HSBC’s Zing has less than 20% of Wise’s monthly downloads – but CEO insists it’s ‘bang on plan’

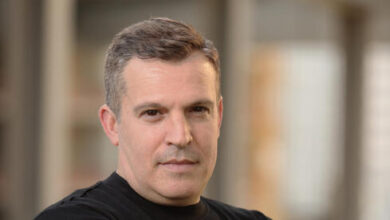

Customer growth of HSBC’s new money transfer app Zing is “bang on plan” since its launch in January, says its CEO and founder James Allan.

That’s despite recent reports indicating a muted start for the app, lagging far behind fintechs Wise and Revolut in terms of monthly downloads in January and February.

Zing’s UK installs numbered 36k while Revolut and Wise attracted 1.1m and 203k respectively, according to estimates from app data intelligence platform Apptopia. Those predictions are made using Apptopia’s algorithm that combines app store metadata with proprietary device data.

Choosing not to comment on download figures, Allan insists it’s been a “fantastic start to the year”.

“Customer takeup has been really good and the bank is really happy with our progress,” he says in an interview with Sifted.

Zing’s January launch was hyped as one of the big fintech debuts of the year. It came at a time when lively new fintech launches were hard to come by — seed funding for the sector numbered just over $600m last year compared to $1.4bn in 2022 according to Dealroom.

Project: Marco Polo

Initially referred to internally under the codename “Marco Polo” (in a nod to the secrecy that surrounded the app’s development), Zing is a result of a more than two-year plan for HSBC to make a mark on fintech.

Work started on the project in January 2022 after research conducted by the bank identified that customer experience in the broader international payments sector was “opaque” and lacking when it came to customer service, says Allan.

Zing offers users the ability to hold money in accounts in 20 major currencies exchangeable at real-time rates with conversion fees as low as 0.2%. Customers are also sent a Visa debit card that can be used with any currency. Both of these features are comparable to what’s offered by rivals Wise and Revolut.

While it may be bankrolled by HSBC, it’s also a separate entity incorporated on Companies House as MP Payments. Zing isn’t a bank and operates under an E-money licence, a regulatory authorisation that allows companies to operate as payment service providers and offer digital wallets.

“We came to the conclusion that building Zing separately under the same standards of HSBC but on a separate technology architecture would help us build it out to current standard,” says Allan.

Zing’s offerings have been carefully crafted to ensure they can attract “customers that don’t have a relationship with HSBC”. Even the colour and shape of the logo were carefully considered to catch the international clientele it’s aiming to poach off its rivals.

“We even had dialogues about the way that the word was written,” says Allan. “The lines [in the logo] are meant to point towards forward direction and movement.”

Big banks vs fintechs

Still, it’s been a bit of a mixed bag for banks creating fintech apps to draw in the younger and more digitally savvy crowd. While US banking institution JPMorgan’s neobank offshoot Chase UK has amassed more than 2m customers and is set to break even next year, other big bank’s fintech forays have not gone so smoothly.

Barclay’s payments app PingIt, RBS’ Monzo-challenger Bo Bank and Santander’s online business bank Asto are just some of fintech flops left to gather dust in the innovation graveyards of Europe’s banking giants. None of these are still operating with Bo Bank barely even lasting a year.

Monese, the neobank which raised $35m from HSBC’s venture arm in 2022, warned that it would need significant funding to keep operating in its accounts filed in January this year. Adding to its troubles, Swedish VC firm Kinnevik wrote off its investment last month.

Allan says that Zing differs from these fintech projects as it was created “in direct alignment” with HSBC’s overall growth strategy.

“International payments is something that HSBC as a group has done since its very first day so it’s an innate part of the current day-to-day workings of the bank” he says. HSBC was founded in what was then the UK colony of Hong Kong as a way to finance trade between Europe and Asia.

With 80 people working on Zing, the fintech is also looking to piggyback off HSBC’s international reputation and expand further afield. Currently only available in the UK, Zing plans to offer its services in other unannounced regions.

“The plan [for Zing] is built on operating in international markets,” he says. “And work is already underway on those markets as we speak.”