Autonomous tech + EV demand drive mining equipment market

Rising demand for nickel, lithium, and phosphates combined with the natural benefits of electrification are driving the adoption of electric mining machines. At the same time, a persistent operator shortage is boosting demand for autonomous machines.

The combined factors listed above are rapidly accelerating the rate at which machines that are already in service are becoming obsolete – and, while some companies are exploring the cost/benefit of converting existing vehicles to electric or, in some cases, hydrogen, the general consensus seems to be that more companies will be be buying more new equipment more often in the years ahead.

Allied Market Research, for instance, is forecasting the global mining equipment market will grow from $141B in 2023, reaching a total value of more than $200B in 2040 based on a compound annual growth rate (CAGR) of 4.1% … but that seems hopelessly slow.

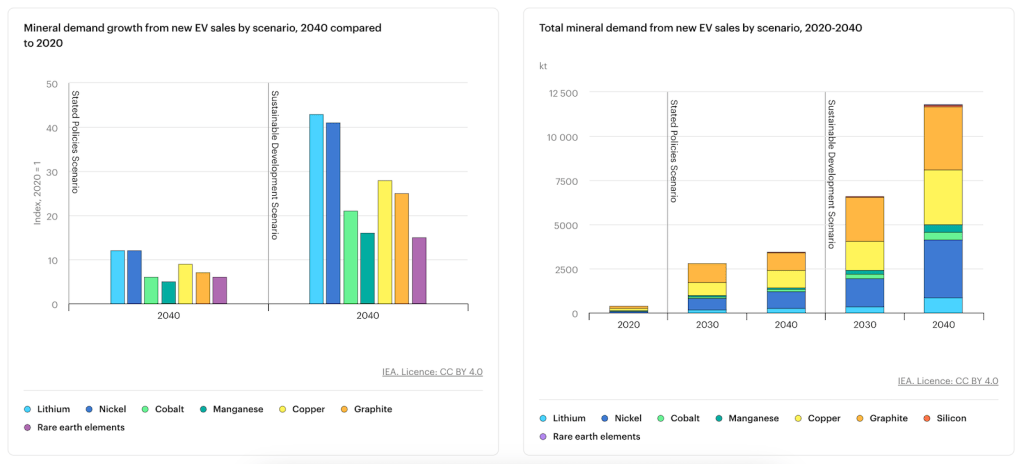

The International Energy Agency (IEA, a Paris-based, 31 nation organization established in 1974 that provides policy recommendations, analysis and data on the global energy sector) projects that mineral demand from EVs will see 30x growth between 2020 and 2040, with demand for lithium and nickel growing 40x as demand for diesel is dropping faster than most people predicted, reaching a 26-year low last quarter.

Mineral demand projections

The IEA’s projections take several battery development scenarios into consideration, and include increasingly familiar terms like utility-scale battery energy storage. All of which is to say: they seem like thoroughly conceived and well-executed projections, with nothing obviously squirrely happening in the scaling or anything like that (#pythonistas).

A delayed shift to nickel-rich chemistries (and away from cobalt-rich chemistries) results in nearly 50% higher demand for cobalt and manganese in 2040 compared to the base case. Nickel demand is 5% lower in 2040 compared to the base case.

The faster uptake of lithium metal anodes and ASSB results in 22% higher lithium demand in 2040 compared to the base case, but also much lower demand for graphite (down 44%) and silicon (down 33%).

Moving rapidly towards a silicon-rich anode results in nearly three times as much silicon demand in 2030 compared to the base case, and a slight decrease in graphite demand (down 6%). By 2040 silicon demand is only 70% higher, owing to a higher adoption of silicon-rich anodes even in the base case.

So, there’s more demand for stuff that’s mined. That means there will be more mines, and more mining, but not necessarily more people willing to go down into those mines. That labor shortage, coupled with stricter safety regulations and the increasing threat of high-dollar lawsuits resulting from workplace injuries, practically invites more automation into the space.

The remote locations of mines and the repetitive nature of the work also invites automation. “A mining vehicle typically travels the same route or makes the same movements over the course of the day, such as digging and loading material into a vehicle,” writes Sara Jensen, at Power & Motion. “This aids the design of an autonomous system because there are known patterns which can be more easily integrated compared to the varied drive cycles of on-road vehicles.”

Big players spending big money

It should come as no surprise, then, that the race is on to bring practical, electric, and autonomous heavy mining equipment to market. At CES this past year, autonomous electric equipment from Hyundai, Bobcat, Volvo CE, and Caterpillar garnered lots of attention with their innovative concepts (above) – and for good reason.

IDTechEx estimates a single 150-ton haul truck can use over $850,000 worth of fuel in a single year. Meanwhile, big electric haul trucks like this 240 ton unit from Caterpillar can, in certain use cases with high amounts of regenerative braking, operate without any significant cost to recharge. At that point, the reduced maintenance and downtime of BEVs compared to diesel vehicles becomes icing on the TCO cake.

All of which makes that 4.1% growth number from Allied seem conservative, at best.

SOURCES: Allied Market Research, IEA, Power Motion; other sources linked in post.

FTC: We use income earning auto affiliate links. More.