Salesforce’s Q1 performance was mixed and near-term top-line guidance is uninspiring; however, long-term business fundamentals are intact with AI offerings gaining traction. Now, let’s re-evaluate Salesforce’s risk/reward using a conservative DCF model.

The Dip Is A Buying Opportunity

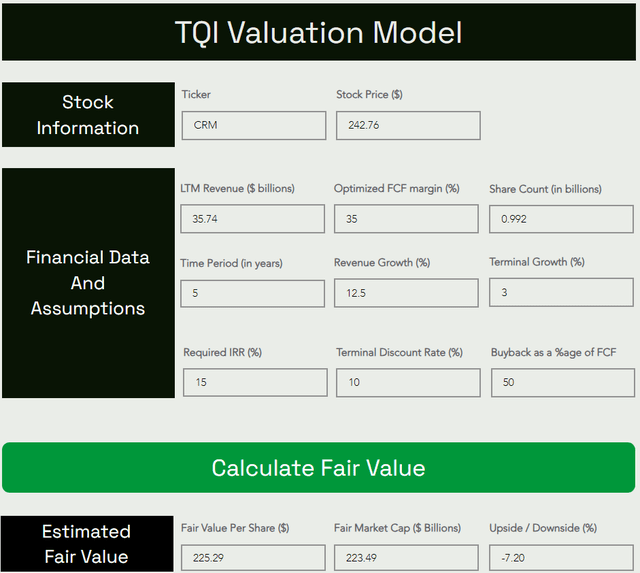

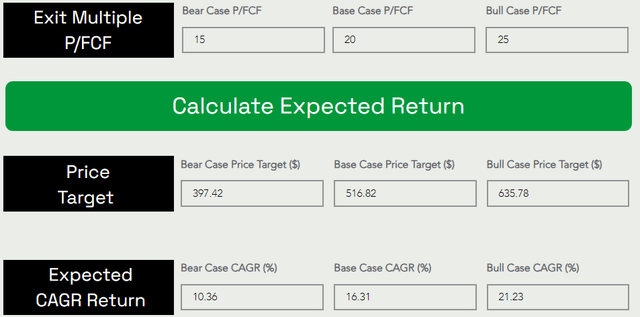

As you know, the price we pay for an asset is a key determinant of future returns. With CRM’s stock declining from ~$300 to ~$240 per share since our last update, our 5-year expected CAGR return for Salesforce stock has risen sharply from ~11% to ~16%, as you can see in our updated valuation model:

TQI Valuation Model (Free to use at TQIG.org) TQI Valuation Model (Free to use at TQIG.org)

Considering our investment hurdle rate of 15%, Salesforce is once again a “Buy” under our valuation process. Henceforth, we have resumed accumulation of Salesforce stock at my investing group.

Key Takeaway: I rate Salesforce a “Buy” at $242.76 per share.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.