Top Publicly-Listed Fintech Companies – Fintech Schweiz Digital Finance News

Cypriot fintech company MD Finance has released its selection of the world’s most promising publicly-listed fintech companies.

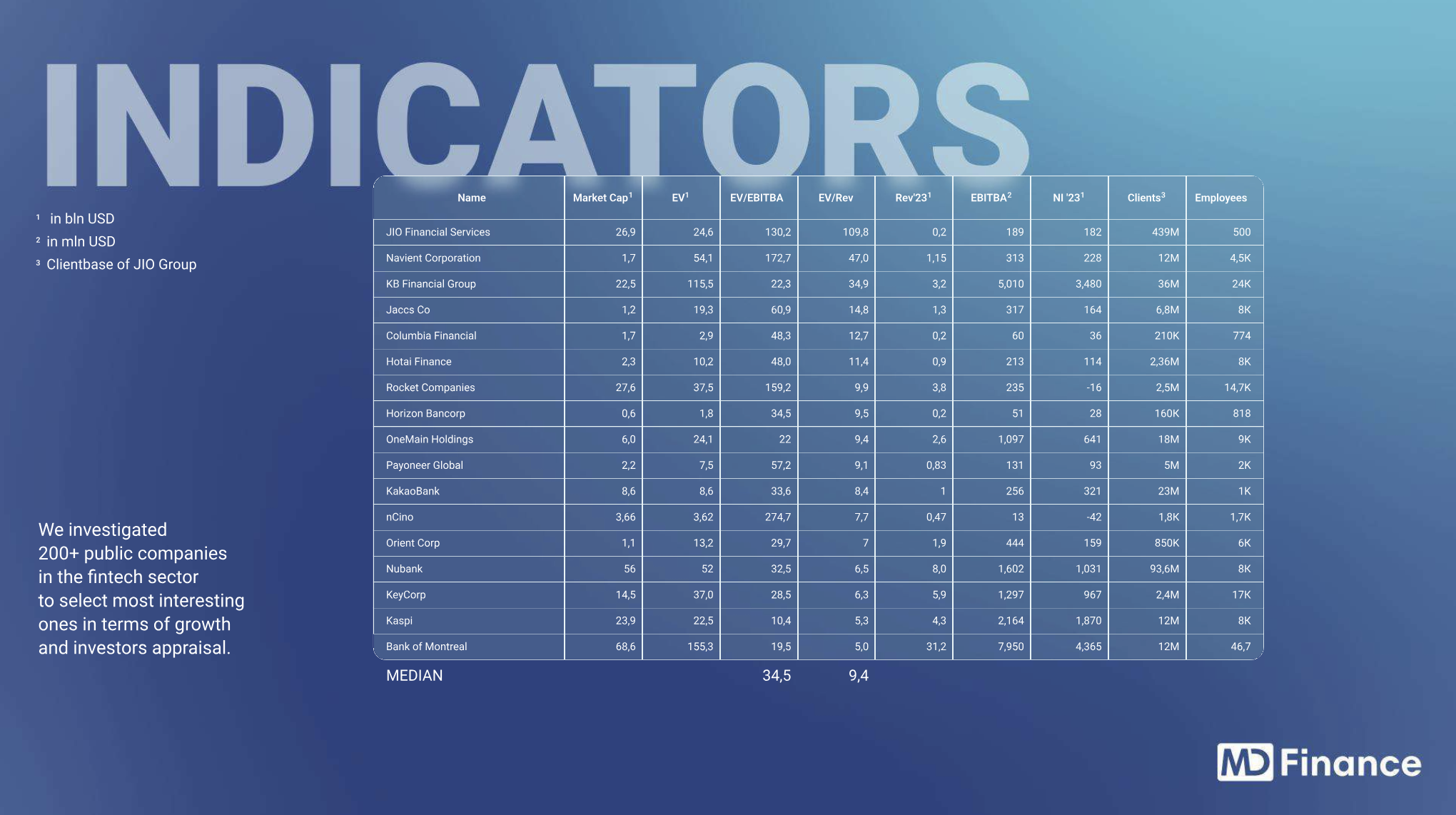

These companies, selected out of a pool of 200 ventures, are standing out in terms of growth potential and investor appeal, and represent the “most attractive fintech companies for investors in 2024,” according to MD Finance.

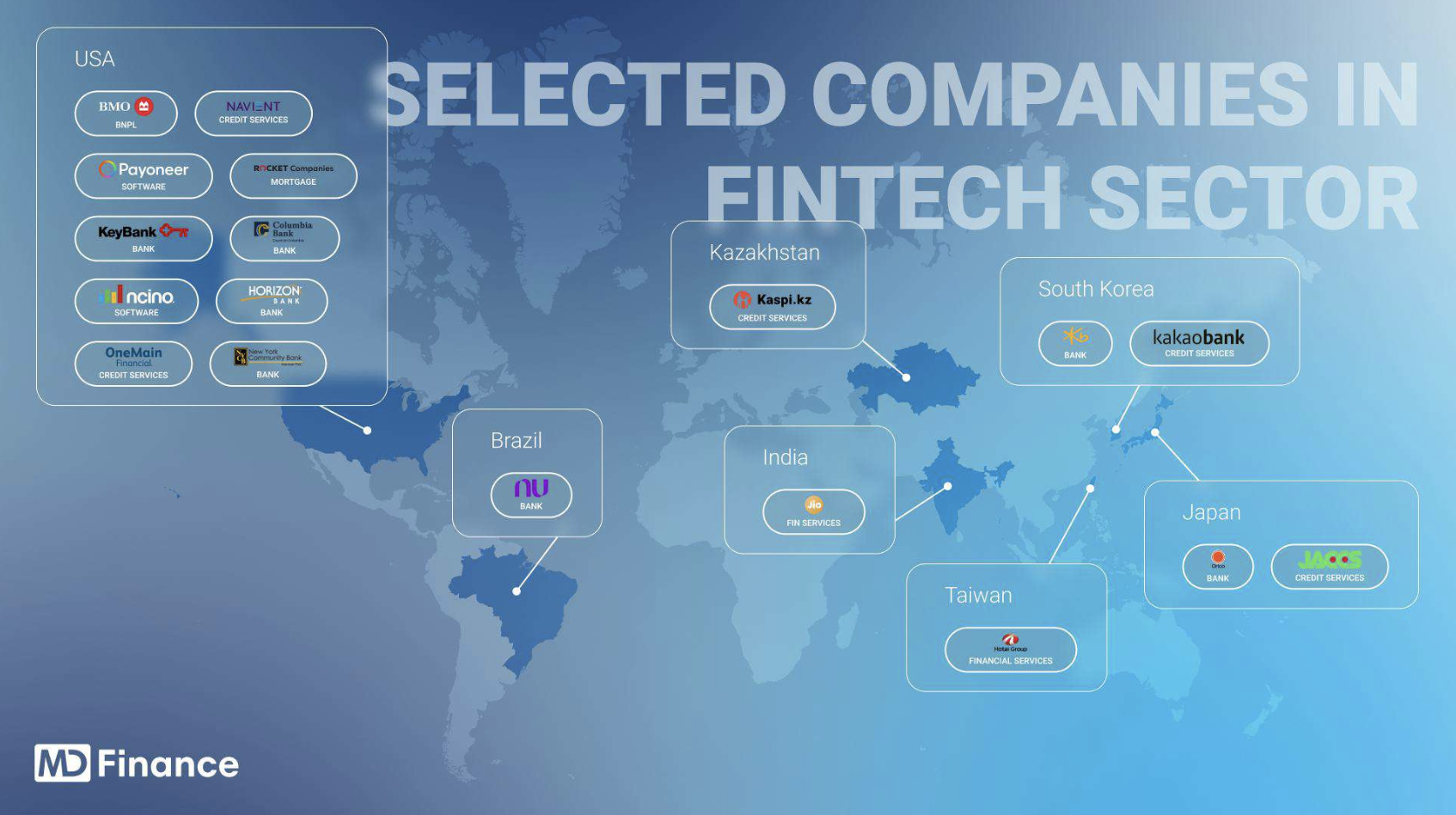

The 18 companies shortlisted come from North and South America (11), and Asia-Pacific (7), with the USA being the most represented country, totaling ten companies. It is followed by South Korea and Japan, with two companies each. Other countries represented include Kazakhstan, India, Taiwan and Brazil, with one company each.

Valuations and investor sentiment

The analysis by MD Finance reveals that the 18 companies exhibit a median enterprise value (EV)/earnings before interest, taxes, depreciation and amortization (EBITDA) ratio of 34.5. The EV/EBITDA ratio is a popular valuation multiple used to determine the fair market value of a company. It is a widely used measure to assess the relative value of companies, especially within the same industry.

An EV/EBITDA ratio below the industry average might suggest the company is undervalued or facing challenges. On the other hand, an EV/EBITDA ratio above the industry average might suggest the company is overvalued or has strong growth prospects.

Bank of Montreal, from Canada; Kaspi, from Kazakhstan; and OneMain Holdings, from the US; have the lowest EV/EBITDA ratios of the cohort at 19.5, 10.4, and 22, respectively. The ratios, which stand below the industry median, suggest that these companies are either undervalued or facing challenges.

Bank of Montreal is the eighth largest bank in North America by assets, providing personal, commercial and investment banking to 13 million customers. Kaspi offers payments, marketplace, and fintech solutions to 12.6 million monthly active users. Finally, OneMain Holdings provides non-prime consumers responsible access to credit.

Conversely, nCino, Navient Corporation, and Rocket Companies – all from the US – have the highest EV/EBITDA ratios of the cohort at 274.7, 172.7, and 159.2, respectively. These numbers are way above the industry average, suggesting that these companies are either overvalued or have strong growth prospects.

nCino is a cloud-based banking software provider that’s partnered with more than 1,800 financial services companies. Navient Corporation is a student loan servicer. Finally, Rocket Companies is a fintech company that provides simple, fast and trusted digital solutions for complex transactions, and which serves 2.5 million clients.

The analysis by MD Finance also reveals that all companies have a EV/Revenue (EV/Rev) ratio higher than 6 with a median of 9.4. The EV/Rev is another valuation metric used to assess a company’s value relative to its revenue. This ratio helps investors understand how much they are paying for a company’s sales, without taking profitability into account.

Like for the EV/EBITDA ratio, an EV/Rev ratio below the industry average might suggest the company is undervalued or limited potential in the eyes of investors, while an EV/Rev ratio above the industry average might suggest that the company is either overvalued or that the market has faith in the company’s ability to generate more efficiently in the future.

Bank of Montreal, Kaspi and KeyCorp, from the US, have the lowest EV/Rev ratios of the cohort, at 5, 5.3 and 6.3, respectively. These ratios stand below the industry median, making these companies either undervalued or witnessing slow revenue growth.

KeyCorp is a bank holding company that offers a range of retail and commercial banking, commercial mortgage and special servicing, consumer finance and leasing, investment management, and investment banking products and services. It holds about US$187 billion in AUM.

At the other end of the spectrum, JIO Financial Services, from India, Navient Corporation and KB Financial Group, from South Korea, have the highest EV/Rev ratios at 109.8, 47, and 34.9, respectively, suggesting overvaluation or strong revenue growth potential.

JIO Financial Services provides financial services, including payment services and insurance broking, and boasts 439 million subscribers. KB Financial Group offers a broad range of banking and financial services, and holds around KRW 517.8 trillion of assets under management (AUM).

Financial performance

The analysis also shows that all of the 18 companies are EBITDA profitable, meaning that their core operations are generating positive earnings before accounting for non-operating expenses and non-cash expenses. However, it also reveals that two companies – nCino and Rocket Companies – reported a negative net income of -US$16 million and -US$42 million, respectively, in 2023.

In contrast, Bank of Montreal, KB Financial Group, Kaspi and Nubank achieved the highest performance in 2023, recording a net income of US$4.4 billion, US$3.5 billion, US$1.9 billion, and US$1 billion, respectively.

Nubank is a digital banking platform from Brazil serving about 100 million customers. The company offers digital credit cards, transfers, and payments.

Other noteworthy publicly-traded fintech companies featured in the MD Finance shortlist include Payonneer Global and KakaoBank. Payoneer is an American financial services company that provides online money transfer, digital payment services and provides customers with working capital. The company posted US$93 million in net income in 2023 and serves 5 million customers. KakaoBank is a South Korean financial institution specializing in mobile banking services and fintech. The bank recorded US$321 million in net income in 2023 and boasts 23 million customers.

Fintech stocks rebound

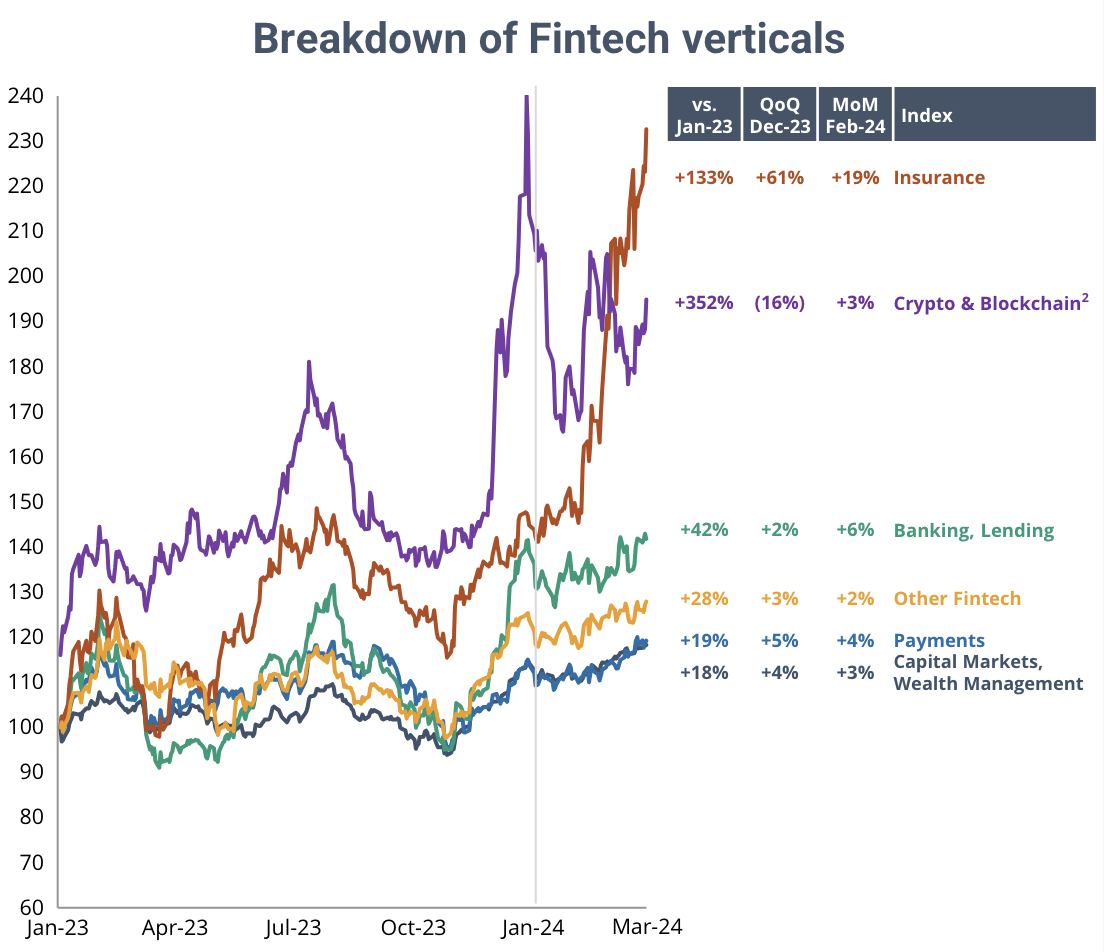

In Q1 2024, fintech stocks continued their upward trend. The RPP Fintech Index, which tracks the performance of key fintech verticals, saw a 4% increase from its December 2023 value, a sustained growth which highlights the continued strength and expansion of the fintech sector, according to London-based corporate finance advisory Royal Park Partners.

Across the fintech verticals covered by the RPP Fintech Index, insurtech recorded the strongest growth, rising by a remarkable 61% quarter-on-quarter (QoQ). The rise of the insurtech index was largely driven by Root Insurance’s strong performances, with its stock price soaring approximately fivefold following the release of its “best-ever” Q4 results.

Meanwhile, payments and capital markets witnessed more moderate growth at 5% and 4%, respectively. Conversely, the cryptocurrency and blockchain sector tumbled 16% QoQ. However, the crypto and blockchain vertical rebounded in the first months of 2024 and added 3% after the launch of the first spot bitcoin exchange-traded funds garnered substantial market momentum.

Featured image credit: edited from freepik