Joe Montana and Ashton Kutcher Among Top Celebrity Startup Investors – Fintech Schweiz Digital Finance News

Celebrity investors are becoming an influential force in the venture capital (VC) landscape, offering significant visibility, credibility and strategic support to the startups they invest in. But some are standing out from the pack, demonstrating a knack for identifying future unicorns or strong merger and acquisition (M&A) targets.

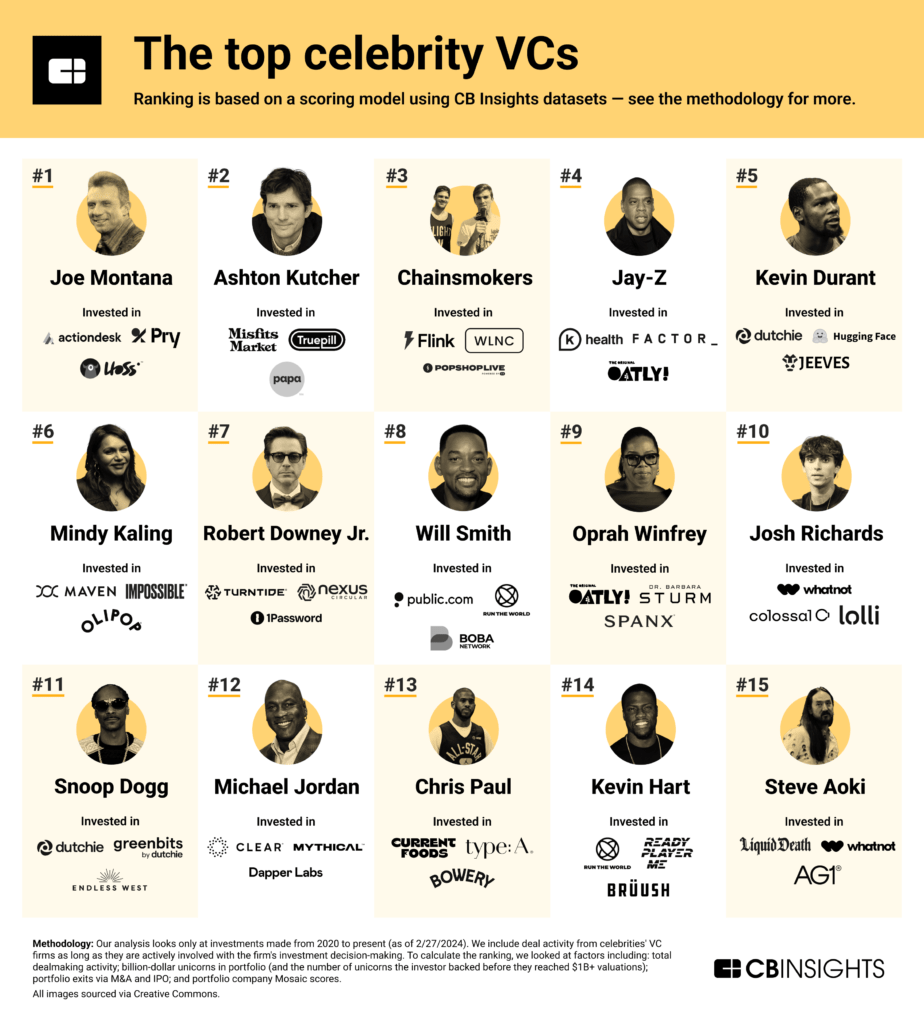

Market intelligence platform CB Insights has released its “Celebrity VC Index”, ranking the top 20 celebrity investors based on the strength of their portfolios. The index takes into consideration recent financing and exit activity, unicorn metrics, as well as the Mosaic scores of portfolio companies, to identify the most successful celebrity VCs.

The Mosaic score is a proprietary algorithm developed by CB Insights that evaluates the health and growth potential of private companies. It combines various metrics and data points into a single score to assess the viability and future prospects of a company.

Most active celebrity VCs and best investors at spotting future unicorns

According to the Celebrity VC Index, Joe Montana, a former American football player, is the most active and successful celebrity VC, topping the ranking by making more investments than any other celebrities and minting more unicorn startups.

Since 2020, Montana’s Liquid 2 Ventures has invested in a whooping 569 deals and backed 10 of today’s unicorn startups. These companies include Airbyte, an open-source data integration platform valued at US$1.5 billion, Pipe, a financial services company providing non-dilutive capital solutions for businesses worth US$2 billion, and Whatnot, a livestream shopping platform valued at US$3.7 billion.

American actor and entrepreneur Ashton Kutcher ranks second with his Sound Ventures having invested in 118 deals since 2020 and bet on five companies that reached unicorn startups. These ventures include Misfits Market, an online grocery delivery service now valued at US$2 billion, Truepill, an online pharmacy platform worth US$1.6 billion, and Papa, an elderly homecare startup valued at US$1.4 billion.

Most exits and highest Mosaic score average

The Chainsmokers, an electronic DJ duo, and Jay-Z, a rapper and entrepreneur, have seen the most exit activity in proportion to their overall deal volume, recording five exits via M&A or initial public offering (IPO) each since 2020. The Chainsmokers and Jay-Z rank third and fourth in the Celebrity VC Index, respectively.

The Chainsmokers have backed startups such as Flink, an online supermarket valued at US$1.07 billion, and WeLoveNoCode, a marketplace that connects 5,000 companies and 36,000 no-code developers; while Jay-Z has invested in ventures including K Health, a healthtech startup worth US$1.5 billion, and Oatly, a Swedish company that develops oat-based diary alternatives. Oatly went public in 2021 at a valuation of US$10 billion, giving Jay-Z a 5x return on investment, according to CB Insights.

Mindy Kaling, an actress and producer, leads the ranking in terms of portfolio companies’ Mosaic scores, averaging 883 out of 1,000. Since 2020, Kaling has only invested in seven startups and backed one company that became a unicorn. Maven, a virtual clinic specializing in women’s and family health, reached a US$1 billion valuation in 2021 after raising a US$110 million Series D funding round. Kaling ranks sixth in the Celebrity VC Index.

Investment trends

Data from CB Insights show that celebrities investors tend to invest in consumer-facing brands and media-adjacent businesses, which align with their personal brand, expertise, and influence. These sectors offer high visibility and market engagement, allowing celebrities to leverage their fame to drive business success.

Kutcher, for example, has invested in Warby Parker, a direct-to-consumer eyewear startup that went public in 2021. Kaling, Jay-Z and Serena Williams (#17) have backed Impossible Foods, a company developing plant-based substitutes for meat products.

The CB Insights report also notes that the top-performing celebrity investors have turned investing into a consistent business practice. This is shown by the fact that the top five celebrities in the ranking have established their own VC funds in addition to complement their individual investing activity. Alongside Montana’s Liquid 2 Ventures and Kutcher’s Sound Ventures, these funds include the Chainsmokers’ Mantis, Jay-Z’s Marcy Venture Partners, and Kevin Durant (#5)’s Thirty Five Ventures.

Other celebrity featured in CB Insights’ Celebrity VC Index include professionals athletes Michael Jordan (#12), Chris Paul (#13), and LeBron James (#19); actors Robert Downey Jr. (#7), Will Smith (#8) and Leonardo DiCaprio (#18); rappers Snoop Dogg (#11) and Drake (#16); social media personalities Josh Richards (#10) and Jake Paul (#20); comedian Kevin Hart (#14); TV host and producer Oprah Winfrey (#9); and DJ Steve Aoki (#15).

Top celebrity VCs, Source: CB Insights, May 2024

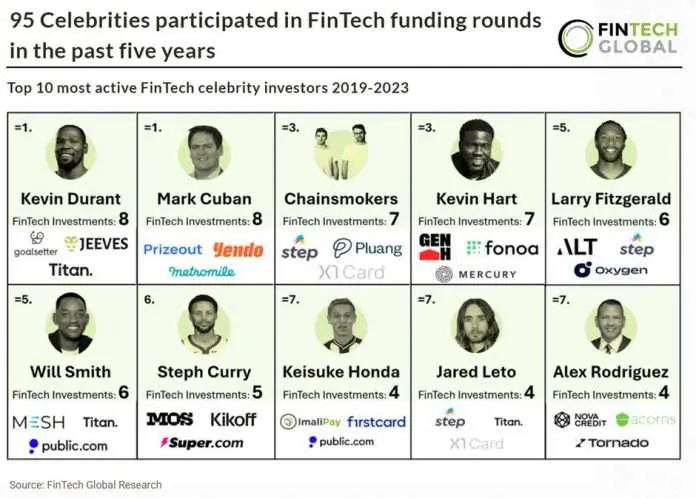

Notable celebrity investors in fintech

Separate research by Fintech Global shows that several of these celebrities are also active in fintech. In particular, Durant, the Chainsmokers, Hart and Smith were among the 10 most active fintech celebrities investors between 2019 and 2023, the report says.

Durant’s key investments over the period include Goalsetter, a mobile banking app that allows peer-to-peer transactions; Jeeves, which provides open global business accounts; and Titan, an investment firm also backed by Smith.

The Chainsmokers invested in Step, a teen banking app also backed by Smith; Pluang, an Indonesian fractional investing app; and X1 Card, a challenger credit card. Hart backed Fonoa, a tax automation platform, and Mercury, a business banking startup, while Smith invested in Front, a strategic investment platform, and Public.com, a social investing platform.

Top 10 most active fintech celebrity investors 2019-2023, Source: Fintech Global Research, Mar 2024

Featured image credit: edited from freepik