the Story of Changan Automobile (Part 1)-盖世汽车资讯

核心提示:Hello, everyone! Welcome to Gasgoo. In this episode of “Wheels of Change: Stories of Chinese Auto Giants,” let’s delve into the transformation journey of Changan Automobile.

Hello, everyone! Welcome to Gasgoo. In this episode of “Wheels of Change: Stories of Chinese Auto Giants,” let’s delve into the transformation journey of Changan Automobile.

It’s well known that Changan is one of China’s three major state-owned automobile enterprises, with its roots stretching back to the Shanghai Bureau of Marine Artillery established in 1862. With a history spanning over 160 years, it has undergone three major entrepreneurial transformations.

Photo credit: Changan

In 1984, Changan ventured into the automotive market by partnering with Suzuki to produce its first batch of mini cars. In 1999, Changan launched models like the Changan Star, quickly becoming a leader in the mini car sector, and capturing nearly 40% of the market share in China at its peak.

Photo credit: Changan

In 2006, Changan embarked on its second entrepreneurial venture, focusing on independent innovation and launching a strategy for developing self-owned passenger car brands. In September of the same year, the company rolled off its first in-house developed car model BenBen. Thanks to the popularity of its key models, like the Eado series and CS35, Changan clinched the title of top-selling domestic brand in China in 2015 and 2016.

Photo credit: Changan

In 2017, Changan started its third entrepreneurial endeavor, boldly stepping into the electrification and intelligence fields. Since then, the company has maintained steady overall development.

From 2018 to 2023, sales of Changan’s self-owned brands surged from 1.5 million to 2.09 million units. The new energy vehicles under its wholly-owned brands recorded sales of over 470,000 units in 2023, reaching a historic peak. Additionally, its presence in overseas markets began to take shape, with sales exceeding 200,000 units.

In just five years, Changan experienced a profound transformation. Looking back on its growth journey since the third entrepreneurial endeavor, the keys to Changan’s success have been its clear strategy, precise positioning, and strong focus on technological innovation.

Breaking free from joint venture dependency

Like other state-owned OEMs, Changan relied heavily on joint ventures to thrive in its early days.

Changan Ford was established in 2001; photo credit: Changan

Changan once had four major joint ventures — Changan Ford, Changan Mazda, Changan PSA (Peugeot Citroën), and Changan Suzuki. Except for Changan PSA, the other three JVs were major contributors to Changan Automobile’s sales and profits. Changan Ford, in particular, reached its peak with annual sales close to one million vehicles and a net profit of up to 18 billion RMB.

However, in 2017, Changan’s joint venture business started to take a downturn. Firstly, Changan Suzuki exited the Chinese market due to poor sales performance and intense competition in the small-sized car market. Then, Changan PSA struggled amid fierce competition in the luxury car segment. Following this, both Changan Ford and Changan Mazda also found themselves in a tough spot due to the lack of competitive products.

As key models like the Focus and Mondeo declined without timely replacement, along with recurring quality issues, Changan Ford’s sales took a steep dive since 2017 onwards, turning profits into losses. Today, Changan Ford’s annual sales have shrunk to around 200,000 units.

Photo credit: Changan Ford

In the field of electrification, Changan Ford will fully rely on the technical output of its Chinese parent. In August 2023, Changan Ford and Changan Automobile agreed to establish a new joint venture, with Changan holding a 70% equity stake. At the end of last year, Ford Motor announced it would exit from the competition in the Chinese electric vehicle market to focus on producing commercial vehicles instead.

Photo credit: Changan Mazda

On the other side, due to slow product updates and the impact of the new energy vehicle market, Changan Mazda’s sales have been declining since 2017. In 2022, its investment income from Changan was merely 45 million RMB.

While engaging in joint ventures, Changan has been actively developing its self-owned brands. Around 2018, although passenger vehicle sales under Changan’s wholly-owned brands was close to one million units, it faced relatively low profits per vehicle as it mainly targeted market below the 100,000 RMB. Amid the decline of joint venture businesses, Changan’s net profit for that year dropped to 681 million RMB, a plunge of 90.46% from 2017.

Independent and resilient

Facing challenges, Changan swiftly revised its market strategy.

For its joint venture operations, Changan made bold moves by selling off its stake in Changan PSA in 2019 and shutting down Changan Ford’s outdated production facility in 2022.

On the front of its wholly-owned brands, Changan went all in.

After over a decade of development, Changan rolled out several own-branded gasoline car product lines, including the CS series, Eado series, Oshan series, and UNI series. In 2019, with the introduction of the Blue Core powertrain, Changan’s products saw a big improvement in performance with a lower fuel consumption.

Especially after 2019, the CS75 and the Eado were upgraded to PLUS versions, hitting the market with exceptional performance. The former even outperformed the best-selling model Haval H6 to become the top seller in the compact SUV segment for a time, with monthly sales exceeding 20,000 units. The latter maintained annual sales of over 150,000 units.

UNI series; photo credit: Changan

With the launch of the UNI series in 2020, Changan solidified its position in the 100,000 RMB to 150,000 RMB gasoline car market.

Driven by the high-margin gasoline vehicles like the CS and UNI series, by 2023, Changan’s wholly-owned brands accounted for around 80% of the group’s total sales, contributing over 80% to the group’s profits.

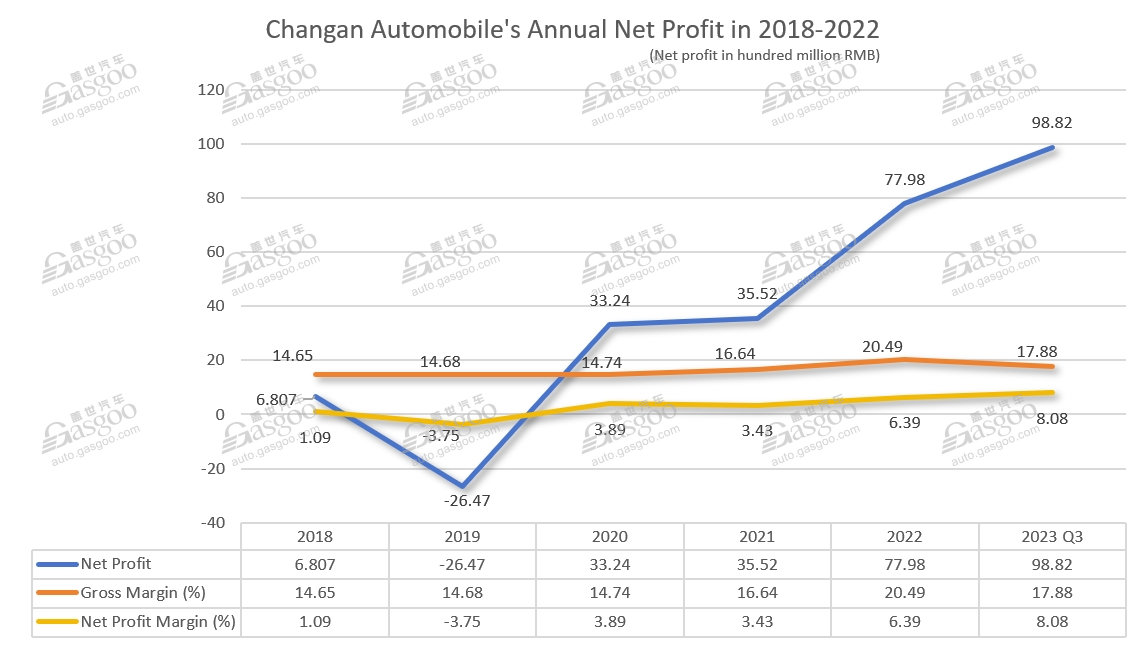

Thanks to the stable user base in the gasoline car market and the continuous growth in new energy vehicle sales, Changan’s annual net profit has been steadily increasing, expected to surpass the 10 billion-RMB mark in 2023. Currently, Changan has over 70 billion RMB in cash reserves.

Developing new energy vehicles with “independent cultivation + cooperation” model

Since announcing its third entrepreneurship in 2017, Changanhas launched the Shangri-La and the Dubhe plans to drive the company’s transformation and upgrade towards new energy vehicles and intelligence.

Photo credit: Changan

Changan aimed for a total sales volume of 4 million vehicles by 2020, including 2.46 million units under its wholly-owned brands and 350,000 new energy vehicles. However, Changan’s actual annual sales in 2020 were only 2 million units, just half of the initial target.

Therefore, in 2022, Changan adjusted its strategic goals for 2025 and 2030.

By 2025, the annual sales target is set at 4 million units, including 3 million units from its self-owned brands and 1.05 million new energy vehicles (35% of the total). By 2030, the goal is to reach 5.5 million units, with wholly-owned brands’ sales at 4.5 million units and new energy vehicle sales at 2.7 million units (60% of total), and 30% of the total sales should be achieved overseas.

Charging ahead into electrification

Guided by new strategic goals, Changan has adopted a multi-brand strategy. Now, it has established five major brands: UNI, NEVO, DEEPAL, AVATR, and Kaicene (for commercial vehicles).

Last August, Changan launched the NEVO brand, targeting mainstream family users. Built upon Changan’s in-house developed SDA intelligent platform, NEVO plans to roll out three product lines: the A series, Q series, and E0 series.

A07; photo credit: NEVO

Just last year, NEVO released three new models, namely, the A05, A07, and Q05, focusing on the PHEV and REEV markets priced between 80,000 to 200,000 RMB. By the end of February 2024, NEVO’s cumulative sales exceeded 55,000 units, with the A07 being the mainstay, selling around 3,000 units per month.

After BYD kicked off a price war in China’s new energy vehicle market with its lower-priced Honor Edition models this year, NEVO swiftly joined the fray, with the A05 dropping to 78,900 yuan, taking on BYD’s Qin PLUS.

This year, NEVO’s product lineup has further enriched. In March, the brand added a new version (named “Zhenxiang”) to the A07’s lineup, and it got two new models in the pipelines: the E07 (code named CD701) and the C798.

Notably, the E07 is the brand’s first battery electric vehicle model.

Gasgoo Auto Research Institute predicts that Changan NEVO will hit 105,000 units in retail sales in 2024. It plans to launch 10 globally-oriented models by 2025 and aims for 1.5-million-unit sales by 2030.

Photo credit: DEEPAL

Another brand DEEPAL, launched in April 2022, is positioned as a young and tech-driven digital new energy vehicle brand (including BEV and REEV models), targeting the price range of 150,000 to 200,000 RMB. With its high cost-effectiveness, DEEPAL’s two models, the SL03 and S7, recorded a combined sales volume of 137,000 units in 2023.

Starting this year, DEEPAL will also aim for the market priced above 300,000 RMB. Its new model, the DEEPAL G318, which debuted in March, is priced over 300,000 RMB, set to enter the off-road vehicle market. Analysts from Gasgoo Auto Research Institute note that with its rugged off-roader design, stand-out features such as a turning radius small enough to make U-turn in place, and coupled with the brand’s Super Range-Extending technology, the G318 has excellent power performance and energy efficiency, catering to consumers’ pursuit of uniqueness and off-road capability.

In Changan’s 2030 strategy, DEEPAL is tasked with selling 1 to 1.2 million vehicles, with this year’s goal at 450,000 vehicles. It’s not an easy job. Gasgoo Auto Research Institute predicts a tough road ahead, with retail sales expected to be around 243,000 units.

Photo credit: Changan

The UNI brand got a refresh earlier this year. Changan confirmed that the CS series and the Oshan brand would be incorporated into the UNI brand.

This brand will focus on the PHEV market based on the Changan Blue Core iDD hybrid technology. Changan projects that by 2030, UNI brand’s annual sales will be around 1.3 million to 1.5 million units.

The abovementioned three brands, grown in-house by Changan, mainly target the market below 200,000 RMB. For the high-end market above 300,000 RMB, to reduce risks while quickly capturing market share, Changan has chosen to cooperate with third parties, resulting in the AVATR brand.

Photo credit: AVATR

Formerly known as Changan NIO, AVATR was renamed in 2021, jointly created by Changan, Huawei, and CATL. In November of the same year, AVATR launched its first model, the AVATR 11. After some market cultivation, its combination of luxury quality, and Huawei-powered intelligence has been recognized. With the launch of the AVATR 12, the brand’s overall sales in January 2024 have risen to over 7,000 units, setting a record for monthly sales.

Changan has placed great expectation on AVATR, planning to launch four models by 2025 and aiming for sales between 400,000 and 500,000 units by 2030. The Gasgoo Auto Research Institute predicts a rapid climb for AVATR, with retail sales expected to reach 86,000 units, tripling from last year’s figures.

Thanks to its strong brand matrix, Changan’s new energy vehicle sales reached 480,000 units last year, surging 69% from a year ago. This year, its target for new energy vehicle sales is 750,000 units, up 56% year-on-year. Changan expects that its annual sales of new energy vehicles will continue to grow at a rate of around 50% over the next few years.