The anti-EV brigade are pushing plug-in hybrids. But electric is still the future

Despite continued strong sales, there’s no denying the negativity surrounding the U.S. battery electric vehicle (BEV) industry as of late.

This has pundits casting about for alternatives, and some have ended up at a not-so-novel solution: plug-in hybrid electric vehicles, or PHEVs for short.

Among the most prominent is a recent Washington Post editorial arguing that the U.S. government needs to do more to support PHEVs rather than put all its eggs in the BEVs basket. This is seriously misguided and leaves the wrong impression about current government support. Let’s clear things up.

In reading the Post editorial, you might worry that the Environmental Protection Agency (EPA)’s multi-pollutant standards for light- and medium-duty vehicles, released on March 20, 2024, in some way require BEVs or that somehow PHEVs don’t count toward the standards.

Neither is true. EPA’s standards are technology neutral and can be met by automakers using a combination of technologies from BEVs to more efficient regular gas cars, as we explain in another blog post.

That PHEVs count toward the standards is underscored by EPA’s own modeling, released with the rule, which shows that the least-cost compliance pathway for automakers includes a 13% PHEV sales share in 2032.

The Post‘s argument for PHEVs relies pretty heavily on the notion that they offer almost as much environmental benefit as BEVs and are seeing strong market demand. The environmental part is theoretical, though, and based on the idea that most PHEV driving can run on electricity because most trips are relatively short.

The EPA estimates electric and gasoline driving shares for PHEVs—and as a result, their greenhouse gas ratings—based on a survey of American travel patterns, with the critical assumption that PHEVs begin each day with a full charge.

Based on this methodology, a PHEV with a 40-mile electric range could cover about 70% of its miles with electricity. But there’s a problem—we know it rarely plays out this way.

Analysis of extensive real-world data collected from PHEVs driving millions of miles in the United States found that the electric share of driving is 26%–56% lower than the EPA’s estimates, and PHEVs consume 42%–67% more gasoline than what’s advertised to consumers.

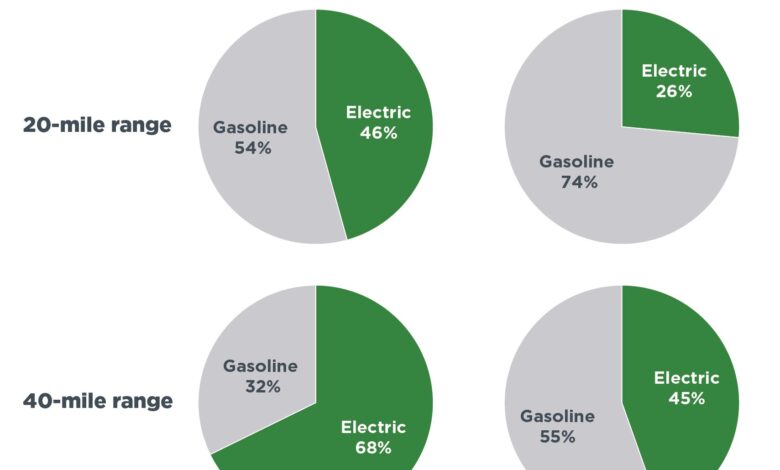

Figure 1 illustrates how the real-world data compares with theory, on average, for a PHEV with a 20-mile and 40-mile electric range. In both cases, PHEVs in the real world use far more gasoline than the theory predicts. With the resultant greenhouse gas emissions from this gasoline use, PHEVs cannot deliver the same climate benefits as BEVs.

PHEVs also fall flat on delivering savings for drivers. Because they require a battery and an electric motor in addition to an internal combustion engine, PHEVs are more complex to build than a vehicle that only uses one powertrain.

With battery prices rapidly falling, BEVs are on pace to become the cheapest vehicles to purchase sometime between 2025 and 2030, depending on their range and vehicle segment; PHEVs, meanwhile, are projected to remain more expensive to purchase than gasoline cars.

For the same complexity reasons, PHEVs are also expected to be more costly to maintain than BEVs, and because PHEVs need gasoline, their average cost per mile is projected to be higher than a BEV.

For an American buying a new car in 2030, we estimated that all of this adds up to a BEV saving that driver about $10,000 over a 6-year period compared with buying a new gasoline car. If they bought a PHEV, we found little to no savings compared with a conventional gas car.

Given these drawbacks for the climate and consumers’ pocketbooks, it would be a shame if PHEVs became the dominant new technology in the U.S. car market. But despite what you may have seen in the headlines, there’s little sign of this being a likely future.

Sales numbers tell the story here. As Figure 2 shows, in every year since 2014, BEVs have outsold PHEVs in the United States. In 2022 and 2023, there were more than four BEVs sold for every one PHEV! The percentages in each column show the BEV sales share of all electric vehicles.

There’s little indication that this trend will change soon, as there are almost four times as many BEV models available as PHEV models for the 2024 model year. Indeed, compared with 2023, the number of available BEVs increased, while the number of PHEVs dropped.

Is there some role for PHEVs in the near term? Certainly. Charging infrastructure across the country is not yet where it needs to be, although both the coverage of charging infrastructure and the user experience are set to improve dramatically in the coming years.

This is part of why the U.S. government explicitly includes PHEVs in its plans for a clean vehicle transition: Not only do PHEVs contribute toward manufacturers meeting the newly finalized technology-neutral light-duty emission standards, but they are also eligible for tax credits of up to $3,750 under the Inflation Reduction Act.

(Even under California’s Advanced Clean Cars II regulation, the strongest in the nation, PHEVs would still be allowed past 2035 if they meet a minimum all-electric range of 50 miles.)

The United States is supporting PHEVs as a cleaner choice for drivers who are not quite ready to switch to BEVs. But research shows that the United States and other leading markets cannot meet climate goals by relying on PHEVs.

Fortunately, as we’ve shown here, consumers and industry are already moving toward the cars that can do the most good for the planet and for their wallets at the same time. No matter the latest headlines, the future of the American car remains fully electric.