A Great Opportunity After the Sell-Off

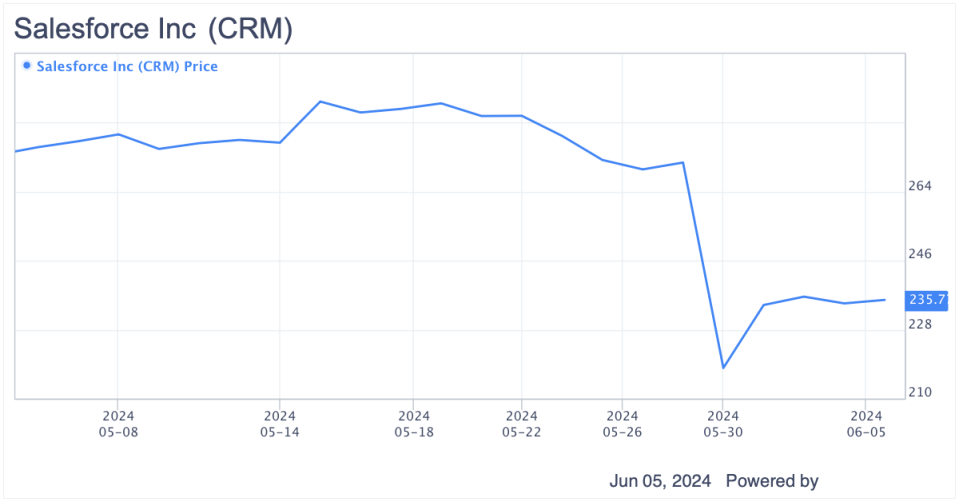

Salesforce Inc. (NYSE:CRM) reported its fiscal first-quarter 2025 results on May 29. While the company only slightly missed expectations for a couple of key metrics, it then downgraded its expectations for the 2025 fiscal year. This led to the stock dropping 15%.

In my opinion, given the company’s unchanged fundamentals, continued high growth potential and compelling valuations, this seems like an overreaction. It could present a great opportunity to invest in a long-term winner.

Why I like Salesforce

Before delving into the company’s recent results and valuation in light of the drastic market reaction, I would like to highlight the main pillars that underpin my positive outlook on the stock.

The San Francisco-based company is the largest vendor in the customer relationship management applications market worldwide, boasting strong recurring revenue and low attrition levels of about 8%, indicative of high customer satisfaction. Additionally, the company has achieved success in cross-selling, driven by an increasingly streamlined sales motion.

The company is well-positioned to benefit from the development of generative artificial intelligence, with management noting continued strong demand for its data cloud. Furthermore, Salesforce has a successful acquisition strategy that expands its product offerings and integrates the latest technologies, such as generative AI. In this context, the potential acquisition of Informatica (NYSE:INFA) could serve as a significant catalyst, enhancing the company’s existing features within the data cloud, which powers the AI models of its Einstein 1 Platform.

Moreover, Salesforce has implemented cost-cutting measures, resulting in a remarkable operating income margin of 31.60%. This highlights the company’s robust profitability and substantial returns on capital to its shareholders, along with growth in free cash flow and expansion of free cash flow margins.

Earnings review

Salesforce’s first quarter will be remembered as the first time since 2006 that the company missed revenue estimates.

While Salesforce surpassed earnigs per share estimates with an adjusted $2.44 compared to the expected $2.38, the revenue of $9.13 billion (an 11% year-over-year increase) fell short of expectations, which triggered a significant selloff, causing shares to plummet by double digits.

CRM Data by GuruFocus

Several other aspects of the earnings report were also less than favorable.

The first-quarter operating profit margin of 18.70% slightly missed the company’s expectations, and the current remaining performance obligations of $26.40 billion increased by 10% year over year, just shy of the expected 11%. However, cash flows remained robust, highlighting one of the company’s strengths. First-quarter operating cash flow reached $6.25 billion, up 39% year over year, while free cash flow was $6.08 billion, up 43%.

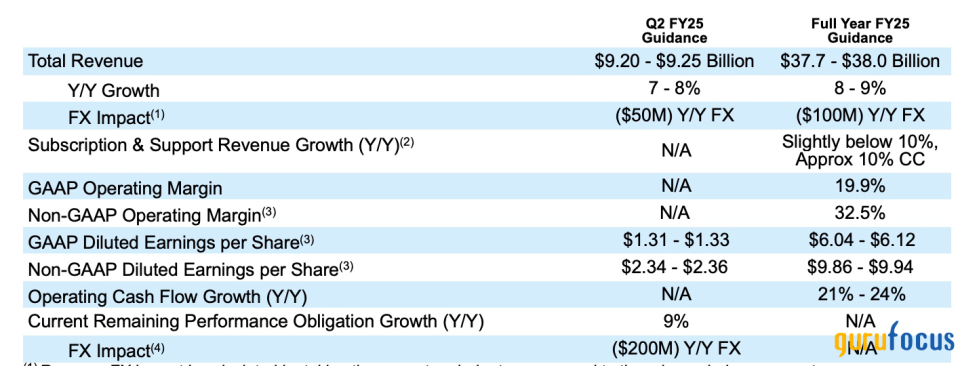

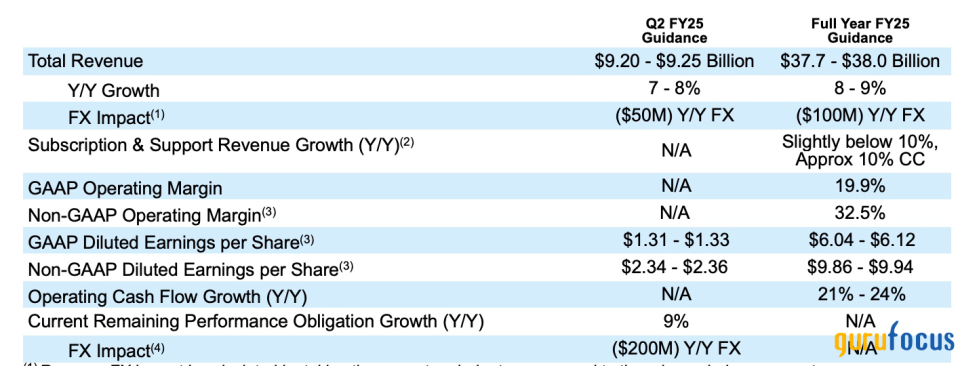

However, the revision in guidance could be seen as another black eye for the company, further contributing to the negative sentiment in the market. Salesforce maintained its full-year revenue guidance, expecting an increase of 8% to 9%, consistent with the previous report. The forecasted 2025 operating profit margin was revised from 20.40% to 19.90%, which, quite frankly, is not considered a significant change.

Source: Salesforce’s earnings release

Another downgrade was seen in the 2025 subscription and support revenue projection. Initially projected to be approximately 10% to slightly above 10%, it is now expected to be slightly below 10%, within the range of approximately 9.20% to 9.60%. While this is a minor adjustment, it does not significantly alter the outlook for that aspect of the business or the full-year operating profit margin.

Although these discrepancies are minor, Salesforce’s reputation for exceeding expectations means that even slight misses can provoke a significant market reaction. Given its solid and consistent growth trajectory over the past decade, analysts typically anticipate Salesforce surpassing expectations.

A few other (minor) concerns

During Salesforce’s first-quarter earnings call, CEO Marc Benioff highlighted the company’s potential to revolutionize customer connections using artificial intelligence. As the leading AI-powered CRM company globally, Benioff expressed confidence in Salesforce’s ability to harness AI’s potential over the next decade.

In my interpretation, while Salesforce is benefiting from the increasing effectiveness of AI, the impact remains modest. These benefits have yet to translate significantly into revenue and profit margin growth. Although there is notable growth in cash flow and free cash flow, the absence of a corresponding increase in operating margin or revenue raises concerns, particularly given Salesforce’s business history and investor expectations.

Over the next five years, Wall Street analysts anticipate Salesforce’s earnings per share to grow by 16.22%. This marks a decline from the previous five years’ growth rate of 23%, signaling a slowdown in earnings growth, which is concerning.

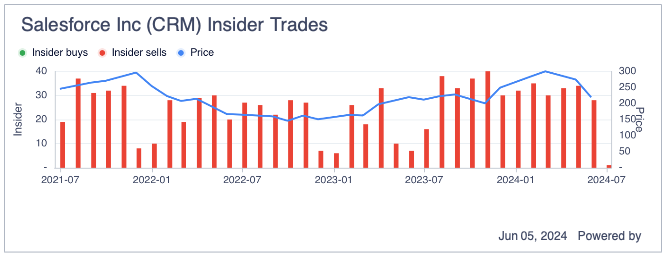

This trend aligns with insider activity within the company. Corporate insiders, including Benioff, have collectively sold approximately $18.40 million shares over the past quarter. Benioff’s consistent selling, which began in July of the previous year and continued with a significant sale of 15,000 shares on May 28, has reduced his stake in the company by over 12% this year.

While insiders may have valid reasons for selling, the CEO’s aggressive divestment raises questions among investors. Particularly puzzling is the significant reduction in Benioff’s stake, especially considering Salesforce’s growth potential in the AI field.

Furthermore, Salesforce announced its first dividend of 40 cents per share of outstanding common stock in February, coinciding with the publication of its fourth-quarter results. While this gesture reflects a commitment to shareholder value, it may also suggest an attempt to bolster stock momentum in anticipation of less favorable news regarding full-year guidance, which indeed materialized.

Valuations seem fairly attractive

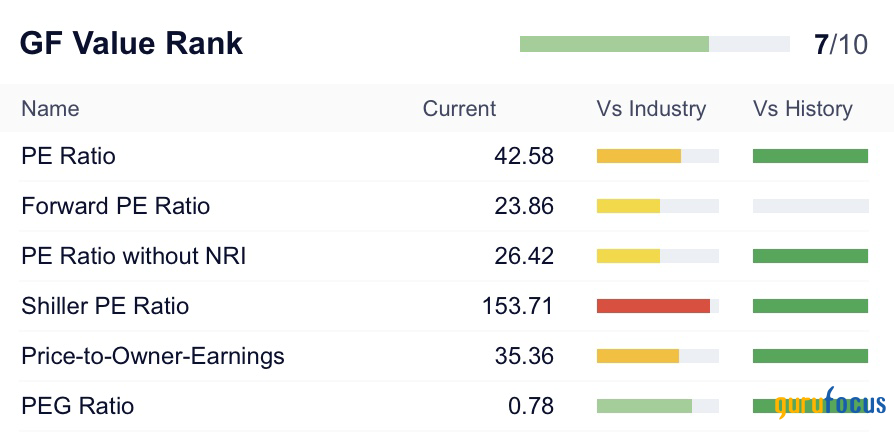

Following the recent selloff, Salesforce is now trading at a forward price-earnings ratio of 23.80. When considering the five-year Ebitda growth rate, Salesforce trades at a price-earnings to growth (PEG) ratio below 1, which is notably attractive when compared to the industry average of 1.60.

Certainly, for Salesforce’s multiples to become attractive, the company must consistently deliver on its guidance instead of revising it downward. However, considering the adjustments made in the first quarter, which led to the negative market reaction, were relatively minor, I do not believe investors should rush to sell shares based on minor future guidance deviations. As the company continues to ramp up profits and cash flows, such deviations have historically not been a recurring issue for Salesforce, and it does not seem that this should become the new normal.

Conclusion

Overall, I do not perceive any significant shifts in Salesforce’s business fundamentals that would warrant such skepticism following its earnings report. I maintain the view that the company is well-positioned in its industry to continue solidifying its leadership position and stands to benefit greatly from the expansion of AI integration across its products and services.

Historically, Salesforce has been subject to high market expectations, and it is likely this minor shortfall in meeting expectations and the slight adjustments in guidance was magnified due to the anticipation of AI-driven improvements in margins.

Salesforce’s business model continues to be lucrative, with operating profit margins hovering around 20%, complemented by robust free cash flow and operating cash flow. Despite the quarter being somewhat disappointing, coupled with other minor setbacks, the company’s fundamentals remain solid.

I view Salesforce as a combination of a strong business model and robust fundamentals trading at reasonable valuations, particularly in light of the recent selloff. Therefore, I believe the company remains poised to be a long-term winner, and investors who recognize this potential may find the current price to be an attractive opportunity.

This article first appeared on GuruFocus.