Tesla Vote Lifts Cloud Off Stock Even as Deeper Woes Lie Ahead

(Bloomberg) — Signs that Tesla Inc. shareholders are set to approve a $56 billion pay package for Elon Musk have given the stock a boost, but the electric vehicle-maker faces broader challenges.

Most Read from Bloomberg

Musk late on Wednesday posted early results on X, the social media site he owns, and said shareholders voted “by wide margins” in favor of the two key resolutions — re-approving his compensation package and moving Tesla’s state of incorporation to Texas. The shares gained in afternoon trading, with final results due later Thursday.

Such an outcome would remove a big risk that analysts and investors have been wary of: Musk’s threat to take his artificial-intelligence ideas elsewhere upon a rejection of his pay plan. That would have spelled disaster for a stock whose pricey valuation depends on an AI story that falls flat without its CEO.

“This removes a $20-$25 overhang on the stock,” Wedbush analyst Daniel Ives wrote in a note to clients, referring to the results touted by Musk. Ives also noted that challenges remained for Tesla — choppy demand for electric cars, and the arduous task of building a truly self-driving vehicle.

The debate on whether Tesla is a car company or a technology firm is longstanding, but a slowdown in electric vehicle demand and a surge of competitors has made this distinction even more crucial. The massive profit margins that it once brought in from EV sales are largely a thing of the past.

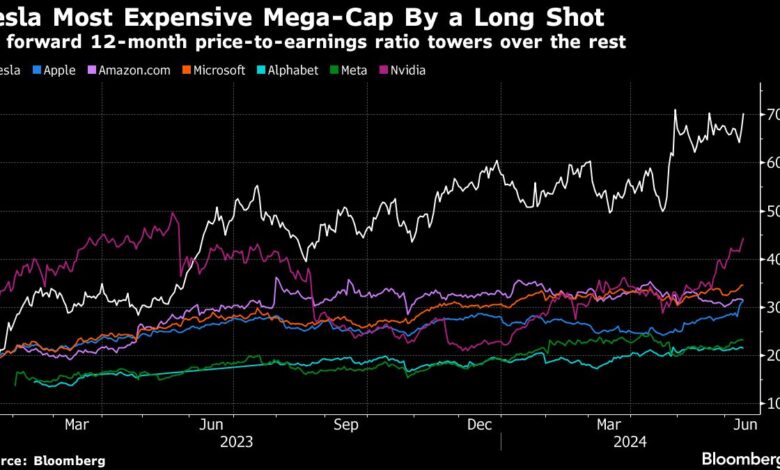

Tesla’s transformation into an AI company will hinge on its ability to develop self-driving cars, an ambitious project that many see as years or even decades away. For many investors, Musk’s focus on this goal is what gives them confidence. Any doubts about his commitment to the company tend to weigh heavily on the valuation, which at around 70 times earnings projected over the next 12 months, is by far the priciest among the tech giants.

J.P. Morgan analyst Ryan Brinkman had likened Thursday’s vote with the one for the company’s acquisition of SolarCity Corp. in 2016. “Investors we spoke with then largely did not support the Solar City acquisition, but worried there would be a more negative share price reaction in the event the transaction were voted down, given the perception of a vote of no confidence,” the analyst added.

Listen and subscribe to Elon, Inc. on Apple, Spotify, iHeart and the Bloomberg Terminal.

Tesla shares jumped as much as 7.8% on Thursday, on the Musk post that the vote is passing, but later pared some of the gains to trade up 3.9% at 1:58 p.m. in New York. The company’s shareholder meeting is scheduled to start around 4:30 p.m.

Still, some investors worry that even a yes vote likely won’t be enough to help Tesla shares sustain this latest momentum. The stock is down 29% this year through Wednesday’s close, falling behind the S&P 500 Index’s 14% advance and the Nasdaq 100’s 16% gain. Tesla now has a market value of about $565 billion, down from a peak of $1.24 trillion in 2021.

“No matter the outcome of the vote, shares, which have already been under substantial pressure, have a list as long as a Walgreens receipt that needs to be addressed,” said David Wagner, portfolio manager at Aptus Capital Advisors.

The vote comes just over two weeks before Tesla is due to report its second-quarter delivery numbers. Sales for the first three months of the year had missed by a huge margin, and estimates for the current quarter have also been coming down rapidly in recent weeks. And then there’s the lingering uncertainty about Tesla’s so-called Robotaxi that the company plans to unveil in August.

“At the end of the day, investors want to see earnings grow,” said Adam Sarhan, founder and CEO at 50 Park Investments. “Once Tesla can show investors that earnings will steadily increase, the stock will most likely come back into favor.”

Top Tech News

-

Broadcom Inc., a chip supplier for Apple Inc. and other big tech companies, rose most in four years after its latest results topped estimates, lifted by robust demand for artificial intelligence products.

-

MicroStrategy Inc. will offer $500 million in convertible notes to acquire more Bitcoin, the third sale of the securities this year by the enterprise-software maker that has made buying the cryptocurrency part of its corporate strategy.

-

Samsung Electronics Co. unveiled a number of forthcoming advancements to its technology aimed at luring makers of AI chips to its manufacturing business.

-

The National Music Publishers’ Association, a trade group that represents music publishers and songwriters, filed a complaint with the US Federal Trade Commission on Wednesday about Spotify Technology SA’s decision to provide audiobooks to subscribers, which resulted in reduced royalty payments to songwriters.

-

Paramount Global Chair Shari Redstone walked away from a deal to sell her family’s media empire to independent producer David Ellison, but she’ll have to agree to an offer from someone eventually, because keeping the status quo isn’t an option.

Earnings Due Thursday

(Updates stock move in second and eighth paragraphs.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.