American Express unveils its approach to generative AI

For now,

Amex’s approach is representative of financial services companies edging into the world of generative AI but hesitant to mix customer data into their usage.

Bhavi Mehta, the global head of AI for financial services at Bain, finds that the vast majority of financial services companies use closed-source generative AI models from OpenAI,

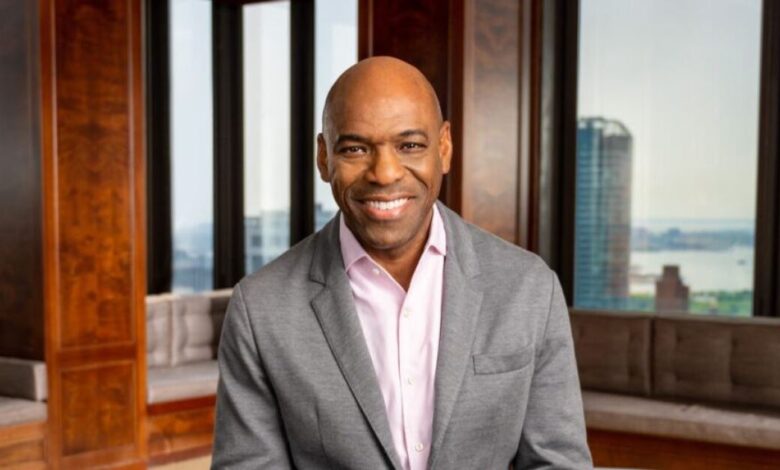

Amex has been using AI and machine learning since 2010, starting with credit risk analysis and fraud detection. But Anré Williams, CEO of American Express National Bank and group president of enterprise services at American Express, sees “tremendous potential” in using generative AI to drill down into more specific recommendations for customers and to bolster customer support.

“I’ve been fascinated by the volume of information generative AI can take in and come back with answers in a concise, conversational manner,” said Williams. “The speed with which it can do it is the groundbreaking thing.”

To prepare for this new wave of technology, Amex convened a generative AI council a year ago to prioritize use cases, manage risk and ensure responsible implementation. It sourced senior leaders from functions including model building, technology, servicing and legal to guide its approach to generative AI.

Five hundred use cases have bubbled to the surface from

“Some were learning opportunities,” said Williams. “In some we saw great potential, and we’ve seen them scale.”

One pilot explored the potential of generative AI copilots to improve recommendations in Amex’s travel agency for Platinum and Centurion cardholders. For instance, if a customer calls and asks for pet-friendly hotels in a preferred neighborhood in a specific city, “it’s not necessarily easy to find,” said Williams. Conjuring up an accurate list from the internet takes time, and the agent may even need to call the customer back or email suggestions later.

Amex agents experimented with feeding such queries into a

Another use case involved Amex’s software engineers. Amex tested a copilot specific to developers for them to seek help with code generation. The tool has knowledge of the way code is typically written and context of what the software engineer might have open on their desktop.

“We believe this enhances their work and gives them more time to spend on complex tasks,” said Williams. The results so far have borne that out: engineers reported that using this copilot saves them 10% of the total time for their work. Early results also suggest it increases satisfaction. In a 2023 survey of developer sentiment, Amex found that 60% of the developers that participated in the survey felt that Amex’s technology ecosystem, or the tools, applications and platforms that they have access to, is intuitive and helpful. A more recent survey gauging their satisfaction with this copilot found that 85% gave it high marks for satisfaction.

All 6,000 software engineers at Amex will get access by the end of June.

The use of copilots that help write code is “huge” in terms of unlocking productivity for organizations with large tech teams, said Mehta. Shadman Zafar at Citi, for example,

For now, Amex’s early experimentations have been with commercial large language models, open-source models, and some models embedded directly into other commercial products. The company is open to changing providers if a model it prefers emerges several months down the line. It does not currently plan to build its own LLM.

Closed-source models tend to perform better and are the quickest way to build muscle around generative AI because they need less infrastructure to maintain, said Mehta. Open source gives an organization more control over model architecture and data flow.

“But in the end I don’t think there will be one [approach],” said Mehta. “Depending on what you are working on and the capabilities required, organizations will have both.”

Amex has also kept employees in the loop rather than deliver generative AI recommendations directly to customers.

“We’re not making credit line or approval decisions using generative AI,” said Williams.

In the travel agency pilot, counselors validated the information returned by the copilot.

“At this point we’re not necessarily validating responses because we did enough of that in early ones to have confidence it’s accurate,” said Williams.

He also notes that Amex’s software engineers review each line of code and take the copilot’s suggestions only a quarter of the time, meaning three-quarters of the time they reject its code recommendations.

Amex declined to disclose the amount it has invested in generative AI, but says these investments include technology infrastructure, purchases of commercial software and licenses, and talent. Several thousand of its 10,000 technology organization employees are working on generative AI initiatives in some capacity; Amex has hired a few hundred more to support its expansion.

Despite the excitement about large language models, Mehta believes there is still a lot of untapped potential in more traditional forms of AI and machine learning for financial services companies.

“They should not forget that a lot of their data is structured data and not everyone is using classic machine learning models at the level they could,” he said. “Some of our banks are saying, ‘I need to first get my act together on classic machine learning and I will be a fast follower on generative AI while others figure it out.'”