Block: 3 Reasons To Buy This Fintech On The Drop (NYSE:SQ)

andresr

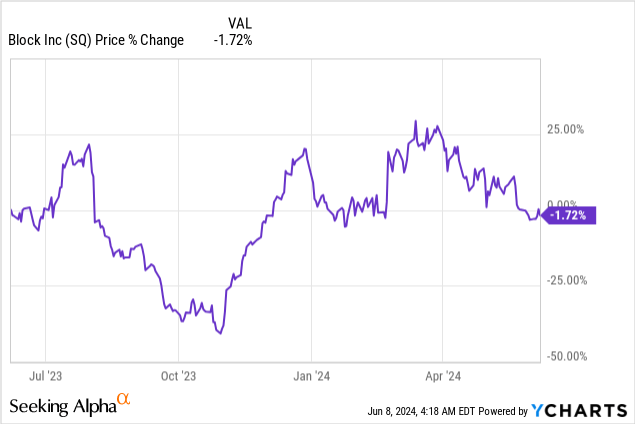

Block (NYSE:SQ) remains a highly attractive growth play for Fintech investors in FY 2024 as it is seeing continual gross profit momentum in both core business segments, is benefiting from strong Cash App Card adoption and the most recent downtrend in valuation makes shares attractive from a valuation point of view as well. Block’s shares have continued to sell off after the Fintech’s solid Q1’24 earnings, and I believe the drop represents a new engagement opportunity for long-term investors with a desire to increase their exposure to the fast-growing industry!

Previous rating

In my last article on Block I indicated that the Fintech was doing a fine job growing its gross profits across the board, but especially in Cash App, and that the profitability picture continued to improve: Blowout Guidance Makes This Fintech A Strong Buy. Block did really well in this regard in the first fiscal quarter, but retains considerable growth and upside potential in the Fintech market as it signs on more Cash App Card users. Block’s growth also compares favorably to PayPal’s (PYPL) growth, which is struggling to keep customers on its payments platform.

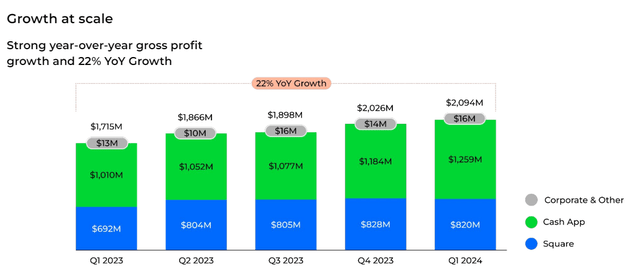

Strong growth play with significant earnings momentum

In the past, I indicated that Block had considerable potential in the Fintech space due to the company aggressively scaling its Cash App, which was essentially where all the momentum is for Block. In the last quarter, Q1’24, Cash App gross profits grew 25% year over year to a record $1.26B while Square, which includes the Fintech’s point-of-sale payment services, saw 19% year-over-year growth to $820M. While both segments clearly have momentum due to growing users (in Cash App) and growing product adoption (Square), Cash App remains the fastest-growing and most important business segment for Block, and this is unlikely to change in the future.

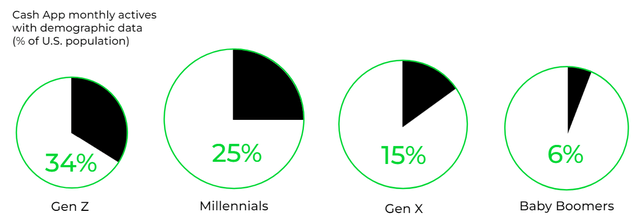

The Cash App still has considerable growth potential, as Block estimates that the company penetrates only about 20% of the market. Gen Z and Millennials, which are the most prolific users of the Cash App represent a huge growth opportunity for Block in the coming years and the company’s Cash App Card could be the product that reels them in.

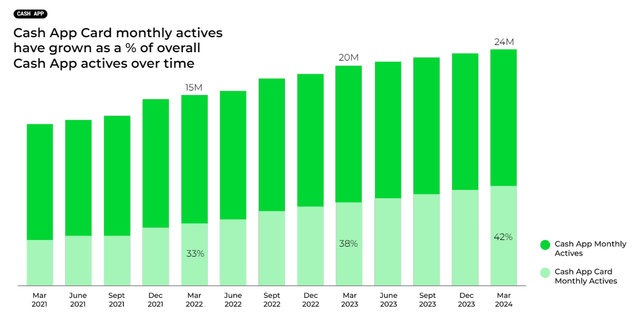

A key product for Block is the Cash App Card, which is a customizable debit card that can be used both online and in stores. The Cash App Card is connected to the Cash App and therefore allows for easy, instant money transfers something that especially younger users value. This financial product is seeing consistent growth and currently has 24M actives and growing usage as well.

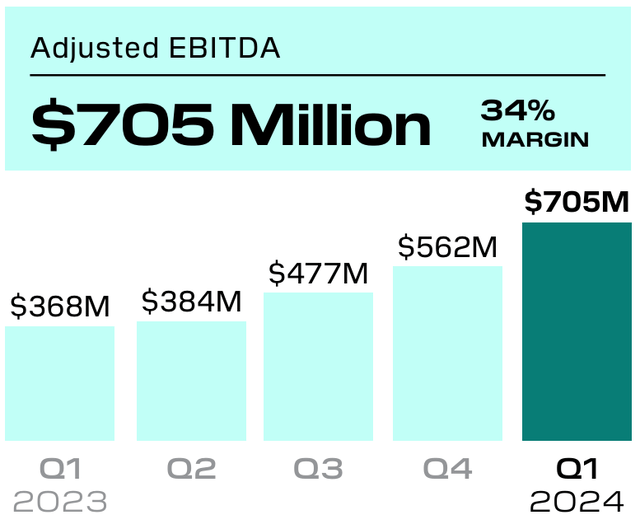

It is especially the Cash App that is driving Block’s adjusted EBITDA gains in recent quarters. In Q1’24, the Fintech saw 92% year-over-year EBITDA growth to $705M, as well as significantly expanding EBITDA margins. In the previous quarter, Block reported an adjusted EBITDA margin of only 24%, so the Fintech generated a 10 PP Q/Q gain in its most important metric.

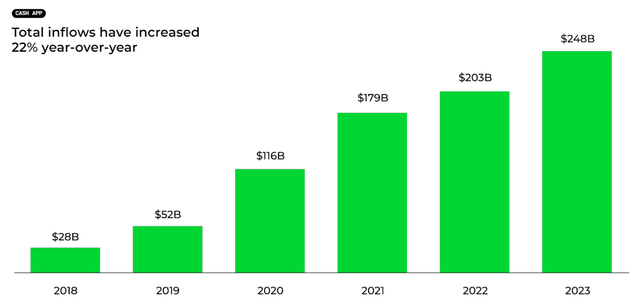

More money is flowing to the Cash App. Millennials and Gen Z are responsible for 70% of Cash App money inflows as they tend to use the app the most, and they are set to be the driving force behind incremental money flows going forward. In FY 2023, Block’s Cash App had $248B in inflows, showing 22% year over growth. In Q1’24, Cash App inflows were $71B, showing 17% year-over-year growth. With more money flowing to the Cash App (and greater app adoption), the ecosystem and the Cash App Card only become more appealing for users.

3 catalysts for an upside revaluation

I see 3 specific catalysts for a share price upside revaluation in FY 2024 and beyond:

- Continual growth in Cash App Card growth (both in terms of users and usage)

- Block is now consistently profitable on an adjusted EBITDA basis. I expect the Fintech to be able to grow its EBITDA margins as it signs on more Millennials and Gen Z users

- Growth in money inflows could make Cash App a very valid alternative to other payment services, including those offered by PayPal.

Block’s valuation

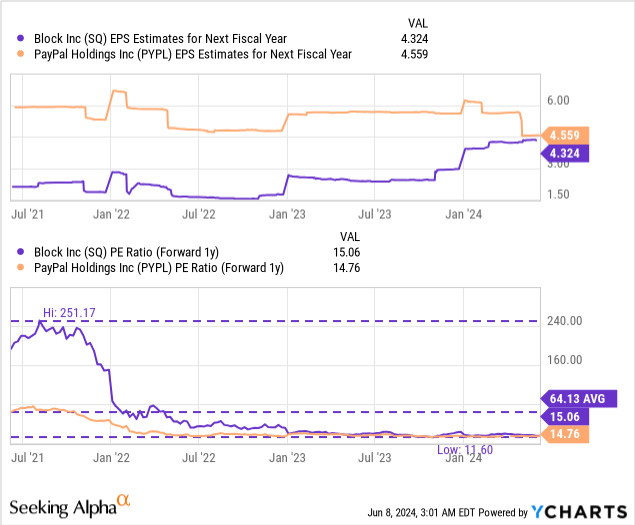

The good news about Block is that the Fintech is already profitable, not only on an adjusted EBITDA basis, but also based off of net income. Therefore, Block can be valued by using a traditional price-to-earnings ratio. The Fintech is currently valued at a price-to-earnings ratio of 15.1X which compares, as an example, to a P/E ratio of 14.8X for PayPal which is a key rival for Block in the Fintech space. Both Block and PayPal have traded at significantly higher P/E ratios in the past, especially during the pandemic, and Block is currently priced way below its longer term (3-year) average P/E ratio of 64.1X. PayPal’s 3-year average P/E ratio is 25.8X, so both PayPal and Block are trading significantly below their historical valuation averages. In the case of PayPal, I believe this valuation draw-down is a bit more deserved, but Block is executing well and growing much more quickly: Block is looking at annual EPS growth rates north of 20% (until FY 2027).

As I indicated above, PayPal has fundamental problems staying relevant with its payment processing services, which has been reflected in an eroding customer base. In the last year, PayPal has almost consistently lost customers, which has resulted in muted EPS growth expectations for the Fintech. PayPal is expected to grow its EPS only 11% next year, which may be an optimistic estimate considering that the company is still losing customers.

Block, on the other hand, is expected to continue to grow at double-digits (+28% Y/Y in FY 2025), which explains why I see the Fintech as a very compelling alternative to PayPal… which is essentially trading at the same valuation multiplier. In my last work on Block I said improving profitability and Cash App momentum are the reasons why I see a fair value P/E ratio of 25X, which hasn’t changed. With a consensus EPS estimate of $4.32 for FY 2025, Block has a fair value closer to $108 and considerable revaluation potential… if the Fintech keeps executing well.

Risks with Block

There are a number of risks that could influence how I see an investment in Block. If the Fintech continued to grow its gross profits at double-digits while improving its EBITDA, then I would be very happy holding on to Block for a long time. What would change my mind, however, is if Block failed to expand its EBITDA margins or the Fintech saw a noticeable growth deceleration in its strongly-performing Cash App business. Slowing adoption rates of the Cash App Card would also be a reason to reevaluate the investment thesis.

Final thoughts

Block remains a compelling growth story in the Fintech space, especially because PayPal’s growth issues contrast nicely and benefit Block. The Fintech generated a ton of gross profit growth in the last quarter, chiefly due to growth in the Cash App segment. I believe that Block’s profit explosion in FY 2024 indicates strong potential for expanding EBITDA margins, driven chiefly by two groups of people: Millennials and Gen Z users. Shares are a bargain, in my opinion, and Block has the growth to back up this valuation. I believe the risk profile for long-term investors in the Fintech market is still very much attractive, and I see continual revaluation upside if Block keeps on executing well on its growth strategy, especially in Cash App!