You Will Earn the Most in These Two Financial Technology Sectors, Survey Finds

The

financial technology sector has experienced significant shifts in hiring and

compensation over the past 18 months. While demand for top talent remains high,

the economic landscape and aftermath of widespread layoffs in 2023 have

impacted salary trends on both sides of the Atlantic.

In its

latest edition of the “Financial Technology Salary Survey,”

Harrington Starr examines how salaries have changed across various branches of

the fintech sector at different employment levels, comparing trend shifts in

both the UK and the USA.

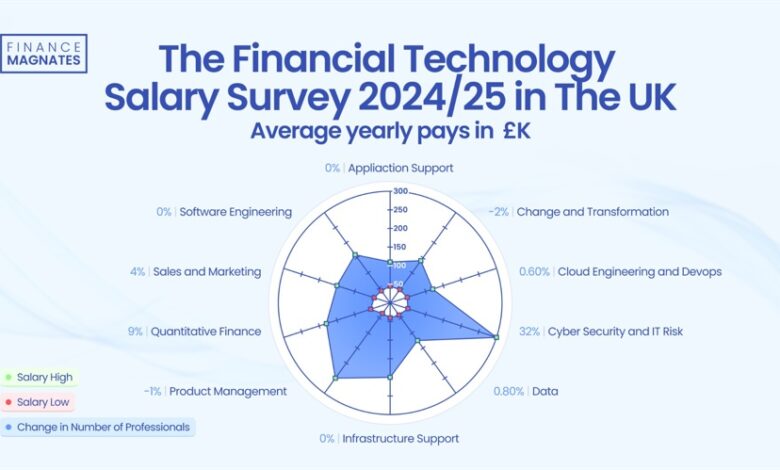

UK Fintech Salaries:

Stability Despite Challenges

Fintech

salaries have remained relatively stable in the UK from 2023 to mid-2024.

However, the job market has become more competitive due to an influx of

available candidates.

For the

application support, salaries grew but remained fairly stable overall.

Compensation varies significantly based on the individual’s technical

capabilities and business knowledge. In the software engineering field they stayed

consistent for junior roles, but experienced workers are more open to taking

pay cuts or changing roles. Senior talent prioritizes factors beyond just

salary when evaluating opportunities.

Toby Babb

“Hiring

levels are up at an 18-month high in financial technology and there remains

strong competition for the best talent in the market,” commented Toby Babb, the

CEO and Co-Founder of Harrington Starr. “A strong candidate in most tech

disciplines can expect two to three offers competing for them, which is once again leading to the bidding wars and counter offers that were so commonplace

in 2022.”

Data and

Analytics experienced candidate-short market which has kept compensation

steady. Data scientists and engineers at the senior level can expect salaries

of £70k-£125k, while lead data scientists often command £90k-£125k.

The highest

earnings were reported in the Cyber Security and IT sector. The top salaries

were for the position of Chief Information Security Officer, ranging from £120K

to £300K. This sector also saw the largest increase in employment over the past

12 months, with a growth rate exceeding 30%. The main employment hubs are

London and Bristol, and the industry remains predominantly male, with men

comprising 75% of the workforce.

“Despite a

fairly challenging economic landscape, the cyber market has remained

competitive as there is an ever-need for firms to protect themselves from

increasingly sophisticated cyberattacks and to ensure they meet certain

regulatory requirements,” commented Andrew Nitek, the Associate Vice President of

Information Security at Harrington Starr.

The UK has seen

an overall uptick in hiring activity in 2024, with firms focusing on securing

candidates with strong technical skills and domain expertise. However,

companies are sticking more closely to budget constraints, leaving less room

for negotiation.

KPMG’s report from February also

highlights the challenges faced by the fintech industry in 2023. It reveals that

funding for fintech projects totaled $113.7 billion, down from $196.3 billion

the previous year. The number of deals was the lowest since 2017.

Comparing the UK and USA

resilience,

with base pay remaining stable compared to previous years. Like the

UK, the US job market has become more competitive post-layoffs. However, the US also

experienced difficulties in fintech funding in 2023. According to Tracxn,

funding dropped by 36% to $18.2 billion, reaching its lowest levels since

before the pandemic.

“The last

twelve to eighteen months have been challenging! Big technology layoffs were

rife in 2023, there was a cost-of-living crisis, the world seemed to lurch from

one catastrophe to the next and there was a pervasive and palpable sense of

volatility and uncertainty in the air,” stated Rob Grant, the Chief Operating

Officer at Harrington Starr.

US fintech

salaries are generally higher across most roles, even accounting for currency

conversions. For example, a mid-level software engineer in the USA earns around

$120k-$150k, while the same role in the UK pays £70k-£120k.

The gender

pay gap remains a challenge in both markets, but the disparity seems more

pronounced in the UK. In 2023, the UK’s gender pay gap in financial services

reached its highest level since 2018. Demand for specialized skills, such as

machine learning, AI, and cybersecurity , commands higher salaries in both

countries.

In April, Finance Magnates examined salaries in the FX industry in Cyprus. The study showed a decrease in average pay for Executive Directors from a range of €100-150K in 2023 to €60-140K in the first months of 2024. However, Heads of Compliance saw an increase in maximum salaries, reaching up to €90 thousand this year, compared to €75K previously.

As we move

further into 2024 and beyond, it’s clear that the fintech job market will

continue to evolve. Companies will need to balance attracting top talent with

managing budgets effectively. Candidates, in turn, must showcase their unique

value proposition and remain open to new opportunities.

Despite the

challenges, the outlook for fintech salaries remains optimistic.

The

financial technology sector has experienced significant shifts in hiring and

compensation over the past 18 months. While demand for top talent remains high,

the economic landscape and aftermath of widespread layoffs in 2023 have

impacted salary trends on both sides of the Atlantic.

In its

latest edition of the “Financial Technology Salary Survey,”

Harrington Starr examines how salaries have changed across various branches of

the fintech sector at different employment levels, comparing trend shifts in

both the UK and the USA.

UK Fintech Salaries:

Stability Despite Challenges

Fintech

salaries have remained relatively stable in the UK from 2023 to mid-2024.

However, the job market has become more competitive due to an influx of

available candidates.

For the

application support, salaries grew but remained fairly stable overall.

Compensation varies significantly based on the individual’s technical

capabilities and business knowledge. In the software engineering field they stayed

consistent for junior roles, but experienced workers are more open to taking

pay cuts or changing roles. Senior talent prioritizes factors beyond just

salary when evaluating opportunities.

Toby Babb

“Hiring

levels are up at an 18-month high in financial technology and there remains

strong competition for the best talent in the market,” commented Toby Babb, the

CEO and Co-Founder of Harrington Starr. “A strong candidate in most tech

disciplines can expect two to three offers competing for them, which is once again leading to the bidding wars and counter offers that were so commonplace

in 2022.”

Data and

Analytics experienced candidate-short market which has kept compensation

steady. Data scientists and engineers at the senior level can expect salaries

of £70k-£125k, while lead data scientists often command £90k-£125k.

The highest

earnings were reported in the Cyber Security and IT sector. The top salaries

were for the position of Chief Information Security Officer, ranging from £120K

to £300K. This sector also saw the largest increase in employment over the past

12 months, with a growth rate exceeding 30%. The main employment hubs are

London and Bristol, and the industry remains predominantly male, with men

comprising 75% of the workforce.

“Despite a

fairly challenging economic landscape, the cyber market has remained

competitive as there is an ever-need for firms to protect themselves from

increasingly sophisticated cyberattacks and to ensure they meet certain

regulatory requirements,” commented Andrew Nitek, the Associate Vice President of

Information Security at Harrington Starr.

The UK has seen

an overall uptick in hiring activity in 2024, with firms focusing on securing

candidates with strong technical skills and domain expertise. However,

companies are sticking more closely to budget constraints, leaving less room

for negotiation.

KPMG’s report from February also

highlights the challenges faced by the fintech industry in 2023. It reveals that

funding for fintech projects totaled $113.7 billion, down from $196.3 billion

the previous year. The number of deals was the lowest since 2017.

Comparing the UK and USA

resilience,

with base pay remaining stable compared to previous years. Like the

UK, the US job market has become more competitive post-layoffs. However, the US also

experienced difficulties in fintech funding in 2023. According to Tracxn,

funding dropped by 36% to $18.2 billion, reaching its lowest levels since

before the pandemic.

“The last

twelve to eighteen months have been challenging! Big technology layoffs were

rife in 2023, there was a cost-of-living crisis, the world seemed to lurch from

one catastrophe to the next and there was a pervasive and palpable sense of

volatility and uncertainty in the air,” stated Rob Grant, the Chief Operating

Officer at Harrington Starr.

US fintech

salaries are generally higher across most roles, even accounting for currency

conversions. For example, a mid-level software engineer in the USA earns around

$120k-$150k, while the same role in the UK pays £70k-£120k.

The gender

pay gap remains a challenge in both markets, but the disparity seems more

pronounced in the UK. In 2023, the UK’s gender pay gap in financial services

reached its highest level since 2018. Demand for specialized skills, such as

machine learning, AI, and cybersecurity , commands higher salaries in both

countries.

In April, Finance Magnates examined salaries in the FX industry in Cyprus. The study showed a decrease in average pay for Executive Directors from a range of €100-150K in 2023 to €60-140K in the first months of 2024. However, Heads of Compliance saw an increase in maximum salaries, reaching up to €90 thousand this year, compared to €75K previously.

As we move

further into 2024 and beyond, it’s clear that the fintech job market will

continue to evolve. Companies will need to balance attracting top talent with

managing budgets effectively. Candidates, in turn, must showcase their unique

value proposition and remain open to new opportunities.

Despite the

challenges, the outlook for fintech salaries remains optimistic.