Biogen, Eisai, Aardvark Therapeutics, etc.

Want to stay on top of the science and politics driving biotech today? Sign up to get our biotech newsletter in your inbox.

Hey there. Today, we learn about how scientists had a happenstance discovery about tumor-suppressor genes and used them to target aggressive pediatric tumor cells. We see a U.K. health agency make a controversial call about an ALS drug made by Biogen, and more.

The need-to-know this morning

- Biogen and Eisai‘s FDA application for a subcutaneous version of the Alzheimer’s drug Leqembi has been delayed. The FDA has asked for three months of immunogenicity data and a Fast Track designation-specific application.

A genetic clue to suppressing a fatal childhood tumor

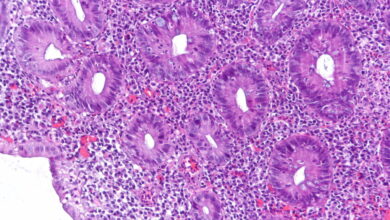

Most cancers are able to proliferate because the “tumor suppressor” genes meant to keep cell growth in check are dysfunctional. But researchers recently chanced upon a way to treat these sorts of cancers, focusing in vitro on a rare and aggressive childhood cancer called rhabdoid tumors. Researchers were able to fix a broken tumor suppressor system, turning malignant cells back into ordinary ones. The approach is still far from clinical trials, but offers a new pathway for scientists to target hard-to-treat cancers.

Rhabdoid tumors tend to be caused by mutations that inactivate a gene called SMARCB1 that’s part of a tumor-suppressing complex. Without this gene functioning, an array of “aggressive, lethal, nasty cancers” can arise in children, the study’s lead author told STAT. But the scientists were able to find that knocking out another gene, DCAF5, allowed healthy cells to continue to grow — but keep rhabdoid tumors at bay.

There’s concern that DCAF5 could play an important role in other important cell processes, so it isn’t safe to yet say that the gene is expendable. But the approach is clearly promising. Jay Bradner, Amgen’s chief scientist, said on LinkedIn that this is “a stunning work of target discovery in an impossible cancer of early childhood.” And that “DCAF5 is now officially in the crosshairs.”

U.K. agency’s ALS drug decision could have ‘chilling effect’ on genetic medicines there

A U.K. health agency has decided to send Biogen’s ALS drug Qalsody through standard approval channels, as opposed to offering it a special pathway for drugs treating rare diseases. And this could make the medicine, which is only viable for about 2% of ALS patients, much harder to win approval. Critics are deeply concerned about the agency’s decision, with one saying it could have a “chilling effect” on access to new genetic medicines.

Because of the agency’s decision, Biogen may not pursue approval of Qalsody in the U.K. at all. The company does “not see a way forward for tofersen,” a Biogen spokesperson told STAT. “The decision has exposed grave concerns about whether the U.K. is committed to patients accessing genetically targeted medicines, particularly in rare and ultra rare conditions.”

Diabetes drugs could be so much cheaper

The generic versions of diabetes drugs, including GLP-1 drugs, could be a lot less expensive than the current branded drugs, but still be profitable, an investigation in JAMA Network Open shows. The study found that a generic vial of insulin could cost between $61 to $111 — as much as 97% less than the current U.S. market price — and still hold onto a 10% to 50% profit margin.

“While we are unaware of the analysis used in the study, we have always recognized the need for continuous evaluation of innovation and affordability levers to support greater access of our products,” said Jamie Bennett, Novo Nordisk’s director of media relations.

Aardvark Therapeutics gearing up for $200 million IPO

San Diego-based Aardvark Therapeutics is planning a $200 million IPO, the Financial Times writes. Early-stage trials showed the company’s lead drug, ARD-101, suppressed hunger cravings in patients with Prader-Willi syndrome, a rare genetic form of obesity.

ARD-101 is a TAS2R agonist that activates both the GLP-1 and CCK gut hormones. GLP-1, of course, is the target used by drugs like Wegovy and Ozempic to allow for weight loss — but CCK could help limit side effects like nausea and the wasting of lean muscle mass. If a Phase 3 trial of ARD-101 works in Prader-Willi, it could be approved in 2026 and cost several hundred thousand dollars, analysts say.

The company is nearly done with a pre-IPO financing round with a group of blue-chip health care investors, sources told FT. It could be worth nearly $2 billion.

More reads

- What does it mean for a confirmatory trial to be ‘well underway’? Regeneron wants to know, FierceBiotech

- BMS’ Zeposia fails to meet primary endpoint in Phase 3 Crohn’s trial, BioSpace

- Veteran life science execs raise $150M for cancer drug targeting hard-to-treat tumors, San Diego Union-Tribune