Better Artificial Intelligence (AI) Stock: Broadcom vs. Marvell Technology

Both companies are targeting the same niche within the AI chip market.

The PHLX Semiconductor Sector index has logged healthy gains of nearly 23% so far in 2024, and that’s not surprising as the robust demand for artificial intelligence (AI) chips has been a driving force for this industry. However, not all companies have benefited from the surge in semiconductor stocks this year.

For example, shares of Broadcom (AVGO 0.38%) and Marvell Technology (MRVL -0.16%) are up only 19% and 10%, respectively, so far this year. That’s despite the fact that both companies are witnessing a sharp jump in sales of the custom AI chips that they manufacture.

However, it won’t be surprising to see these companies step on the gas thanks to the lucrative AI-focused market that they serve. So, if you had to choose from one of these two semiconductor stocks to ride the AI wave, which one should you buy? Let’s find out.

The case for Broadcom

The market for custom AI chips that Broadcom and Marvell sell is expected to grow rapidly. According to Morgan Stanley, application-specific integrated circuits (ASICs) could account for 30% of the $182 billion AI chip market by 2027, indicating that there could be an addressable opportunity worth almost $55 billion for Broadcom and Marvell.

The advantage for Broadcom is that it is the leading player in the ASIC market with an estimated share of 35%, according to JPMorgan. This solid share explains why Broadcom is anticipating $10 billion in revenue from sales of AI chips this year. It is worth noting that Broadcom’s AI chip revenue jumped fourfold year over year in the first quarter of fiscal 2024 (which ended on Feb. 4) to $2.3 billion.

The chipmaker has reportedly built a solid clientele in the custom AI chip market already, including the likes of Meta Platforms and Alphabet. Thanks to such clients, Broadcom’s AI revenue is expected to jump at least 2.5 times in 2024 as compared to last year. More importantly, the growth of the custom AI chip market and Broadcom’s dominant position in this niche explain why its AI revenue is expected to jump to $16 billion in 2025 and $20 billion in the following year, according to Melius Research.

The improving contribution from AI chips is probably the reason why analysts have raised their revenue expectations from Broadcom for the next couple of years, as evident in the chart below:

AVGO Revenue Estimates for Current Fiscal Year data by YCharts.

However, the possibility of Broadcom exceeding Wall Street’s growth estimates cannot be ruled out. Melius Research analyst Ben Reitzes is predicting that Broadcom’s AI revenue could even rise to $50 billion annually if it can land one more customer for its custom chips. Of course, that looks like an ambitious number, but the good part is that Broadcom has the ability to get closer to such a lofty target.

The company added a new customer for its AI chips in March this year, with analysts pointing out that the new customer is either Amazon, Apple, or ByteDance (the TikTok parent). Considering that many companies are now building custom, in-house chips for AI workloads, it won’t be surprising to see Broadcom gaining another customer in the future. As such, there is a good chance that Broadcom could become a more prominent player in the lucrative AI chip market in the future.

The case for Marvell Technology

We have already seen that Broadcom and Marvell are targeting an identical AI niche where the former is currently the leading player right now. This explains why Marvell anticipates its annual AI revenue to hit $1.5 billion, at least, in the current fiscal year. That would be substantially lower than Broadcom’s anticipated revenue from this segment.

Additionally, Marvell CEO Matt Murphy indicated on the company’s latest earnings-conference call that it expects AI-related revenue to increase by at least $1 billion in the next fiscal year. That would bring its potential revenue from AI chip sales to $2.5 billion next year. Apart from the fact that Marvell is a smaller player in the custom AI chip market, it is worth noting that it is facing headwinds in enterprise networking, carrier infrastructure, the consumer market, and the industrial/automotive markets.

These four segments together produced 30% of Marvell’s total revenue in the previous quarter. Also, all of them declined heavily on a year-over-year basis on account of poor end-market demand. As a result, Marvell’s overall quarterly revenue fell 12% year over year to $1.16 billion. Broadcom, on the other hand, reported 11% organic revenue growth in the previous quarter, while its revenue, including the VMware acquisition, jumped 34% to almost $12 billion.

However, the good part about Marvell is that its data-center revenue jumped 87% year over year to $816 million thanks to the demand for its AI chips. Throw in the fact that the company is expecting its beaten-down segments to start stabilizing in the second half of the year, it is easy to see why analysts are expecting Marvell to deliver impressive growth from the next fiscal year.

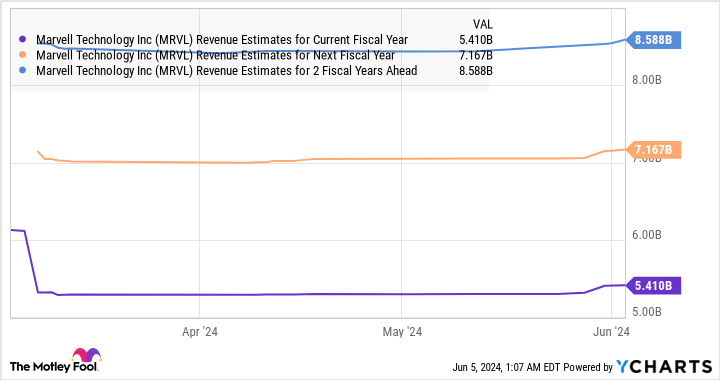

MRVL Revenue Estimates for Current Fiscal Year data by YCharts.

For some perspective, Marvell’s revenue is expected to decline 2% this fiscal year to $5.4 billion, followed by a 32% increase in the next fiscal year, and a 20% jump in the one proceeding that. Meanwhile, as we saw in the Broadcom revenue chart, its revenue is expected to jump 14% next year and 10% in the one following that.

So, even though Marvell is a smaller custom AI chip player compared to Broadcom, the company is expected to clock faster growth thanks to its smaller revenue base.

The verdict

In the end, we can say that Marvell’s smaller size means that AI could move the needle in a more meaningful way for the company and help it clock faster growth than Broadcom. At the same time, investors should note that Marvell is trading at 11 times sales, which is lower than Broadcom’s sales multiple of 15.

As such, Marvell Technology could deliver faster growth at a cheaper valuation, which is why it looks like the better AI stock of the two companies discussed in this article.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, JPMorgan Chase, and Meta Platforms. The Motley Fool recommends Broadcom and Marvell Technology. The Motley Fool has a disclosure policy.