Blair Institute sets out ‘progressive vision’ for fintech

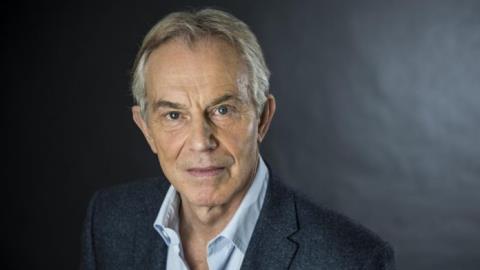

If it wins the upcoming UK general election, the Labour party must harness the fintech sector as an engine for economic growth, opportunity and inclusion across the country, says a report from the Tony Blair Institute for Global Change.

With Labour holding a double-digit lead in the polls, Keir Starmer’s party is widely expected to return to power after 14 years in opposition.

The party’s former prime minister, Blair, has put his institute’s name to a report co-authored with the Startup Coalition that lays out a vision for how one of the country’s most successful sectors can be used to deliver a “progressive agenda for a mission-driven government”.

Fintechs, the report says, can fuel economic growth if they are given the right environment to grow. This means “optimising incentives like R&D tax credits and share option schemes, building fintech export opportunities, and providing regulatory certainty”.

The report also calls for a national financial inclusion strategy that puts innovation front and centre by, for example, unlocking pensions to invest in startups, and increasing choice for small businesses in how to accept payments.

Labour has already promised an open finance roadmap, while just this week the government set up its own task force. The Blair report calls for an Open Finance framework within 100 days of taking office.

In addition, regulation for Buy Now Pay Later lending should be introduced within 100 days, while there should be mandating of financial education in primary schools by 2025

Jeegar Kakkad, director, government innovation, Tony Blair Institute for Global Change, says: “Fintech startups have a crucial role to play in breaking down barriers to financial opportunity across the UK.

“By developing a national financial inclusion strategy with fintech at its core, and delivering innovations like Open Finance, we can increase choice and competition in financial services. This will empower individuals and communities to take control of their financial well being like never before.”