China’s position in the global race for alternative EV batteries

At the Beijing Auto Show in April, CATL, the world’s largest electric vehicle (EV) battery maker, stunned many with a new product.

The Shenxing Plus battery can power an EV for more than 1,000 kilometres on a single charge, according to CATL. That’s enough to get from Guangzhou to Wuhan, or London to Berlin.

“[The battery] can reach a range of 600 kilometres with a 10-minute charge, equalling one kilometre every second,” Gao Huan, chief technology officer of CATL’s electric car business, proudly announced at the launch ceremony.

Chinese firms have been unveiling new lithium-ion cells with longer ranges, shorter charging times and more charging cycles in their lifespans, at a frequency unseen anywhere else in the world.

But with the global demand for EV batteries projected to jump up to tenfold by 2030, companies worldwide have been racing to develop next-generation technologies to seize future market shares.

The innovation rush is driven by various motivations, mainly to cut cost and avoid supply chain bottlenecks. But it could also benefit the environment and climate by reducing carbon emissions during the mining and production of certain minerals, according to a report by consulting firm McKinsey.

“Whoever wins the battery war will win it all,” Chinese economist Ren Zeping said in 2022. Ren noted that the technologies and performance of batteries is the “core” of taking the EV sector forward.

LFP vs NMC

Currently, commercial EVs use one of two main types of lithium battery – those that contain iron and phosphate, known as LFPs, and those that contain nickel, manganese and cobalt, known as NMCs.

The primary distinction between them is that NMCs usually have a greater energy density while LFPs are safer, Liu Chenguang, an assistant professor at Xi’an Jiaotong-Liverpool University specialising in battery materials, tells Dialogue Earth.

Energy density typically measures how much energy a battery contains in proportion to its weight, and is a key performance metric.

The two types have an equal footing in the EV market globally, but in China, LFPs have become far more popular over the past few years because they are safer, according to Mao Shiyue, a researcher at the International Council on Clean Transportation (ICCT) think-tank. They are also cheaper than NMCs given the high cost of cobalt and nickel, Mao tells Dialogue Earth.

“[LFPs] can be charged and discharged for more times, and they have a longer lifespan, too,” he adds.

LFPs are also more environmentally friendly than NMCs because cobalt and nickel are heavy metals that can be harmful to humans and the environment, particularly the aquatic environment.

Mining operations can damage nature and local communities by eroding soil, disrupting habitats and diminishing biodiversity. EV and battery manufacturers have been put under increasing scrutiny due to such adverse impacts, particularly as countries like Indonesia – the world’s largest nickel producer – have lowered labour and environmental standards to boost their mining industry.

Ingredients for the batteries of EVs – as well as for their bodies – are among the minerals with “the strongest links to deforestation”, according to a new report published by environmental NGOs Aidenvironment and Rainforest Foundation Norway. This makes the automotive industry the second most important driver of mining-related deforestation globally after construction, the report said.

A worker at a nickel mine operated by PT Vale Indonesia, South Sulawesi province. Indonesia is the world’s largest producer of nickel and a hotspot for mining-related deforestation (Image: Hariandi Hafid/Alamy)

CATL’s Shenxing Plus is an LFP battery. So is BYD’s signature Blade Battery, which powers all the brand’s EVs.

Searching for new options

Lithium technologies are expected to advance quickly over the next few years. However, companies in China and beyond are frantically pursuing alternative batteries not centred around lithium, in part because the minerals needed to make the current options come from just a few countries.

These elements are often described as “critical raw materials” or “transitional minerals”, and they mostly include lithium, cobalt, nickel, manganese and graphite. Their concentrated supply chains can lead to problems such as dramatic price swings.

Lithium: The largest lithium reserves found so far are in Latin America (mainly Chile, and some in Argentina) and Australia. But Australia dominated the production side, putting out 52% of the global supply in 2021, followed by Chile and China at 25% and 13%, respectively. In 2022, China held around three-quarters of the world’s lithium-refining capacity.

Cobalt: Around three-quarters of the world’s cobalt was produced by the Democratic Republic of the Congo (DRC) in 2021, with Australia being a distant second with 3%. Cobalt’s reserves are relatively more spread out, with the DRC holding 48%, Australia owning 18% and Indonesia having 7%. China refined 67% of the world’s cobalt in 2020, followed by Finland and Japan, which accounted for 10% and 5%, respectively.

Nickel: Indonesia was the largest producer of nickel globally in 2023, with its reported share varying from 40.2% to 55% of the worldwide total. Australia ties with Indonesia as the most nickel-rich nations at 19.6% of the global reserves, followed by Brazil (14.9%) and Russia (7%). Around 70% of the world’s nickel is refined in China.

Manganese: South Africa tops the chart for manganese reserves, boasting 32.1% of the global total. Ukraine and Brazil both have 17.3%, ranking joint second, followed by Australia, with 12.4%. The production landscape is more diverse. The mineral, which is also used in making steel and aluminium, is mined in more than 30 countries, with South Africa, Australia and Brazil being among the major producers. China processes around 90% of the battery-grade manganese sulphate used in EV batteries.

Graphite: Turkey, Brazil and China have the largest natural graphite reserves, accounting for 27.3%, 22.4% and 15.8% of the global total respectively. China dominates global production of natural graphite at 65%, followed distantly by Madagascar, Mozambique and Brazil. China also makes up more than 75% of the global production of synthetic graphite and more than 90% of the battery-grade graphite used to make anodes.

Cost control sits high among Chinese firms’ reasons to seek alternatives. A battery typically carries 40% of the price tag of an EV, and the ability to minimise production cost is critical for firms to survive the nation’s brutal EV price wars.

Between June 2020 and November 2022, the prices for lithium carbonate, a key ingredient for lithium-ion batteries, soared nearly 14 fold, Phate Zhang, founder of Shanghai-based industry outlet CnEVPost, tells Dialogue Earth.

“That was when Chinese car and battery makers started to seriously look for alternative battery technologies that are not only cheap, but also suitable for mass production,” he says. “Sodium-ion batteries are one of them.”

These batteries use sodium, a highly abundant element that can be extracted from sea salt.

CATL debuted its first-generation sodium-ion battery in 2021 amid those rapid price hikes. “After that, quite a few Chinese companies also announced their plans to develop sodium-ion batteries,” Zhang says.

For western companies, however, it is their less developed supply chains for battery materials – such as mining and refining – that forces them to think outside the box.

By avoiding the use of so-called critical raw materials, companies can reduce “geological and geopolitical constraints”, Maximilian Fichtner, an expert in energy-storage materials, tells Dialogue Earth.

Fichtner is executive director at the Helmholtz Institute Ulm, a battery research centre in Germany, and a professor in solid-state chemistry at the universities of Ulm in Germany and Swansea in the UK.

He stresses the importance of switching “from less abundant and maybe toxic materials, coming sometimes from politically unsecure regions, to materials which can be obtained everywhere on Earth”.

Regulations, such as the European Union’s Batteries Regulation, are also pushing companies – Chinese or not – to reduce their cells’ carbon footprint and pursue sustainable production.

For one, a battery carries 40-60% of the embedded greenhouse gas emissions in the production of an EV, according to estimates by McKinsey. A previous analysis projected that producing enough cobalt to facilitate the global energy transition will lead to at least 4.7 million tons of CO2 emissions by 2030, equivalent to the total fossil fuel and industrial emissions of Albania in 2022.

Cutting the demand for some “high risk” minerals and battery chemistries will allow the industry to reduce its negative impacts on biodiversity and forests, Julia Naime, senior supply chain advisor at Rainforest Foundation Norway, tells Dialogue Earth.

But she also warns that “caution is needed so that alternative battery chemistries do not create other adverse impacts on nature or people.”

Sodium-ion: the star

Other battery technologies are also being developed across the world, from magnesium-ion batteries to zinc-air batteries. Both magnesium and zinc are more abundant than lithium.

Sodium-ion batteries are likely to be the first to make headway because they are close to commercialisation and can achieve similar performance to LFP cells, according to a report by the Germany-based Fraunhofer Institute for Systems and Innovation Research.

A sodium-ion battery created by Swedish battery manufacturer Northvolt. Sodium is an abundant material and batteries made using it may perform similarly to those made with lithium (Image: Northvolt)

Although sodium-ion batteries are cheaper and more sustainable, their “main bottleneck currently is the low energy density,” Zhang says. Sodium-ion batteries support a shorter range than a lithium-ion battery of the same weight.

The technology is therefore more likely to be used in low-speed and small EVs, as well as electric trikes and scooters. An industry insider told Dialogue Earth that it is also considered an ideal solution for the energy storage sector as companies look for safe, reliable and cost-effective methods to store renewable power.

Moreover, sodium-ion batteries deal effectively with cold temperatures, explains Cory Combs, associate director at Trivium China, a Beijing-based research group. “If you’re looking at, say, the Scandinavian market or the Russian market, this might actually be a really good way to go.”

China: A strong player

From UK-based Faradion to the US’s Natron Energy, global firms are racing to make a breakthrough in the potentially revolutionary sodium-iron battery technology. The huge interest could see the market balloon by nearly six times, from USD 860 million in 2022 to USD 4.8 billion in 2032, according to market analyst Precedence Research.

China is a strong player in this industry. Patents related to the technology filed by the country jumped 109 fold over the past decade, dwarfing Japan and the United States, according to analysis by Nikkei Asia. It is also the first country to mass produce EVs powered by these new cells, with two models currently on offer.

One was launched by battery manufacturer Farasis Energy and automaker JMEV, both based in Jiangxi. The other, Huaxianzi, was the brainchild of Jiangsu-based HiNa Battery and Yiwei, a subsidiary brand of the Anhui Jianghuai Automobile Group. Both models rolled off the production line last December and the companies claimed they had a range of around 250 kilometres.

BYD and CATL are also in the mix, with the former having started building a USD 1.4 billion sodium-ion battery plant in Jiangsu and the latter reportedly working on its second-generation sodium-ion cells. CATL has also said that its sodium-ion batteries would be used in a model by Chinese automaker Chery.

Other contenders have also upped their game. Swedish start-up Northvolt announced late last year that it had developed a “state-of-the-art” sodium-ion battery for energy-storage systems.

Northvolt’s chief executive and co-founder, Peter Carlsson, told the Financial Times that the technology, which could be “worth tens of billions of dollars”, would open up markets for the company including the Middle East, Africa and India.

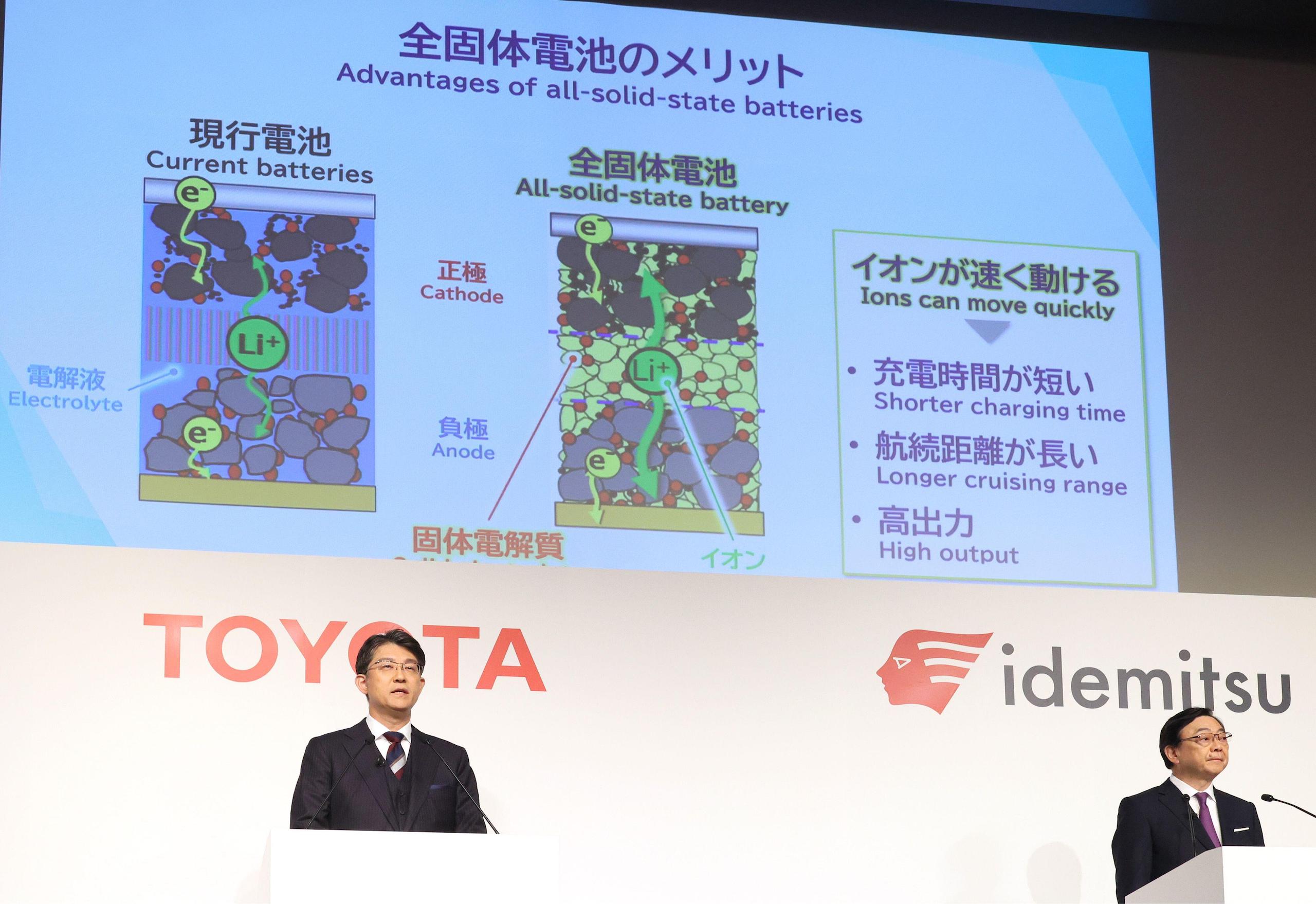

All-solid-state batteries

Another buzzword is “all-solid-state batteries”. Also known simply as “solid-state batteries”, these replace the liquid or gel electrolytes in traditional lithium-ion batteries with solid electrolytes.

“They offer higher energy densities, improved safety as they are less prone to catching fire, and potentially longer lifespans,” says Yang Li, associate dean for research and impact at Xi’an Jiaotong-Liverpool University’s school of science.

Solid-state batteries could also charge faster and have lower carbon footprints than the current lithium-ion options, according to Scott Gorman, a senior research scientist at CPI, a technology innovation centre in the UK. The latter is down to the fact that they use fewer materials, Gorman wrote in a CPI blog post.

But their high manufacturing costs could pose a roadblock. Solid electrolytes are harder to design and more expensive to fabricate – factors that have restricted their mass production. The cost to produce solid-state batteries can be four to 25 times higher than that of conventional lithium-ion batteries, Nikkei Asia reported, citing the Japan Science and Technology Agency.

“Companies like Toyota, CATL, and China Aviation Lithium Battery (CALB) are heavily investing in this technology, working to overcome challenges related to manufacturing costs and temperature sensitivity,” Yang tells Dialogue Earth.

Full on global race

The race to master solid-state battery technology is fully on, which could bring new dynamics to the future battery sector.

Governments and blocs around the world – from the United States to European Union – have included its development as official strategies, according to analysis by TrendForce, a market intelligence firm. Beijing has instructed the country to “fast-track the research, development and industrialisation” of solid-state batteries in its strategy for the new-energy vehicle industry from 2021 to 2035.

Toyota president Koji Sato at a press conference in October 2023. The Japanese car-maker announced a partnership with petroleum company Idemitsu to develop all-solid-state EV batteries, aiming for mass production by 2028 (Image: Yoshio Tsunoda / Alamy)

BMW plans to roll out its first “demonstrator” vehicle featuring a solid-state battery before 2025 after partnering with US firm Solid Power for the technology.

German firm PowerCo SE, a battery subsidiary of Volkswagen, said in January that its tests had shown that a solid-state battery from its partner, California-based QuantumScape, maintained more than 95% of its original capacity after more than 1,000 charging cycles.

Toyota last year said that it intended to halve the size, cost and weight of batteries for its EVs following a “breakthrough” in solid-state batteries, the Financial Times reported. The Japanese automaker, which is working on the technology through a joint venture with Panasonic, plans to mass produce the cells as early as 2027.

South Korea’s Samsung SDI has set up a pilot line for solid-state batteries and is also eyeing mass-production in 2027.

China’s CATL is similarly aiming to commercialise its solid-state battery in 2027, but only for small-scale production, the company’s chief scientist, Wu Kai, said at an industry forum in April. Large-scale production would continue to face problems such as high production costs, Wu noted.

Meanwhile, Shanghai-based NIO is reported to have developed a type of “semi-solid-state” battery pack that can travel 1,070 kilometres on a single charge.

China has also set up a dedicated fund of six billion yuan (USD 828 million) to fast-track the development of solid-state cells, an industry insider told Caixin. A battery manufacturer must team up with an EV maker to apply for the fund, the publication said, citing the source.

The period around 2028 is expected to be a “tipping point” for the cells’ mass production, TrendForce predicted.

All-solid-state batteries could be a game changer for the battery sector. TrendForce pointed to “a significant gap” in the “patent layout” between Chinese companies and their international competitors for the technology.

“In the future competition for [all-solid-state batteries], companies from Japan, South Korea, Europe and the US have the opportunity to surpass China and reshape the competitive landscape of the future EV battery industry,” it wrote.

But Zhang thinks the race is too early to call because the technology is still being developed.

Battery makers are currently looking at three main chemical routes to make a solid electrolyte, each with their advantages and shortcomings.

“There are no signs yet to show which route will be the best choice,” Zhang says. “Once one of the routes takes the lead, the EV industrial chain will be key in deciding if this solution is actually viable commercially, and China has a massive advantage in this regard.”