Swiss Sustainable Fintech Map Reveals Booming Sector – Fintech Schweiz Digital Finance News

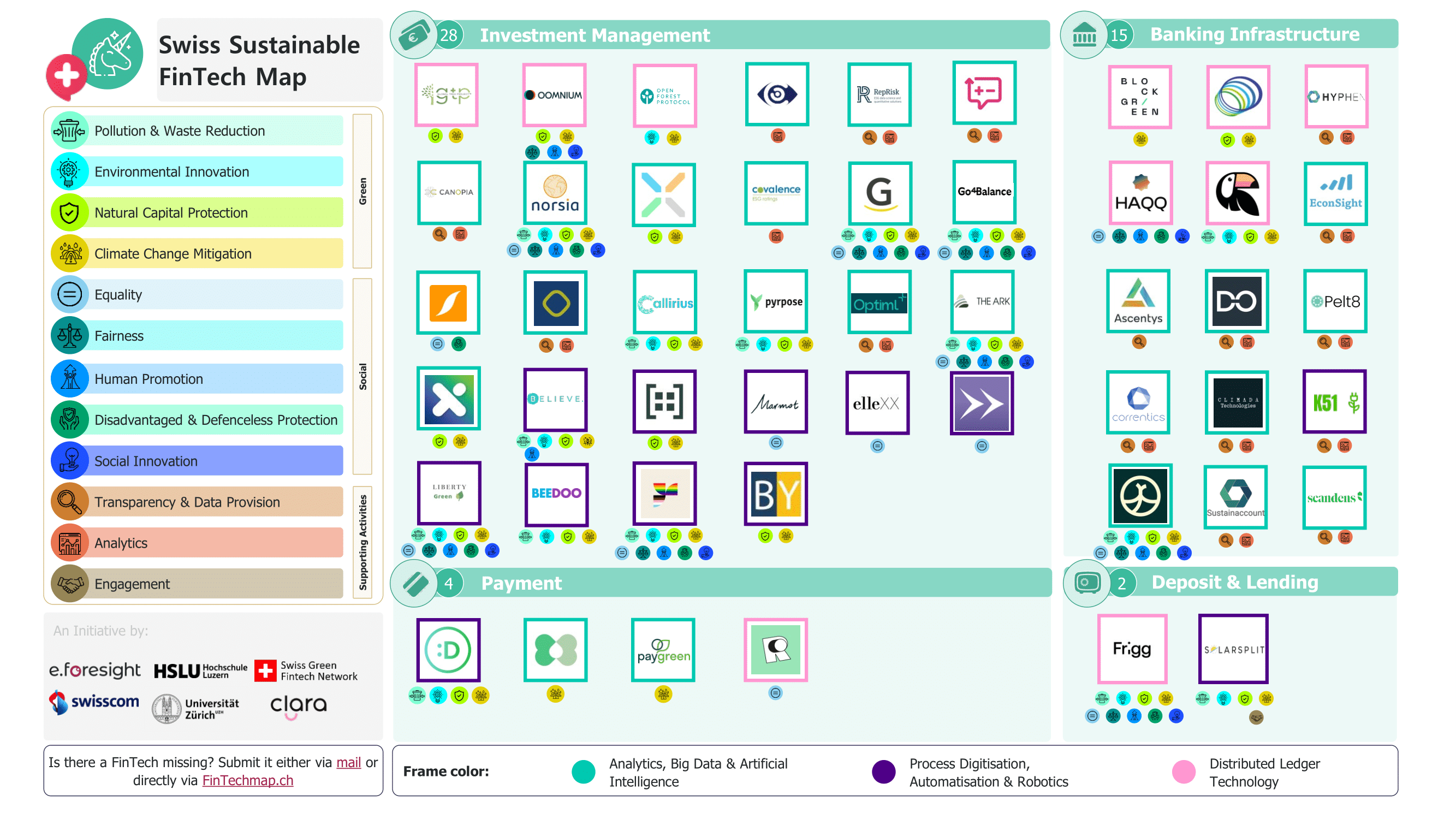

E.foresight, a Swiss banking think tank operated by telecommunications provider Swisscom, has released its Swiss Sustainable Fintech Map, highlighting the fintech companies in Switzerland that incorporate sustainability into their core business models, operations, and products.

The map shows that Switzerland is currently home to 49 companies that fall under the sustainable fintech category, providing the segment a share of 12% of the overall fintech ecosystem. Investment management is the most developed sustainable fintech vertical in Switzerland, with 28 companies. It’s followed by banking infrastructure with 15 companies, payments with four, and deposit and lending with two.

The figure implies that the Swiss sustainable fintech sector rose by 53% between 2023 and 2024, growing at a much faster pace than the fintech sector as a whole (16%) during the period, data from the 2024 IFZ Fintech Study by the Lucerne University of Applied Sciences and Arts’ Institute of Financial Services Zug (IFZ) show.

An analysis of the founding years of the sustainable fintech companies based in Switzerland reveals that around half of all sustainable fintech companies were founded in the last three years, which indicates a certain momentum in this area.

From a regional perspective, the report shows that the largest cluster of sustainable fintech companies can be found in the canton of Zurich (22 companies), followed by Geneva and Zug (8 each), Basel-City and Schwyz (three each), Vaud (two), and Jura, Neuchâtel, and Thurgau (one each).

Sustainable finance on the rise

Sustainable fintech companies leverage technology to promote environmental, social and governance (ESG) criteria while providing financial services. These companies are rising in prominence for their positive contribution to sustainable developments goals such as reducing carbon footprints, promoting financial inclusion, and encouraging ethical investments.

Open Forest Protocol, for example, is developing a scalable open platform that allows forest projects of any size, from around the world to measure, report and verify their forestation data. The company, which raised US$4.1 million in January 2023, uses blockchain technology to verify and record forest data publicly, so anyone can see what is happening with the forests registered.

Frigg.eco is a Zurich-based company that provides business-to-business (B2B) software for the financing of renewable energy projects through tokenized green loans. The platform utilizes AI and distributed ledger technology (DLT) to streamline the creation of tokenized green bonds backed by sustainable infrastructure projects and improve transparency.

And Pelt8 offers a comprehensive solution for auditable data collection, climate key performance indicators (KPIs) calculation and reporting, helping companies move away from excel spreadsheets to save time and improve efficiencies. The company was named “Early Stage Start-up of the Year” at the 2023 Swiss Fintech Awards.

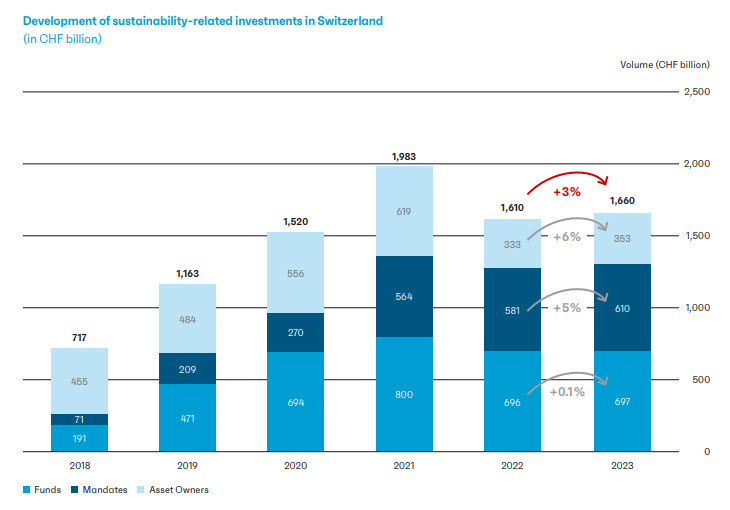

Sustainability in banking and finance has gained increasing attention in recent years, a trend that is evident among investors and with investment activities. Analyses by IFZ show that around half of people in Switzerland have a some preferences for sustainability in financial investments. Moreover, a 2024 report by the Swiss Sustainable Finance organization reveals that sustainability-related investments have been on the uptick over the past years, rising from a volume of CHF 717 million in 2018 to about CHF 1.7 billion in 2023.

The topic is also highly relevant at a regulatory level. On January 01, 2023, the new self-regulation of the Swiss Bankers Association came into force, obliging banks to survey the sustainability preferences of their customers and provide customers with investment products that are in line with these preferences.

Switzerland’s green fintech ambitions

Switzerland is recognized as the fourth market globally for sustainable fintech. This thriving space has risen on the back of supportive initiatives and promotion efforts by the government.

Key initiatives include the establishment of the Green Fintech Network, set up in November 2020, and the subsequent release of the Green Fintech Action Plan in April 2021. The Green Fintech Network is an informal group of experts representing companies and organizations such as the Zurich University of Applied Sciences, F10 Fintech Incubator and Accelerator, PwC and Swisscom, but also green fintech startups like MSCI Carbon Delta, Rep Risk and Yova. The group was initiated by the State Secretariat for International Finance SIF and is part of Switzerland’s broader ambition to become a global leader in green digital finance.

In 2022, the Federal Council launched a new system that measures the environmental impact of financial investments. The Swiss Climate Scores are designed to provide both institutional and private investors in Switzerland with clear, comparable information on how well their financial investments align with international climate goals.

Currently, the Swiss government is working on a new legislation to regulate greenwashing in the financial sector. The Federal Department of Finance said a draft bill should be available for consultation by August 2024.

Featured image credit: edited from freepik