Collaborative Robots Market Exceeds $1 Billion in 2023 as Growth Rate Dips

Summary

According to Interact Analysis, collaborative robot (cobot) market revenue grew by 11.9% to US$1.07 billion in 2023, reaching the $1 billion milestone.

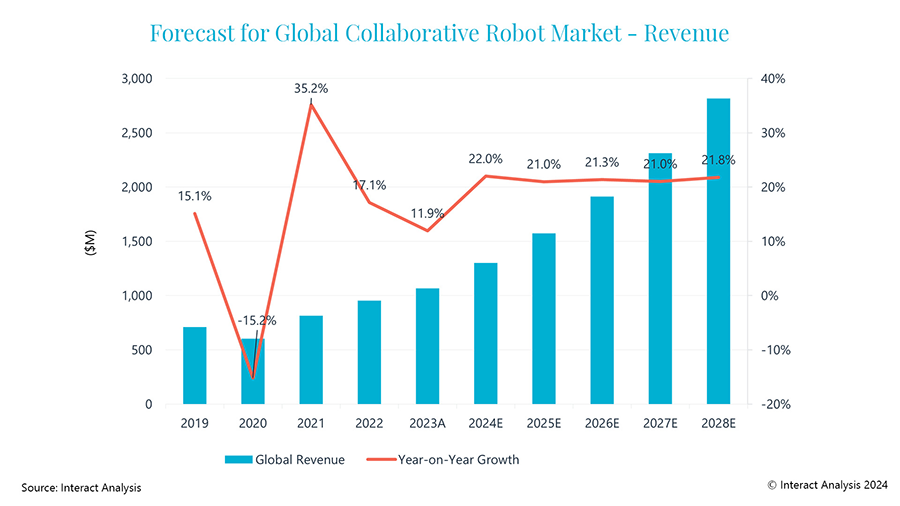

According to Interact Analysis’ newly published “Collaborative Robot Market–2024” report, collaborative robot (cobot) market revenue grew by 11.9% to US$1.07 billion in 2023, reaching the $1 billion milestone. However, the growth rate hit a new post-pandemic low point.

We saw a small ‘V-shaped’ trajectory for cobot sales in 2022-2024. After bottoming out in 2020, the collaborative robot market experienced a startling recovery in 2021, with growth of over 35% taking it beyond its 2019 market size. However, poor economic conditions and supply chain issues placed great pressure on the market in 2022 and 2023, leading to a new post-Covid growth low-point in 2023.

Market: The outlook is still optimistic in the medium to long-term, with price declines slowing

The pandemic exposed the shortcomings of relying on labor in manufacturing, and accelerated automation upgrades to make enterprises more resilient in the face of possible future crises in the logistics and service industries. This is going to be a long-term positive for the robotics industry as a whole and will be a driver of ~20% average revenue growth over the forecast period (2024-2028).

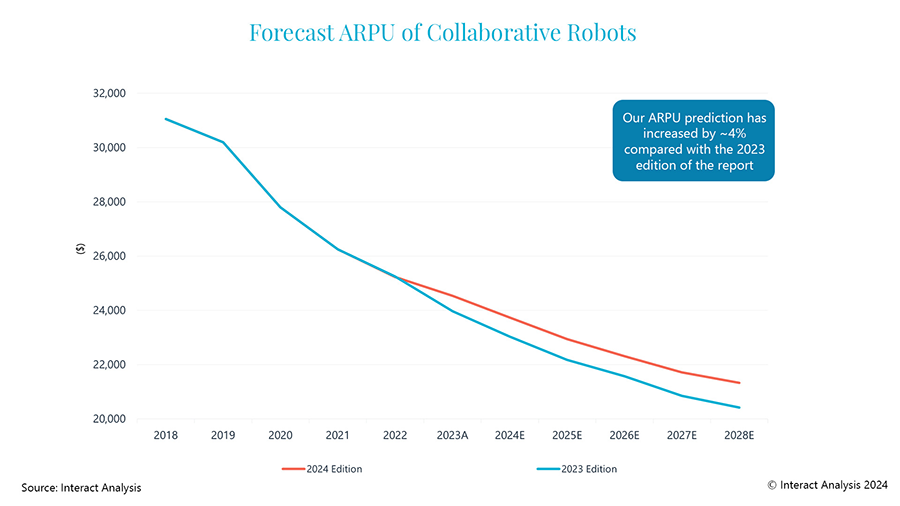

The average market price of cobots slightly increased in 2023, mainly due to a significant increase in shipments of larger payload models (especially >20kg group) in Q4 2023, and we expect rising demand for heavier-duty models to become more apparent during our forecast period. The latest forecast shows that average market price will increase by 4.4% compared with 2023 by 2028.

However cost reductions brought about by economies of scale and maturing industrial supply chains. In the Chinese market, which accounts for more than half of global shipments, the price decline trend is still significant. Please note that the curve below has removed economy models priced below $5,000. At the same time, the emergence of some larger cobot orders (exceeding 100 units) has helped to lower prices. According to our research, several orders from the EV field with over 100 units have transaction prices below $6,000.

Product: From general products to segmented models

The development of collaborative robots is gradually transitioning from general-purpose products to segmented models for specific application scenarios. This trend reflects growing demand in the market for more specialized cobots in different industries. Listed below are some factors influencing the development of these specialized collaborative robots:

- Diversification of load and working range: The load capacity and working range of collaborative robots are key parameters in their design. Robot manufacturers provide products with different loads and working ranges for different application requirements. For example, lightweight collaborative robots are suitable for lightweight assembly and handling tasks, while heavy-duty robots are suitable for heavier material handling tasks.

- Application specific optimization: Some collaborative robots are designed for specific application scenarios, such as laboratory automation, medical surgical assistance, education, and scientific research. These robots typically possess special functions suitable for their application scenarios, such as higher accuracy, special end effectors, or safety features that comply with industry standards.

- Technology integration and innovation: As collaborative robots develop, they are integrating more advanced technologies, such as artificial intelligence, machine vision, and force feedback control to meet the needs of specific market segments. The application of these technologies enables cobots to work more effectively alongside human workers and perform more complex tasks.

Customers: Direct sales and collaboration with customers growing

The collaborative robots sales channel can be divided into direct sales and distribution network (through distributors or system integrators). Because most clients are small and medium-sized companies, the distribution network contributed more than 90% of total market sales before 2020. Direct sales mainly target major customers in key industries, but due to the wide coverage and geographical distribution of the robot market, relying solely on direct sales does not best meet user needs. Distributors are usually systems integrators with engineering backgrounds who provide automation solutions paired with robots for customers in different industries.

The distribution model can quickly build a sales network to occupy the market. However, it is also important that robot manufacturers do not become overly reliant on the sales and technical support capabilities of distributors, and make sure they have a solid understanding of the real needs of downstream customers. In order to have a deeper connection with customers and understand their practical application needs, the proportion of direct sales has rapidly increased over recent years, and it has become an important trend for robot manufacturers to collaborate with customers, creating different scenarios and use cases.

Direct sales enable robot manufacturers to provide suitable solutions based on the specific needs of customers, discover suitable applications for collaborative robots in a certain scenario, and work with customers to think about how best to use collaborative robots. By working closely with customers, robot manufacturers can also enhance retention rates and loyalty.

For different application scenarios, there are more suitable semi-customized products or secondary development activities that can be carried out. These methods include:

- Providing process packages that support rapid deployment and adaptation to certain application scenarios. Users can choose and configure kits according to their needs to build their own systems.

- Providing diversified solutions for secondary development interfaces, which can quickly meet the customized needs of different industries.

- Launch different semi-customized products for various categories of application.

The future looks bright for the expanding cobot market

Across all the various lenses through which the global collaborative robots market has been analyzed, it is clear there are signs of change and growth. We predict the market will continue to expand and adapt to shifting customer needs and global events.

Strong growth is predicted in shipments through to 2028 and beyond, with price declines slowing as cobots become more intelligent and capable of carrying greater payload. While logistics applications are currently leading the market, growth is also expected in non-industrial sectors and in areas such as welding, where the full market potential has not been exploited.

To make the most of the potential for growth, cobot manufacturers will need to listen closely to what their customers demand and develop new application scenarios, while also working alongside distributors to build their sales networks.

About The Author

Maya Xiao, research manager at Interact Analysis, has an interdisciplinary technical background in vehicle electrification, system automation and robotics. Based in China, she is the lead analyst for Interact Analysis’ Li-ion battery and forklift research, also covering markets for industrial and collaborative robots.

Did you enjoy this great article?

Check out our free e-newsletters to read more great articles..