Arizonans locked out of accounts after Synapse bankruptcy

Paying for rent, mortgage, groceries, gas, and fun – life is expensive! But what happens to a person’s life if they lose access to their money? Right now, that’s the reality many Americans are facing.

The banking accounts of thousands of consumers and businesses have been locked for weeks. At the center of the crisis is a dispute between fintech startup Synapse, and its banking partners. Synapse serves as a middle man between customer-facing financial technology, or fintech, brands and FDIC-backed banks.

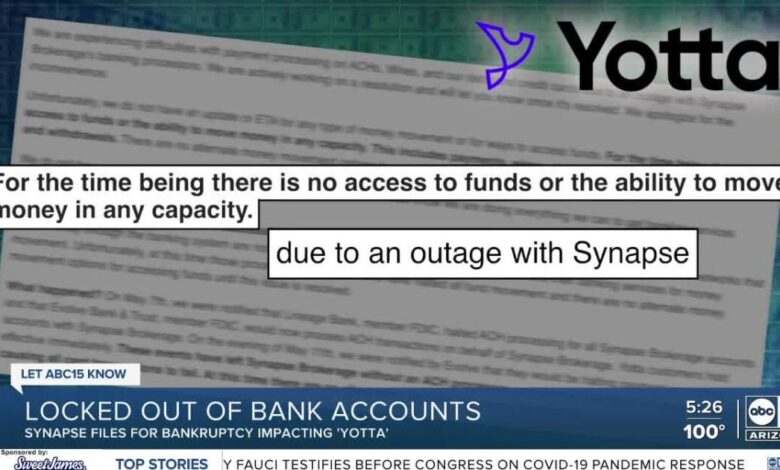

Synapse filed for Chapter 11 bankruptcy protection in April and shut down its services to some of its fintech partners, including Yotta. Yotta is an online application that gives users the chance to win prizes for saving money. Since Synapse shut down its services, Yotta has been unable to process transactions, according to its website.

It’s impacting people like Carl who Let ABC15 Know about his experience. Carl writes in an email “I was supposed to get my paycheck last week and I haven’t gotten it yet. I also can’t access my own money or withdraw it. I’m struggling right now financially because of this…”

In an email to consumers, Yotta states there is no access to funds or the ability to move money in any capacity due to Synapse’s systems being shut off. According to Yotta’s website, a Chapter 11 trustee has been appointed to the Synapse case but an update isn’t expected until June 6.

Latest from Let ABC15 Know:

For years, traditional bankers and consumer advocates have criticized the fintech model of doing business. More often than not, fintech companies are not actual banks. Instead, these companies partner with banks – many of them smaller institutions – and use the bank as a place to store customer finds without having to be a bank themselves. To operate like this, the fintech companies often need a middleman to do the bookkeeping – that’s where Synapse comes into play. However, since none of the banks Synapse has worked with have failed, there is no eligibility for FDIC deposit insurance to be paid out.

It’s not the first time a fintech failure has negatively impacted consumers’ bottom line. In 2015, hundreds of thousands of customers of RushCard, a prepaid debit card company, were frozen out of their funds after a botched software update. The company was later fined $13 million dollars by the Consumer Financial Protection Bureau.

If you have been impacted and need to file a complaint contact the FDIC by phone at 1-877-275-3342 or online.

If you would like to weigh in on regulations regarding fintech, reach out to the Consumer Financial Protection Bureau by phone or online.