This Artificial Intelligence (AI) Stock Is Down 38% in 2024. Should Investors Start Buying It Hand Over Fist Right Away?

SentinelOne (NYSE: S) investors have endured a terrible 2024 so far as shares of the cybersecurity specialist have plunged 38%. The company’s latest results for the first quarter of fiscal 2025 (for the three months ended April 30) also have added to the gloom.

The company’s shares crashed over 13% in a single session following its quarterly report, even though it beat Wall Street’s top- and bottom-line expectations handsomely. Let’s see why that was the case and check if new cybersecurity growth drivers, such as artificial intelligence (AI), can help supercharge the company’s growth.

The bigger picture for SentinelOne is solid despite revenue guidance concerns

The company’s fiscal Q1 revenue increased 40% year over year to $186.4 million, beating the consensus estimate of $181.1 million. Additionally, it broke even on the bottom line on a non-GAAP basis, compared to a loss of $0.15 per share in the year-ago period. Analysts were expecting a $0.05 per-share loss.

However, SentinelOne reduced its full-year revenue guidance to a range of $808 million to $815 million, down from the earlier range of $812 million to $818 million. The updated guidance suggests that its revenue is on track to grow almost 31% at the midpoint from fiscal 2024 levels. It’s worth noting that SentinelOne’s top line was up an impressive 47% in fiscal 2024.

SentinelOne management pointed out on the company’s latest earnings conference call that it has adjusted its guidance to “reflect the impact of persistent macro uncertainty and our go-to-market transition.” More specifically, the company is witnessing tighter spending by enterprises, thanks to high interest rates and inflation, two factors impacting the budgets of its customers.

Even then, there were quite a few silver linings that investors shouldn’t miss. For instance, the number of SentinelOne customers with annualized recurring revenue (ARR) of more than $100,000 increased 30% year over year in the previous quarter to 1,193. This metric refers to the annualized revenue run rate of the company’s subscription, consumption, and usage-based agreements at the end of a period, so the growth in the ARR points toward an increase in the adoption of its cybersecurity platform.

This also explains why SentinelOne’s adjusted gross margin increased to 79% in the latest quarter from 75% in the year-ago period. These metrics tell us that SentinelOne delivered a resilient performance despite the spending-related headwinds it’s facing, driven by the growing adoption of the company’s AI-powered Singularity cybersecurity platform.

Singularity allows enterprises to prevent and remediate cyber threats in real time with the help of AI models. The good part is that SentinelOne is witnessing strong interest in its AI-focused solutions such as Purple AI, which is a large language model (LLM)-powered generative AI cybersecurity assistant that the company introduced in April this year.

SentinelOne management points out that customers using Purple AI have “reported 80% faster threat hunting and investigation,” and security teams have been able to save hours while carrying out cybersecurity tasks. The adoption of generative AI within the cybersecurity space is expected to grow at an annual rate of 26% through 2032 and generate annual revenue of $147 billion at the end of the forecast period. Therefore, it won’t be surprising to see SentinelOne’s growth picking up once again in the future.

Is the valuation attractive enough?

SentinelOne is currently trading at 7.5 times sales, which is almost in line with the U.S. technology sector’s current price-to-sales ratio. However, the company’s slowing growth means it isn’t exactly a screaming buy.

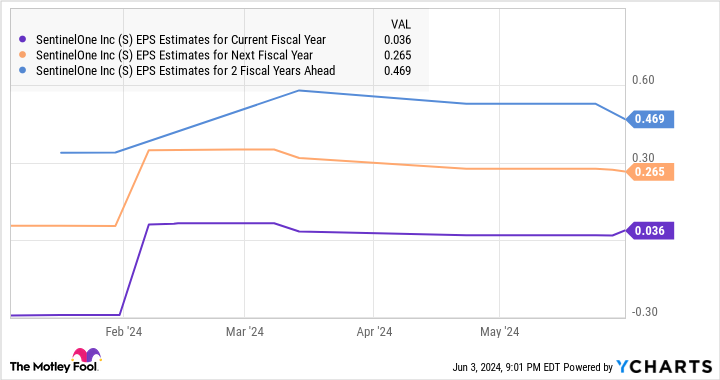

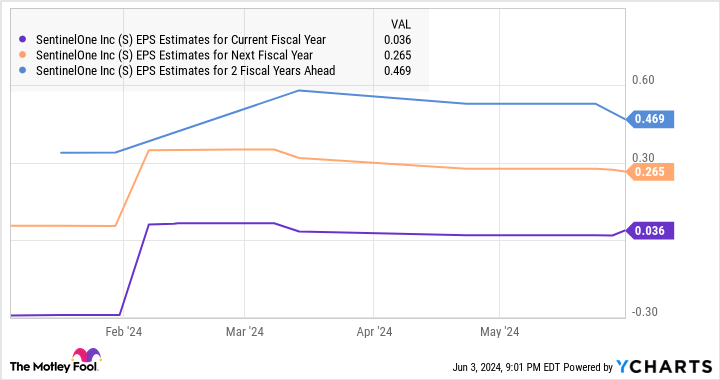

However, the good part is that the margin gains that SentinelOne is clocking are expected to help it report a small non-GAAP profit in the current fiscal year, compared to a loss of $0.28 per share in fiscal 2024.

What’s more, analysts are expecting SentinelOne’s bottom line to grow at an annual rate of 40% for the next five years. However, if the company’s AI-focused platform continues to gain steam and drive greater customer spending, it may be able to deliver even stronger bottom-line growth. That’s why opportunistic investors can consider using the pullback in this cybersecurity stock as a buying opportunity, as the growing adoption of AI in this niche could give SentinelOne a nice boost in the long run.

Should you invest $1,000 in SentinelOne right now?

Before you buy stock in SentinelOne, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SentinelOne wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This Artificial Intelligence (AI) Stock Is Down 38% in 2024. Should Investors Start Buying It Hand Over Fist Right Away? was originally published by The Motley Fool