A Study Of Emerging Electric Vehicle (EV) Supply Chain In Malaysia – Analysis – Eurasia Review

By Tham Siew Yean and Neo Hui Yun Rebecca

Malaysia has announced an ambitious plan to boost Electric Vehicles (EVs) development within the country, proposing to achieve at least 15 percent EV usage of the country’s total industry volume (ITV)[1] by 2023, and 38 percent by 2040.[2] To facilitate this ambitious plan, the government formulated the National Automotive Policy (NAP) and the New Industrial Master Plan 2030 (NIMP 2030). The NIMP 2030 is an industrial policy document formulated to provide national strategic directions for industrial development. It mainly oversees all manufacturing and manufacturing-related service sectors, and facilitates collaboration between the government and the private sector.[3] The NAP, on the other hand, focuses more on the development of energy-efficient vehicles (EEVs) through specific strategies.[4] These include establishing a framework, roadmaps and blueprints for developing next-generation vehicles (NxGVs) or EEVs with some degree of automation, designed to make Malaysia a regional hub for NxGVs.[5] In that sense, the NAP’s primary aim is to develop various types of EEVs, while the NIMP specifically highlights the development of EVs as part of Malaysia’s industrial policy mission to push to net zero.

New investments are needed to create an EV ecosystem. This includes having multiple stakeholders who effectively cover the end-to-end value chain for EVs, such as power utilities providers, infrastructure developers, manufacturers (for example, original equipment manufacturers (OEMs), component suppliers etc), battery providers, policymakers, regulators, EV-related business associations, and researchers for research & development (R&D) purposes.[6] To facilitate investments in this new sector, the Malaysian Investment Development Authority (MIDA), which is the main government agency tasked to promote and facilitate investments in manufacturing and services in the country, has provided incentives such as Pioneer Status or Investment Tax Allowance for a list of promoted products in the EEV and NxGV supply chain. The products promoted include the critical components needed in the assembly of EEVs and NxGVs, such as electric motors, batteries, and battery management systems.[7]

According to MIDA, 58 projects worth RM26.2 billion were approved for EV and its related ecosystems from 2018 to March 2023.[8] This includes foreign marques establishing a presence to sell and distribute cars in Malaysia as in the case of Tesla, which has just established an office as well as an experience and service centre for the import of Tesla EVs that are assembled in Shanghai.[9] Tesla is also building a network of Supercharger fast-charging stations, with its latest installation in Pavilion Bukit Jalil, the sixth Supercharger deployment within six months of its debut in Malaysia.[10] These charging stations differ from the government’s network of charging stations, given that they are designed only for Tesla vehicles. That being said, the Malaysian government has stepped in to ensure that foreign investors like Tesla can contribute to the expansion of the EV ecosystem in the country. As part of the approval process for Tesla’s establishment, the company is required to set up at least 50 Superchargers within three years, with 30% of these being accessible to other EV brands.[11]

This article attempts to shed light on various little-known investments that are being made to support the entire EV supply chain, focusing on what and where these investments are located, as well as which parts of the supply chain these involve. This article will also elaborate on the key challenges faced in establishing an EV ecosystem in Malaysia.

EV SALES IN MALAYSIA

Four-wheel vehicle sales fell in 2019-2021 due to the Covid-19 pandemic, but recovered from 2021 onwards to grow to 774,600 units for passenger and commercial vehicles in 2023 (Figure 1). Sales of hybrids grew by 3.5 times while battery EVs (BEVs) grew from a low base of 278 to 10,159 from 2021 to 2023 (Figure 1). Demand picked up after the government provided various incentives, facilitated by the post pandemic economic recovery and the market entry of EV versions of popular premium cars like the BMW and Mercedes Benz as well as new and well-known EV marques like Tesla, BYD and GMW.[12] Be that as it may, in 2023, hybrids and EVs comprised a mere 4.9% of total vehicles sold in 2023. The government is targeting to achieve at least 15% by 2030, based on the Low Carbon Mobility Blueprint (LCMB 2021-2030), whose calculations include electric motorcycles. Although electric motorcycles were also provided purchase rebates[13] by the government, the uptake has been slow; these bikes have reportedly a market share of only 1.7%.[14]

The government has targeted to have 100,000 electric cars on the road, including 2,000 electric buses and 125,000 charging stations in the country by 2030. Achieving this depends on several factors including how fast the EV ecosystem evolves to meet the aspired demand.[15] Overcoming challenges such as EV’s affordability, and accessibility to charging infrastructure is important if the EV ecosystem is to advance.

Figure 1. Sales of Total Vehicles, Hybrids and BEVs, 2021-2023

EMERGING EV SUPPLY CHAIN

The EV supply chain comprises several key components, starting with the sourcing and transportation of raw materials, followed by battery manufacturing, vehicle design and assembly, EV sales and dealership, and lastly EVs’ end-of-life management, such as battery recycling.[17] This differs from the supply chain of ICE, in having fewer mechanical parts, with the EV battery being the key component and representing over 40% of the total cost.[18] However, as the technology develops, the cost of EV batteries is also expected to fall over time.

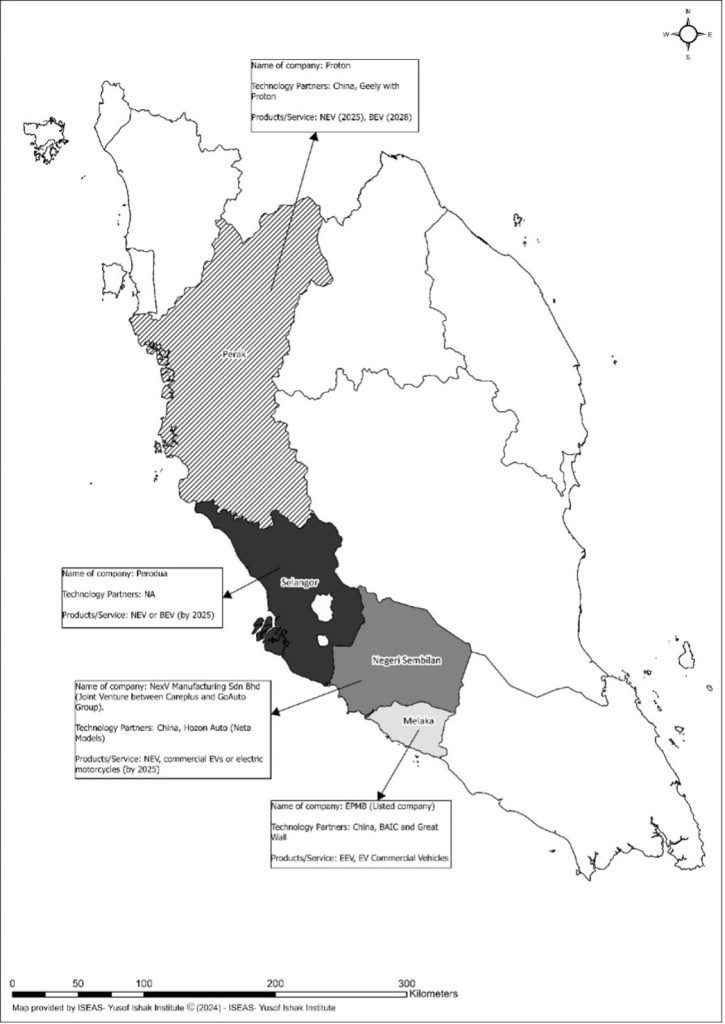

Investments in Malaysia over the last few years show a diverse and diffused pattern. These cut across all segments of the supply chain, and are distributed across various states in the country (Figure 2). The following sections illustrate the various components of the EV supply chain, and the companies involved.

Figure 2. Manufacturing Plants for EVs in Peninsula Malaysia

| No. | Technology Partner(s) | Local partner/company | Name of company | Products/Service |

| Kedah | ||||

| 1 | Stellantis (US) | None | Stellantis (US) | ICE, hybrids and EV Assembly plant |

| 2 | Infineon and Siemens (Germany) | None | Infineon Technologies AG | EV electronic chips |

| 3 | Eve Energy (China) *Unconfirmed site |

None | Eve Energy Malaysia Sdn Bhd | Battery assembly |

| Penang | ||||

| 4 | Shenzhen Serious Technology Material Co. (China) | n.a. | INV New Material Technology (M) Sdn. Bhd | Battery separators |

| Enovix (US) | None | Enovix | Battery for four-wheelers | |

| 5 | United E-motor (Indonesia) | Antroniq (Malaysia) | Antroniq Bhd. | E-motorbikes |

| Selangor | ||||

| 6 | Volvo (Germany) | Federal Auto | Volvo Malaysia | Assembly of EVs |

| 7 | China’s Sharkgulf Technologies Group Ltd, Blueshark (China) | EP Manufactuing Berhad | EP Manufactuing Berhad | Electric motorcycles |

| 8 | Tron Bradbury Energy (Taiwan) | None | Tron Bradbury Energy (Malaysia) Sdn Bhd | Commercial EVs and energy storage systems (including Battery R&D) |

| 9 | Thamlev (USA-based) | None | Kulim Thamlev Mobility Sdn. Bhd (Malaysia) | Electric motorbikes |

| 10 | Graphene Synergy (Malaysia) | Graphene Synergy R&D Berhad (Malaysia) | Graphene Synergy R&D Berhad | Graphene-based raw materials |

| Negeri Sembilan | ||||

| 11 | Samsung SDI Co Ltd (Korea) | None | Samsung SDI Energy Malaysia Sdn Bhd (SDIEM) | Lithium-ion battery by 2025 |

| 12 | Chinese companies like Higer and Yu Tong and Hozon Auto | Joint venture between Careplus Group Bhd and GoAuto Group Sdn Bhd with Chinese companies like Higer and Yu Tong and Hozon Auto | NexV Manufacturing Sdn Bhd (NMSB) | Assembly of Neta brand and other completely-knocked-down (CKD) operations |

| Melaka | ||||

| 13 | BAIC and Great Wall (China) | EP Manufacturing Bhd (EPMB) | EP Manufacturing Bhd (EPMB) | Manufacture and assembly of four-wheel EEVs, EVs, and electric commercial vehicles |

| Johor | ||||

| 14 | United E-motor (Indonesia) *Unconfirmed site |

Antroniq (Malaysia) | Antroniq Bhd. | E-motorbikes |

| Pahang | ||||

| 15 | Mercedes Benz (Germany) | DRB Hicom | Mercedes Benz Malaysia | Assembly of EVs |

| 16 | Graphjet Technology Sdn Bhd (Malaysia) | Graphjet Technology Sdn Bhd(Malaysia) | Graphjet Technology Sdn Bhd(Malaysia) | Transform palm industry waste materials, palm kernels, into graphite and single-layer graphene. |

COMPONENTS OF EV SUPPLY CHAIN

Minerals

Critical minerals like nickel, lithium, cobalt, manganese, rare earth, and graphite are needed for battery Electric Vehicles (BEVs). Indonesia, for example, has used its nickel reserves to develop an EV battery supply chain as well as the manufacture and assembly of EVs.[19]

Although Malaysia has some critical minerals such as rare earth elements (REE),[20] policies regarding its extraction, processing and usage are still being formulated. A Parliamentary Caucus for Critical Minerals was established in March 2024 to strengthen understanding of matters relating to critical minerals as well as advocate for a legal and regulatory framework to manage Malaysia’s critical mineral sectors.[21] Malaysia currently has domestic sources of nickel, cobalt, manganese, and graphite, which should ease the country’s efforts to develop its own EV supply chain.

Nevertheless, foreign investments in minerals have begun to emerge in Malaysia. From Figure 3, Sarawak in East Malaysia is venturing into graphite manufacturing, including synthetic graphite, in Bintulu, under a Memorandum of Understanding (MOU) between Sarawak Economic Development Corporation (SEDC), and Gallois New Energy Materials (M) Sdn Bhd.[22] The latter is a subsidiary company of the established Madagascar graphite miner, Gallios.[23] Although graphite is used for EV batteries, Sarawak has announced that it also intends to use it for the development of hydrogen fuel cells. The state is championing the use of such cells in public transportation.[24]

Figure 3. Manufacturing Plants for Mineral and Batteries in Sabah and Sarawak

| No. | Technology Partner(s) | Local company | Products/Service |

| 1 | SK Nexilis (South Korea) | KKIP (Kota Kinaablu Industrial Park) Sdn Bhd (Malaysia) | Copper foil manufacturing for EV batteries |

| 2 | Gallois New Energy (HK) | SEDC Energy (Sarawak), Gallois New Energy Materials (M) Sd Bhd | Graphite plant |

Peninsular Malaysia is also pursuing the development of alternative mineral resources, namely graphene. In fact, a National Graphene Action Plan was launched in 2014, which focuses on the commercialisation of graphene, including for the use of lithium-ion battery anodes.[25] The most important development on this front is the emergence of an initially private local company, Graphjet Sdn. Bhd, in 2019. Graphjet has patented technology to produce graphene from recycled palm kernel shells, which can then be used for EV batteries, medical devices and home appliances.[26] The company was also identified as one of NIMP’s national mission-based projects or catalytic projects, at the launch of the plan in 2023.[27] It is building a factory at Malaysia-Kuantan Industrial Park (MCKIP) in Pahang, where it is expected to produce 10,000 tonnes of graphite and 60 tonnes of single-layer graphene annually.[28] In March 2024, the company went public on Nasdaq Global Market.[29] It also aims to be the leading source of graphite and graphene in the US market, thereby offering itself as an alternative source to China, which is the largest synthetic graphite manufacturer in the world.

Another local R&D company, Graphene Synergy R&D Sdn. Bhd, is also producing graphene and graphene-based materials at Teknologi Park Malaysia, in Selangor. It is exploring partnerships with producers and manufacturers.

EV Batteries

Malaysia also has investments in EV battery assembly for two and four wheelers as well as the manufacture of key components for EV batteries. The government has initiated various incentives to attract investors, including having tax break extensions for the production of various components in battery assembly.[30] For battery assembly, investments come from different countries such as China, the US, Taiwan, and South Korea. Their new manufacturing plants are primarily concentrated within Kedah, Negeri Sembilan, Penang and Sabah. Table 1 illustrates the investors involved in the development of EV battery components.

Table 1: List of Investors for EV batteries and its components

| State | Name of Investor(s) | Details of investment |

| Kedah | Eve Energy | Manufacture lithium-ion batteries at a new factory in Kulim.[31] |

| Penang | Joint-venture between Enovix Corporation (lithium-ion manufacturer listed in Nasdaq), and YBS International of Malaysia | Manufacture silicon battery at Penang Science Park.[32] |

| INV New Material Technology (M) Sdn Bhd, which is a subsidiary of Shenzhen Senior Technology Material Co. Ltd | Manufacture wet process and coated separators for lithium batteries, key components in ensuring battery safety | |

| Negeri Sembilan | Tron Energy Technology Corporation, in partnership with Bradbury Asset Management (Hong Kong) Ltd | Planning to build a battery research and development facility at Malaysia Vision Valley |

| Samsung SDI | Building a battery factory | |

| Sabah | South Korea with SK Nexilis | Producing copper foil for EV battery materials manufacturer SKC |

EV ELECTRONICS

Germany’s Infineon Technologies and Siemens will expand their facility in Kulim Hi-Tech Park to manufacture chips for different uses, including in EVs. These are crucial components in EVs and can affect their optimal and efficient performance.

Vehicle Assembly

Luxury cars with plants in Malaysia have already started assembling EV models locally. For example, Mercedes Benz in Pahang launched locally assembled CKDs in early 2023.[33] Volvo is also assembling EVs at its plant in Shah Alam and plans to export locally assembled EVs to other countries in ASEAN.[34]

There are also new vehicle players coming from new source countries. Stellantis from the US has acquired Naza Automotive Manufacturing Sdn. Bhd. and the latter’s manufacturing plant in Gurun, Kedah.[35] This company assembles various marques such as Peugeot, Alpha Romeo, and Citroen, and is reportedly planning to assemble ICEs, hybrids and BEVs for Malaysia and the regional market, using Malaysia as its ASEAN hub.[36] The targeted plan is to assemble the first EV in Malaysia by the second half of 2024, followed by the production of its BEV series (STLA medium vehicle) in 2025.[37] Tron Bradbury Energy (Taiwan) and Bradbury Asset Management (Hong Kong) Ltd, are also planning to assemble commercial vehicles at Port Klang.[38]

Locally assembled electric motorcycles are also emerging. The first is a partnership between Malaysia’s Antroniq, an investment holding company, and Indonesia’s United E-motor in Batu Kawan, Penang and Johor.[39] US-based Thamlev, which was started by a Malaysian, is assembling at Balakong in Kuala Lumpur.[40] A local parts and components manufacturer, EP Manufacturing Berhad is partnering with China’s Sharkgulf Technologies Group Ltd, to assemble, manufacture and distribute the latter’s Blueshark two-wheeler at Glenmarie in Shah Alam, Selangor.[41]

Two local companies have been given the license to assemble EVs with technology partners from China, in Melaka and Negeri Sembilan. While new players make an entry into the automotive market in different states, main foreign brands assembling in Malaysia, namely Toyota, Honda, and Mitsubishi,[42] have yet to introduce BEVs and are in fact still assembling at the EEV segments, including hybrids. According to Toyota, their stand remains at providing a broad range of engine options for their consumers, which includes petrol, diesel, hybrid, plug-in hybrid, and hydrogen. As much as electric cars can be a solution to carbon neutrality, Toyota believes that there is still value in investing in other fuel types such as hydrogen fuel cell, synthetic fuel etc.[43] This could account for their slow entry into the BEV markets, including in Malaysia.

CHALLENGES TO THE EMERGING SUPPLY CHAIN

Slow take-off of affordable EVs

EVs continue to remain out of reach for most Malaysians, primarily due to their high prices. According to MITI’s Franchise AP policy, the import of completely built-up (CBU) EVs is capped at the road price tag (OTR)[44] of RM100,000 to prevent dumping and to provide time for local car manufacturers, primarily Proton and Perodua, to develop their EVs for the local market. As much as the restriction aims to protect the interest of local players, it has nevertheless led to a slow introduction of affordable EVs in the market. This effectively means that the majority of EVs are priced much higher than petrol-powered vehicles (the cheapest EV in the market still costs around RM140,000[45]), a price unaffordable for most Malaysians. While Proton and Perodua have announced intentions to produce their own EVs by 2025,[46] no concrete plans have been released.

Difficulty in developing an EV supply chain that can support local assembly could be the reason for slowness in pushing out affordable EVs. Both Proton and Perodua will have to deal with the need to upgrade the capabilities of existing vendors or facilitate their exit since EVs use a smaller number of moving parts compared to ICE engines. Proton has reportedly 116 vendors[47] while Perodua has 120.[48] Handling the transition therefore requires careful planning to phase out existing suppliers and concurrently introduce new suppliers with the right capabilities. This is not such a simple matter in Malaysia since national car producers have to nurture localization, especially Bumiputera auto parts suppliers.[49] Moreover, there are also implications on the company’s approved permits (AP) if such localisation is not properly managed within their supply chain. A potential relaxation of Bumiputera equity requirement for AP qualification could hasten the development of a local EV supply chain.[50]

Apart from that, foreign suppliers for Proton will also have to shift their current capabilities to support EV assembly. To illustrate, Camel Power Battery (CPB) from China entered Malaysia and built a factory at Malaysia-Kuantan Industrial Park (MCKIP) in 2018. It is a key supplier of batteries for Proton.[51] To stay relevant in the transition and beyond, CPB will have to shift from traditional ICE batteries to EV batteries. The same goes for other suppliers. This could be difficult if the company is not equipped to manage the transition, given that moving into EV production means shifting from developing an electromechanical intensive vehicle (such as ICE) to an information intensive vehicle (such as EV).[52] This also entails demands such as software designing and supporting electronics, all of which require higher capital and technological advancement. High costs could deter companies from moving into this field, especially when the demand in Malaysia is still relatively low.

Nonetheless, both Proton and Perodua may be able to produce their own EVs in the coming years. Proton has been distributing the SMART EV for Malaysia and Thailand since 2023 and will be exploring the local assembly of this vehicle at its Tanjung Malim plant. Apart from that, Proton is planning to shift progressively to hybrid engines for existing models, while developing Range-Extender EVs (primarily driven by an electric motor but using a small combustion engine functioning as a battery generator) as a bridging technology before migrating to full BEVs from 2028 onwards (Figure 4).[53] Perodua is also reportedly planning to launch a new energy vehicle by end 2025, which may possibly be a hybrid rather than a full BEV.

Interestingly, two other local companies have also been given the license to manufacture EVs. Listed auto parts producer and distributor, EPMB, has ventured into EV assembly operations with technology from China’s BAIC and Great Wall. Another company, NexV has also announced local assembly of Neta cars produced by China’s Hozon Auto. While pricing is still not known at this juncture, the cars assembled by these two new EV assemblers with Chinese technology can pose serious competition to Proton and Perodua’s planned hybrid/EV cars.

Figure 4. Local companies planning to assemble BEVs, March 2024

Need for policy coordination

While Malaysia manoeuvres the shift in the supply chain, policy coordination is needed to shift the demand. Demand is largely affected by the slow uptake of charging infrastructure needed to reduce range anxiety, especially for intra-state travel. The government’s aim of having 10,000 EV charging infrastructure by 2025 may be quite challenging; by January 2024, only 1,500 have been installed.[54] Private investors are slow to invest as the capital costs are high; it is estimated that installing 10 rapid charging stations costs RM1.5-RM2 million. At the same time, demand is held back by the lack of affordable EVs.

Furthermore, the removal of general fuel subsidies which is to take place in 2024, is facing challenges due to lower than expected registration at the Central Database Hub (PADU), which is to provide information on who will be receiving subsequent targeted subsidies.[55] If the subsidies are given back as cash transfers to the targeted groups, as planned, it may not facilitate any shift towards the use of electric vehicles since these groups can still choose to use ICE, especially in view of the slow development of charging infrastructure and affordable EVs.[56]

There is essentially a chicken-and-egg situation; both supply and demand must move forward at the same time to accelerate EV adoption. Hence the government has to review the incentives for the private sector to participate in EV adoption, and increase public provision especially along the highways for inter-state travel.

The government should also reveal its EV policy for 2026 onwards. At present, it is not known what will happen to the import cap of RM100,000 after 2025. It appears likely that Proton and Perodua will be introducing hybrids as a transition to BEVs.[57] Should the government further extend the import cap, then the availability of affordable BEVs will be further delayed, and it will be difficult to overcome the chicken-and-egg problem.

CONCLUSION

Malaysia has planned to draw in foreign and domestic investments to build an EV supply chain in the country. The investment pattern that has emerged is diverse and diffused across different segments of the EV supply chain, stretching from minerals to the assembly of batteries and vehicles in the two-wheeler and four-wheeler markets.

Be that as it may, Malaysia still faces outstanding challenges for the EV market to take off. This can be attributed to the slow emergence of affordable EVs; the number of BEVs still remains small, though growing. The demand for EVs is also deterred by the slower than expected installation of charging infrastructure. This chicken-and-egg problem requires the government to intervene in developing public charging infrastructure and providing a clear roadmap for the transition from ICE to BEVs. Setting aspirational targets alone is not enough.

For endnotes, please refer to the original pdf document.

- About the authors: Tham Siew Yean is Visiting Senior Fellow at ISEAS – Yusof Ishak Institute and Emeritus Professor at Universiti Kebangsaan Malaysia. Neo Hui Yun Rebecca is Research Officer at ISEAS – Yusof Ishak Institute. Both authors would like to thank Manggi Habir, Siwage Dharma and Cassey Lee for their comments on an earlier draft.

- Source: This article was published by ISEAS – Yusof Ishak Institute