Adobe: Generative AI Fears Create An Opportunity (Ratings Upgrade)

wwing

Adobe (NASDAQ:ADBE) was once considered a clear generative AI winner, but I am now seeing an increasing number of investors grow fearful of potential long-term risks. That is an argument that I have been making for nearly a year, though these fears continue to be missing from the stellar financial results. The company has sustained enviable double-digit top-line growth alongside robust profit margins, and management continues to direct free cash flow toward share repurchases. The company maintains a strong net cash balance sheet, helping to position the company to weather any potential storm. While I remain of the view that generative AI presents some long-term uncertainty, I believe that the stock is offering an attractive valuation in light of the strong financial metrics. I am now upgrading the stock to buy.

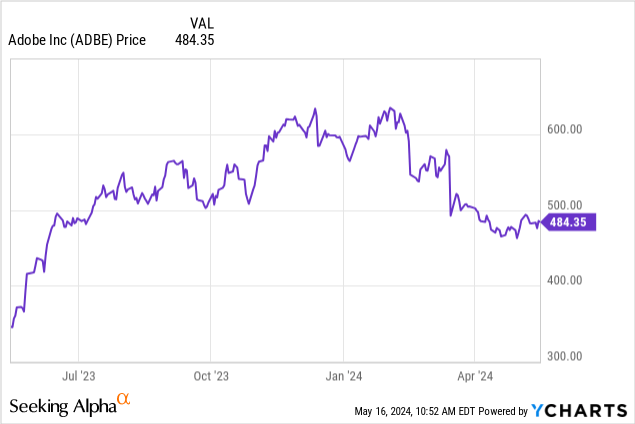

ADBE Stock Price

I last covered ADBE in February, where I reiterated my avoid rating on account of the poor risk-reward profile against competitive and potential generative AI threats. The stock has since underperformed the broader market by double digits.

I actually have been warning against the valuation ever since June 2023 – the stock has underperformed the broader market by a hefty sum in all my coverage since then. After a long period of underperformance, as well as my growing conviction in high-quality tech stocks, I am finally of the view that enough is enough – it is time to buy the stock.

ADBE Stock Key Metrics

ADBE has embraced the rise of generative AI by quickly integrating it into its products through its Firefly offering. That initially allowed the stock to soar as the company benefited from an initial generative AI boost to growth, but now comes the hard part as the company begins to lap those tough comparables.

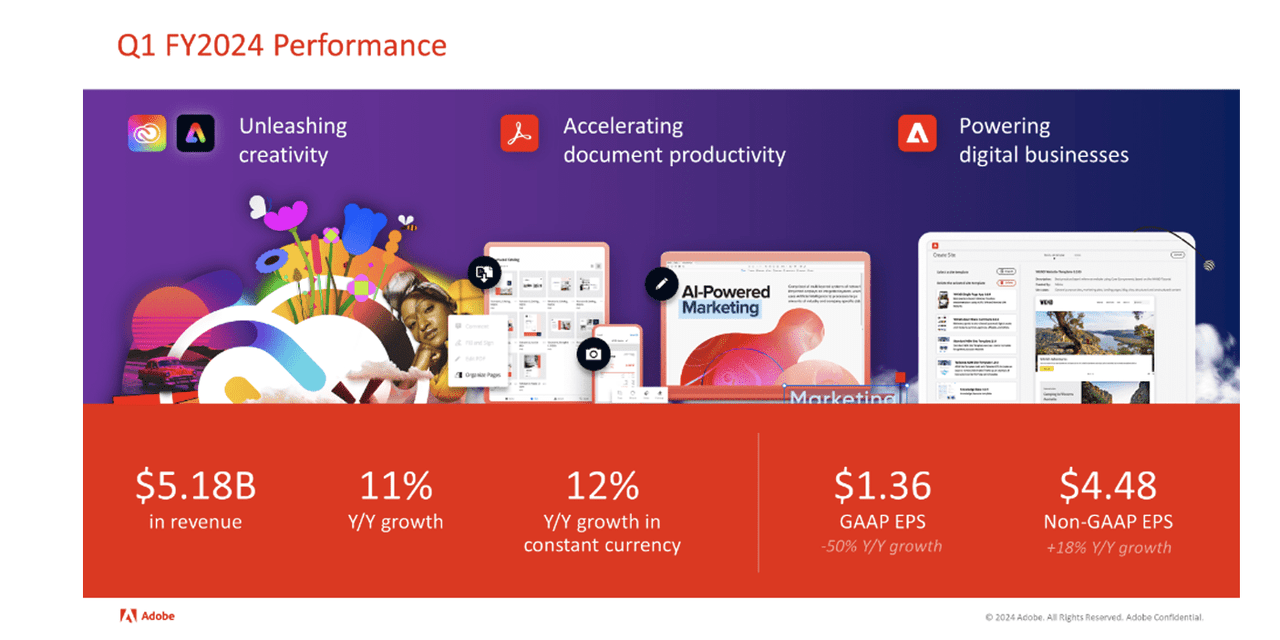

In its most recent quarter, ADBE generated 11% YoY revenue growth to $5.18 billion, narrowly surpassing guidance for $5.1 billion to $5.15 billion. The company generated $4.48 in non-GAAP EPS, also narrowly surpassing guidance for $4.35 to $4.40. For a company that typically crushes guidance by a wide margin, the more modest beat may have disappointed some investors.

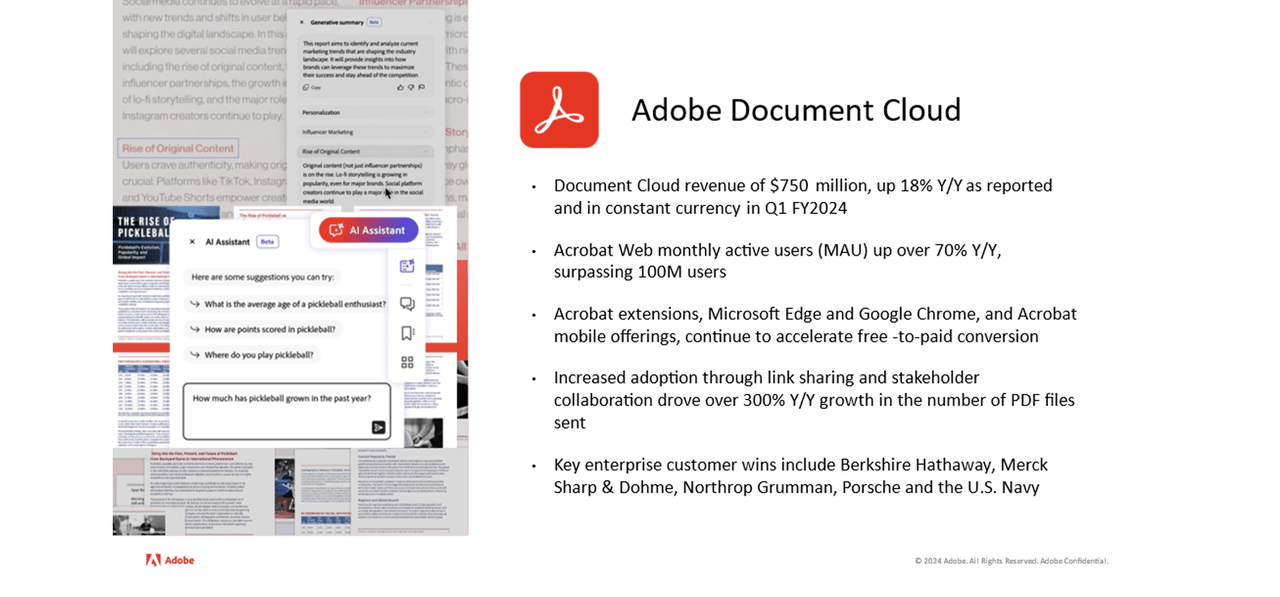

Management notes that GAAP EPS was negatively impacted by the hefty $1 billion termination payout made to Figma as a result of the failed merger. The Document Cloud segment continued to be the strongest performing product, with revenue growing 18% YoY.

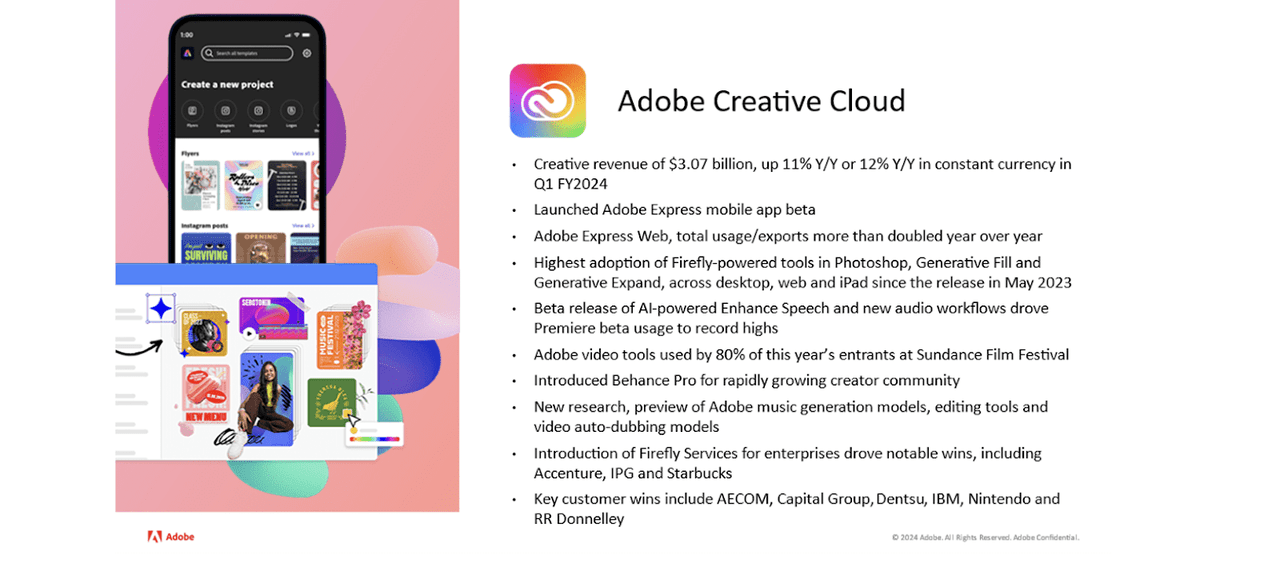

The company’s core offering in the Creative Cloud (which includes well-known products like Photoshop and Illustrator) saw revenues grow at 11% YoY, an incredible feat given the large nominal revenue generation of this segment.

ADBE exited the quarter with $17.58 billion in remaining performance obligations (‘RPOs’), representing 16% YoY growth. Investors sometimes view RPO growth as a potential leading indicator of future revenue growth.

ADBE had $6.8 billion of cash versus $3.6 billion of debt, representing a pristine balance sheet. The company repurchased 3.1 million shares in the quarter, with management authorizing a new $25 billion share repurchase program.

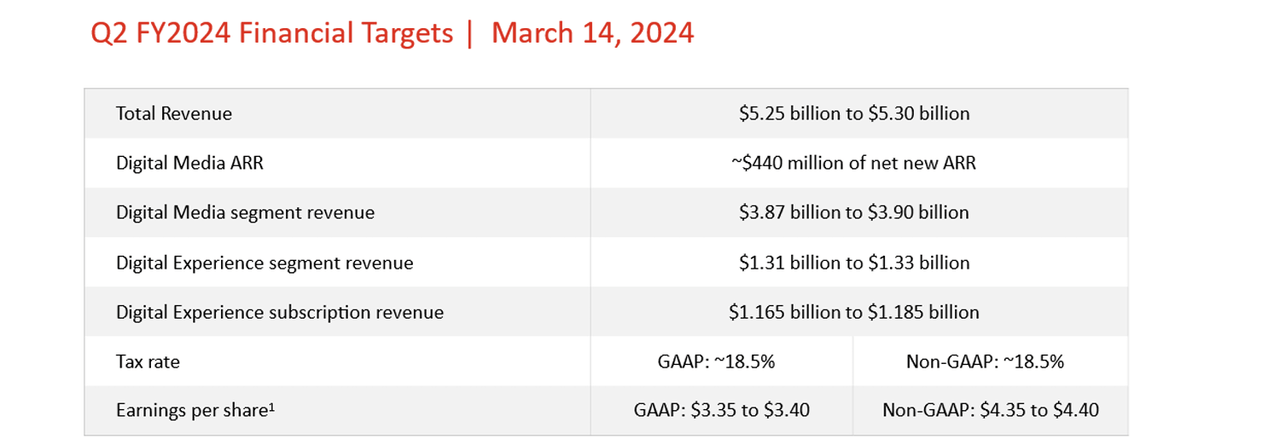

Looking ahead, management has guided for the second quarter to see up to $5.3 billion in revenue (consensus estimates call for $5.29 billion), representing 10.4% YoY growth and up to $4.40 in non-GAAP EPS (versus consensus estimates of $4.39). Consensus estimates call for $5.29 billion in revenues and $4.39 in non-GAAP EPS. While the company narrowly beat guidance in this past quarter, I find consensus estimates to look quite achievable, at least for this upcoming quarter.

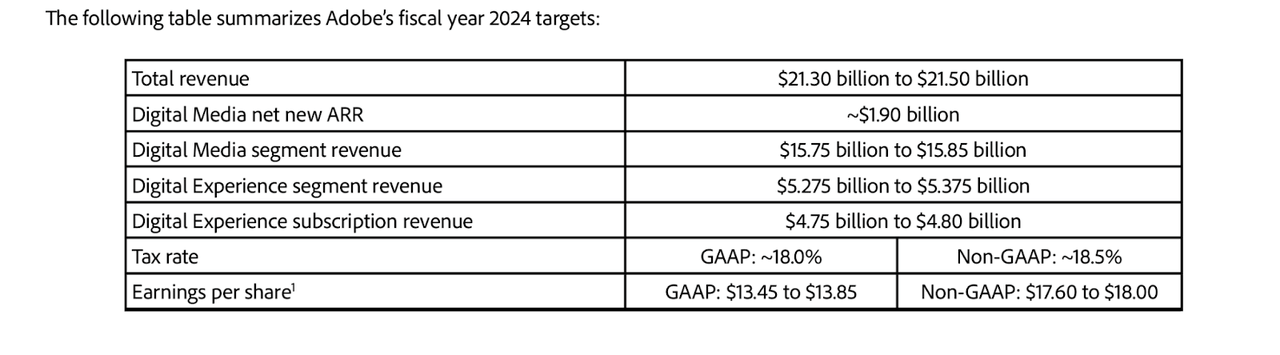

It is notable that the press release did not explicitly include verbiage on full-year targets, but on the conference call, management reiterated confidence in those targets, stating that they do believe in their ability to meet expectations for a second-half ramp-up. To refresh readers’ memories, management had previously guided towards $1.9 billion in digital media net new ARR, which looks like an ambitious target given that management is guiding for only $440 million in the second quarter.

Management also addressed the main bear thesis: potential risk from generative AI. Whereas some investors (including yours truly) may be fearful that generative AI may elevate competitive risks, management has a different view. Management noted that an increase in text-to-image generation leads to more content that needs editing, creating tailwinds for the entire industry. Management also noted that it isn’t enough to create any image – it has to be based on models that are easily editable. The fact that Adobe Firefly is directly integrated in ADBE’s products makes the company well-positioned in this regard. This commentary does make some sense, even if I remain unconvinced about the competitive threat outlook. It’s instead valuation that has brought me back to the name.

Is ADBE Stock A Buy, Sell, or Hold?

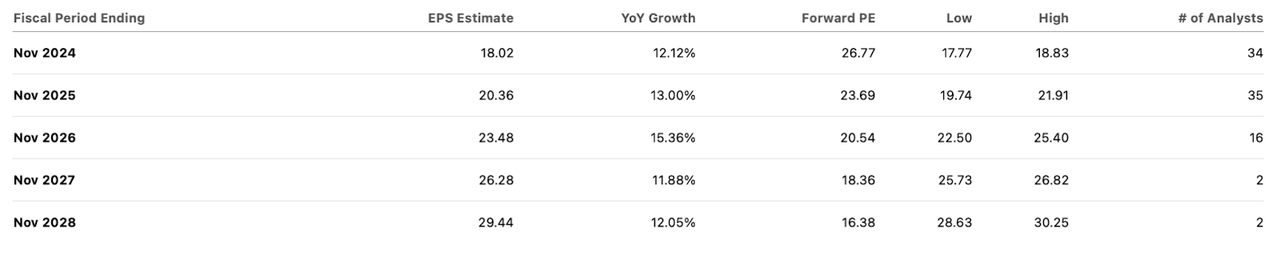

ADBE still trades at the same price it did 4 years ago, which implies great valuation compression since then. The stock recently traded hands at just under 27x earnings, well under its 36x 5-year average.

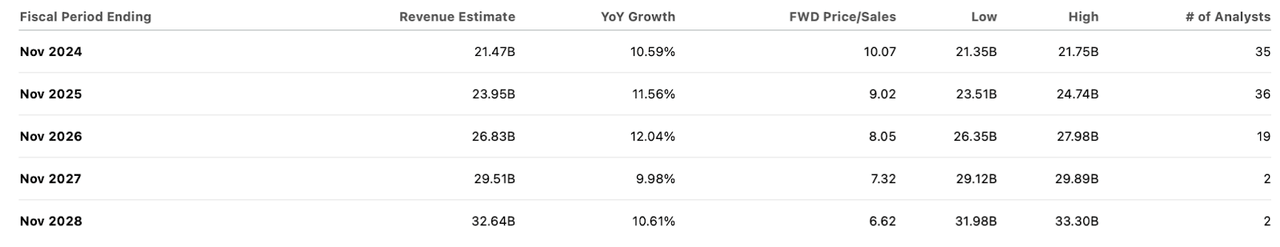

Consensus estimates call for the company to sustain low double-digit top-line growth at least in the medium term.

In my prior reports, I was quite bearish on the stock due to valuation, as I felt that the prospective return potential was not high enough given the aggressive assumptions needed to reach estimates. The stock has pulled back while the company has sustained strong growth, helping to ease these valuation concerns somewhat. But beyond just this individual picture, I am also growing of the view that tech stocks overall (with a mind on valuation) may outperform the broader markets on account of their highly recurring revenue streams and secular top-line growth rates. Tech stocks performed admirably since the 2022 tech crash, showing that they can raise profit margins essentially “at will” in spite of the rising interest rate environment. I expect high-quality tech stocks across the board to be able to sustain rich multiples even as their growth rates mature. In the case of ADBE, I can see the stock sustaining a 10x sales multiple at the very least over the long term. I see the company generating 45% net margins over the long term, meaning that a 10x sales multiple equates to a 22x earnings multiple, which looks quite reasonable given the aforementioned recurring revenue business model, high profit margins, and net cash balance sheet. That would imply that the stock might deliver annual returns in line with its revenue growth rate plus the earnings yield, which might total around 15% annually over the next several years. That return profile looks attractive given the strong balance sheet.

Adobe Stock Risks

It is possible that ADBE will see revenue growth rates slow down considerably, perhaps due to competition or simply the law of large numbers. There are cheaper tech stocks available in my coverage universe, and ADBE certainly trades near the high end of what I consider fair value to be for the stock. That suggests that volatility is possible for the stock, especially if Wall Street begins to doubt the high-quality assessment for the revenue stream. It is possible that my projected re-rating for tech stocks does not occur, as it is true that we are still only a handful of years removed from the 2022 tech crash, when sentiment towards tech stocks turned exceedingly bearish.

Adobe Stock Conclusion

ADBE appears to be offering investors a nice combination of secular top-line growth and best-in-class profit margins. The company is repurchasing stock and maintains a net cash balance sheet. Wall Street appears to be concerned about long-term generative AI threats, but for now, the company appears to be reaping the benefits from integrating generative AI across its product suites. At this valuation, I am less concerned about that tail-end risk as the company’s strong financial footing makes the prospective return profile quite attractive. I am upgrading the stock to buy.