Nokia (NOK) Achieves Enhanced Flexibility in Cloud RAN Solution

Nokia Corporation NOK recently confirmed the successful completion of the Cloud RAN (Radio Access Network) trial with In-Line accelerator architecture. This trial took place at Nokia’s Open Cloud RAN innovation center in collaboration with Hewlett Packard Enterprise HPE and Arm Holdings plc ARM, a U.K.-based semiconductor and software design company.

Hardware acceleration technology plays a crucial role in Cloud RAN systems. In-Line and Look-Aside are the primary options for Cloud RAN acceleration. The In-Line accelerator ensures greater system scalability, significantly lower power consumption and seamless compatibility across multiple silicon architectures. This approach is aligned with Nokia’s anyRAN strategy.

Many operators are increasingly adopting a hybrid network approach, a mix of architectures, such as a combination of Purpose-Built RAN and Cloud RAN. Nokia’s In-Line accelerator stands out by providing the necessary performance parity and interoperability between Cloud and Classic RAN. It gives operators the flexibility to choose their preferred server designs, along with their choice of cloud infrastructure software and hardware stacks.

During the trial, an end-to-end Cloud RAN L3 data call was completed. Data calls refer to the establishment of a connection for information transmission between devices. The process involved the utilization of HPE ProLiant RL series servers and Ampere Computing’s Arm-based general-purpose processor in conjunction with Nokia’s Cloud RAN technology. The HPE ProLiant RL series servers provide next generation compute performance for a wide range of cloud native use cases. The test was conducted over the air utilizing the most common 5G capacity band used worldwide with the help of Nokia’s industry-leading Airscale baseband portfolio.

The trial effectively showcased the flexibility of Nokia’s Cloud RAN technology and demonstrated the viability of its anyRAN vision. These advancements will support network operators in managing the challenges associated with rising energy costs, improving efficiency and matching the demand of an evolving 5G landscape. This, in turn, is likely to strengthen Nokia’s market position and augment its long-term revenues.

Nokia is well-positioned for the ongoing technology cycle, given the strength of its end-to-end portfolio. Its installed base of high-capacity AirScale products, which enables customers to upgrade to 5G quickly, is growing fast. It is driving the transition of global enterprises into smart virtual networks by creating a single network for all services, converging mobile and fixed broadband, IP routing and optical networks with the software and services to manage them. Leveraging state-of-the-art technology, it is transforming the way people and things communicate and connect with each other.

NOK aims to create new business and licensing opportunities in the consumer ecosystem. It facilitates its customers to move away from an economy-of-scale network operating model to demand-driven operations by offering easy programmability and flexible automation needed to support dynamic operations, reduce complexity and improve efficiency. It seeks to expand its business into targeted, high-growth and high-margin vertical markets to address growth opportunities beyond its traditional primary markets.

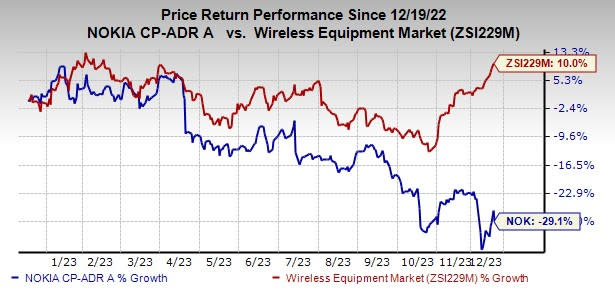

The stock has declined 29.1% in the past year against the industry’s growth of 10%.

Image Source: Zacks Investment Research

Nokia currently has a Zacks Rank #4 (Sell).

Stocks to Consider

Model N Inc MODN, carrying a Zacks Rank #2 (Buy) at present, delivered a trailing four-quarter average earnings surprise of 20.78%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MODN provides revenue management solutions for life sciences and technology companies, including applications for configuration, price, quote, rebate management and regulatory compliance. In the last reported quarter, it delivered an earnings surprise of 3.33%.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build cloud architecture and enhance their cloud experience. Arista delivered a trailing four-quarter average earnings surprise of 12%.

ANET holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is gaining market traction in 200 and 400-gigabit high-performance switching products and is well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nokia Corporation (NOK) : Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report