Post-Earnings Dip Opens Window of Opportunity

Salesforce stock (NYSE:CRM) experienced a dramatic post-earnings sell-off following the release of its Q1 report. Investors were likely dispirited with Salesforce’s revenues, as it missed consensus estimates for the first time in 18 years. Management’s guidance for Q2 also appeared soft, implying further deceleration in growth, moving forward. Despite these concerns, Salesforce is making strong progress in its bottom line. Thus, the sell-off may have opened a window of opportunity, and I am bullish on the stock.

Does Salesforce Have a Revenue Growth Problem?

Salesforce’s recent revenue growth performance was the main reason behind the post-earnings sell-off. To understand this, we need to look at the current market environment, which is buzzing with excitement in the tech industry. The AI era has arrived, leading to substantial spending and impressive revenue beats across the board.

For instance, Nvidia (NASDAQ:NVDA) managed to beat revenue estimates by 6% in its latest quarter despite high expectations. Other tech giants like Microsoft (NASDAQ:MSFT), Apple (NYSE:AAPL), and Broadcom (NASDAQ:AVGO) have also outperformed analysts’ forecasts.

Given this high-expectation environment in the tech sector, it shouldn’t come as a surprise that Salesforce missing estimates (even marginally) and providing soft guidance caused a very negative market reaction. Regarding the Q1 revenue miss, note that it marked just the second time in 20 years that Salesforce has not met the Street’s expectations, with the only previous miss happening in Q4 of 2006. This is only two revenue misses in 80 quarters.

Finally, regarding the guidance, the company’s Q2 estimates point toward revenue growth between 7% and 8%. Even if Salesforce exceeds these estimates, the second quarter will still be the weakest quarter in its history in terms of revenue growth. Thus, the post-earnings sell-off wasn’t entirely unjustified.

Salesforce Keeps Delivering Bottom-Line Growth

Despite Salesforce’s ongoing revenue growth unwinding, investors shouldn’t overlook the progress the company has been making regarding its bottom-line growth. In recent quarters, Salesforce has managed to improve its margins considerably, resulting in strong operating and free cash flow growth, which should strengthen its investment case.

Specifically, Salesforce ended Q1 with an adjusted operating margin of 32.1%, marking a huge expansion of 450 basis points compared to last year. Therefore, despite the slowdown in revenue growth, Salesforce still managed to grow its operating cash flow by a significant 39% to $6.25 billion.

Now, consider the fact that Salesforce runs on a capital-light business model. In fact, capital expenditures (CapEx) came in at a light $163 million, further declining from an already measly $243 million last year. Thus, the strong operating cash flow growth and decline in CapEx led to free cash flow surging 43% to $6.1 billion. These numbers tell a different story than the rather soft top-line growth and management’s second-quarter outlook.

Is Salesforce’s Valuation Attractive?

My initial argument was that Salesforce’s post-earnings sell-off has created a window of opportunity for bullish investors. As I just mentioned, Salesforce has made noteworthy progress in terms of improving its profitability. This progress and the recent decline in its share price have likely created fertile ground for investors to take advantage of, valuation-wise.

Indeed, Salesforce’s valuation appears to hover at rather reasonable levels. While most tech stocks have seen their multiples expand lately, Salesforce’s valuation seems quite more grounded. In fact, the stock is trading at some of the most attractive multiples it has seen in its history.

Its forward P/E of 24.2x has never been more attractive. Even during the Great Financial Crisis of 2007-08, this multiple would still hover closer to 30x. Further, Salesforce is expected to achieve free cash flow of $11.75 billion this year, which implies a price/FCF multiple of 20x. I find this valuation multiple quite attractive as well, especially considering that Salesforce is likely to achieve further margin improvements, which aligns with the current trend.

Is CRM Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Salesforce stock has a Moderate Buy consensus rating based on 29 Buys, 10 Holds, and one Sell assigned in the past three months. At $297.11, the average CRM stock price prediction suggests 23.3% upside potential.

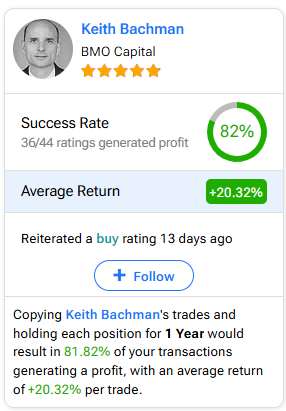

If you’re unsure which analyst you should follow if you want to buy and sell CRM stock, the most profitable analyst covering the stock (on a one-year timeframe) is Keith Bachman from BMO (NYSE:BMO) Capital, with an average return of 20.32% per rating and an 82% success rate. Click on the image below to learn more.

The Takeaway

While Salesforce’s Q1 revenue growth and Q2 outlook may have disappointed investors, the company’s substantial progress in bottom-line growth is noteworthy. If anything, the post-earnings sell-off has resulted in shares now trading at an attractive valuation. With the potential for Salesforce’s ongoing margin expansion to persist and its valuation hovering near all-time lows, the tech behemoth looks like a compelling opportunity.