1 Magnificent EV Stock Down 50% to Buy and Hold Forever

Despite recent challenges, Tesla’s strategic direction positions it as a must-have long-term investment with immense potential.

It’s been a tough go for investors in Tesla (TSLA -2.44%) over the last couple of years. Since the stock hit an all-time high of $407 in 2021, it’s been a grueling road down.

Yet despite this descent, there are several reasons Tesla remains not only the best electric vehicle (EV) stock for investors today but also the best company to gain exposure to the future of technological innovation. Here’s why — even though the stock is down more than 50% from its all-time highs — it’s worth buying and holding forever.

The EV catalysts worth noting

Since EVs constitute the majority of Tesla’s business, it’s essential to examine the company’s prospects from the perspective of the current state of the automobile market. Unfortunately, this is why it has been struggling so much. With high interest rates dampening demand, several EV manufacturers — not just Tesla — have taken a hit. This culminated in the company experiencing its first year-over-year decline in deliveries since 2020.

Making matters worse are slipping profit margins and a series of layoffs earlier this year. Its stock has regained some losses, but just a few months ago, Tesla was down more than 65% from its highs.

However, the tide might be starting to turn. Central banks in Canada, Sweden, Switzerland, and the European Union have recently cut interest rates for the first time since 2021, and the hope is that the U.S. will be next. As borrowing becomes more affordable, consumer investment in new vehicles is likely to increase, potentially giving Tesla’s sales a substantial boost.

While interest rate cuts would bode well for Tesla in the short term, the long term is what really matters. Fortunately, it is still well-positioned to benefit from the overarching trend of growing EV adoption. Analysts predict that by 2030, two out of every three cars sold globally will be EVs. As the world’s largest EV manufacturer, Tesla stands to gain tremendously from this movement as it expands its global footprint.

With its dominance in the U.S and a solid grasp on the European market, the company is currently building a new factory in Mexico and is in the beginning stages of entering India. That country presents an enormous opportunity as analysts expect India’s EV market to reach up to 10 million units annually by 2030, or roughly eight times larger than the U.S. EV market today.

By leveraging its extensive experience, leading production levels, and optimized supply chain, Tesla is uniquely poised to succeed in these emerging markets ripe for EV adoption.

Image source: Getty Images.

Going beyond EVs

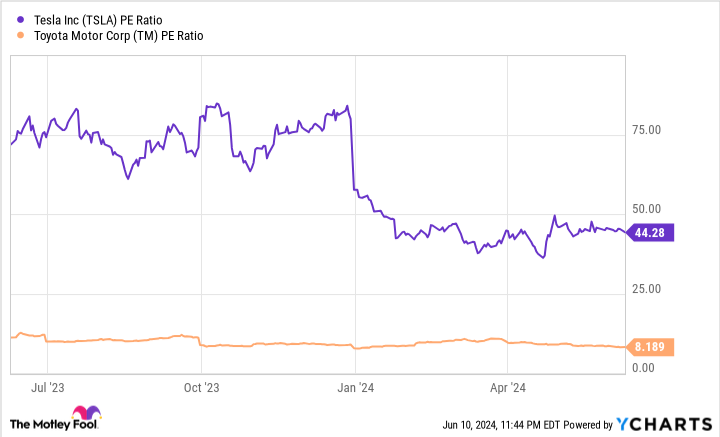

EVs will remain a core component of Tesla’s future, but it’s important to address one issue. The stock trades at a valuation more than five times that of the next most-valuable automaker, Toyota.

This makes investing in Tesla purely for its EV potential difficult to justify. The reason for such a high valuation relative to the rest of the EV industry lies in the company’s ambitions beyond electric vehicles.

TSLA PE ratio data by YCharts; PE = price to earnings.

In the future, Tesla aims to build out its business around artificial intelligence (AI), self-driving vehicles, and humanoid robots. If all goes according to plan, CEO Elon Musk believes his company will become the most valuable in the world.

These ambitious endeavors might seem like wishful thinking, but there is mounting evidence that Tesla is on track to realize its AI-powered future. Enabling these technologies is Tesla’s supercomputer, Dojo.

The more powerful Dojo becomes, the closer Tesla gets to achieving full autonomy for its vehicles and creating more-advanced robots. Best of all, Dojo is becoming more capable, with a near-doubling in computational power since the beginning of 2023.

If Tesla can keep up the pace, the successful realization of its goals carries not only the potential to transform society but also to take its financial performance to the next level.

Quantifying this potential is challenging due to the nascent nature of the technology and the absence of existing markets for autonomous vehicles and humanoid robots. However, the opportunities are expected to be monumental.

There are some projections that highlight this potential. For instance, ARK Invest’s analysis on the impact of autonomous driving and the launch of a robotaxi business — a venture Musk believes to hold “quasi-infinite demand” — is revealing. According to ARK’s Monte Carlo simulation, robotaxis could generate $400 billion in revenue, roughly eight times greater than current levels.

Humanoid robots are an opportunity that Musk believes will be greater than EVs, and he thinks they could begin shipping by the end of 2025. Add that in with robotaxis, and the case for Tesla to keep growing for years to come and become more than an EV company looks all the more likely.

A necessary disclaimer

As is common when discussing speculative topics of this nature, some with differing opinions might believe these endeavors will never come to fruition. While a valid concern, we must remember how far Tesla has come.

What started as an unprofitable start-up bleeding cash has evolved into a successful automaker. If Tesla can replicate its EV success in its AI ventures, the realization of its goals becomes more a matter of when rather than if.

Few companies today offer such comprehensive exposure to the technologies of tomorrow for investors with a long-term perspective and a tolerance for risk. The EV market might not see explosive growth in the short to midterm, but it is still on an upward trajectory. When combined with the impact of Tesla’s AI advancements, the case for buying its shares and holding them forever becomes all the more compelling.