Affirm hits it out of the park with their earnings

Affirm reported earnings before the bell this morning and, in the words of CEO Max Levchin on X, “In the parlance of our times, we slayed.” Yes, it was a terrific quarter, continuing the excellent run of earnings from the fintech sector so far this earnings season. Keep in mind that this was Affirm’s Q3 2024 earnings. as their fiscal year goes from July 1 to June 30.

Solid Growth and Strategic Innovations Fuel Progress

Affirm’s third fiscal quarter of 2024 marked another period of strong performance, setting a new benchmark for the company’s operational and financial metrics. As fintech continues to evolve at a rapid pace, Affirm’s latest results provide valuable insights for executives in the fintech sector. Here’s an analysis of the key takeaways from Affirm’s third-quarter shareholder letter.

Continued Growth in Gross Merchandise Volume (GMV)

Affirm reported a robust 36% year-over-year growth in GMV, totaling $6.3 billion. This growth is not only a testament to Affirm’s expanding market presence but also reflects the effective engagement strategies the company has implemented across its top merchant and platform partners. The diversity in product categories contributing to this growth—especially general merchandise and travel and ticketing—highlights Affirm’s strong adaptability to consumer demands and market trends.

Enhancements in Core Products and Services

A significant highlight of the quarter was the enhancement of core products like the Affirm-built AI assistant, which has improved customer support efficiency, with over 60% of customer interactions resolved without human intervention. Additionally, the introduction of an embeddable version of the Purchasing Power feature marks a strategic move to improve end-to-end checkout conversions through deeper integration at points of sale.

Revenue Performance and Profitability

Affirm’s revenue saw a substantial increase, growing 51% year-over-year to $576 million. This increase was largely driven by a significant rise in interest income, reflecting the successful implementation of pricing initiatives and an increased balance of loans held for investment. Revenue Less Transaction Costs (RLTC) also grew impressively by 38% to $231 million, with RLTC as a percentage of GMV slightly increasing, indicating improved profitability and efficient cost management.

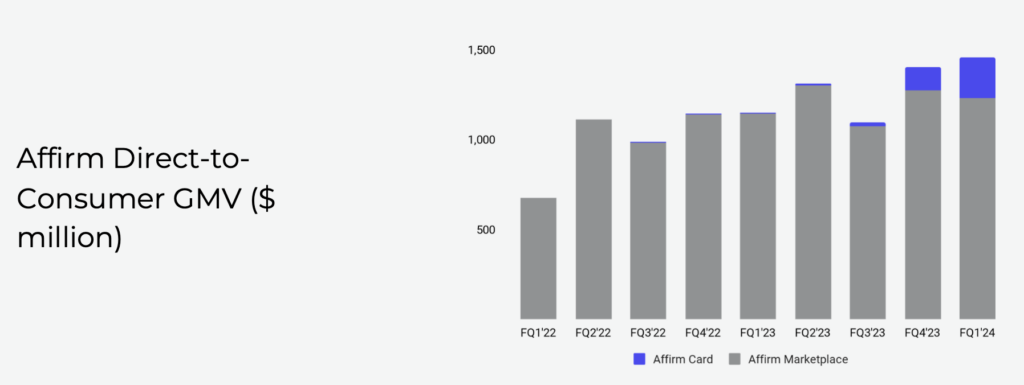

Strategic Focus on the Affirm Card

The Affirm Card has been a focal point of the company’s strategy to capture more of the average annual spend of its users. With active cardholders crossing the one million mark post-quarter, the product continues to show strong user engagement and spending in new categories such as restaurants and home improvement. This expansion into traditionally non-addressed categories by Affirm underscores its strategic intent to broaden its market reach and utility.

Operational Efficiency and Adjusted Operating Income

Affirm reported a substantial improvement in operating income, reducing its operating loss significantly from the previous year. Adjusted Operating Income stood at $79 million, a stark contrast to a loss in the prior year, highlighting effective cost management and operational efficiency improvements. The reduction in technology and data analytics expenses, alongside savings from restructuring efforts, played a crucial role in this turnaround.

Looking Ahead

As Affirm moves forward, the company remains well-positioned to capitalize on its strategic initiatives and robust platform. With a focus on expanding its technological capabilities and enhancing product offerings, Affirm is set to continue its trajectory of growth and market penetration. The integration of AI and advanced analytics into its services will likely bolster its competitive edge and appeal to a broader consumer base.

Final Thoughts

Affirm’s third fiscal quarter results reflect a company that is not only growing in terms of numbers but is also making significant strides in operational efficiency and product innovation. For industry leaders and executives, understanding Affirm’s strategic maneuvers—especially in product integration and technological enhancements—offers valuable lessons in sustaining growth and adapting to the dynamic fintech environment. As Affirm prepares for future challenges and opportunities, its trajectory provides a promising outlook for stakeholders invested in the evolving landscape of financial technology.