BUG ETF: A Cybersecurity Theme That Won’t Go Away

Maskot

I think one thing bulls and bears can agree on is that cybersecurity is only going to get more important over time, especially in a digital age dominated by artificial intelligence. Safeguarding everything from personal data to national security is in a perpetual uptrend. If that’s a megatrend that is unstoppable, then why not play it through an ETF? There’s one worth considering – the Global X Cybersecurity ETF (NASDAQ:BUG).

BUG was launched on October 25, 2019. It seeks to track the performance of the Indxx Cybersecurity Index, which includes companies that stand to benefit from the increased adoption of cybersecurity technology. These include companies whose principal business is the development and management of security protocols to prevent intrusion and attacks on systems, networks, applications, computers, and mobile devices. With assets under management totaling $788 million and a portfolio of 26 holdings, BUG represents a focused yet diversified approach to investing in the cybersecurity sector. The ETF has a total expense ratio of 0.50% and offers semi-annual dividend distributions.

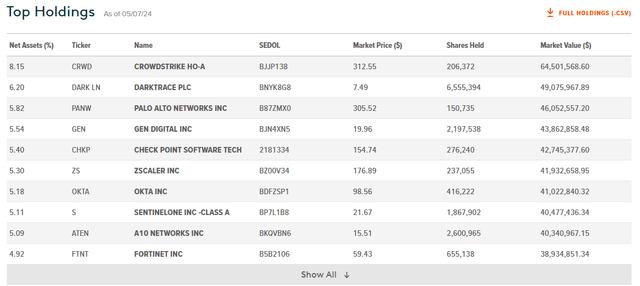

ETF Holdings: A Representative Sample

The top holdings include companies which one can argue are pretty good pure-plays to cybersecurity.

- CrowdStrike Holdings (CRWD), the largest holding with an 8.15% weight, is known for its cloud-native endpoint security platform that utilizes AI to offer real-time threat detection and response.

- Gen Digital (GEN), with a 5.54% share, provides a broad array of cybersecurity solutions, including endpoint protection and identity management, catering to a diverse clientele.

- Zscaler (ZS), with a 5.30% allocation, delivers cloud-based security as a service, acting as a secure internet gateway that blocks cyber threats.

- Check Point Software Technologies (CHKP), with a 5.40% weighting in BUG, offers cutting-edge threat prevention technologies that protect customers from cyberattacks with a high catch rate.

- Fortinet (FTNT), making up 5.09% of the fund, specializes in broad, integrated, and automated cybersecurity solutions, ensuring a fast and secure network.

One of the things I like here is that these are names many people may not be familiar with, but which underpin the industry and likely have long-term outperformance potential.

Sector Composition and Weightings

This is, of course, a thematic tech fund. Which, of course, then begs the question of how correlated it would be to a correction in market-cap weighted tech stocks that drove the market higher in the last year and a half. It also begs the question of how these mega-cap tech stocks might compete with the fund’s holdings, as Microsoft, in particular, with its AI focus could serve as a competitive threat to many of these companies. The reality is that a market correction would still hurt BUG, but I suspect less so than more broad-based tech-heavy averages like the NASDAQ composite.

Peer Comparison

There are, of course, other cybersecurity plays out there like the First Trust NASDAQ Cybersecurity ETF (CIBR) which seeks to track the Nasdaq CTA Cybersecurity Index. When looking at a price ratio of the two, BUG overall has underperformed CIBR. Much of this has to do with the fact that CIBR has a number of less pure-play companies in the top holdings, like Broadcom as an example, in an environment that has favored semis.

Pros and Cons of Investing in Cybersecurity

Investing in cybersecurity through ETFs like BUG presents several advantages. The sector is expected to experience significant growth, driven by the escalating frequency and sophistication of cyberattacks and the corresponding increase in global cybersecurity spending. This growth potential makes cybersecurity an attractive sector for investors seeking long-term appreciation. Additionally, the diversified nature of ETFs like BUG can help mitigate the risk of volatility associated with individual stocks within the rapidly evolving tech landscape.

There are risks, of course. The industry is subject to rapid technological changes and regulatory developments, which can introduce volatility and uncertainty. Furthermore, as a specialized investment, BUG can certainly be more volatile than a more diversified tech or broad-market ETFs, potentially affecting short-term performance.

Conclusion

I think overall, this is a good fund for what it’s trying to capture. With its focused portfolio of leading cybersecurity companies, BUG is well-positioned to capitalize on the increasing global demand for digital protection. For those looking to invest in the future of digital security, the Global X Cybersecurity ETF is a quick and easy option.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.