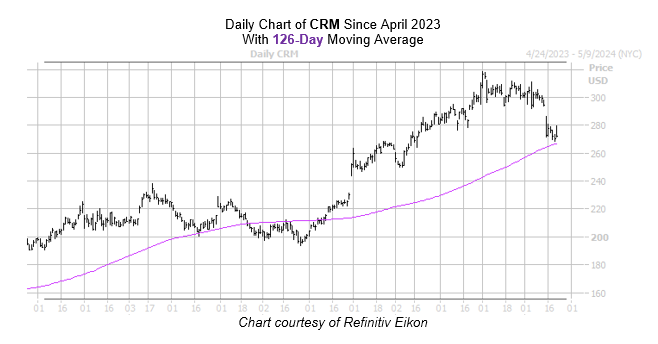

Bull Signal Flashing for Cloud Technology Stock

The equity’s 126-day moving average acted as a springboard in the past

Specifically, Salesforce.com stock just came within one standard deviation of its 126-day moving average, after months spent above this trendline. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, one similar signal was seen over the last three years. CRM enjoyed a positive return one month later after that instance, snagging a 5.5% gain. From its current perch, a comparable move would place the security at nearly $286.

The stock’s 50-day put/call volume ratio of 0.91 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) is in the elevated 85th percentile of its annual range. This suggests a very healthy appetite for long puts of late, and an unwinding of this pessimism could help the stock move higher.

The stock’s “oversold” 14-day relative strength index (RSI) of 23.9 points to near-term tailwinds. Options are affordable at the moment too, per Salesforce.com stock’s Schaeffer’s Volatility Index (SVI) of 29% that ranks in the 20th percentile.

![Rick and Michonne Finally Dispose of the CRM in ‘The Ones Who Live’ Finale [Spoilers] Rick and Michonne Finally Dispose of the CRM in ‘The Ones Who Live’ Finale [Spoilers]](https://europeantech.news/wp-content/uploads/2024/04/the-walking-dead-crm-thumb-700xauto-261596-390x220.jpeg)