Bank Muscat’s Meethaq goes live with Temenos’ core banking tech

Meethaq, the Islamic banking arm of Bank Muscat in Oman, has gone live with Temenos’ core banking software for retail and corporate banking.

Meethaq Islamic Bank goes live with Temenos

The bank claims to have passed a “significant milestone” by migrating “over 200,000” customer accounts to the Sharia-compliant, cloud-based platform through the Swiss vendor’s delivery partner, Systems Limited.

Meethaq general manager, Shamzani Hussain, says the API-driven technology will be utilised to “embrace innovation and offer competitive Islamic banking products and services” as part of its “digital transformation journey”.

Launched by Bank Muscat in 2013, Meethaq’s current remit extends to deposit products, consumer financing, credit cards and corporate banking services, supported by a network of branches, contact centres, and internet and mobile banking channels.

Its selection of a new core banking provider comes after Oman Housing Bank (OHB) also inked its own core transformation deal with the vendor in April to ready the way for new card and deposit products, and 17 years after Bank Muscat first tapped the Temenos platform to “improve revenues, profitability and speed to market”.

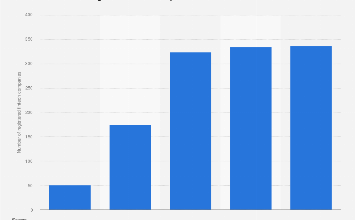

On a wider scale, the development marks the continued proliferation of Temenos’ presence throughout the Middle East and Africa. Just this year alone, BNI Madagascar, Cooperative Bank of Oromia in Ethiopia and Stanbic Bank Kenya have all announced similar core modernisation initiatives with the vendor.