3 Robotics Stocks to Turn $1000 into $1 Million: June 2024

My task today is to identify three robotics stocks to buy in June that you can turn into $1 million from a $1,000 investment.

As I write this mid-way through June, the S&P 500 is already up nearly 15% on the year, while the largest U.S.-listed robotics exchange-traded fund, the Global X Robotics & Artificial Intelligence (NASDAQ:BOTZ) with $2.75 billion in net assets, is up 43 basis points year-to-date relative to the index. Since its inception in September 2016, BOTZ has had a cumulative return of 114%.

BOTZ tracks the performance of the Indxx Global Robotics & Artificial Intelligence Thematic Index, a collection of 43 stocks that will benefit from robotics and artificial intelligence.

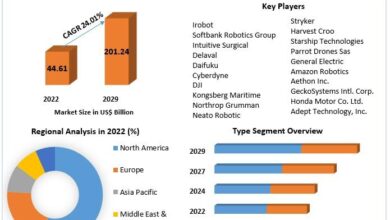

The global robotics market is expected to grow from $80 billion to $280 billion between 2022 and 2032. This gives investors a long growth runway. The ETF’s top 10 holdings represent 65% of its top 10 holdings.

I’ll want to select at least one stock from the top 10 holdings. Here are my three choices for June 2024.

Intuitive Surgical (ISRG)

Source: Sundry Photography / Shutterstock.com

Intuitive Surgical (NASDAQ:ISRG) is the third-largest holding of BOTZ with an 8.7% weighting. Its shares are up nearly 30% year-to-date.

The company launched its first da Vinci surgical system in 1999. It was cleared by the Food and Drug Administration for use in general laparoscopic surgery. According to the company’s 2023 10-K form:

“Da Vinci systems offer surgeons three-dimensional, high definition (‘3DHD’) vision, a magnified view, and robotic and computer assistance. They use specialized instrumentation, including a miniaturized surgical camera (endoscope) and wristed instruments (e.g., scissors, scalpels, and forceps) that are designed to help with precise dissection and reconstruction deep inside the body.”

Recently, the FDA found that patients who have robotic prostatectomies have overall cancer survival rates on par with open surgery. Robotic prostatectomies can cause shorter hospital stays and less blood loss than traditional non-robotic radical prostatectomies.

In the first quarter, worldwide procedures using da Vinci robotic systems increased by 16% from a year ago. It placed 313 da Vinci surgical systems in the quarter, about the same as last year. Its adjusted net income grew 23.8% to $541 million on $1.89 billion in revenue.

It remains the gold standard in surgical robotics.

ABB (ABBNY)

Source: Daniel J. Macy / Shutterstock.com

ABB (OTCMKTS:ABBNY) is the second-largest holding of BOTZ with a 9.6% weighting. Its shares are up nearly 33% year-to-date. Its 10-year annualized total return is 25.7%.

The Swiss-based company provides many end markets with electrification, motion, and automation solutions and products. It generates more than $32 billion in annual revenue, and its Robotics and Discrete Automation business accounts for 11% of it. Its operational EBITA (earnings before interest, taxes, and amortization) accounts for 9% of the $5.43 billion profit in 2023.

The segment’s two largest end markets are machine automation (34% of revenue) and automotive (33%). Europe accounts for 53% of the segment’s revenues, followed by China (22%), and the U.S. (10%).

Of the division’s $3.6 billion in revenue, robotics accounts for approximately 69%, while machine automation accounts for 31%.

Two highlights of ABB’s first quarter was the $551 million in free cash flow generated, 240% higher than a year earlier. The company’s operational EBITDA in the first quarter was 17.9%, 160 basis points higher than a year earlier.

Over the past five years, its stock has appreciated by 185%, more than double the index. Yielding 1.7%, it’s an excellent long-term buy.

Rockwell Automation (ROK)

Source: JHVEPhoto / Shutterstock

Rockwell Automation (NYSE:ROK) isn’t a holding of BOTZ. However, it provides industrial automation for industries such as auto manufacturing, food and beverage production, etc. Its shares are down over 14% this year.

Last October, it paid $565 million for Clearpath Robotics, a Canadian company specializing in industrial AMRs (autonomous mobile robots). The market for AMRs is expected to grow to $6.2 billion by 2027.

In May, Rockwell lowered its organic sales for fiscal 2024 (September year-end). It now expects them to fall by 7% at the midpoint of its guidance, down from a 1% gain previously. On the bottom line, it cut its earnings per share by 18% to $10.50. At its current share price, it trades at 25x the estimate, below its five-year average of 27x.

“Despite the lower FY24 outlook, we are gaining share across many of our most important product lines and in North America, our largest market,” said Blake Moret, chairman and CEO.

In North America, its organic sales fell just 3% compared to double-digit declines elsewhere. Once its industrial customers get their inventories in better shape, the market share gains will show up in future quarterly reports.

Buying ahead would be a timely call.

On the date of publication, Will Ashworth did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.