Argan: Generative AI, EV Adoption, And Healthy Project Backlog Compositions (NYSE:AGX)

Ron and Patty Thomas

Synopsis

Argan, Inc. (NYSE:AGX) conducts its operations through a few subsidiaries. They are Gemma Power Systems [GPS], The Roberts Company [TRC], Atlantic Projects Company [APC], and Southern Maryland Cable [SMC]. It offers a wide range of services to the power generation market, the light and heavy industrial market, and the telecommunications infrastructure market.

Currently, the demand for electricity is increasing, and it is anticipated to increase in the years to come. Generative AI is driving up demand for data centers, and it is also increasing data center power usage. In addition, EV adoption has been consistently growing as well. As EV adoption grows, so does the demand for power. For its most recent quarter, AGX has reported strong and healthy project backlog compositions. Furthermore, its Trumbull Energy Center project is anticipated to reach peak construction activity this year and will continue into the next as well. Given its positive outlook, I am recommending a buy rating for AGX stock.

Historical Financial Analysis

Before I begin, it is important to address the fact that AGX’s dependency on large construction contracts might cause uneven financial results. Its contract revenues are based on the amounts of cost incurred, to a significant degree. The total cost can differ from quarter to quarter due to the timing of equipment purchases, subcontractor services, and other contract events, which may not be evenly distributed over the terms of its contracts. Therefore, this could potentially result in uneven amounts of quarterly and annual consolidated revenue. As a result, it causes consecutive quarter comparisons of operating results to be a less meaningful way to access AGX’s growth.

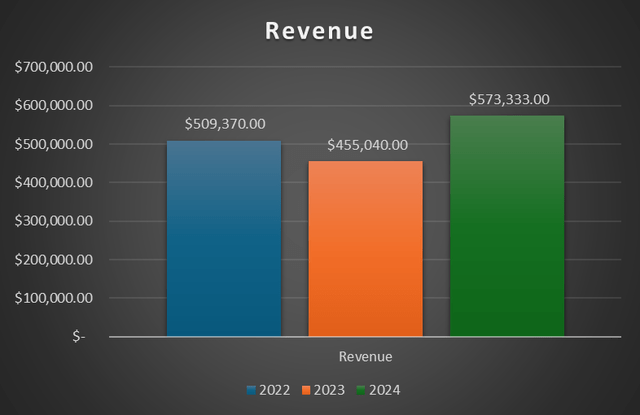

Looking at AGX’s historical financials, its revenue growth was volatile. In 2021, it reported revenue of approximately $509.37 million. In 2022, revenue fell to $455.04 million, and this was caused by a decline in its power industry services and industrial fabrication and field services segments, which fell 13.1% and 5.2%, respectively. The power industry services segment’s revenue decrease was due to construction on the Guernsey Power Station project and the Maple Hill Solar Energy Facility coming to an end.

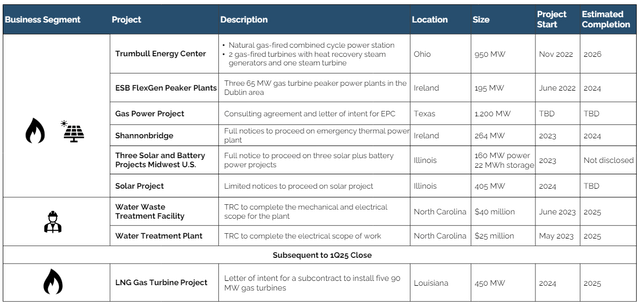

In 2023, revenue grew to $573.33 million. Both the power industry service and industrial construction services segments grew year-over-year at 20.3% and 53.9%, respectively. The growth in the power industry service segment was driven by an increase in construction activities at the Trumbull Energy Center, the Shannonbridge Power Project, the ESB FlexGen Peaker Plants, and the Midwest Solar and Battery Projects. On the other hand, the strong growth in its industrial construction services was driven by AGX’s focused business development efforts in the expanding regional business environment. This effort resulted in new customer project awards.

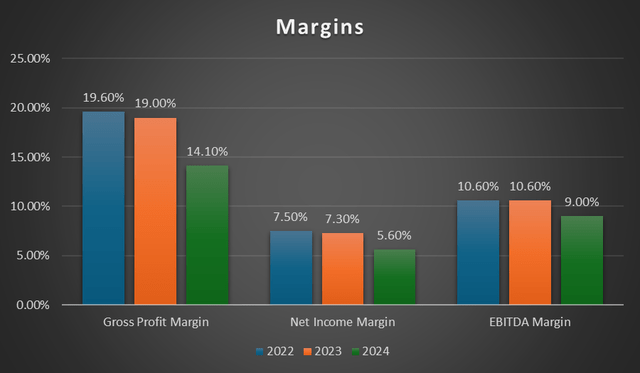

Regarding its profit margins, there were slight contractions in 2024. In 2024, its gross profit margin contracted from 19% to 14.10%. The main cause of this gross margin contraction was a $13.6 million loss in connection with the Kilroot project. As a result of the gross margin contraction, it affected its net income margin, which contracted from 7.30% to 5.60% in 2024. However, a reduction in AGX’s SG&A expense as a percentage of revenue from 9.8% to 7.7% in 2024 partially offset the net income margin contraction. The net income margin contraction also negatively impacted its EBITDA margin, which contracted from 10.60% to 9% in 2024.

First Quarter 2025 Earnings Analysis

AGX released its most recent 1Q25 results on June 6, 2024. For the quarter, AGX’s consolidated revenue increased 52.1% year-over-year to $157.7 million. This strong growth in consolidated revenue was driven by all three of its reportable segments. AGX saw increased revenues at some of its projects, such as the Trumbull Energy Center, the Midwest Solar and Battery Projects, and the Shannonbridge Power Project.

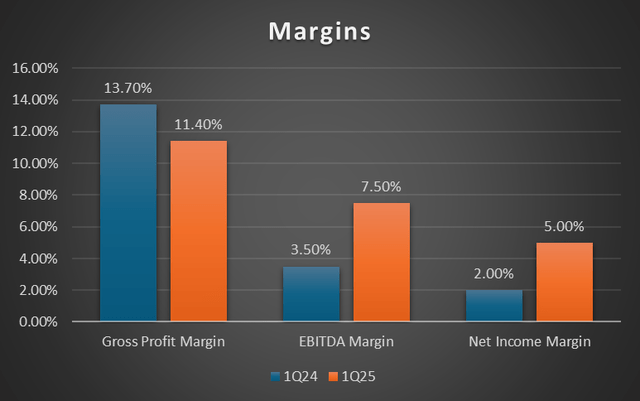

Regarding margins, although gross profit margin contracted, EBITDA margin and net income margin expanded. AGX’s gross profit margin contracted from 13.70% to 11.40% year-over-year. Its gross profit was impacted by losses related to the Kilroot project. On the other hand, the EBITDA margin expanded from 3.50% to 7.50%. The EBITDA margin expansion was mainly driven by an expansion in its net income margin.

For the quarter, the net income margin expanded from 2% to 5%, and this expansion was driven by lower SG&A expenses. For the quarter, SG&A as a percentage of revenues decreased from 10.2% to 7.2%. Additionally, other income net, contributed to the margin expansion as well. Other income net for the quarter was approximately $4.8 million. This includes income earned from invested funds in the money market, which was approximately $4.5 million. For context, for the same period last year, AGX incurred a loss of approximately $600,000 due to wire-transfer fraud losses of approximately $3.0 million, partially offset by income earned on invested funds of approximately $2.4 million.

Business Overview

AGX’s business segments consist of power industry services, industrial construction services, and telecommunications infrastructure services. According to its most recent quarter results, power industry services accounted for the largest share of total revenue, accounting for approximately 70%. Coming in second are its industrial construction services, which accounted for approximately 28%. Its telecommunications infrastructure services are the smallest, accounting for approximately 2%.

AGX’s power industry services specialize in constructing cutting-edge power solutions that assist in the transition towards low or no carbon emissions. Its industrial construction services provide both light and heavy industrial clients with industrial construction services, particularly in new industries. Lastly, the telecommunications infrastructure services specialize in the construction and connecting of technology and telecommunications.

Demand for Electricity is Increasing

For the years ahead, it is anticipated that the demand for electricity will only increase. The drivers behind this anticipated increase are the expansion and growth in artificial intelligence [AI] and data centers, electric vehicles [EVs] and charging stations, and solar and battery factories. Therefore, in order to support these drivers, the existing global energy infrastructure will need to be expanded, upgraded, and strengthened in order to meet the expected increase in energy demand.

AI and Data Centers

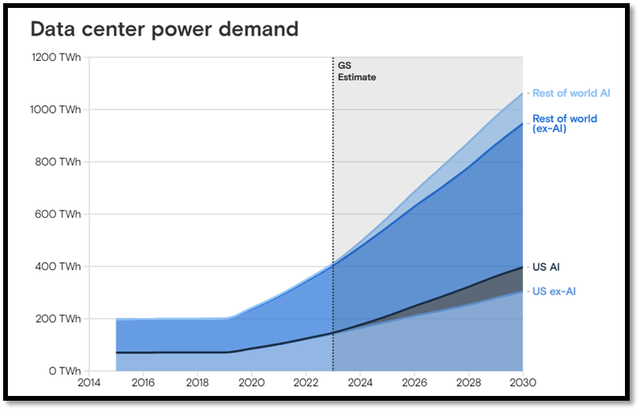

Currently, the strong growth in generative AI is driving up demand for data centers. According to Goldman Sachs, it is estimated that by 2030, the power consumption of data centers will increase by 160%. Currently, data centers use 1% to 2% of overall power, but by the end of the decade, this number is expected to increase to 3 to 4%. For context, an AI query requires almost ten times as much electricity to process as compared to a Google search.

Through 2027, Morgan Stanley forecasts that the average annual growth rate of power demand from generative AI will be approximately 70%. This increase in power demand is primarily due to the expansion of data centers. As a result, this increase in power demand is expected to drive power providers to create storage and renewable energy projects to meet this demand.

Given AGX’s extensive experience and capabilities in the construction and management of complex power facility projects, the strong growth in generative AI and data centers is expected to bolster AGX’s growth outlook.

Increasing EV Adoption

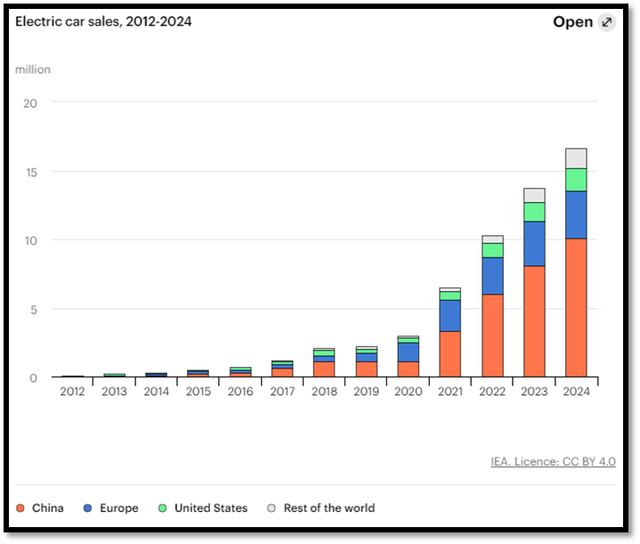

According to the International Energy Agency [IEA], the EV market is growing rapidly, as sales hit almost 14 million in 2023. Additionally, in 2023, EV sales as a percentage of total sales rose from approximately 4% in 2020 to 18%. For 2024. IEA expects EV growth momentum to continue, as there were more than 3 million EVs sold in just the first quarter. For context, this figure is 25% more than last year. For the full year, they expect EV sales to reach approximately 17 million, which represents a year-over-year growth of more than 20%. In addition, IEA expects new EV sales to accelerate in the second half of 2024.

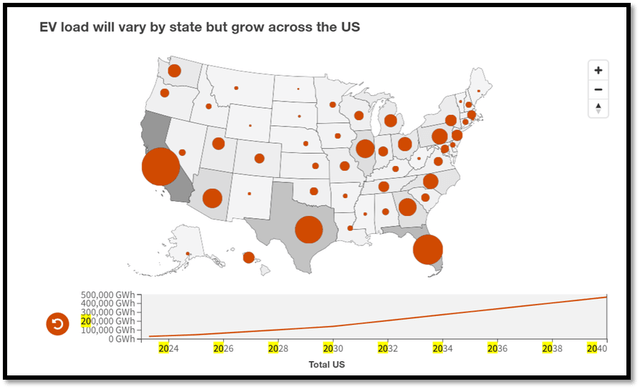

According to PWC, there were an estimated 4.5 million EVs on US roads in 2023. By 2040, it is forecast that there could potentially be more than 90 million EVs, which represents twenty times the 2023 quantity. As EV adoption grows, so does the demand for power. PWC estimates that EVs’ average total annual load will increase from approximately 24,000 GWh in 2023 to 468,000 GWh by 2040. At this amount, the estimated EV load could potentially account for 9% to 12% of the projected US grid capacity.

Relative Valuation Model

Author’s Relative Valuation Model

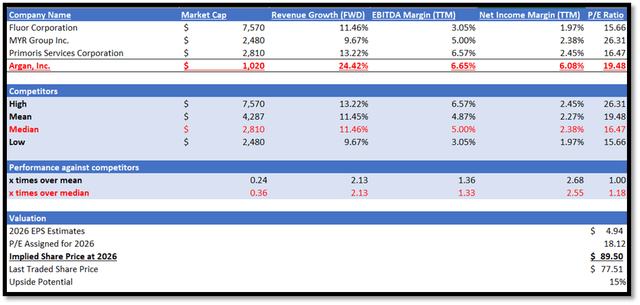

For context, AGX operates in the construction and engineering industry and specializes in providing services to the power generation market. In my relative valuation model, I will be comparing AGX against its peers in terms of growth outlook and profitability margins trailing twelve months [TTM]. For growth outlook, I will be comparing their forward revenue growth rate, while for profitability margins, I will be comparing EBITDA margin TTM and net income margin TTM.

Starting with the growth outlook, AGX’s forward revenue growth rate significantly outperformed its peers’ median. AGX has a forward revenue growth rate of 24.42% vs. its peers’ median of 11.46%, which represents 2.13x over the peers’ median.

Regarding profitability margins, AGX also outperformed its peers in both EBITDA margin TTM and net income margin TTM. AGX has an EBITDA margin TTM of 6.65%, which is higher than its peers’ median of 5%. In terms of net income margin TTM, AGX reported 6.08%, while its peers’ median is 2.38%.

Currently, AGX has a forward P/E ratio of 19.48x, which is significantly higher than its peers’ median of 16.47x. Although AGX’s outperformance in terms of both growth outlook and profitability margins justifies its higher valuation, I will be adjusting my 2026 target P/E for AGX down slightly in order to remain conservative in my valuation approach. I will apply a 10% premium to its peers’ median instead of the current ~18%. In addition, my adjusted 2026 target P/E of approximately 18.12x is also in line with the broader sector median of 18.61x, in which AGX operates, as provided by Seeking Alpha.

For 2026, the market revenue estimate for AGX is approximately $876 million, while the 2026 EPS estimate is $4.94 per share. According to AGX, its Trumbull Energy Center project is anticipated to reach peak construction activity throughout this year and will continue into the next.

In addition, AGX has executed a limited notice to proceed with a customer for the construction of a utility-scale solar field in Illinois. For context, this solar field will generate 405 megawatts [MW] of electricity and is the largest solar venture AGX has undertaken so far. It shows AGX’s ongoing effort to grow its renewable energy business.

Lastly, AGX also has a letter of intent. From this letter of intent, it is anticipated that it will enter into a subcontract with a full notice to proceed with the installation of a 590 MW gas turbines for an LNG facility in Louisiana. Based on its strong and healthy project backlog compositions and the anticipated growth in electricity demand for the upcoming years, they justify the market’s estimates. Therefore, by applying my target P/E to its 2026 EPS estimate, my 2026 target share price is $89.50.

Risk and Conclusion

The risk associated with AGX is its dependency on large construction contracts. Currently, in any given reporting period, the majority of AGX’s power industry services activities are focused on a small number of large construction projects. AGX’s contract revenues are based on the amount of expenses incurred, to a significant degree. The total cost can differ from quarter to quarter due to the timing of equipment purchases, subcontractor services, and other contract events that may not be evenly distributed over the terms of its contracts. Therefore, this could potentially result in uneven amounts of quarterly and annual consolidated revenue. As a result, it causes consecutive quarter comparisons of operating results to be less meaningful.

In addition, most of AGX’s revenue is from its power industry services, which focus on a few key customers and projects. If there are any delays or cancellations to these projects, its consolidated revenue will be significantly affected. For context, its power industry services segment represented 73% of consolidated revenue for FY2024, 76% for FY2023, and 78% for FY2022.

Demand for electricity is increasing, and this demand is expected to continue growing for the foreseeable years ahead. Additionally, the demand for data centers is also increasing due to generative AI. As AI consumes more electricity, it is expected to increase data center power usage. Apart from AI, the growing adoption of EVs is expected to drive up demand for power as well.

Currently, AGX has a strong and healthy project backlog composition. In addition, its Trumbull Energy Center project is expected to reach peak construction activity this year. This momentum is expected to continue into the following year. Given AGX’s positive outlook, I am recommending a buy rating for it.