Block: Top Fintech Growth Stock Poised For A Breakout (NYSE:SQ)

hapabapa

Block’s Bullish Thesis Remains Intact

Block, Inc. (NYSE:SQ) stock has outperformed my expectations since I upgraded SQ to a Buy in early February 2024 before Block’s fourth-quarter earnings release. Investors in the Jack Dorsey-led company saw SQ notch a 15% gain against the S&P 500’s (SPX) (SPY) 3% upside over the same period. However, like leading fintech player PayPal (PYPL), SQ remains well below its 2021 all-time highs, down nearly 75% from those levels. As a result, investors who chased SQ’s pandemic-fueled bubble are likely still nursing significant losses if they still hold to their SQ bag.

However, I believe investors must assess every investment thesis independently and intelligently. While SQ’s bubble was unceremoniously burst as the Fed unleashed its unprecedented rate hikes, it’s now evident that it bottomed out in late 2023. In other words, fintech investors have become confident enough to return to SQ’s bullish thesis, lifting its buying momentum.

Block’s business model isn’t difficult to understand. Its main revenue drivers are predicated on its Square (commerce) and Cash App (consumer) ecosystem. Block operates a capital-light business model that benefits from network effects and scalability. Square has customarily focused on smaller businesses to gain traction. The strategy proved largely successful in the earlier days, as Square’s revenue grew nearly 3x between 2018 and 2023. In addition, Cash App’s focus on Millennials and Gen Z also produced meaningful gains, as Cash App saw its revenue grow more than 22x from 2018 to 2023. I believe these growth metrics were instrumental in leading investors to chase SQ’s growth thesis in the past, leading to significant overvaluation.

Block Needs To Improve Its Operating Leverage

However, the 2022 bear market has taught us invaluable lessons about the perils of ignoring overvaluation as we chased alpha. For Block, the massive growth rates of the past will unlikely be replicated as its momentum in its targeted segment slows. Block management believes it still has significant unmet potential. However, analysts’ estimates suggest Block’s revenue growth is expected to slow down through 2026, with a CAGR of just 11.75%. As a growth investor, that hardly excites me, as SQ is still valued at a significant premium.

However, management telegraphed a surprisingly robust FY2024 guidance, suggesting Block could achieve at least $2.63B in adjusted EBITDA, up 47% YoY. Therefore, I assessed that Block’s growth story is far from over, demonstrating its ability toward an impressive profitability inflection. As highlighted earlier, fintech companies like Block can scale rapidly as they upsell solutions across their product suites to their merchant customers. Furthermore, Cash App customers can also “engage more deeply with the full suite of banking products and financial services.” As a result, as the ecosystem expands and gains traction, more valuable transactions will likely accrue to Block. The company is also looking to expand its value proposition as a banking platform for customers to perform direct deposit transactions. Management highlighted that only 3% of its monthly transacting actives perform direct deposits through Cash App. Therefore, management envisions a significant growth opportunity for Block to capitalize.

Is SQ Stock A Buy, Sell, Or Hold?

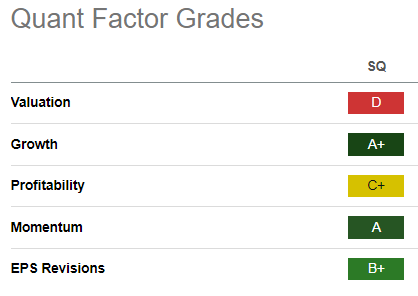

SQ Quant Grades (Seeking Alpha)

However, I believe investors must consider that financial services is an intensely competitive business. While SQ boasts a best-in-class “A+” growth grade, its “C+” profitability grade suggests its business model could be under duress if economic conditions worsen. Therefore, given the relatively aggressive growth outlook articulated by management, Block management will likely need to execute immaculately to justify its growth premium.

Despite that, SQ’s “A” momentum grade suggests the market seems highly confident of its ability to execute. Buying momentum should remain robust unless Block disappoints markedly over the next few quarters as it broadens its banking base.

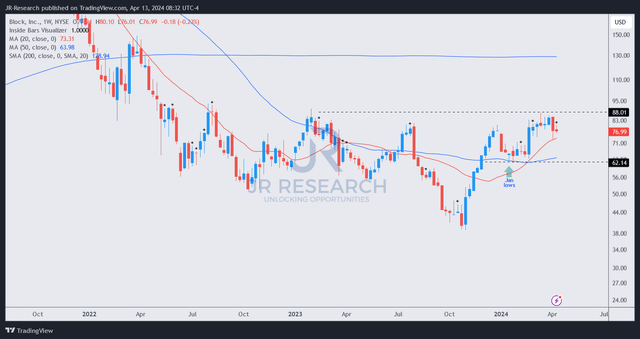

SQ price chart (weekly, medium-term) (TradingView)

As seen above, SQ remains well supported as it surged from its 2023 lows. SQ’s price action has remained constructive, corroborating its “A” momentum grade. Moreover, SQ has moved back into a bullish bias, giving confidence to dip-buyers looking to capitalize on the recent pullback to add more shares.

I assessed that SQ’s January lows could be re-tested if we get a “nastier” retracement to shake out the recent buying fervor. However, that should also present a brilliant opportunity for fintech investors looking to invest in a growth company with the potential to gain significant operating leverage moving ahead.

Rating: Maintain Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!