AI in Banking Presents Both Risks and Opportunities – Fintech Schweiz Digital Finance News

Despite the promised benefits of improved customer support and personalization, the use of artificial intelligence (AI) in banking also introduces several disadvantages and risks, including data privacy and security issues as well as fraud risks, a new survey by Glassbox found.

The study, which polled 1,000 US consumers aged 21+ in May 2024, found that 60% of respondents believe AI in banking presents equal parts benefit and risk. Notably, 47% of respondents identified security risks as their primary concern regarding AI in banking.

Security is considered an extreme priority in digital banking by over half of the respondents, with 90% stating that the security of personal information is important or extremely important. This underscores the urgent need for banks to prioritize security and reliability in their digital services.

There is also a clear demand for transparent and proactive communication about AI use and related security measures, with 85% of consumers expecting proactive communication from their banks. Moreover, more than half of the respondents indicated they would switch banks if they were victims of AI-related fraud.

These concerns are substantiated by another survey conducted by BioCatch, a security services firm. The company, which polled financial institutions in the US and ten other countries in January and February 2024, found that 51% of the organizations surveyed lost between US$5 million and US$25 million due to AI-based or AI-driven threats in 2023. Nearly half of the respondents anticipate an increase in financial crime and fraud in 2024.

A rising challenge in this context is deepfake technology, which allows for the creation of fake videos, images, and audio to impersonate individuals. This technology has become increasingly sophisticated and accessible, leading to a significant increase in its use for fraudulent purposes.

According to Sumsub’s 2023 Identity Fraud Report, there was a tenfold increase in the number of deepfakes detected globally across all industries from 2022 to 2023, with the crypto and fintech sectors accounting for 96% of these cases. In the fintech space alone, deepfake incidents rose by 700% in 2023 compared to the previous year.

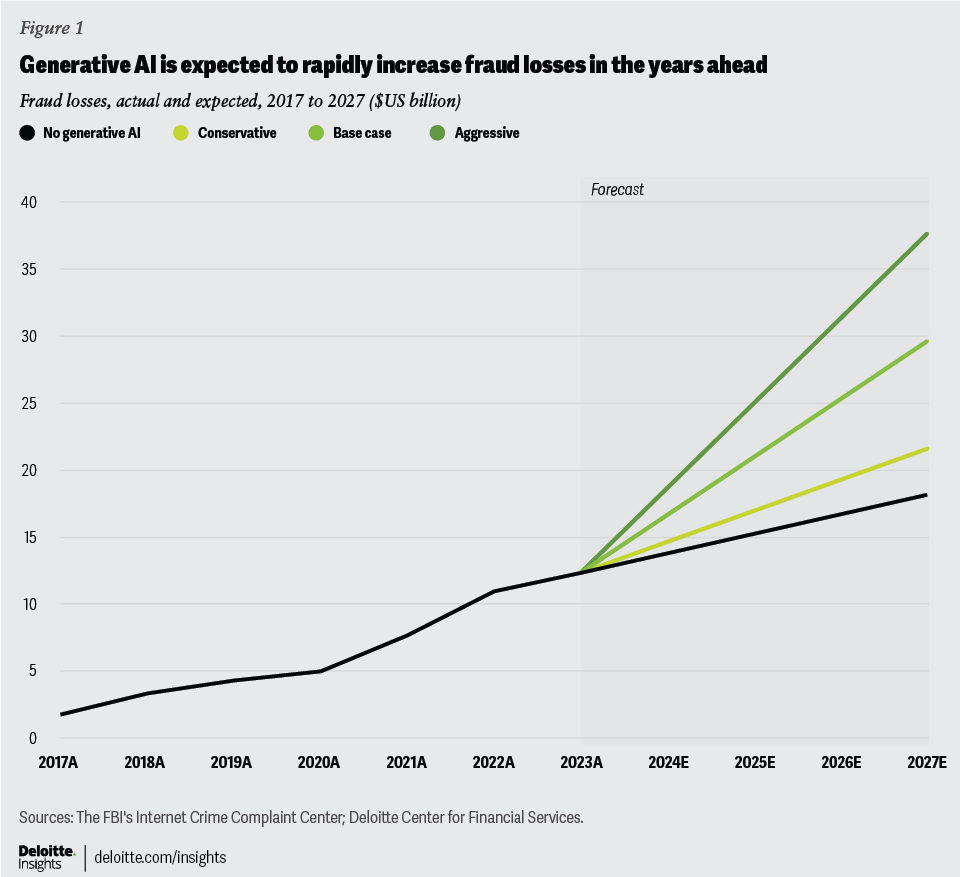

Deloitte expects deepfake incidents to proliferate in the years to come as bad actors continue to exploit increasingly sophisticated and affordable generative AI (gen AI) technologies to defraud banks and their customers.

The firm estimates that gen AI, which refers to AI systems designed to autonomously generate new, original content, could drive fraud losses in the US to US$40 billion by 2027, up from US$12.3 billion in 2023, representing a compound annual growth rate of 32%.

Fraud losses, actual and expected, 2017 to 2027 (US$ billion), Source: Deloitte Center for Financial Services, May 2024

Despite the risks and challenges, consumers recognize AI does provide some valuable use in banking. According to the Glassbox survey, 59% of US consumers are comfortable with AI being used to identify potential fraud, and nearly half support its use in fixing mobile app or website errors to improve usability.

AI also aids in providing a seamless customer experience across digital platforms, a feature deemed important by 66% of consumers. Additionally, 79% of users emphasized the importance of quality customer support online, and 63% consider personalization based on past activity and history to be significant.

Furthermore, customers expect reliable and consistent experiences when accessing financial information and resources. In fact, 87% of respondents stated that overall reliability and the absence of errors are essential when conducting transactions via app or website.

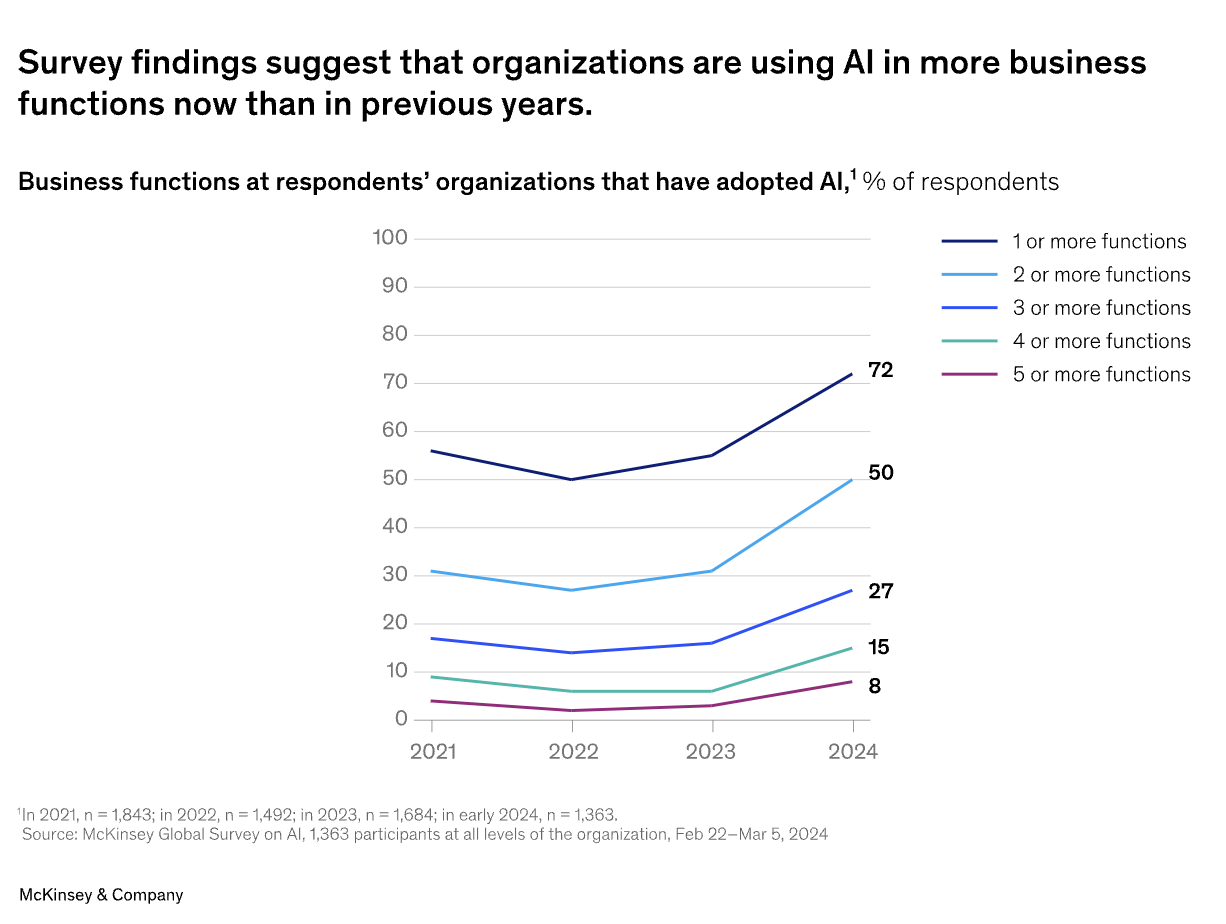

Globally, AI is being adopted by the banking sector at a fast pace. A recent McKinsey survey found that adoption of AI has reached a remarkable 72% this year, up from 55% in 2023. Also, responses show that companies are now using AI in more parts of the business. Half of respondents reported that their organizations have adopted AI in two or more business functions, up from less than a third of respondents in 2023.

Business functions at respondents’ organizations that have adopted AI, % of respondents, Source: McKinsey and Company, May 2024

Top executives in the finance and banking sector are willing to take significant risks for the efficiency improvements brought about by AI. A study conducted by IBM, which surveyed more than 3,000 CEOs in the banking and financial markets, found that 66% believe the potential productivity gains from automation and AI are so substantial that they would accept significant risks to stay competitive. Additionally, 67% said they would take more risks than their competitors to maintain their competitive edge, underscoring the importance of adopting AI in this sector.

Featured image credit: edited from freepik