Better Artificial Intelligence Stock: Intel vs. Nvidia

These companies have exciting prospects in AI, but one is trading at a far better valuation.

Chip stocks have captivated Wall Street over the past year as the boom in artificial intelligence (AI) has sent demand for graphics processing units (GPUs) skyrocketing. Powerful hardware is critical to training and running AI models. Thus, as interest in AI has soared, so have chip sales.

As a result, chip stocks like Nvidia (NVDA -0.09%) and Intel (INTC 1.05%) have been placed under a microscope over the past year, with analysts questioning how much growth potential these companies have in AI. Nvidia has made countless investors bullish, getting a head start in AI chips and quickly becoming the go-to GPU supplier for many AI-driven companies.

Intel has taken a slower approach to AI. However, it is gradually setting itself apart from its chip rivals by expanding into manufacturing. The company is gearing up to become one of the biggest semiconductor manufacturers in the U.S. and Europe just as chip demand is rising.

Let’s take a closer look at these two chipmakers and determine whether Intel or Nvidia is the better AI stock this June.

Intel

Shares of Intel have taken a deep dive since 2021, falling 46%. Investors began to lose faith in the tech giant as macroeconomic headwinds, increased competition, and a lack of direction led to significant financial losses. However, recent developments suggest now could be the perfect time to invest, just as Intel is at the start of a potential recovery.

Last year, Intel announced it was transitioning its business to a foundry model and would begin construction on chip plants throughout the U.S. Taiwan Semiconductor Manufacturing Company is currently the world’s largest semiconductor chip manufacturer, responsible for at least 60% of the market.

However, rising tensions between China and Taiwan forced tech companies to rethink their dependency on TSMC. Intel is taking advantage of the need for more manufacturing options by diving head-first into the industry.

Starting a foundry business is costly, which is why most companies opt to outsource their manufacturing. As a result, it’ll take time for Intel to make back its investment. But the move could significantly pay off over the long term. In fact, the company has stated it believes the change will save it between $8 billion and $10 billion by 2025, and help it hit adjusted margins of 60%.

Intel has a long way to go before reclaiming its leading position in chips, but its venture into manufacturing could see it profit from the tailwinds of AI and tech long into the future.

Nvidia

Shares of Nvidia soared 192% over the last 12 months and 132% year to date. The company’s business has exploded alongside the boom in AI, with its chips becoming the gold standard for AI developers worldwide.

Nvidia’s success in the industry has led to multiple quarters of posting record earnings. The tech giant announced its results for the first quarter of 2025 (ending April 2024) on May 22. Revenue for the period increased by 262%, beating Wall Street expectations by more than $1.4 billion. The bulk of its growth came from its data center segment, with revenue gains of 427% thanks to a spike in AI GPU sales.

However, Nvidia’s dominance in the industry doesn’t mean it has slowed its AI development. On June 2, CEO Jensen Huang announced Rubin, its newest AI chip architecture, and a more powerful version of its Blackwell platform, which was unveiled in March.

The announcement saw Nvidia’s share price pop 5% on June 3. The chipmaker also promised to abide by a “one-year rhythm” regarding its product releases, whereas it had previously stuck to a two-year timeline for chip updates.

Nvidia is on a promising growth trajectory in AI, and will likely retain its market dominance for years.

Is Intel or Nvidia the better AI stock?

Intel and Nvidia are at vastly different stages in their AI journeys. Intel appears to just be getting started, while Nvidia has achieved a well-established position that is unlikely to diminish soon.

As a result, their stocks are trading at significantly different values.

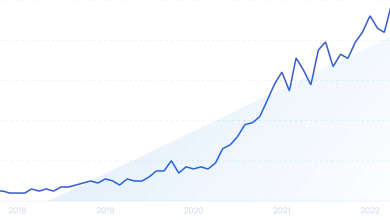

Data by YCharts

This chart compares the valuations of Intel and Nvidia using two useful metrics: forward price-to-earnings (P/E) and price-to-sales (P/S). For both metrics, the lower the figure, the better the value. As a result, the figures above indicate Intel’s stock is trading at a bargain compared to Nvidia’s, with a significantly lower forward P/E and P/S. The data shows Intel is potentially a lower-risk way to invest in AI, with a better-valued price tag.

So despite Nvidia’s more established position in AI, it could be worth taking a chance on a better-priced stock like Intel and holding over the long term as the company develops. Intel could have more room to run in the coming years, with its AI business still in its infancy and so much potential in its foundry model.

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.