Actually, EV Sales Aren’t Struggling—Just Tesla’s

Much has been said about electric vehicle sales tumbling off a cliff in the U.S., but there’s reason to believe that the latest downturn in sales is mostly a Tesla problem, not one affecting EVs in general. The bleak EV sales outlook of 2024 can be traced to weaker demand and subsequently-lower sales of market-leading Tesla vehicles, which saw a steep decline in sales this year compared to the first quarter of 2023. Meanwhile, most other automakers bolstering their lineups with EVs actually saw a healthy increase in pure-electric sales.

It looks like the market is conflating Tesla’s tumble with one that’s impacting the market overall, but that’s not true according to data from Bloomberg and Cox Automotive. EVs from Ford, Mercedes-Benz, BMW, Toyota, Rivian, Hyundai and Kia have seen a retail surge. Ford leads in growth with models like the F-150 Lightning and Mustang Mach-E, while Hyundai and Kia came in with the least growth of the best-selling bunch for models such as the Ioniq 6 and EV6. But by any measure, automakers are enjoying a notable increase in quarterly EV sales expansion this year.

Patrick T. Fallon via Getty Images

Among the major manufacturers Bloomberg’s data focuses on, EV sales increased as follows: Ford’s grew 86.1%; Toyota’s grew 85.9%; Mercedes-Benz’s grew 66.9%; Rivian’s grew 58.8%; BMW’s grew 57.8%; and Hyundai/Kia’s grew 56.1%.

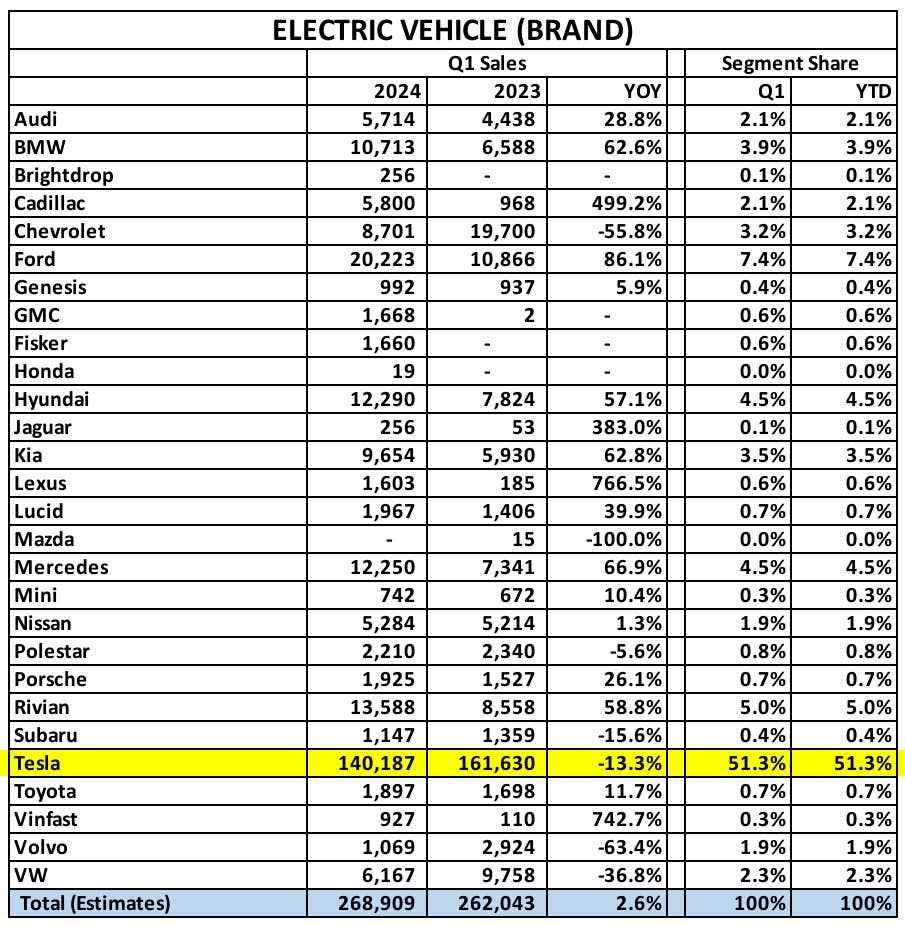

Compared to the table below, you may notice some discrepancies, and that’s down to the fact Bloomberg packaged some brands and their subsidiaries together. Toyota overall saw an observed 86% rise in a year because Lexus didn’t have any EVs to sell in the early part of 2023. Nevertheless, Toyota alone rose 11.7%, which is not too shabby considering it’s got but one EV, and its heart clearly belongs to hybrids.

Hell, even Nissan saw EV sales growth of 1.3% with oft overlooked models like the Ariya and Leaf. The number is one percent if you round down, but growth is growth no matter how small. And, yet, at the other end of the scale, Tesla saw a decrease in sales growth of 13%.

Cox Automotive (portion highlighted by The Drive)

That’s better than GM’s decline of nearly 21 percent, but even Volkswagen fared better than Tesla, with a milder decline in EV sales growth of 12 percent. Keep in mind that despite the decline in growth, Tesla is still well ahead of competitors, with its Q1 numbers reaching 140,187 vehicles sold. Compared to the quarter’s EV sales growth champ, Ford, still sold nearly 120,000 more EVs in total. And Tesla still commands 51 percent of all EV segment share in America, as Cox Auto shows.

That’s a major slice of the EV pie. So, why all the doom and gloom surrounding Tesla and EV sales in 2024? That’s mostly folks projecting Tesla’s stall in growth to all other EVs, which is a misread. The market more or less looks to Tesla as a bellwether for EVs, but Elon Musk’s company has lost customers to rivals as people flock to other brands in record numbers, per Bloomberg. Production is another major hurdle for sales growth, and some of this quarter’s biggest losers in the category faced production challenges or otherwise saw their EV lineups shrink.

Tesla interrupted production of its popular Model 3 to give the sedan a much-needed facelift. General Motors, meanwhile, saw the biggest decline in EV Q1 sales growth across its brands, in part, due to losing its most popular EV after killing the Chevy Bolt. Problems with GM and LG’s Ultium batteries also forced the automaker to delay its EV plans for 2024. Bloomberg says the decline in growth caused by the temporary loss of the Tesla Model 3 and Chevy Bolt alone were major factors in the decline of EV sales. If we exclude those two models, EV sales growth in America actually increased by 23 percent.

In other words, EV sales are not grinding to a halt; the meteoric growth of the last few years is merely contracting. Analysts from Cox Auto say the EV segment is hitting slowdowns as it matures, which is to be expected. Cox reiterates that “segment growth typically slows as volume increases.” (It’s that “chasm” we’ve talked about before.) Which is to say the EV boom has not yet given way to a bust—not even close. If you prefer to take a look at the market from a perspective that’s fixed further afield, then consider that analysts expect EV sales to account for 10% of total car sales in the U.S. by the end of 2024, up from their slow but sure start as the year kicked off when they accounted for 7.3% of car sales in the country.

Got tips? Send ’em to tips@thedrive.com