Fiscal Policy Can Help Broaden The Gains Of AI To Humanity – Analysis – Eurasia Review

New generative-AI technologies hold immense potential for boosting productivity and improving the delivery of public services, but the sheer speed and scale of the transformation also raise concerns about job losses and greater inequality. Given uncertainty over the future of AI, governments should take an agile approach that prepares them for highly disruptive scenarios.

A new IMF paper argues that fiscal policy has a major role to play in supporting a more equal distribution of gains and opportunities from generative-AI. But this will require significant upgrades to social-protection and tax systems around the world.

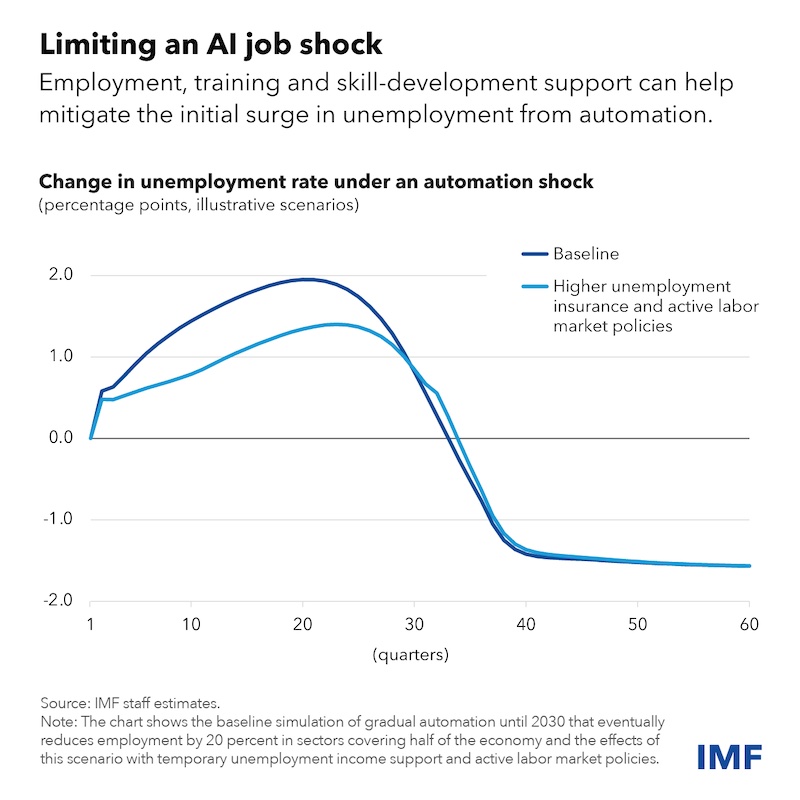

How should social-protection policies be revamped in the face of disruptive technological changes from AI? While AI could eventually boost overall employment and wages, it could put large swaths of the labor force out of work for extended periods, making for a painful transition.

Lessons from past automation waves and the IMF’s modeling suggest more generous unemployment insurance could cushion the negative impact of AI on workers, allowing displaced workers to find jobs that better match their skills. Most countries have considerable scope to broaden the coverage and generosity of unemployment insurance, improve portability of entitlements, and consider forms of wage insurance.

At the same time, sector-based training, apprenticeships, and upskilling and reskilling programs could play a greater role in preparing workers for the jobs of the AI age. Comprehensive social-assistance programs will be needed for workers facing long-term unemployment or reduced local labor demand due to automation or industry closures.

To be sure, there will be important differences in how AI impacts emerging-market and developing economies—and thus, how policymakers there should respond. While workers in such countries are less exposed to AI, they are also less protected by formal social-protection programs such as unemployment insurance because of larger informal sectors in their economies. Innovative approaches leveraging digital technologies can facilitate expanded coverage of social-assistance programs in these countries.

Should AI be taxed to mitigate labor-market disruptions and pay for its effects on workers? In the face of similar concerns, some have recommended a robot tax to discourage firms from displacing workers with robots.

Yet, a tax on AI is not advisable. Your AI chatbot or co-pilot wouldn’t be able to pay such a tax—only people can do that. A specific tax on AI might instead reduce the speed of investment and innovation, stifling productivity gains. It would also be hard to put into practice and, if ill-targeted, do more harm than good.

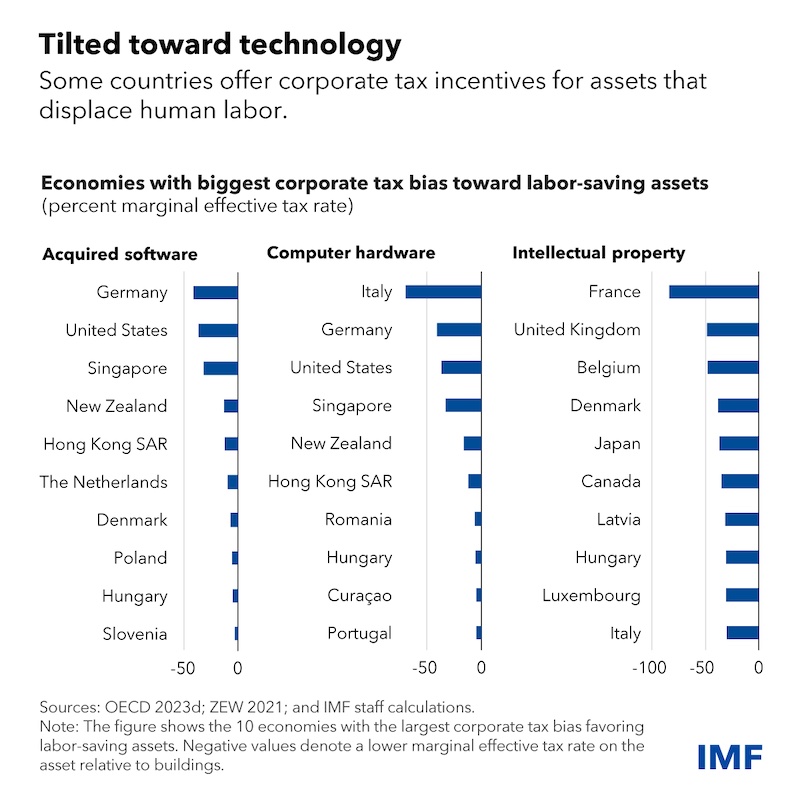

So, what can be done to rebalance tax policy in the age of AI? In recent decades, some advanced countries have scaled up corporate tax breaks on software and computer hardware in an effort to drive innovation. However, these incentives also tend to encourage companies to replace workers through automation. Corporate tax systems that inefficiently favor the rapid displacement of human jobs should be reconsidered, given the risk that they could magnify the dislocations from AI.

Many emerging market and developing countries tend to have corporate tax systems that discourage automation. That can be distortive in its own way, preventing the investments that would enable such countries to catch up in the new global AI economy.

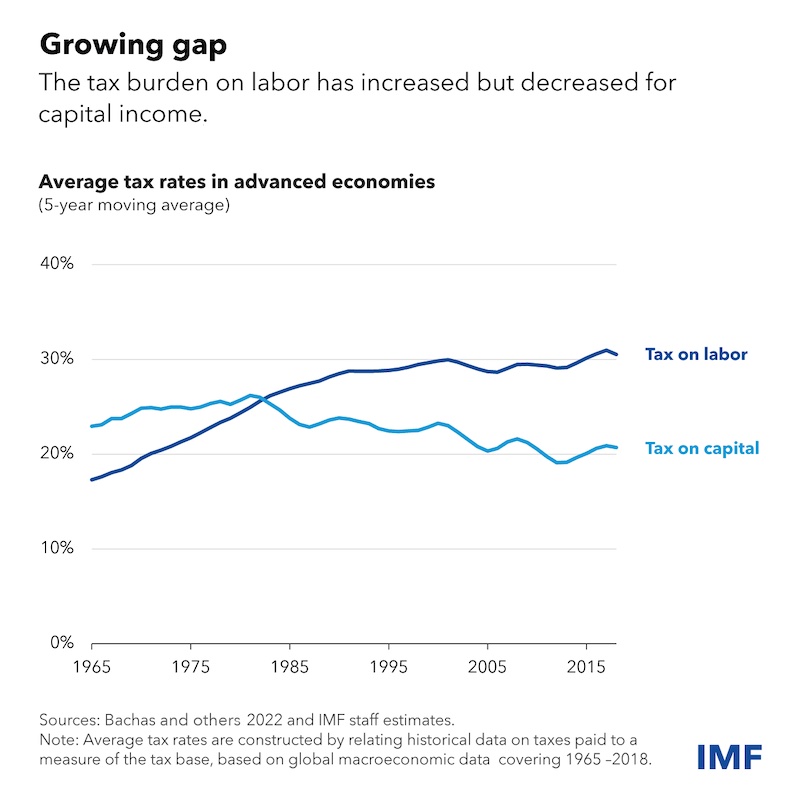

How should governments design redistributive taxation to offset rising inequality from AI? Generative-AI, like other types of innovation, can lead to higher income inequality and concentration of wealth. Taxes on capital income should thus be strengthened to protect the tax base against a further decline in labor’s share of income and to offset rising wealth inequality. This is crucial, as more investment in education and social spending to broaden the gains from AI will require more public revenue.

Since the 1980s, the tax burden on capital income has steadily declined in advanced economies while the burden on labor income has climbed.

To reverse this trend, strengthening corporate income taxes could help. The global minimum tax agreed by over 140 countries, which establishes a minimum 15-percent effective tax rate on multinational companies, is a step in the right direction. Other measures could include a supplemental tax on excess profits, stronger taxes on capital gains, and improved enforcement.

The latest AI breakthroughs represent the fruit of years of investment in fundamental research, including through publicly funded programs. Similarly, decisions made now by policymakers will shape the evolution of AI for decades to come. The priority should be to ensure that applications broadly benefit society, leveraging AI to improve outcomes in areas such as education, health and government services. And given the global reach of this powerful new technology, it will be more important than ever for countries to work together.

—Fernanda Brollo, Daniel Garcia-Macia, Tibor Hanappi, Li Liu, and Anh Dinh Minh Nguyen contributed to the staff discussion note on which this article is based.

About the authors:

- Era Dabla-Norris is a Deputy Director in the IMF’s Fiscal Affairs Department, where she leads the work on the IMF flagship report, the Fiscal Monitor. Previously she was in the Asia Pacific Department as mission chief for Vietnam, where she also led the work on fiscal, climate, and gender issues in the region.

- Ruud De Mooij is a Deputy Director in the IMF’s Fiscal Affairs Department, where he previously headed the Tax Policy Division. He has extensive experience in providing capacity development on tax policy issues in over 25 countries.

Source: This article was published at IMF Blog