Artificial Intelligence And Utilities, Whoda Thunk? Likely Beneficiary: UTG (NYSE:UTG)

mysticenergy

One of our long-time favorite closed-end funds has been Reaves Utility Income Fund (NYSE:UTG). Utilities have been one of the most solid dividend payers and growers over many years, and certainly seem like they would be a logical component of an Income Factory. UTG pays a dependable dividend, currently 8.3%, that has increased 12 times since the fund’s inception 20 years ago.

This is especially important, at a time when we worry a lot about “yield chasing,” where investors become so enamored of the high yields of some funds that they forget to check whether the fund is actually earning its high yield, as opposed to paying out a distribution that is higher than the fund’s total return. When that happens, the difference between the higher yield and the lower total return has to come out of somewhere; and where it comes out of is the market price and/or the net asset value of the fund. In other words, a fund that pays a yield of, say, 16% per annum, but only has a total return averaging 12% per annum (which is still very good!), must be experiencing a price/value slippage of the 4% difference.

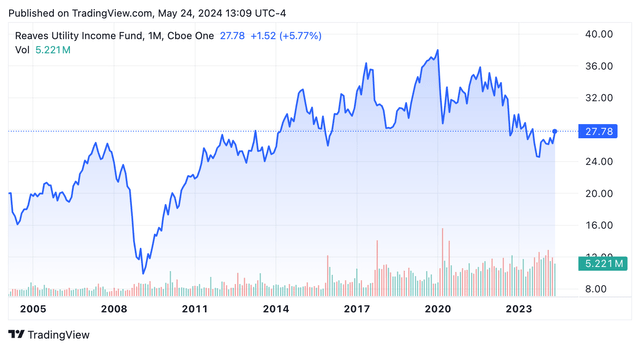

Fortunately, we haven’t seen that happen over UTG’s history, where its overall price has actually increased from $20 to its current almost $28 over the course of its life; while also paying us generous dividends that it has increased repeatedly.

This chart just shows the price growth, which if it were a normal growth stock fund that only paid a 1-2% per annum yield, would look pretty meager. But with Income Factory investing, where we expect most or all of our targeted return of 8-10% to come from our cash yields, we are generally happy to see our holdings just retain their value over the long term, as long as we can create our own growth by collecting and reinvesting that “river of cash” in the form of our high yields. That’s why UTG, having retained and slowly added to its market price and net asset value over time, while paying generous and steadily growing dividends, has earned a position on so many income investors’ “short lists” of long-term “buy ’em and hold ’em” positions.

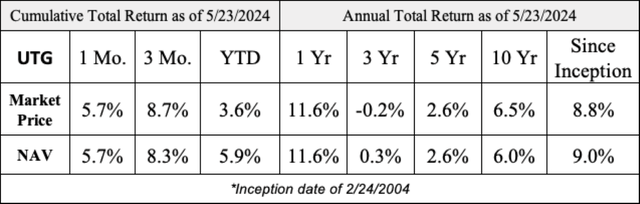

This table shows the total returns (cash income distributions PLUS capital gain or loss) over the 20 years since UTG was launched in 2004. As you can see, the fund earned an average total return on its NAV of about 9% per annum over that time, which is pretty impressive when you consider that it included a long period of Fed “zero-interest-rate” policy, when inflation and base interest rate expectations were artificially low, bringing expected rates of return down with them (for a while, at least, in what PIMCO’s Bill Gross and Mohammed El-Erian originally dubbed “the new normal,” although it didn’t last too long.) Later on UTG was hammered, with the utilities industry generally, by the higher interest rates of recent years, which drove up borrowing costs for industries, like utilities, that are capital intensive and heavily dependent on long-term bond markets.

While I’m pleased that the fund has done so well over the long term, with its 9% average return through the various ups and downs of the past 20 years, I am even more heartened by the 11.6% total return over the past year, which seems to be continuing in the solid 1-month, 3-month, and year-to-date results. I am also heartened by UTG’s co-manager and chief investment officer Tim Porter’s comments, when announcing the latest distribution payments: “We remain confident that our portfolio of utility and infrastructure companies will continue to support the Fund’s monthly distribution to shareholders.”

I don’t think a fund with UTG’s record and reputation would risk its credibility by saying that so confidently if they didn’t mean it. Also, they were announcing the distribution for the following three months, not just a single month, which is another sign of confidence.

I believe there is reason for us to feel confident that UTG’s and the utility industries prospects are positive for several reasons. While utility firms are heavily dependent on capital and long-term interest rates, most of them are also “regulated industries.” That means, unlike most industries, the rates they charge customers are determined by state regulators who consider their cost of capital as a part of their cost structure. So while their costs may jump when interest rates increase, just like other highly capital-dependent companies, within a reasonable period of time they will get relief from the higher costs by being able to pass those costs onto their customers. So even if we believe we are destined for “higher-rates for longer” (which I believe we are, since rates aren’t really all that high, compared to averages over the past 40-50 years), I think regulated utilities and funds like UTG that buy them, will be fine in the long-term and be able to resume their winning ways, if they haven’t already done so.

But there’s more!

I have also been happy to note that there has been a lot in the financial press recently about artificial intelligence and the industries that will benefit from it. Besides the obvious industry participants, like NVIDIA (NVDA), recently a lot of attention has been focused on the huge role utilities will have to play in producing the electrical power required to create and run the programs needed to “train” the AI programs as well as to maintain and run them, as a multitude of industries and companies adopt, get up to speed with, and utilize the various new technologies.

I don’t claim to be an expert on this, but I was impressed with some articles by Goldman Sachs (article link here) as well as this one by Reaves itself (article link here), describing the link between AI and the utilities industries and the opportunities it presented. This Fortune article headline seemed to say it all: “Wall Street finds a back door into the AI stock boom as energy demand soars: utilities.”

I’ve owned UTG for years in my personal portfolio as well as in our model portfolios, both Core and Taxable. I’ve been buying more recently, even though I wish it were cheaper. (It’s slightly above par right now).