Autonomous Operations Could Threaten Intuitive Surgical’s Moat in Robotic Surgery

As artificial intelligence has now had its moment to hit the mainstream, many investors are wondering what the next field to be noticed by the masses will be. Forbes recently released a video where OpenAI’s first investor, Vinod Khosla, mentioned he believes it will be robotics. A similar sentiment is also shared by Nvidia (NASDAQ:NVDA) CEO Jensen Huang, which he mentioned in an interview on CNBC a year ago. In fact, Huang specifically mentioned robotic surgery as one of the potentially highly accretive sectors of the not-too-distant future, where AI meets the physical world more noticeably.

I agree that one of the industries that robotics will be able to most powerfully transform is health care, particularly surgical operations. The reason I believe this is it will be increasingly more viable for lower-risk, robotics-assisted surgeries to eventually become the norm. Indeed, this is already happening and one of the companies leading the way is Intuitive Surgical Inc. (NASDAQ:ISRG).

Operations analysis

Founded in 1995, Intuitive Surgical was publicly listed in 2000. It has become famous in the health care industry for offering surgeons a lower-risk, more precise surgical method, which is minimally invasive and also primarily performed by robotic endpoints touching the patient’s body. The surgeon stands behind a screen with 3D vision separate from the operating table, akin to operating remotely.

The company’s most well-known product is called the da Vinci surgical system, which is sold to hospitals and surgical centers. The company also offers various instruments and accessories that are compatible with da Vinci systems. Notably, a lot of the instruments are single-use or have a limited number of uses, which has developed a recurring revenue model for Intuitive Surgical; servicing, surgeon training and software updates also help contribute to this. Another prominent revenue driver is its system called Ion Endoluminal, which is designed for minimally invasive biopsies of the lung.

Intuitive Surgical is the largest robotic surgery company in the world with a market cap of $135.87 billion at the time of writing. As such, it is arguably positioned to capitalize extremely well off of the growing trend in AI, automation and robotics. I believe one day it will be possible for surgery to be able to be performed fully autonomously, with human supervision. I believe this will not only be more cost-effective, but also safer, less invasive and more precise. The reason I say this is that with highly advanced AI integrated into these systems, robotic surgery has the potential to have fuller vision and use movements in operations that humans simply do not have access to.

At this stage, the da Vinci system is about as close to this as we can get, and it seems to be doing an exceptional job of integrating the technology available with the comfort levels of health care professionals, adhering to regulatory compliance and rigorous training standards for surgeons. Additionally, Intuitive Surgical now has its brand very well-established, predominantly in the United States, but also outside of it. It is growing a moat in the sense that hospitals and surgical centers are already heavily invested in Intuitive Surgical’s equipment. All the company has to do is continue to evolve its offerings at a competitive rate and hospitals will be both wise and financially prudent to continue with Intuitive Surgical as a dominant equipment provider. The main risk here, which I will expand on later, is that new, more advanced developments are brought to market by a competitor, which might include more fully autonomous and deeper AI-assisted services, significantly reducing the competitive value of systems like da Vinci as they currently stand.

Financial considerations

One of the financial elements that I am most impressed by with Intuitive Surgical is it carries no typical debt. As such, its balance sheet is in immensely good shape, with an equity-to-asset ratio of 0.88. The company is so well structured in this regard that it has not had any debt as far back as 2004. I believe this places the company in a very strong position. Not only is it much more secure in the case of recessions, but it is well-prepared to take on any reasonable amount of debt it might consider in the future to fund advancements in autonomous surgery and AI assistance that could keep its competitive advantage intact.

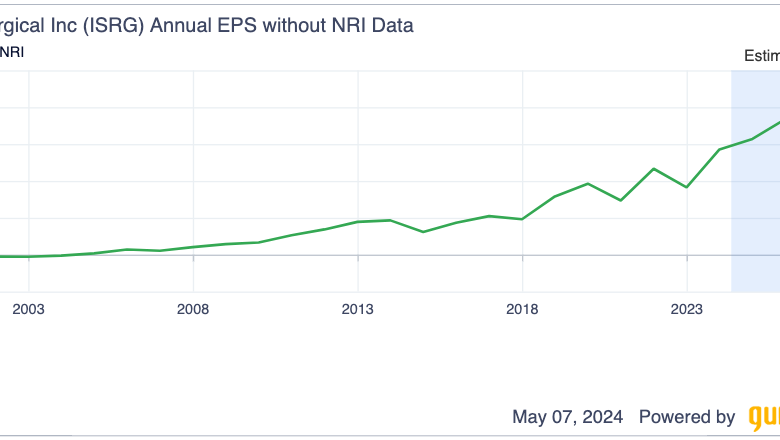

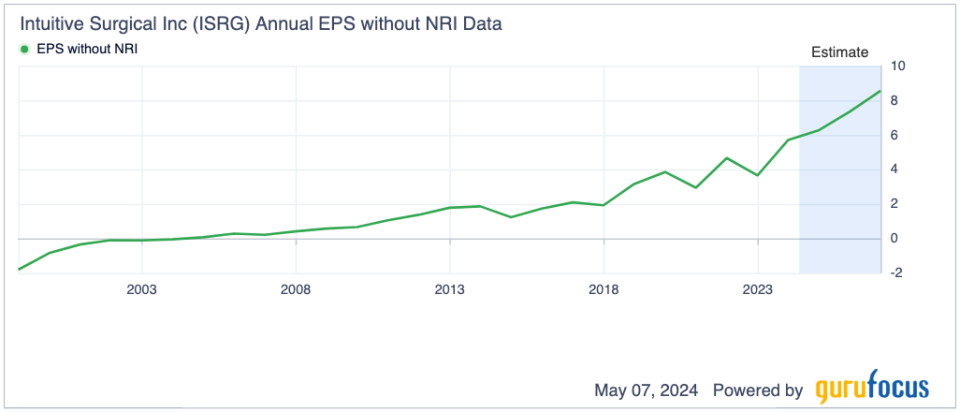

Additionally, the company has extremely high growth. Its three-year revenue growth rate is 18.20%, while its three-year earnings per share without nonrecurring items growth rate, which is perhaps the most important, is an even larger 24.80%. The consensus analyst estimates for the company’s earnings growth rate are also strong, with a compound annual growth rate expected of 14.45% from 2023 until 2026.

Most investors do not dispute the attraction of Intuitive Surgical, based primarily on the excellence and moat in operations I outlined above, and the two core financial elements presented. However, where people are rationally deterred is the company’s valuation. At the time of writing, Intuitive Surgical has a price-earnings ratio of almost 70 and a forward price-earnings ratio of around 61. This is rationally unsettling for some investors, and it does present some reasonable concern about the speculative nature of an investment in Intuitive Surgical as it is trading much higher than what would be deemed intrinsic value by a discounted earnings model.

Consider the following as a reference point. In a discounted earnings model, I estimated a 17.50% earnings per share without NRI CAGR for the next 10 years, a 4% earnings per share without NRI CAGR for the 10 years following that, as it is in line with U.S. inflation, and a 10% discount rate, as that is my low-end total portfolio return expectation. The intrinsic value alluded to is $165, while the stock price is $383 at the time of writing.

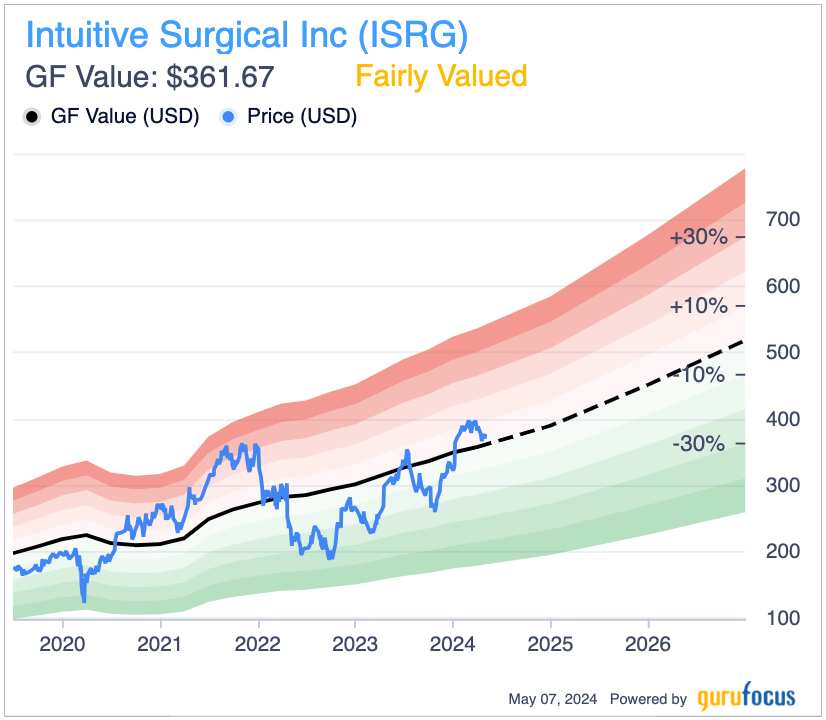

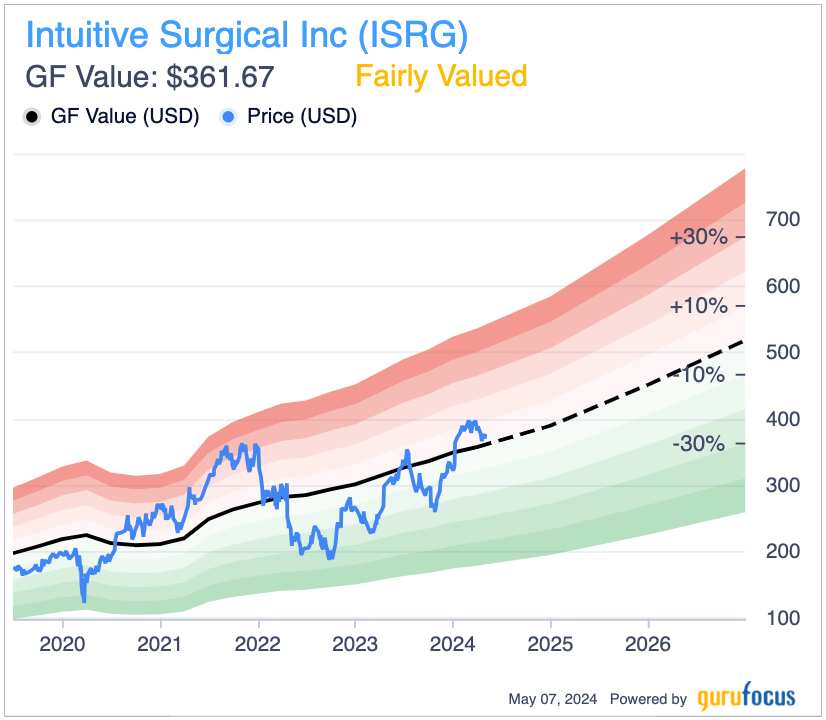

However, investors should remember Intuitive Surgical has traded at a median price-earnings ratio of 51 over the past 10 years. With the future looking evermore hinged on automation and robotics, I believe the higher demand we are likely to see for da Vinci systems sustained over the long-term future compared to historically elicits a higher price-earnings ratio at this time. From my analysis, and in line with what the GF Value chart depicts, it is reasonable to consider Intuitive Surgical fairly valued.

Competitive analysis

This competitive analysis will act as a litmus test on two measures. First, how well Intuitive Surgical appears compared to its dominant peers at this time. Second, it will act as a more future-oriented risk analysis that deciphers how Intuitive Surgical may fare in speculative but reasonable future scenarios that could place competitive pressure on the company and, in turn, reduce shareholder returns, which may be exacerbated by the already high valuation.

For instance, Medtronic’s (NYSE:MDT) Hugo system is similar to Intuitive’s da Vinci system, but offers more flexibility in operational capability, a deeper emphasis on the capability of collaboration between surgeons and a more comprehensive digital platform. The Hugo system is a newer entrant, and in many respects, even if it is better in some regards, the da Vinci system has a moat in being the first mover in the field. As I mentioned earlier, it is very unlikely for hospitals that are established with Intuitive Surgical to transfer providers unless the value added is remarkably high because of all of the associated costs.

Additionally, Johnson and Johnson (NYSE:JNJ) launched the Ottava robotic system, which offers six arms, a notable step up from the typical four arms in robotic surgery systems, including da Vinci. Again, the da Vinci systems have been in use since the late 1990s, and the Ottava system was only announced in 2019. I believe Ottava’s iteration is not pronounced enough to offer the significant competitive advantage that would disrupt Intuitive Surgical’s long-term moat.

Looking to the future, there are many newer startups, including CRM Surgical, Vicarious Surgical (NYSE:RBOT) and Activ Surgical, which are offering advanced AI and machine learning assistance in robotic surgery. However, developing fully autonomous surgery is a challenge, primarily as a result of regulatory hurdles and a shift required in public sentiment about safety. Even the very established companies I have mentioned above, including da Vinci, employ AI to some degree. However, this is the largest risk I can see for the da Vinci system and Intuitive Surgical moving forward. If new players provide more advanced technology, which paves the way for or eventually provides fully autonomous surgery, I believe the market for da Vinci systems will begin to wane unless it rapidly adapts accordingly. The good news is the company is well positioned at the cross-section of technology and surgery to be ready to make the necessary shifts. However, it takes a careful restructuring gradually away from core mechanics toward a deeper emphasis on machine and deep learning capabilities, which requires more software and program development, including applications, which evidently will require different skill sets to what da Vinci is used to and prepared for. If the company does not understand this threat enough, I believe the investment case may lose its attractiveness over the long term.

Key elements

Intuitive Surgical offers investors an extremely well-established moat in robotic surgery, with high initial purchase prices and a recurring revenue model. It is well positioned if it acts carefully to capitalize on the coming deeper emphasis on physical AI systems in the global economy.

The company is positioned well financially, with no debt and a remarkably strong balance sheet. It is also a high-growth enterprise. Investors just need to be careful of the valuation, as if future results do not prove as promising as now expected due to competitive threats coming to fruition, the stock price could meet a significant correction.

Its immediate competition does not look too daunting. However, investors must consider that over a long-term horizon, it is likely that new disruptive companies will rise that are more intelligently focused on AI-assisted and even fully autonomous robotic surgery, which could significantly displace Intuitive Surgical’s position in the market if it does not prepare in advance and with correct measures.

Overall, while the company has some significant long-term risks I need to keep an eye on, it looks very strong to me at this time. It is a likely portfolio addition for me in the next few months.

This article first appeared on GuruFocus.