Alphabet Goes All In on Artificial Intelligence (AI). Is It Time to Go All In on the Stock?

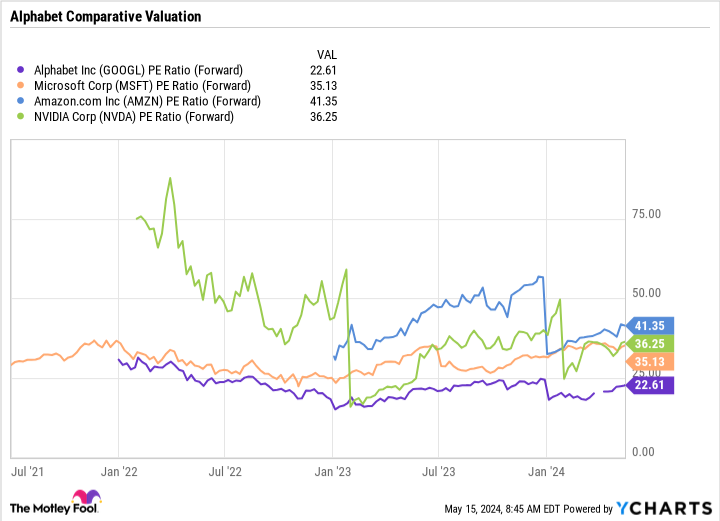

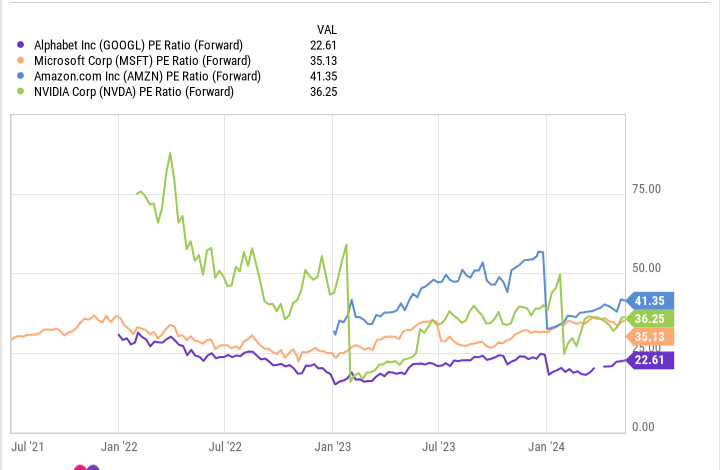

Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) showed that it’s going all in on artificial intelligence (AI), unveiling new AI features and products at its Google I/O developer conference on May 14. The company has long invested in AI, but there have been some lingering doubts among investors that it is behind and that AI could disrupt its dominant position in search. This can be seen in the company’s valuation, which trails other leading large-cap AI names.

The company, however, has been working to dispel this notion. Its recent developer conference was the latest foray to show its AI innovations.

AI-powered search

The biggest announcement to come out of the developer conference undoubtedly is that Alphabet is set to fully incorporate AI overlays into its Google search results.

Google search has long been based on the company serving up website links to search queries. That will remain for the simple queries that Google typically serves alongside ads when giving search results. However, for more complex subjects and searches, the company will now provide AI-generated summaries at the top of its search results.

The new AI search overlays are currently being rolled out. They’re expected to reach 1 billion people by the end of the year.

One debate that remains is how Alphabet will make money from AI search. Google only monetizes about 20% of its searches with ads and only gets paid if users find those ads useful and click on them. That means that the company currently doesn’t make money on 80% of the searches it runs.

AI overlay results will likely be used for the search queries that the company doesn’t currently monetize. However, Alphabet management has already talked about adding ads into its search generative experience (SGE) and experimenting with new ad formats. This will basically open up monetization opportunities for the 80% of search traffic on which it currently doesn’t make money.

That will provide a long growth runway, which currently isn’t reflected in Alphabet’s valuation.

Other AI innovations

Alphabet isn’t stopping with search when it comes to AI innovations. Its newly bolstered Gemini AI model will be incorporated in various products.

This will include a new AI assistant named Gemini Live that will be able to take voice commands and interact with apps such as Gmail and Google Messages. The AI assistant will also be able to access a smartphone’s camera and allow Gemini Live to interact with the real world and what it can see through the camera lens

The company demonstrated that its new AI-search assistant can craft plans for users, as well. One example that it used was finding a recipe and then adding the ingredients needed into a shopping list. The AI overlay was also able to adjust the recipe’s measurements for the number of people being served. This feature can also be used to plan vacations and make itineraries and recommendations.

Alphabet also built Gemini into its Workspace line of products. It will be accessible as a side panel on apps like Gmail and Google Docs and be able to summarize emails and suggest responses, as well as translate different languages.

The company demonstrated setting up a virtual teammate within Workspace that can be tasked with various duties, such as monitoring and tracking projects and organizing information. Gemini for Workspace is a paid add-on subscription that costs about $20 a month per user for up to 1,000 uses a month.

It also introduced Gemini Nano specifically for Android Pixel smartphones, which will work without an internet connection. Nano can do such things as summarize conversations, lectures, or interviews, as well as detecting suspicious financial activity and fraud. Other AI features that Alphabet demonstrated included VideoFX, which lets users use AI to help create 1080p videos; AI image generator Imaggen 3; and Ask Photos, which allows users to search for photos and videos through natural conversation.

While most of these innovations are incremental, they demonstrate that Google isn’t sitting back when it comes to AI. The company generates a lot of cash and will continue to invest in this area.

Time to go all in on the stock

Alphabet is among the cheapest of the large-cap companies investing heavily in AI, trading at just over a 22.5x forward price-to-earnings ratio (P/E). Valuation alone, though, isn’t enough reason to buy the stock. However, the company could very well be one of the biggest AI winners — if not the biggest.

First, Alphabet has developed and owns its own large language model (LLM) that it can tie into decades of search datasets and analytics that can be used for training. It also has its own cloud offering and hardware ecosystem that it can monetize further by incorporating AI features. That in and of itself is powerful, and no other company offers all that.

In addition, Alphabet now has an opportunity to slowly monetize the 80% of search results from which it currently wasn’t generating any revenue. That’s a huge opportunity.

So yes, it does look like a great time for long-term investors to invest in Alphabet stock. The company is an undervalued AI leader with a lot of potential.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Alphabet Goes All In on Artificial Intelligence (AI). Is It Time to Go All In on the Stock? was originally published by The Motley Fool